As we approach the end of 2025, the financial world is watching the Federal Reserve closely. Will they make the move that many expect in December and cut rates by a quarter-point? Or will macroeconomic forces and internal Fed dynamics force them to stay put? After analyzing the data, running simulations through my Powerdrill Bloom platform, and evaluating the broader market sentiment, I’m confident in making a core prediction:

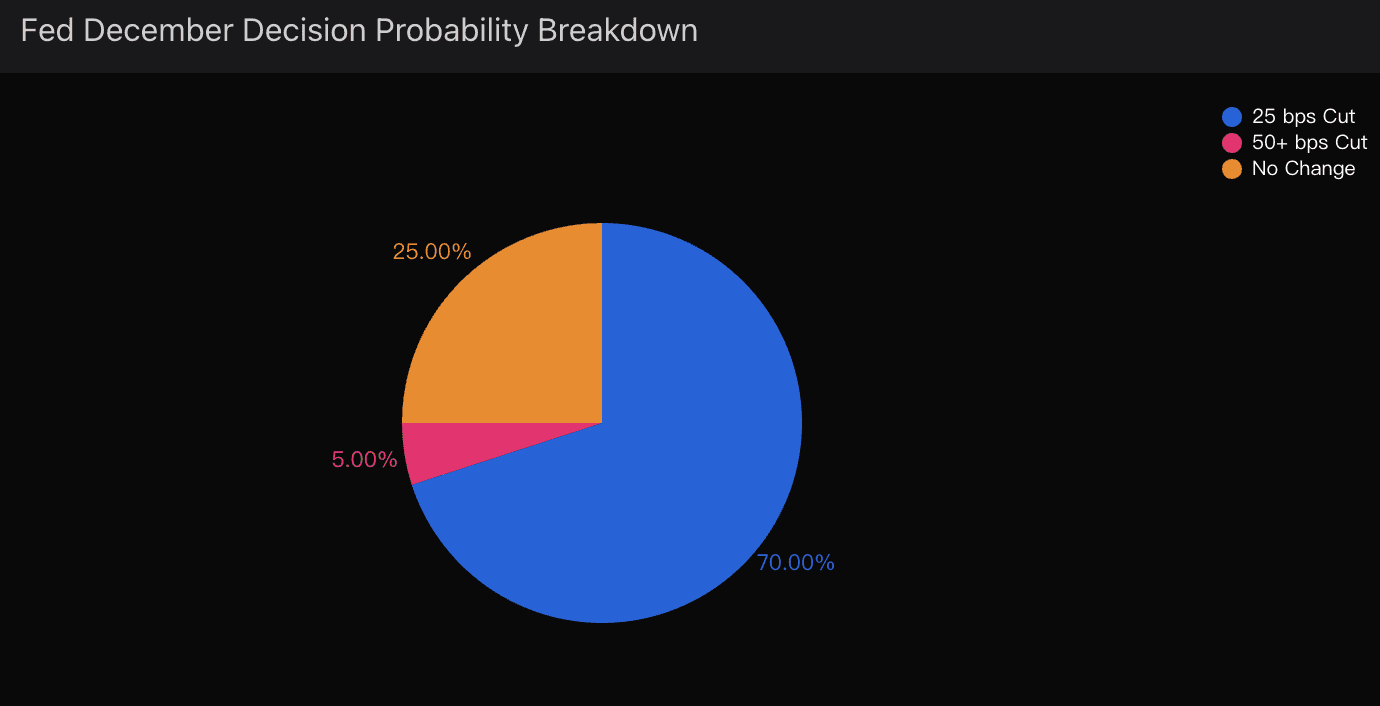

A 25 basis point (bps) cut remains the base case with a 70% probability.

But this prediction isn’t as straightforward as it might have seemed just a few weeks ago. The Fed is now in a delicate balancing act, trying to manage a softening labor market while battling stubbornly high inflation. And the complexity of the situation isn’t just limited to the numbers; it’s also about the underlying political pressures, internal Fed dynamics, and geopolitical uncertainties that could drastically change the trajectory.

Let’s dig deeper into the forces shaping this crucial decision.

