After reviewing the $3.26 million in Polymarket volume, cross-referencing negotiation reports from the White House, and tracing the flow of institutional chatter, my central prediction is clear: an Oracle-led consortium has emerged as the overwhelming favorite to acquire TikTok.

This is not a standard Silicon Valley bidding war. It’s a geopolitical chess match where Oracle holds nearly all the right pieces, navigating both Washington and Beijing’s competing interests with surgical precision.

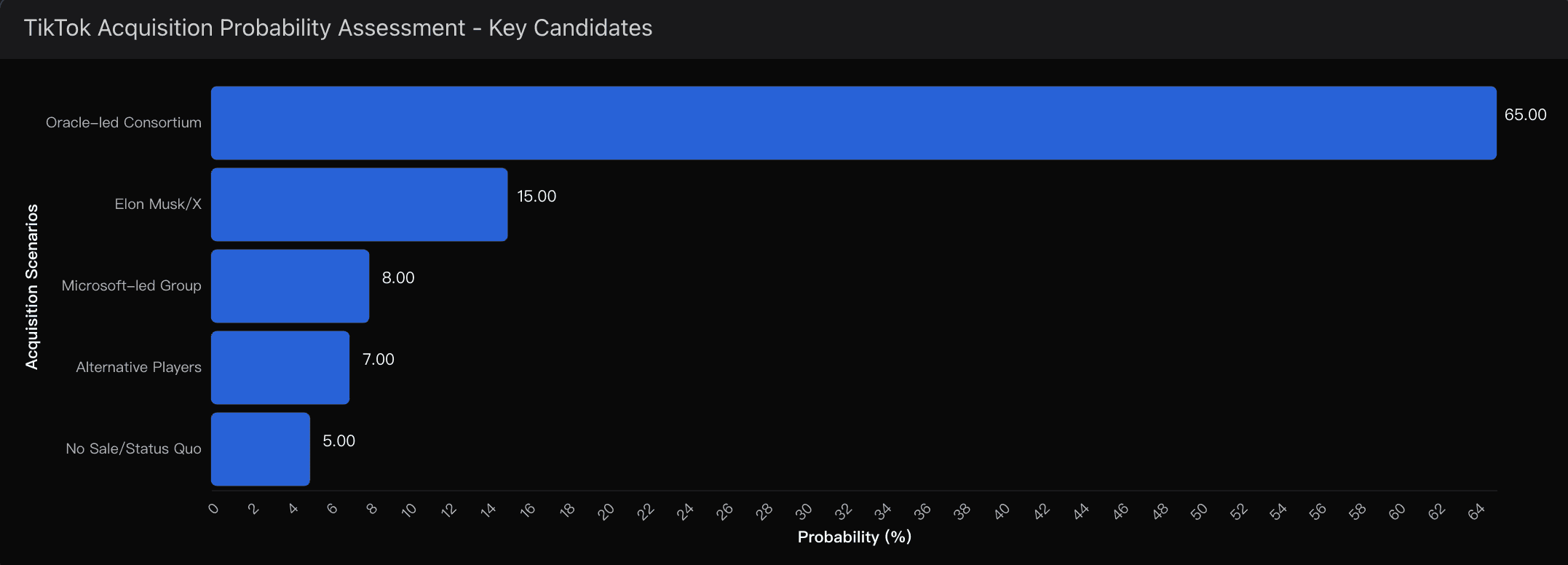

Powerdrill Bloom Probability Breakdown

Using Powerdrill Bloom’s real-time probability calibration model — which blends Polymarket sentiment, political event data, and regulatory news impact weighting — my current distribution looks like this:

Oracle-led Consortium: 65% — The clear frontrunner

Elon Musk / X: 15% — Trump’s wildcard candidate

Microsoft-led Group: 8% — The traditional tech challenger

Alternative Players (e.g., Perplexity AI): 7% — Emerging dark horses

No Sale / Status Quo: 5% — A deadlock scenario

These numbers aren’t static. Powerdrill Bloom continuously recalibrates them using live market signals — every new Treasury leak, every headline about ByteDance legal counsel, and even subtle shifts in trading liquidity. But the message remains consistent: Oracle is leading this race by both political proximity and operational logic.

if you’re following these moves closely, Dive deeper with Powerdrill Bloom to see the full probability breakdown and advanced insights.

