As I write this, something extraordinary is happening in global markets — a trillion-dollar knife fight.

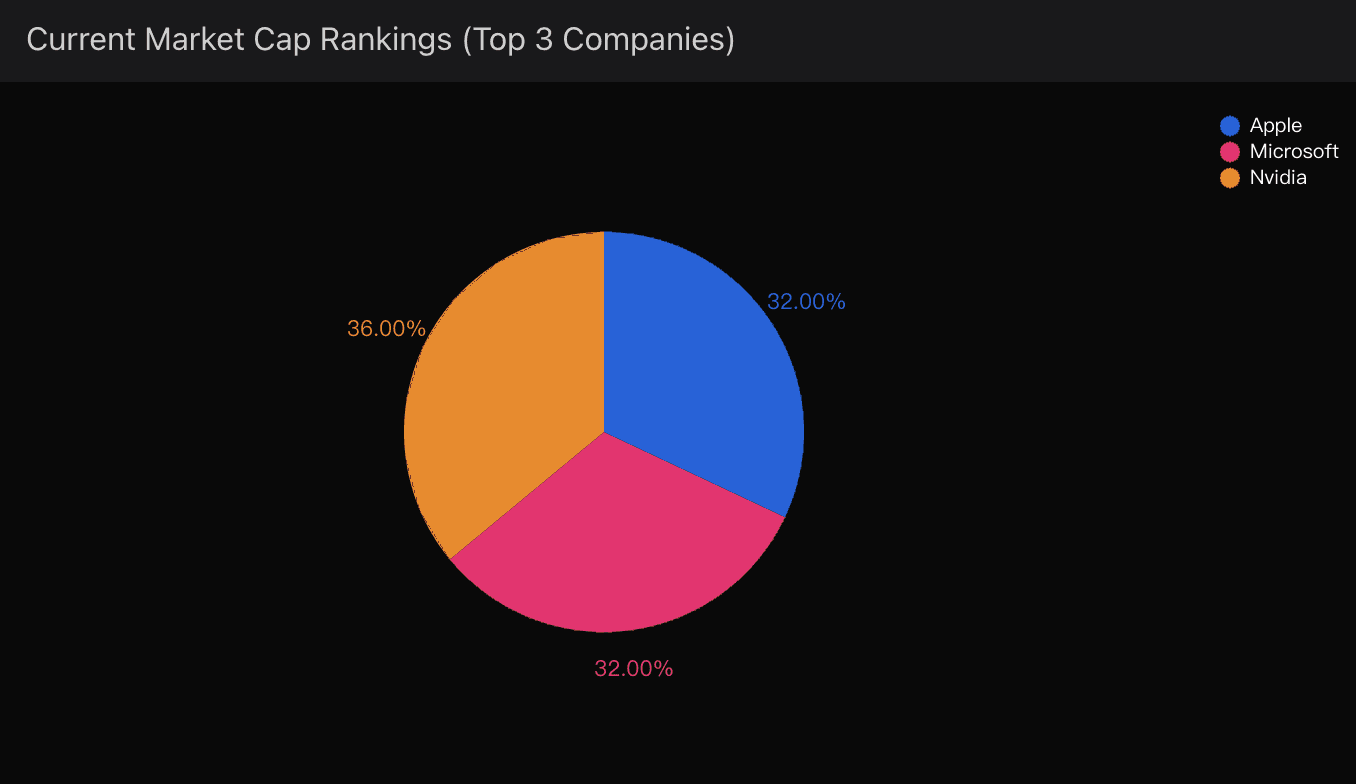

Microsoft and Apple are locked in one of the tightest market cap races in history, both hovering around the $4 trillion mark, while Nvidia sits comfortably on top at $4.5 trillion, thanks to its near-monopoly on AI compute.

But here’s my core prediction, based on real-time data analysis powered by Powerdrill Bloom:

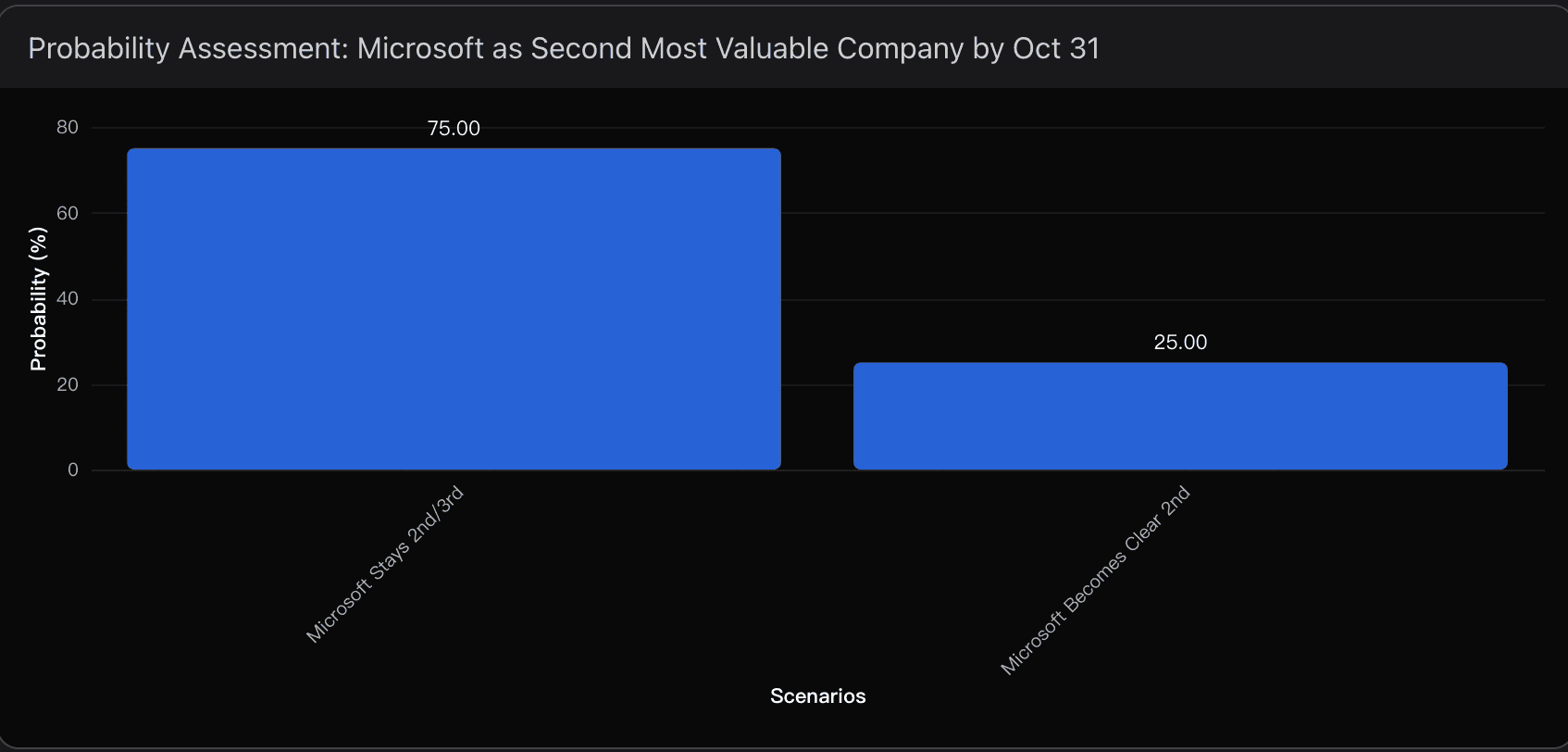

Microsoft’s probability of securing (and sustaining) the #2 market cap position is just 25%.

And the reason is brutally simple — this isn’t about performance alone anymore. It’s about narrative velocity, timing, and which company can weaponize AI visibility faster.

Powerdrill Bloom’s Core Forecast

After running millions of data points through Powerdrill Bloom, my AI forecasting engine that maps sentiment, capital flows, and probability-weighted catalysts, the market outcome looks like this:

Scenario | Probability | Key Catalyst |

|---|---|---|

Microsoft Secures #2 | 25% | Strong Azure growth, upbeat guidance, clear AI monetization |

Apple Reclaims #2 | 60% | iPhone 17 and Services overperformance, market rotation post-MSFT earnings |

Nvidia Extends Lead | 15% | Sector-wide flight to AI hardware strength amid macro uncertainty |

These probabilities reflect momentum asymmetry: Microsoft may lead on hype, but Apple leads on consistency.

Key Drivers and Their Impact

1. Earnings Catalyst: The 48-Hour Window

Microsoft’s upcoming report on October 30 is the single most important event in this race.

Consensus expects $75.4 billion in revenue (+15% YoY), with Azure sustaining 34% growth — but the real test is how effectively those AI investments translate into operating leverage.

A strong beat could push MSFT toward $4.1T+ temporarily. But as Powerdrill Bloom’s sentiment mapping shows, post-earnings reversals are historically more likely when expectations exceed +10% sentiment divergence — which we’re already at.

Bloom Insight: When AI hype outruns earnings momentum, markets correct faster than models expect.

2. Apple’s Quiet Strength

While Microsoft dominates the enterprise AI narrative, Apple is executing a slower, steadier play: deep consumer loyalty, expanding Services margin, and strong hardware cycle recovery.

The iPhone 17 lineup has exceeded initial channel expectations by 12–15% in Asia, and Apple’s subscription revenue now rivals Netflix, Spotify, and Disney+ combined.

If that trajectory continues, Apple could reassert the #2 slot — not through volatility, but through gravitational consistency.

3. Nvidia: The Unmovable King

With $4.5 trillion in market cap and AI chip revenue growing at +45% YoY, Nvidia’s dominance is not just a lead — it’s a structural moat.

As long as AI training demand stays vertical, neither Microsoft nor Apple will unseat it. Nvidia’s cap dominance acts as a stabilizer that keeps both competitors fighting for second place.

Final Take

The narrative around Microsoft being the inevitable #2 is seductive — but markets rarely reward “inevitability.”

My view remains disciplined:

Base Case: Microsoft and Apple trade within a 2% market cap band through Q4

Probability of Microsoft Sustaining #2 by Dec 31: 25%

Risk Bias: Downside volatility post-earnings due to elevated expectations

In short, the trillion-dollar tie will continue, and it will take more than an AI buzzword or one earnings beat to break it.

Until then, Nvidia reigns — and the rest of us just watch from the $4 trillion trenches.