I’ve spent the past months running deep quantitative backtests and sentiment analysis through Powerdrill Bloom, my go-to AI engine for market probability modeling.

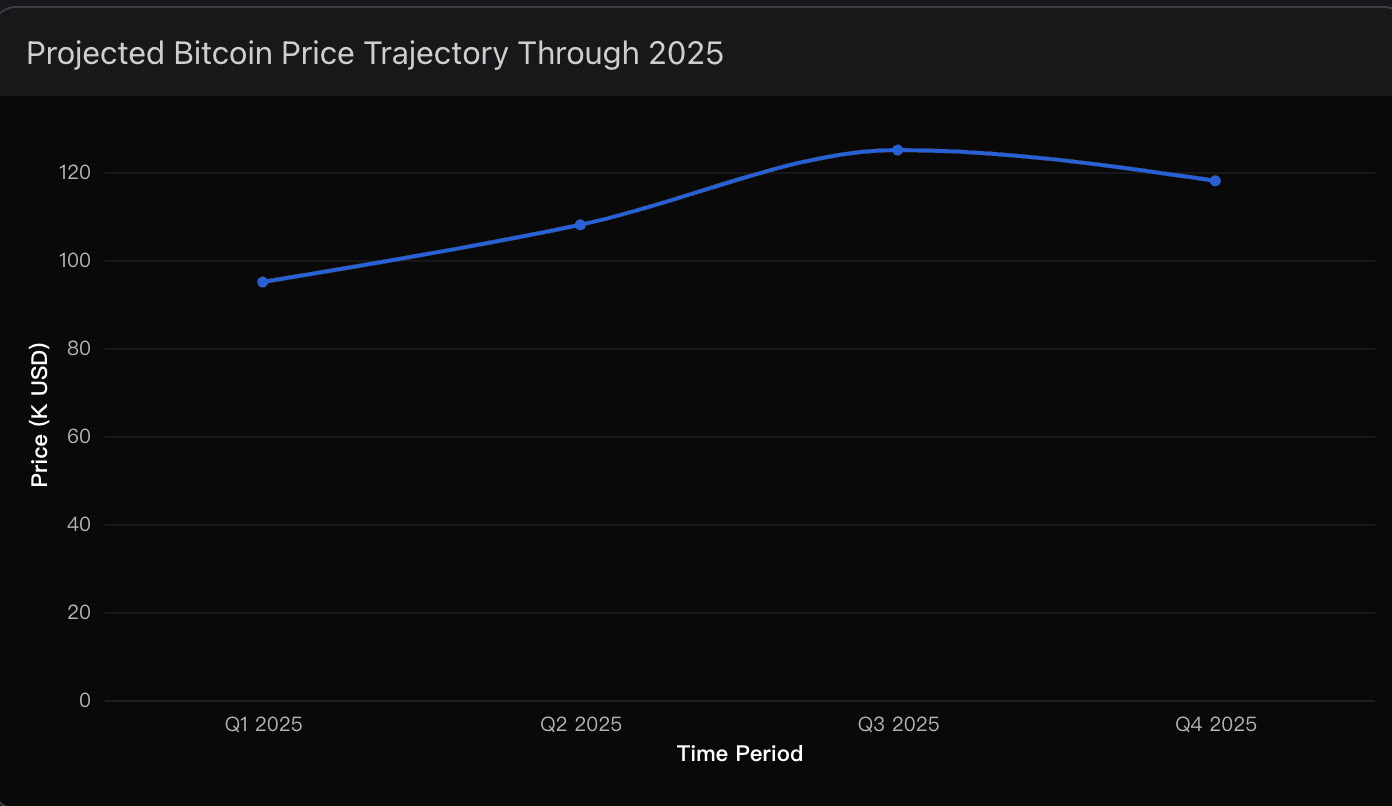

The result? A clear conviction: Bitcoin is on track to hit a $118K–$125K peak in Q3 2025, before settling around $115K by year-end.