The Current Market Consensus

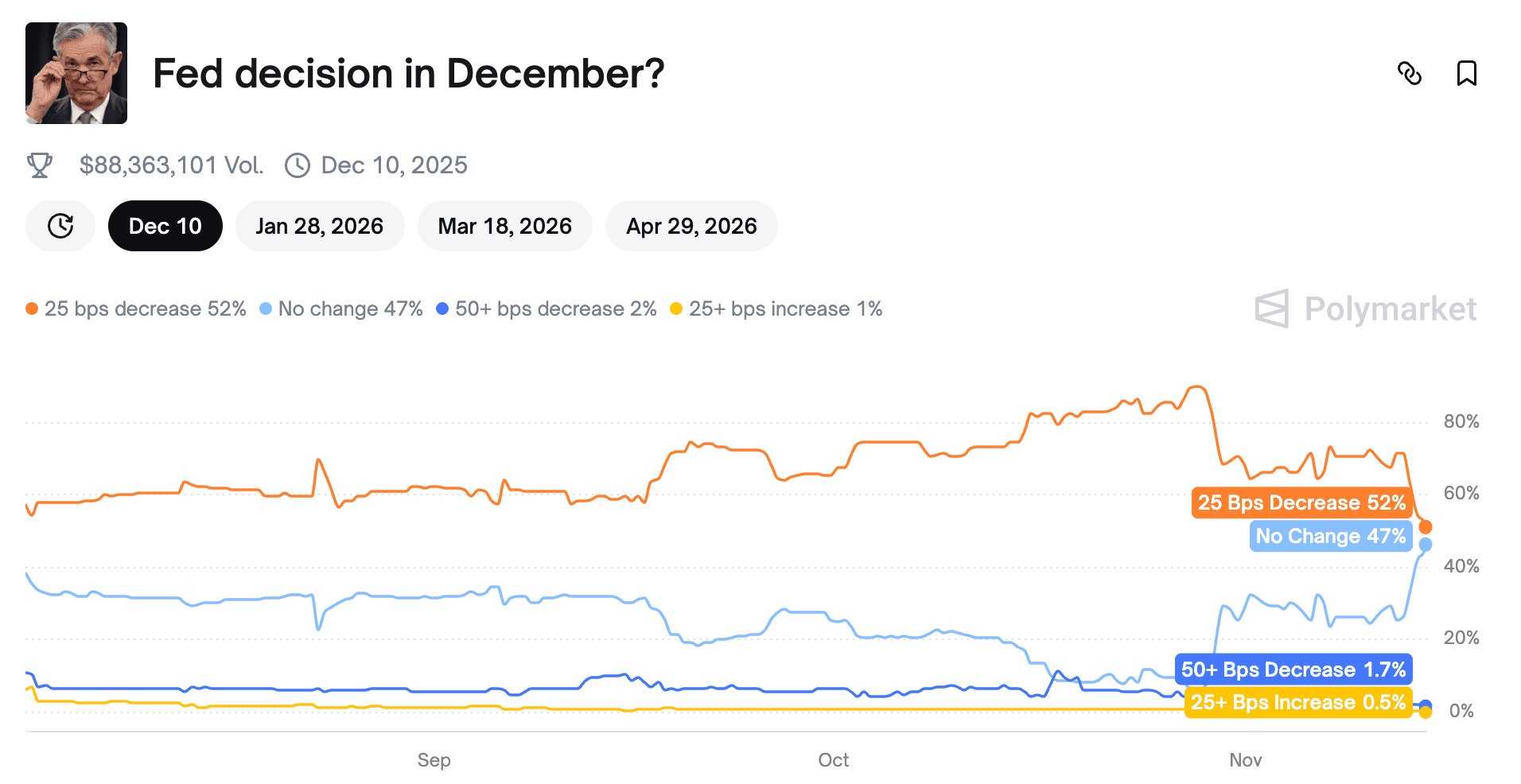

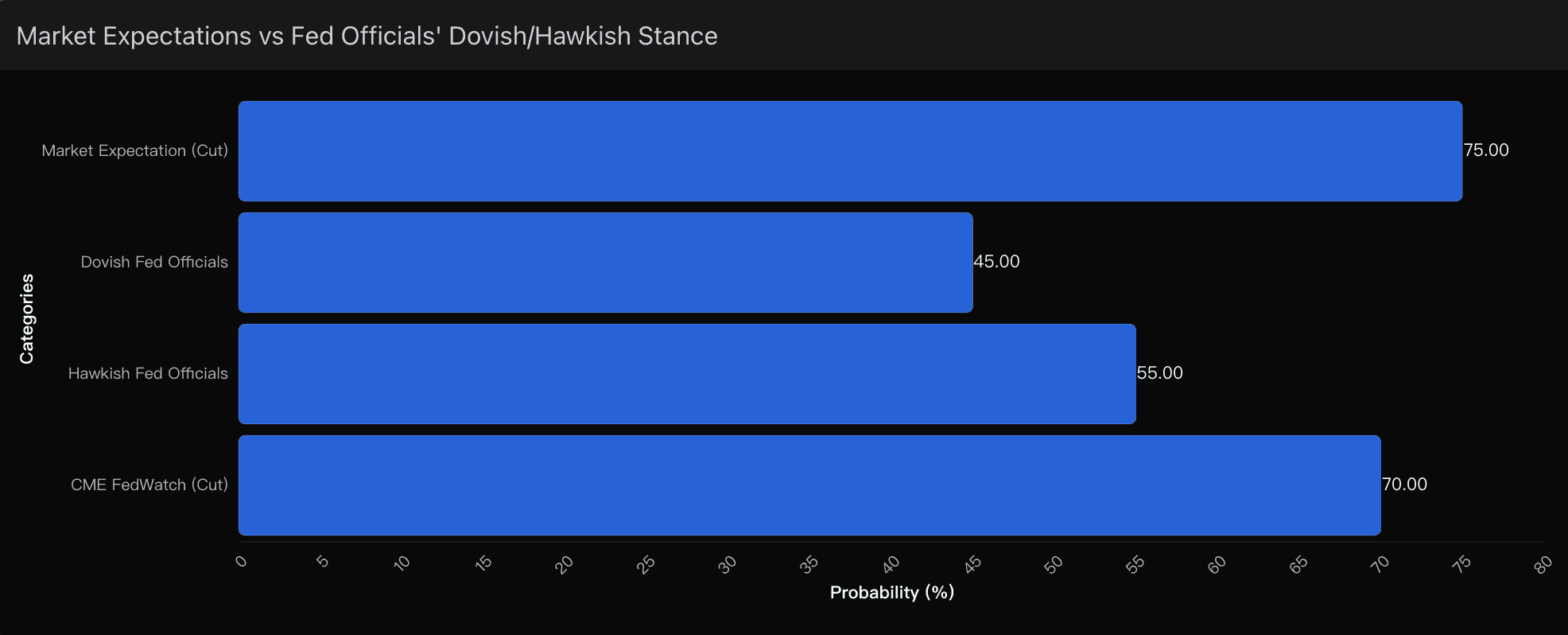

At first glance, a quarter-point cut in December looks almost inevitable. According to CME’s FedWatch tool, there’s a 75% probability of a 25bps cut, which aligns with 80% of economists surveyed in a recent Reuters poll. This broad consensus is supported by market actions on platforms like Polymarket and Kalshi, where traders are pricing in similar odds, with some even speculating on the possibility of larger cuts.

But, as I’ll explain, these numbers mask an underlying complexity that suggests this isn’t the slam dunk it first appeared to be.

The Pro-Cut Forces:

I believe the 25bps cut remains the most likely outcome, but it’s critical to understand why this is the path of least resistance. Let’s start by looking at the pro-cut forces that are driving the market’s expectations:

