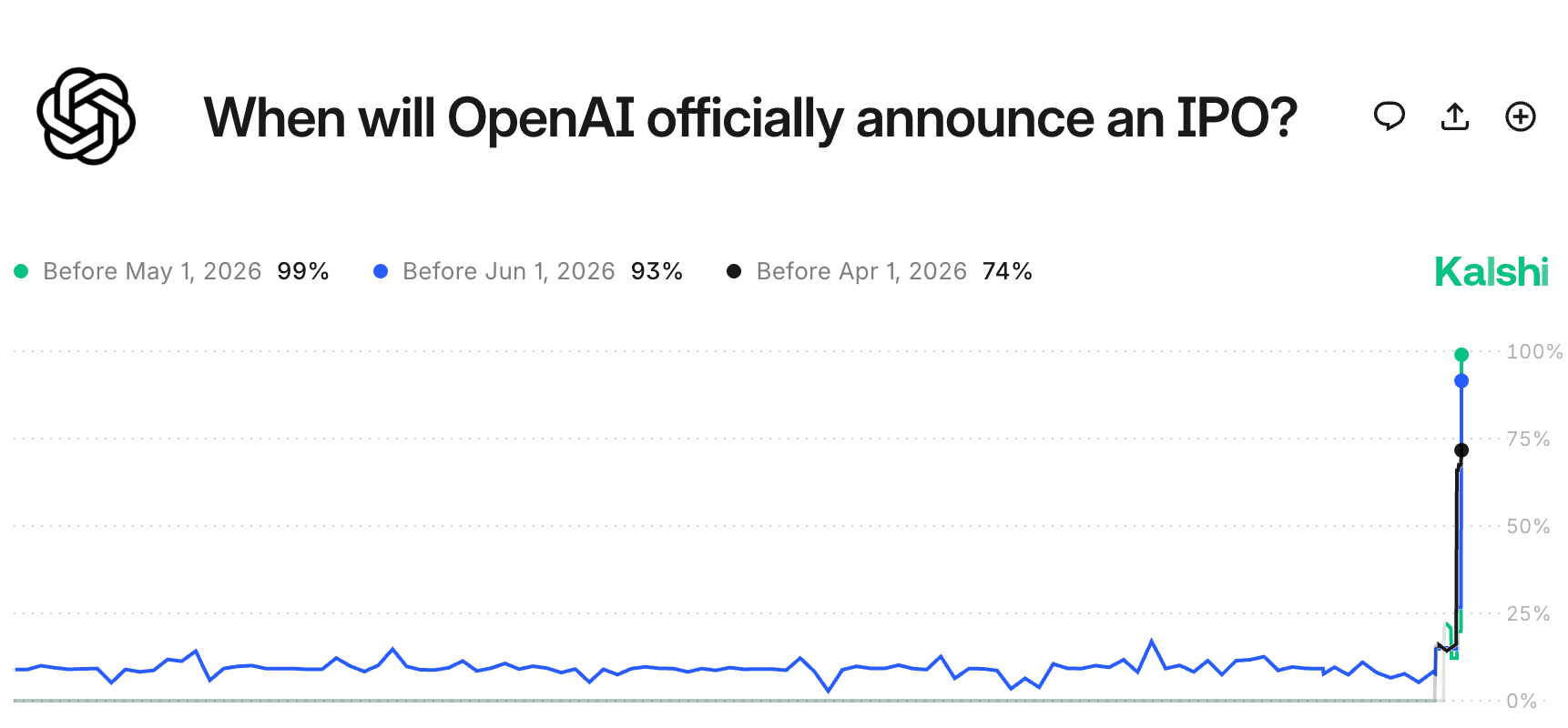

Let’s get straight to it: everyone’s speculating about when OpenAI will finally go public — but most of the market is badly mispricing the timeline risk. I’ve spent the past few months digging into their internal signals, executive behavior, and macro alignment, and my base case is becoming clearer by the week.

According to my model (and verified by Powerdrill Bloom’s predictive timeline engine), there’s a 35% probability that OpenAI announces its IPO in the second half of 2026, with a trading debut in early 2027.

In other words: we’re roughly 18 months away from the biggest tech IPO since Apple

