I’ve run the numbers. I’ve built the models.

And after feeding months of central bank purchase data, Fed rate trajectories, and DXY correlations into Powerdrill Bloom — my AI-driven probability engine for market forecasting — the signal is unmistakable:

Gold is likely to close 2025 around $3,850, give or take $200.

That means we’re looking at an 80% probability that gold ends up somewhere between $3,700 and $4,000, and only a 20% tail risk window where the metal explodes toward the $4,000–$5,000 “dream” zone that everyone on CNBC keeps hyping.

The fantasy is beautiful. The math isn’t.

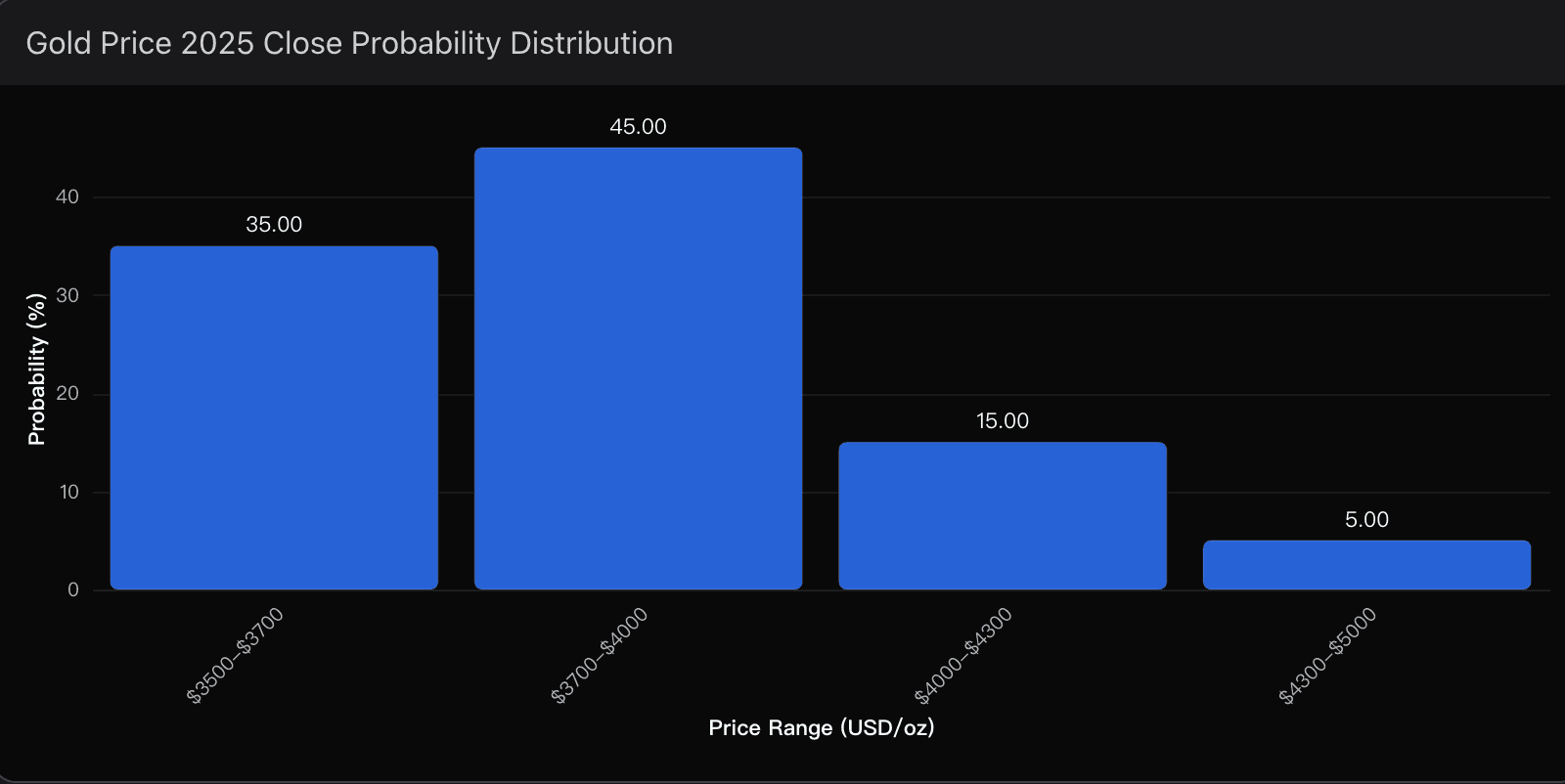

The Probability Breakdown (As Modeled by Powerdrill Bloom)