Why Oracle Leads the Pack

1. Infrastructure Lock-In Advantage

Oracle already hosts TikTok’s entire U.S. user traffic under the “Project Texas” framework. This infrastructure lock-in gives it a first-mover continuity edge no competitor can easily replicate. For policymakers, that continuity translates directly into national security assurance — a non-negotiable condition for approval.

2. Political Capital

Larry Ellison’s personal relationship with Donald Trump — highlighted by his presence at the January 21st White House announcement — has turned Oracle from a corporate bidder into a trusted political ally. In a process where politics outweighs balance sheets, this relationship is arguably Oracle’s most valuable asset.

3. Regulatory Sweet Spot

Unlike a pure U.S. takeover, the Oracle-led consortium model allows ByteDance to retain a minority, non-controlling stake, while granting Oracle “effective oversight” over U.S. operations. This hybrid approach satisfies both sides: Beijing avoids the optics of a forced divestment, and Washington secures operational control over data flows.

4. Financial Engineering Strength

With “tens of billions” reportedly at stake (per NPR sources), Oracle’s consortium model enables distributed capital pooling — involving private equity and infrastructure funds — without putting Oracle’s balance sheet under direct strain. This structure also reduces the risk of triggering antitrust scrutiny, unlike if Microsoft or Amazon led the charge.

Counterarguments & Risk Factors

Despite Oracle’s strong lead, several counterforces could still disrupt the path to acquisition.

1. The Musk Wild Card

Trump has publicly expressed “comfort” with Elon Musk acquiring TikTok. While this currently sits at a 15% probability, Musk’s unpredictability and Trump’s loyalty patterns make this a tail risk worth watching. If Musk formalizes a bid backed by foreign capital, it could shift political momentum almost overnight.

2. Financial Constraints

Oracle’s net debt position stands in stark contrast to the massive cash reserves of Microsoft or Amazon. In an aggressive bidding escalation, Oracle could be forced into financial engineering that weakens long-term sustainability.

3. Regulatory Turbulence

The legality of the 75-day extension granted for the sale remains uncertain. If courts challenge it, the administration may be forced into a compressed decision window — favoring bidders capable of all-cash offers and fast execution.

4. Congressional Pressure

Before these recent developments, Kalshi’s market priced TikTok’s ban probability at 87%. Even though sentiment has cooled, the underlying legislative hostility toward any deal preserving ByteDance’s ownership remains. This could resurface suddenly if lawmakers frame the Oracle structure as a “soft sellout.”

My Contrarian Take

While markets overwhelmingly price Oracle as the frontrunner, I see hidden fragility beneath the surface.

ByteDance’s $200 billion internal valuation sets an extremely high bar for buyer alignment. Historical precedent shows that megadeals above $100 billion have a 40% failure rate during the negotiation phase — often collapsing under regulatory or valuation pressure.

Oracle’s consortium approach, though politically elegant, introduces operational complexity. Each participating investor brings separate compliance obligations, risk appetites, and timeline constraints. If even one key partner pulls out under political or legal uncertainty, the entire framework could unravel.

The 30-Day Critical Window

From now through late November, the timeline becomes the single most important variable.

Powerdrill Bloom’s timeline forecasting module — which maps negotiation momentum against public meeting frequency — flags the next 30 days as a “volatility acceleration phase.” With weekly White House meetings scheduled and a 59% market probability of announcement by December 31st, we’re entering a window of high informational velocity.

Expect sharp probability swings driven by incremental leaks, Treasury clarifications, or coordinated political signaling. In previous cycles, these bursts have shifted acquisition odds by 20–30% within a week.

My base case remains:

Oracle announces the acquisition framework between October 30 and December 31, 2025 — with ByteDance retaining a symbolic minority stake and Oracle assuming operational control.