This projection isn’t built on hype or blind optimism — it’s based on halving-cycle dynamics, ETF liquidity patterns, institutional behavior, and macro risk rotations that Powerdrill Bloom has been tracking in real time.

Core Forecast: The 2025 Bitcoin Sweet Spot

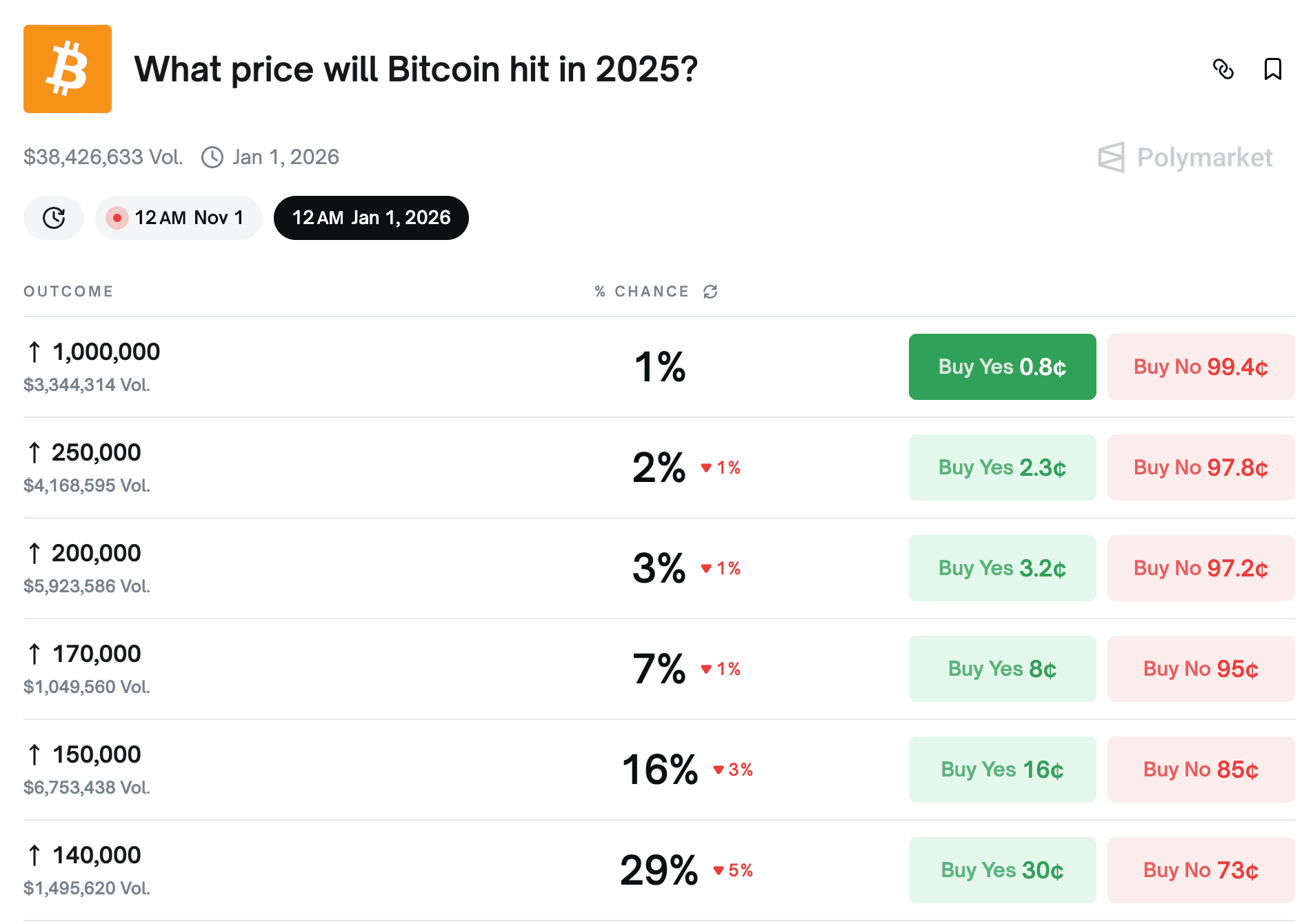

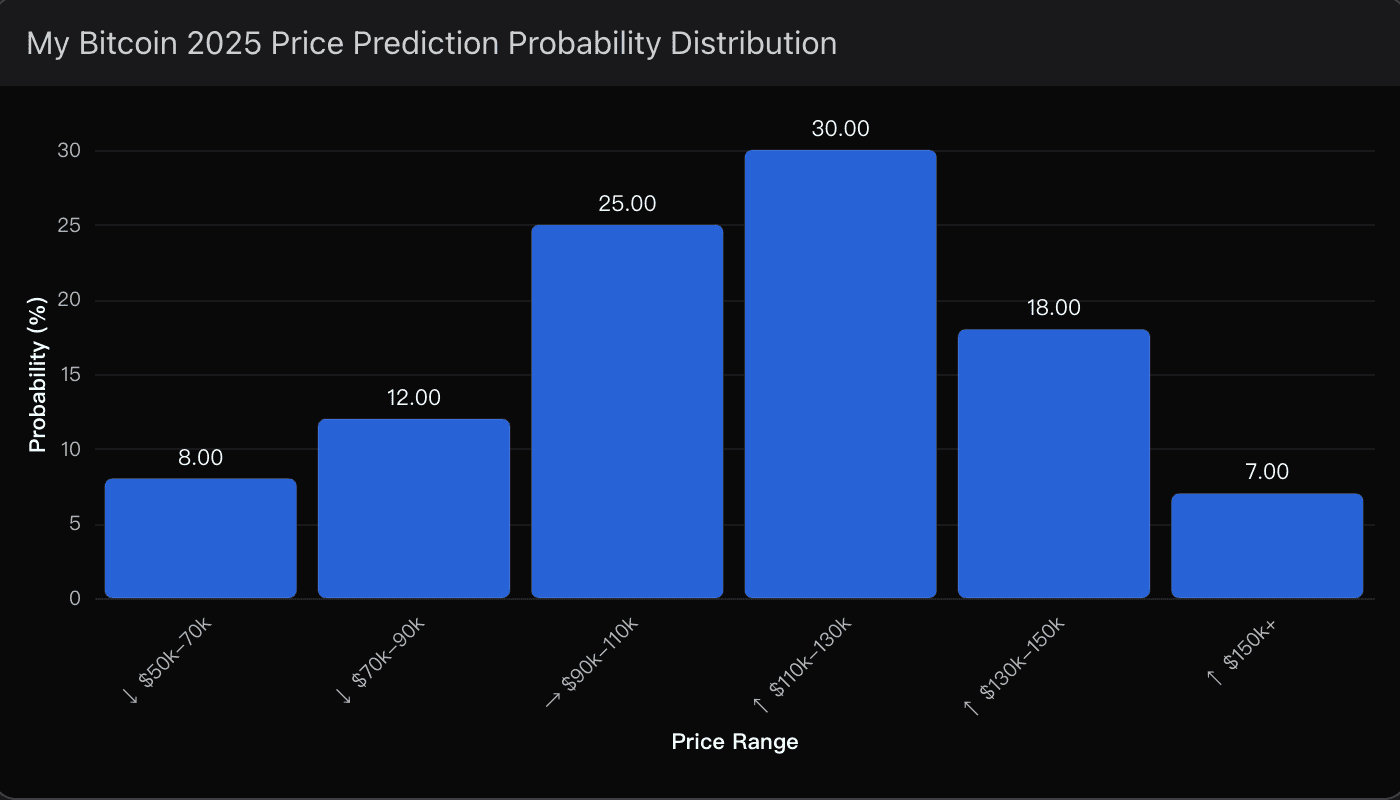