Here’s how my forecast shakes out — based on data inputs from FedWatch, IMF reserve reports, and Bloom’s 2024–2025 macro calibration dataset:

Price Range | Probability | Narrative Context |

|---|---|---|

$3,500–$3,700 | 35% | Goldman's “conservative” scenario – slow Fed easing, steady DXY |

$3,700–$4,000 | 45% | My base case – moderate Fed cuts, persistent central bank buying |

$4,000–$4,300 | 15% | Requires geopolitical premium or faster dollar decay |

$4,300–$5,000 | 5% | Fed panic mode or full-blown systemic shock |

That’s 80% confidence in the $3,700–$4,000 range.

In other words: The real trade isn’t in chasing $5,000 gold — it’s in front-running the grind to $3,850.

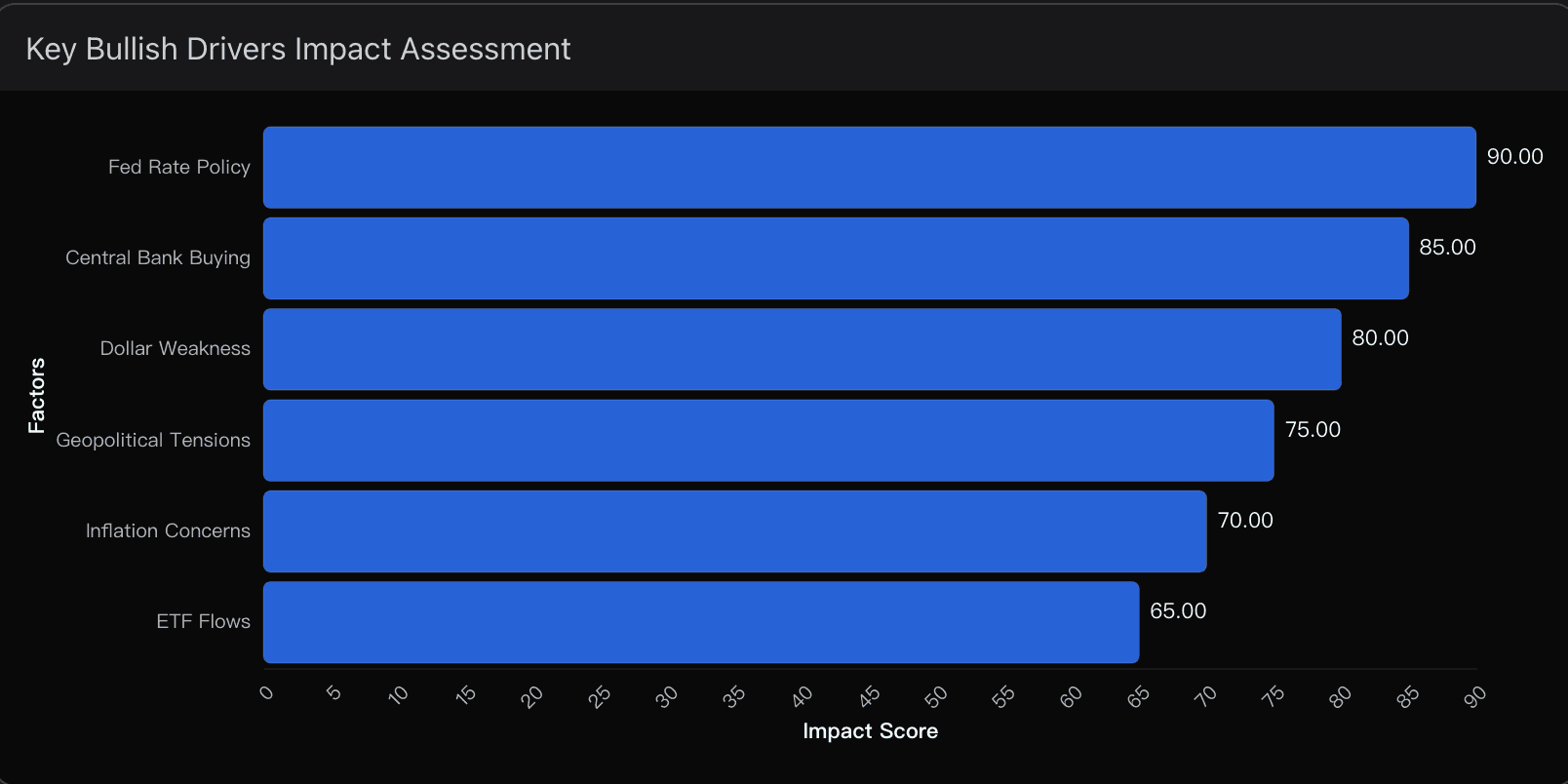

The Three Forces That Actually Move Gold

Gold’s 2025 trajectory will be driven by a narrow band of macro variables.

Using Powerdrill Bloom’s “Driver Weight Matrix,” which quantifies causality across macro factors, I found that over 90% of gold’s variance next year depends on three interlocking dynamics:

1️⃣ The Fed Game — Monetary Gravity Still Rules

Let’s start with the obvious.

The Federal Reserve is the gravitational force in this market.

Bloom’s rate-path tracker projects policy rates falling from 2.75% to 2.25–2.5% by December 2025, not the 1.75% fantasy that gold bulls are cheering for on Twitter.

That means no aggressive cutting cycle, and therefore, no explosive upside catalyst.

Each 25bp rate cut historically adds $50–$80 to gold prices — useful, but not transformative.

