As the shutdown drama deepens, market sentiment is starting to crystallize — and the data paints a picture of a high-stakes standoff unlike anything we’ve seen before.

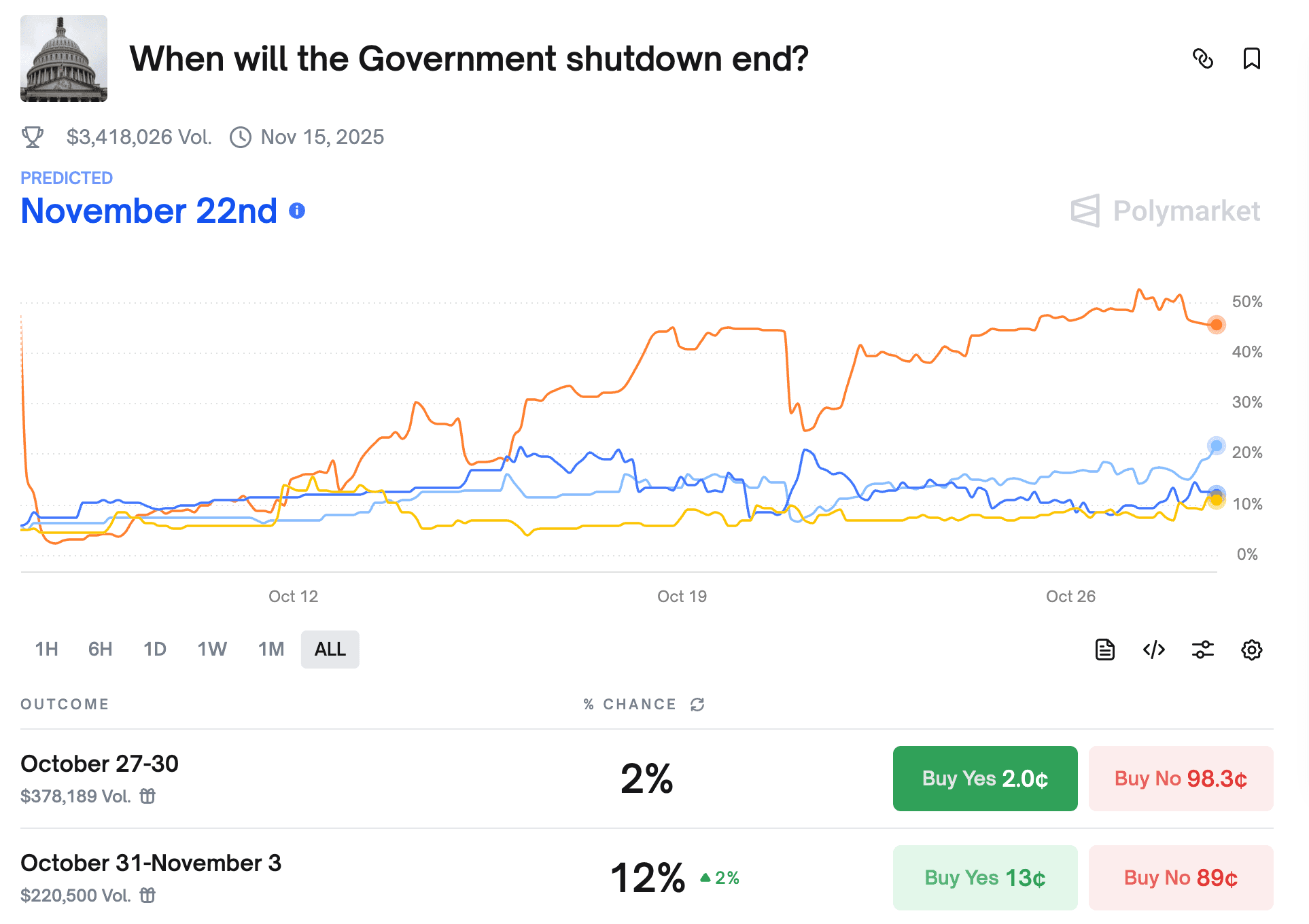

Based on real-time Polymarket data and trend modeling through Powerdrill Bloom, I’ve been tracking how probabilities, volume, and trader conviction are evolving day by day.