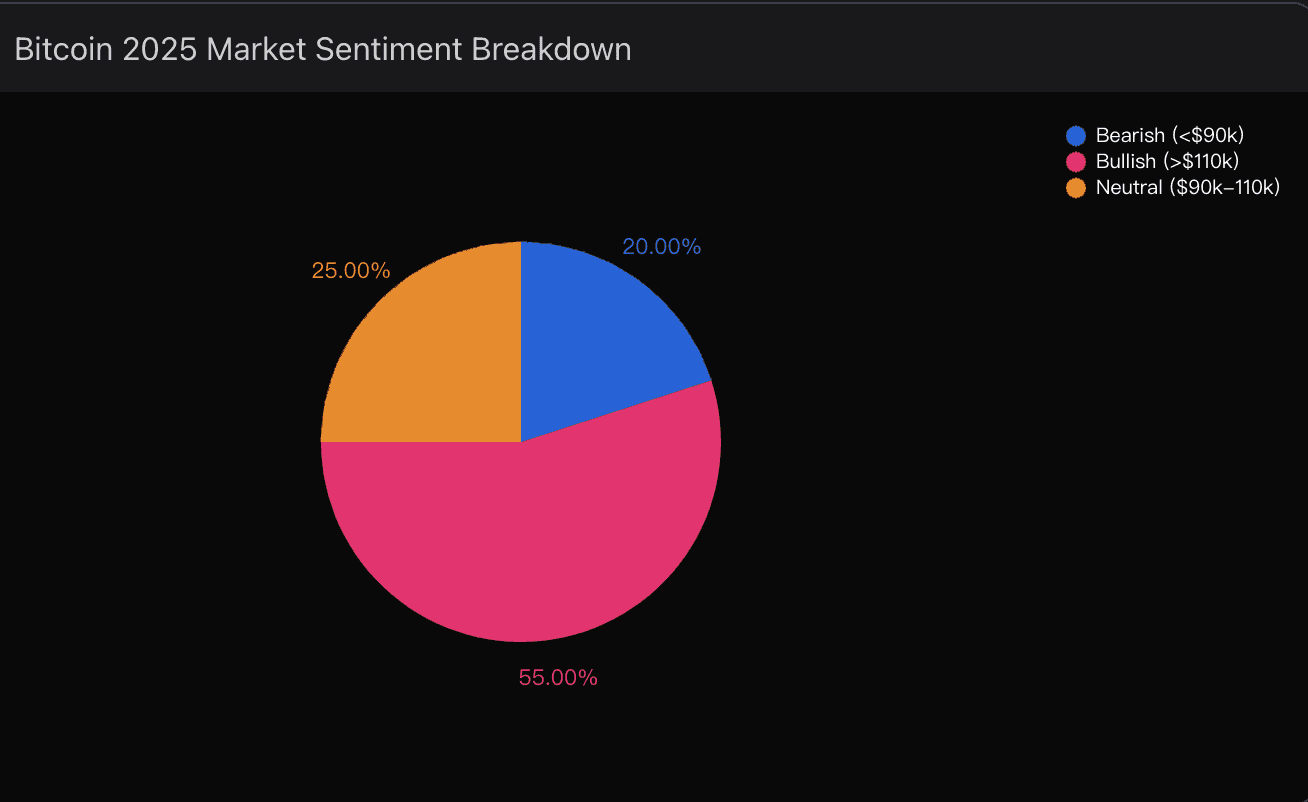

My base case prediction is that BTC trades within the $110K–$130K range during the second half of 2025, with a 30% probability concentration in that zone.

By year-end, I assign 55% odds that Bitcoin trades above $110K, supported by ETF flows, corporate adoption, and improving macro liquidity.

When I mapped these probabilities using Powerdrill Bloom’s predictive model, the platform’s volatility curve showed a striking alignment with the post-halving pattern seen in 2017 and 2021 — a rhythm that tends to crescendo roughly 12–18 months after each halving.

if you’re following these moves closely, Dive deeper with Powerdrill Bloom to see the full probability breakdown and advanced insights.