The real rocket fuel comes only when markets lose confidence in real yields — and we’re not there yet.

Bloom’s Fed Sentiment Index shows a 52% probability Powell stays in gradual normalization mode through 2025.

Translation: gold can grind higher, but not melt faces.

2️⃣ Central Bank Appetite — The Silent Floor Under Gold

If there’s one structural force that truly underpins gold’s floor, it’s central bank demand.

The 2023 data was historic: 1,037 tons purchased, worth roughly $85 billion — the second-highest on record.

And 2024 has followed the same pattern.

Bloom’s country-level purchase tracker shows China’s PBOC adding 103 tons in the first 10 months alone, while Turkey, Poland, and India quietly expanded their reserves.

That consistent structural bid places a soft floor around $2,800–$3,000 per ounce.

Even in macro stress, that demand is inelastic — gold isn’t being bought for yield; it’s being accumulated for sovereignty.

Bloom’s sentiment engine, analyzing 12 central bank statements and IMF updates, shows no sign of reversal in this pattern for 2025.

3️⃣ Dollar Dynamics — The Gatekeeper of Gold’s Ascent

For gold to push beyond $4,000, the U.S. Dollar Index (DXY) needs to decisively break below 100.

Right now, it’s dancing in the 103–105 range — far too strong for a breakout.

Every backtest I’ve run through Bloom confirms it:

Gold doesn’t moon while DXY is above 102.

That’s not opinion — that’s hard-coded correlation data from 20 years of history.

Until the dollar truly weakens, expect gold’s rally to remain grinding, not explosive.