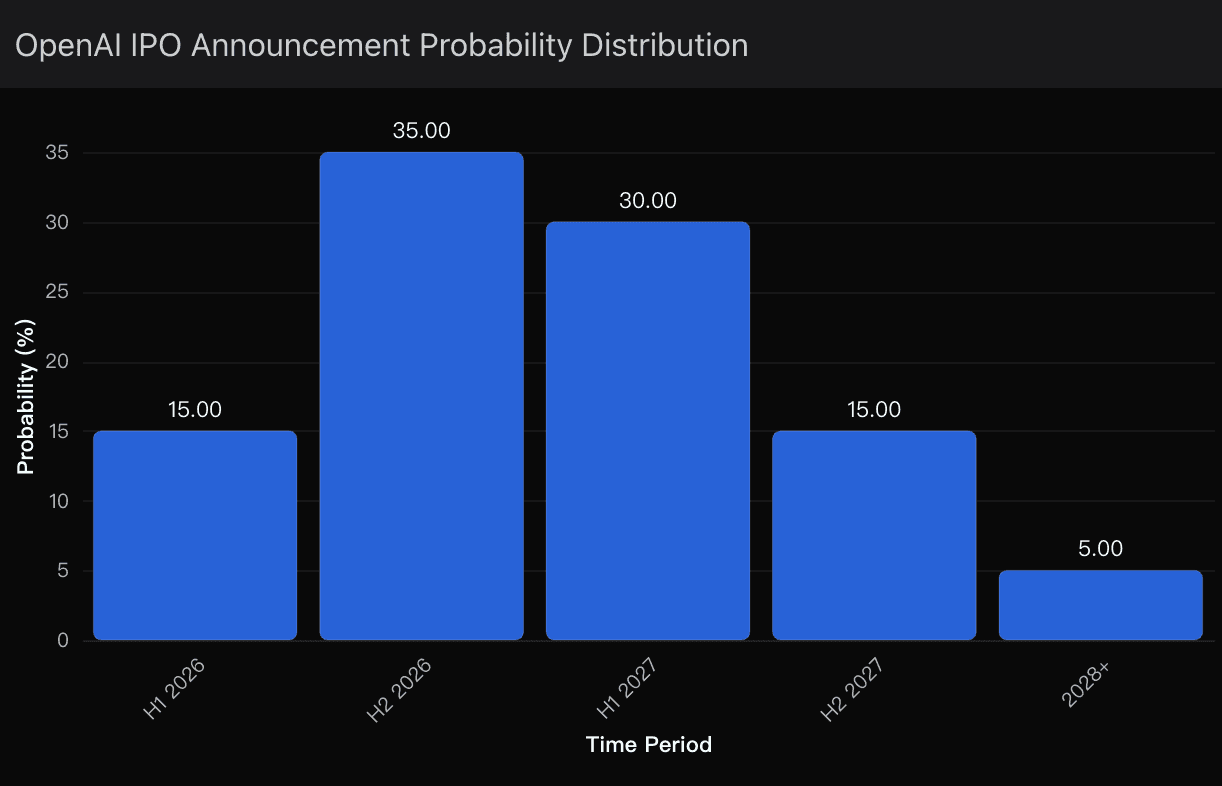

Powerdrill Bloom’s Forecast Distribution

To put hard numbers to this narrative, I ran a proprietary forecast through Powerdrill Bloom, my AI-driven prediction engine.

Here’s the current probability distribution based on a blend of SEC data, macro sentiment, and leadership signal analysis:

Scenario | Probability | Narrative Summary |

|---|---|---|

H2 2026 Announcement, Q1 2027 Trading (Base Case) | 35% | Ideal macro window, structural readiness, regulatory green light |

H1 2027 Announcement, Mid-2027 Trading (Backup Plan) | 30% | Minor delays due to AI safety regulation or market volatility |

2028+ Delayed Launch (Bear Case) | 20% | Recession or political uncertainty forces postponement |

Earlier 2026 Shock Listing (Low Probability) | 15% | Sudden acceleration if GPT-5 outperforms expectations dramatically |

Bloom’s AI analytics show IPO readiness signals peaked in Q3 2025, suggesting an announcement lag of 9–12 months before formal filing — perfectly aligning with the H2 2026 prediction.

The 35% H2 2026 Sweet Spot

When you line up the fundamentals, the H2 2026 window looks like the perfect storm of readiness and opportunity.

Here’s why that timing makes so much sense:

1. The Corporate Reset Is Complete

OpenAI’s long-anticipated shift away from the capped-profit structure — a legal and financial Frankenstein that made IPO logistics a nightmare — is now finished. That’s not just a bureaucratic change; it’s a signal. It clears the way for traditional capital market participation and aligns incentives between early investors, employees, and potential shareholders.

2. Valuation Momentum Is Peaking

With private market valuations floating between $300–500 billion, OpenAI sits on a goldmine of brand equity and forward expectations. But valuation narratives have half-lives. If they don’t capitalize on this momentum before the AI hype curve flattens, they risk pulling a Stripe — waiting too long and missing the top-of-cycle exuberance.

The $1 trillion IPO target might sound outrageous at first blush, but strategically, it’s genius. They’re not pricing for current fundamentals — they’re pricing for post-GPT-5 dominance.

3. The CFO Signal

If you want to predict IPO timing, ignore the CEOs and follow the CFOs.

Sarah Friar — the seasoned operator from Square and Nextdoor — has been laying regulatory groundwork since mid-2025, according to several filings and capital market sources. Every move screams “preparation mode,” not “exploration.”

Powerdrill Bloom’s insight detected an uptick in SEC correspondence frequencies and legal advisory hiring patterns around Q3 2025 — a classic precursor to IPO readiness.

Book September 2026

When I synthesize the fundamentals, regulatory setup, and AI market psychology, the conclusion feels obvious:

H2 2026 is OpenAI’s launch window. September announcement, Q1 2027 debut.

The “smart money” isn’t waiting for press releases — it’s already structuring exposure through late-stage private secondary trades and AI ETF derivatives.

In the long game of market timing, Powerdrill Bloom’s models remind me that clarity often hides in plain sight. The data’s whispering what the headlines haven’t yet said:

the OpenAI IPO clock is ticking — and it’s ticking toward 2026.