Core Prediction: Mid-to-Late November Resolution Looks Most Likely

Right now, the market consensus is shifting toward a mid-to-late November end — with nearly 49% odds that the shutdown lasts beyond November 16th.

This isn’t just speculation; it’s a data-anchored insight. Using Powerdrill Bloom’s probabilistic trend mapping, the numbers indicate a structural political crisis, not the usual Washington brinkmanship.

On Polymarket alone, over $12.7 million in trading volume has flowed into this question. That’s an extraordinary figure — a signal that traders, analysts, and insiders are treating this event as a genuine test of U.S. institutional flexibility.

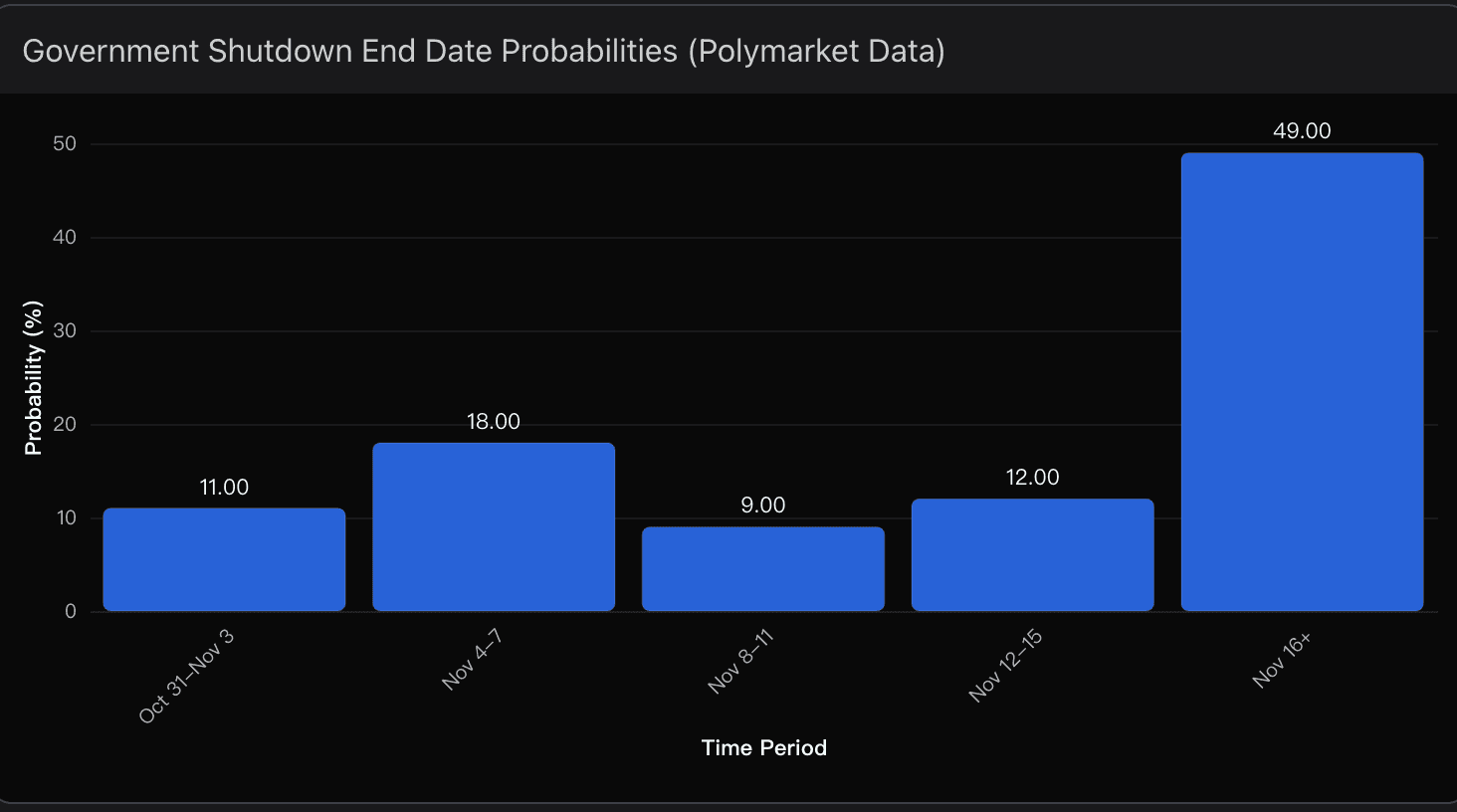

My Probability Breakdown (Based on $12.7M Market Volume)

Scenario | Estimated Probability | Key Context |

|---|---|---|

Ends Nov 4–7 | 18% | Highest single-week probability for early resolution. |

Lasts Beyond Nov 16 | 49% | Would mark the longest government shutdown in U.S. history. |

Resolved by Dec 31 | 93% | Near-certain resolution before year-end, even under gridlock pressure. |