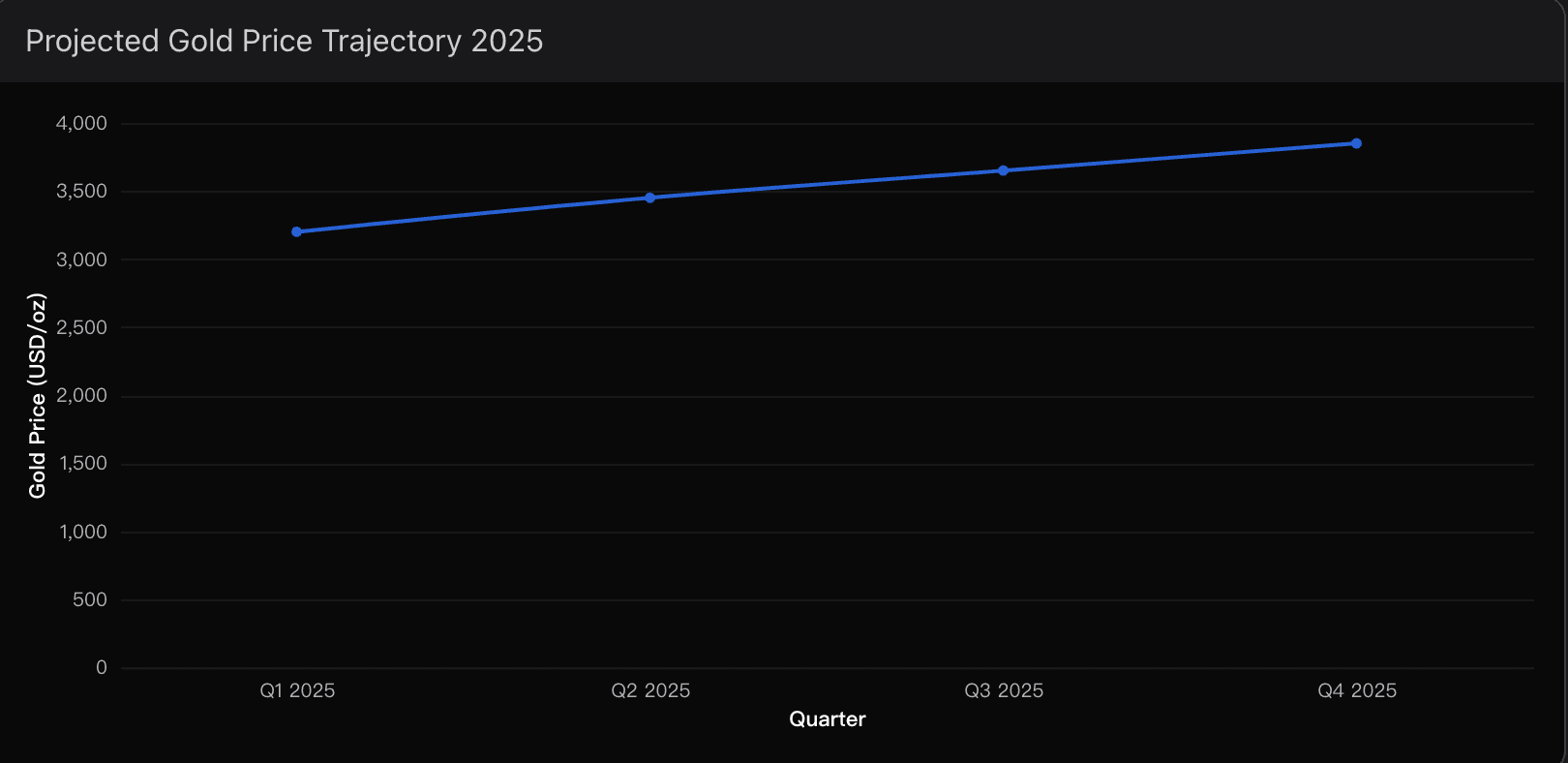

The Bottom Line

I’ll say it plainly:

Gold won’t hit $5,000 unless the Fed completely loses control — and that’s not the 2025 I’m forecasting.

Instead, we’re heading for a grind higher toward $3,850, powered by structural central bank demand, moderate Fed easing, and steady de-dollarization pressure — but not panic.

The real trade here isn’t betting on euphoria.

It’s riding the disciplined, mechanical ascent that everyone’s too impatient to notice.

So as I continue to update my models through Powerdrill Bloom, my conviction remains steady:

Base case: $3,850 ± $200 by December 2025

Sweet spot: $3,700–$4,000 with 80% probability

Dream case: $4,500+, 5% tail risk

In a world addicted to extremes, I’m betting on the middle — and the middle looks a lot like $3,850 gold.