Labor Market Softening

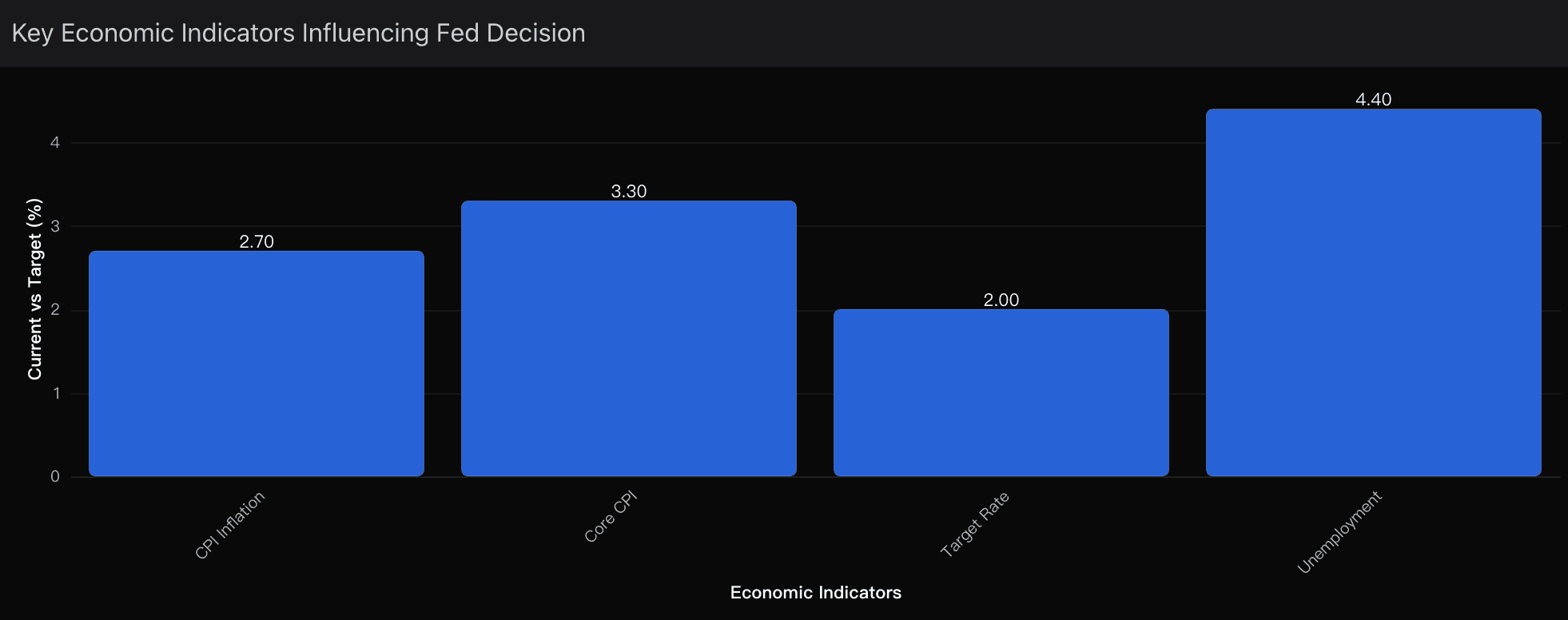

Over the past few months, the U.S. labor market has shown clear signs of slowing. Monthly job growth collapsed from an average of 150K in early 2025 to just 50K in the second half of the year. This sharp deceleration points to a cooling economy, which supports the Fed’s case for easing policy to avoid a hard landing.Powell’s September Guidance

In his September statements, Fed Chair Jerome Powell indicated that the Fed was targeting three rate cuts by year-end. With two of those cuts already delivered, the market is fully pricing in one final 25bps cut to close out the year.Real Rates Remain Restrictive

Current Fed funds rates sit between 4.75% and 5.00%, and even with recent cuts, real interest rates remain restrictive. As the U.S. economy slows, it becomes increasingly difficult for businesses and consumers to maintain their current level of spending and borrowing. A final 25bps cut would help reduce financial strain without completely abandoning the Fed’s inflationary battle.

The Major Uncertainty Factors at Play

While I’m confident in a 25bps cut as the most probable outcome, there are several uncertainty factors that could alter the final decision:

FOMC Unity Crisis

As mentioned earlier, Powell is grappling with a growing division within the FOMC. The differing views between committee members are likely to increase in the lead-up to the December meeting. With the Fed facing strong internal dissent — as shown by the two recent public dissents from Schmid (anti-cut) and Miran (pro-larger cut) — we could see even more vocal opposition within the Fed before the meeting. This could increase the chances of a split decision, or even a no-cut outcome.Data Dependency Trap

The November CPI report is going to be critical. If inflation unexpectedly rises or comes in higher than expected, it will completely kill the case for a December rate cut. Inflation is the Fed’s primary concern, and any upside surprise in the data would likely force them to reconsider any further easing, regardless of the labor market's performance.Political Transition Risk

Another wildcard is the upcoming political transition in the U.S. with a new administration potentially taking office. Markets are pricing in some policy uncertainty leading up to the election. The incoming administration’s approach to fiscal policy could have significant implications for the Fed’s own policy decisions, adding an extra layer of unpredictability to the rate-cut debate.Labor Market Inflection Point

We are seeing signs of the classic late-cycle slowdown in the labor market, but the big question remains: is this simply a soft landing, or are we heading into something more severe? The answer to this question will shape the Fed’s decision, as they will need to gauge whether further rate cuts are necessary to avoid a hard recession.

The Powerdrill Bloom Prediction: Where the Data Points

Using Powerdrill Bloom, I’ve modeled the probabilities of various scenarios, weighing institutional data, CPI metrics, FOMC sentiment, and external geopolitical risks. The data consistently shows that the 25bps cut remains the most probable outcome (around 70% probability), with the remaining 30% split between:

No rate cut (a 25% chance) due to higher-than-expected inflation or a shift in FOMC unity.

Larger rate cut (50bps) (5% chance) if inflation shows signs of further deceleration and the Fed is willing to act more aggressively.

The probability distribution also indicates that market expectations are largely aligned with the consensus, and Polymarket traders have similarly priced in a 25bps cut as the most likely outcome, though they remain less certain about the magnitude or timing of future cuts.

Based on current data and the forces at play — labor market weakness, inflation persistence, and geopolitical risk — I remain confident that a 25bps cut is the most likely outcome, with a 70% probability.

I’ll be keeping a close eye on the November CPI report, as it could tip the scales one way or the other, but for now, I’m sticking with this prediction. The December FOMC meeting is shaping up to be one of the most contentious and critical in recent memory.