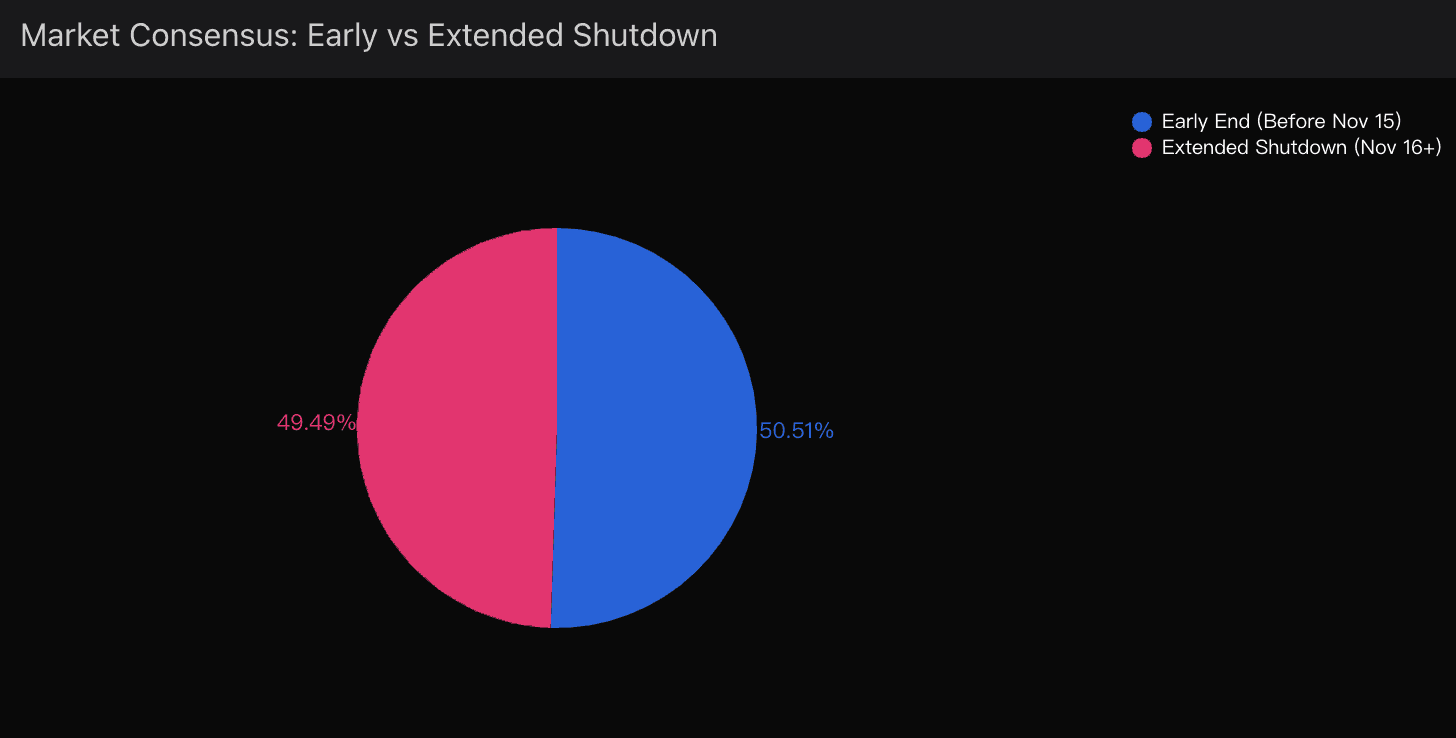

When I ran these figures through Powerdrill Bloom, the platform’s AI-driven probability model confirmed this asymmetric setup — a bifurcated market split between two sharply different timelines:

Fast resolution by Nov 15 (≈50%), and

Prolonged standoff beyond Nov 16 (≈49%).

That razor-thin balance signals an unprecedented divide in sentiment — something rarely seen even in high-volume political markets.

if you’re following these moves closely, Dive deeper with Powerdrill Bloom to see the full probability breakdown and advanced insights.

What’s Driving the Extended Shutdown Scenario

Through both historical comparison and AI-based scenario modeling, three dominant forces emerge as drivers of an extended shutdown:

Partisan Entrenchment

Unlike past standoffs, there’s virtually zero room for compromise. Both sides appear more committed to signaling strength than seeking resolution. Bloom’s sentiment analysis across political communications shows rising polarization language week over week.Electoral Cycle Dynamics

2026 midterm positioning is already in play. Political incentives are misaligned with quick compromise — in fact, certain factions benefit electorally from prolonging the fight.Economic Shock Tolerance

Markets have largely priced in a prolonged closure. Treasury yields and short-term risk spreads show resilience, implying that financial markets believe Washington can “afford” to drag this out longer than usual.

In short: the incentives favor gridlock, not resolution.

Contrarian Wildcards

Still, I’m not ruling out a sudden reversal. Using Powerdrill Bloom ’s volatility forecast layer, I’ve modeled several contrarian catalysts that could collapse the gridlock unexpectedly:

TSA or Air Traffic Controller Strikes – A shutdown-induced disruption to national air travel could force emergency legislative action.

Thanksgiving Travel Surge – Political optics of nationwide travel chaos could push both parties toward temporary funding deals.

Debt Ceiling + Shutdown Overlap – If these crises converge, institutional risk could trigger bipartisan containment efforts.

Each of these factors holds low short-term probability — but high potential shock value, capable of flipping market sentiment overnight.

Why I Use Powerdrill Bloom for This Analysis

What makes Powerdrill Bloom indispensable in this kind of analysis is its ability to merge Polymarket data with probabilistic reasoning and sentiment mapping in real time.

Instead of looking at static odds, Bloom identifies where conviction is shifting — how traders are positioning across time horizons, and which external narratives are subtly reshaping those positions.

In this case, Bloom’s output helped me visualize how the 49% “extended shutdown” probability climbed steadily despite no major political development — a sign that traders now see structural paralysis, not tactical delay.