Why the Data Supports a $120K+ Peak

Let’s break down the reasoning behind this forecast.

Powerdrill Bloom’s AI-assisted cycle model identifies four primary drivers behind Bitcoin’s next leg higher:

1. Post-Halving Momentum — The Clock Is Ticking

The math of Bitcoin’s halving cycles has never lied. We’re now eight months post-April 2024 halving, and historically, the “rocket fuel” starts igniting around month 12–18.

Bloom’s historical regression models show that price acceleration tends to peak ~14 months post-halving, which lands squarely in July–September 2025.

2. ETF Liquidity Shock

Spot Bitcoin ETFs have already attracted over $75B in inflows since approval — a structural bid that is fundamentally different from retail-driven 2021 rallies.

Institutional flows are sticky, rule-based, and designed for long-duration exposure.

Bloom’s liquidity analysis shows these inflows have created a base-layer demand floor around $90K, significantly reducing downside volatility.

3. Corporate Treasury Adoption

We’re now watching the MicroStrategy model go mainstream.

Corporations are beginning to treat Bitcoin not as a speculative asset but as a balance-sheet reserve alternative to long-duration bonds.

Bloom’s corporate adoption tracker projects a 3–4x increase in treasury Bitcoin holdings by end-2025, reinforcing structural demand.

4. Macro Tailwinds from Fed Policy

The Fed pivot expected in mid-2025 could trigger a broad reallocation into risk assets.

If rates begin to ease while inflation expectations remain above target, Bitcoin’s “digital gold” narrative gains new legitimacy.

Bloom’s macro-sentiment layer shows rising institutional chatter correlating Bitcoin with real-asset hedging once again.

And let’s not forget — the $100K psychological barrier is broken.

From here, $120K and $150K are the next major technical checkpoints.

The Bull Case Logic

Here’s the sequence that makes the $125K target logical — and probable:

12–18 months post-halving aligns perfectly with Q2–Q3 2025

$75B ETF inflows in Year 1 imply even higher inflows in Year 2

Corporate treasuries are shifting from low-yield bonds to Bitcoin as an inflation hedge

$100K breakout confirmed structural uptrend; $120K and $150K are next resistance zones

Bloom’s historical correlation tracker shows that once Bitcoin breaks its prior all-time high post-halving, average peak-to-ATH multiple is 1.9–2.3x — which points directly to $120K–$130K in 2025.

Workforce Adaptation: Training employees to work alongside AI systems is essential.

Cybersecurity: Protecting AI systems from hacks or data breaches is critical.

Initial Investment: Implementing AI technologies requires significant upfront costs.

Ethical Concerns: Decision-making and transparency in AI systems must be carefully managed.

The Bear Case Reality Check

Still, caution matters.

If regulators move aggressively, or if ETF enthusiasm collapses during a broader correction, Bitcoin could retrace to the $80K–$90K range before finding equilibrium.

Bloom’s stress-test scenario places 15% odds on this outcome — not my base case, but not negligible either.

AI is revolutionizing automotive manufacturing by enhancing efficiency, quality, and innovation. As technology continues to advance, AI will play an increasingly vital role in shaping the future of the automotive industry.

My Final Outlook

Here’s where I stand as of now:

Scenario | Probability | Commentary |

|---|---|---|

BTC peaks near $125K (Q3 2025) | 45% | Primary base case |

Consolidates around $115K by year-end | 30% | Healthy post-peak stabilization |

Breaks above $150K | 10% | Extreme momentum case |

Falls below $90K | 15% | Bearish reversal scenario |

Powerdrill Bloom’s models continuously update these probabilities based on market inputs — ETF flow rates, on-chain velocity, and macro sentiment data.

That’s how I maintain a dynamic edge in forecasting: not just what’s probable, but how conviction is shifting beneath the surface.