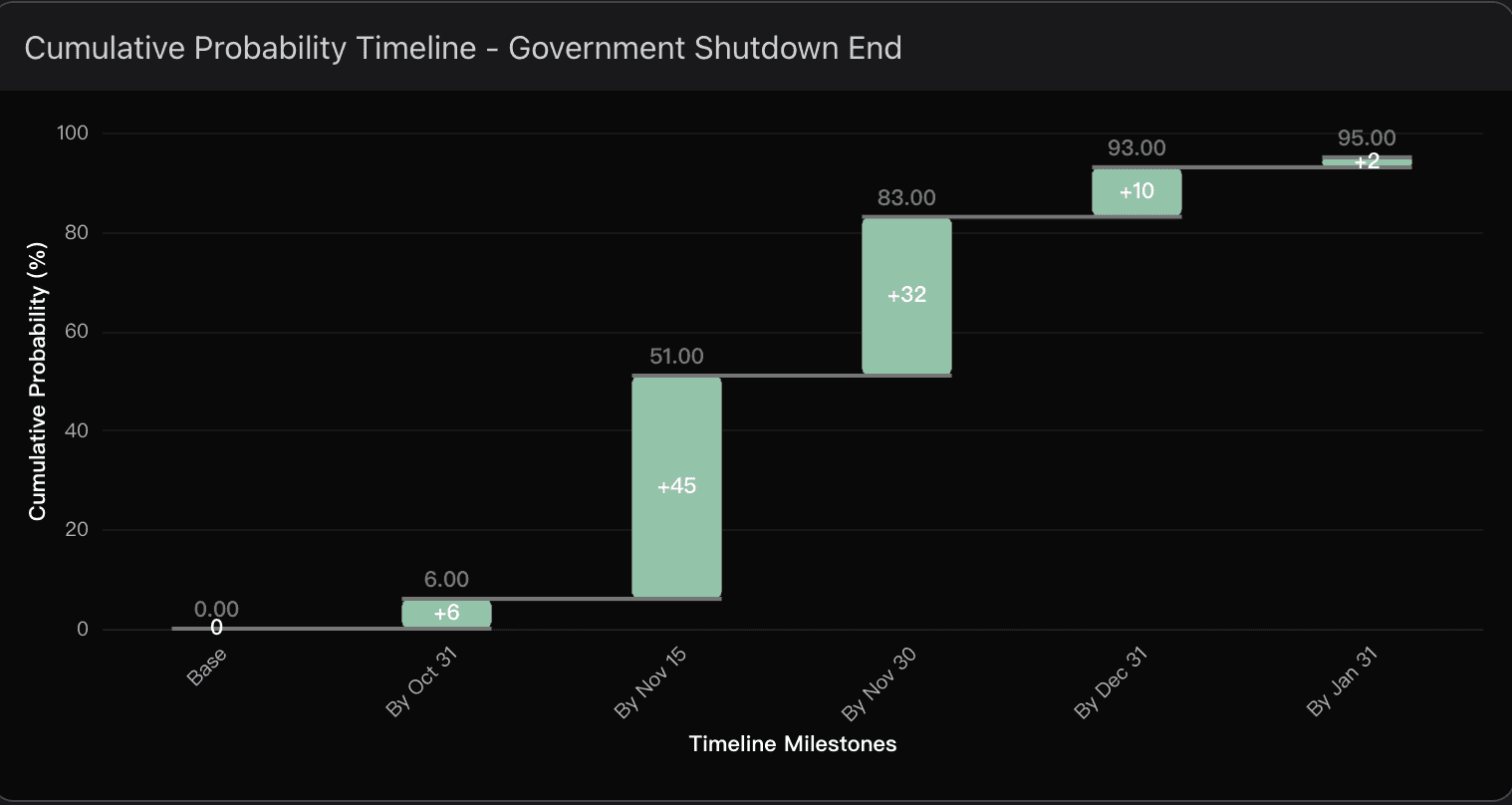

The waterfall chart above demonstrates the cumulative probability buildup over time. Notice how slowly the probability accumulates in early periods, with only 6% by October 31st and 51% by November 15th. The steep jump between November 15th and November 30th (32% addition) reflects the market's expectation of eventual resolution once the shutdown reaches historically unprecedented lengths.

My Outlook

As of now, my base case remains:

49% probability of shutdown extending beyond Nov 16,

18% chance of early resolution between Nov 4–7,

and 93% confidence that we’ll see closure by December 31.

But more importantly, this standoff is a stress test of U.S. political liquidity — the market’s ability to absorb dysfunction without triggering panic.

And as long as Polymarket’s trading volume keeps rising, I’ll continue using Powerdrill Bloom to track not just what traders think, but how their conviction evolves in real time.