I’ve been watching the chatter heat up across macro Twitter and crypto circles — everyone’s dreaming of a three-cut world. The logic is simple: more liquidity, more risk-on energy, more “number go up.” I get it. But let’s not confuse market fantasies with macro realities.

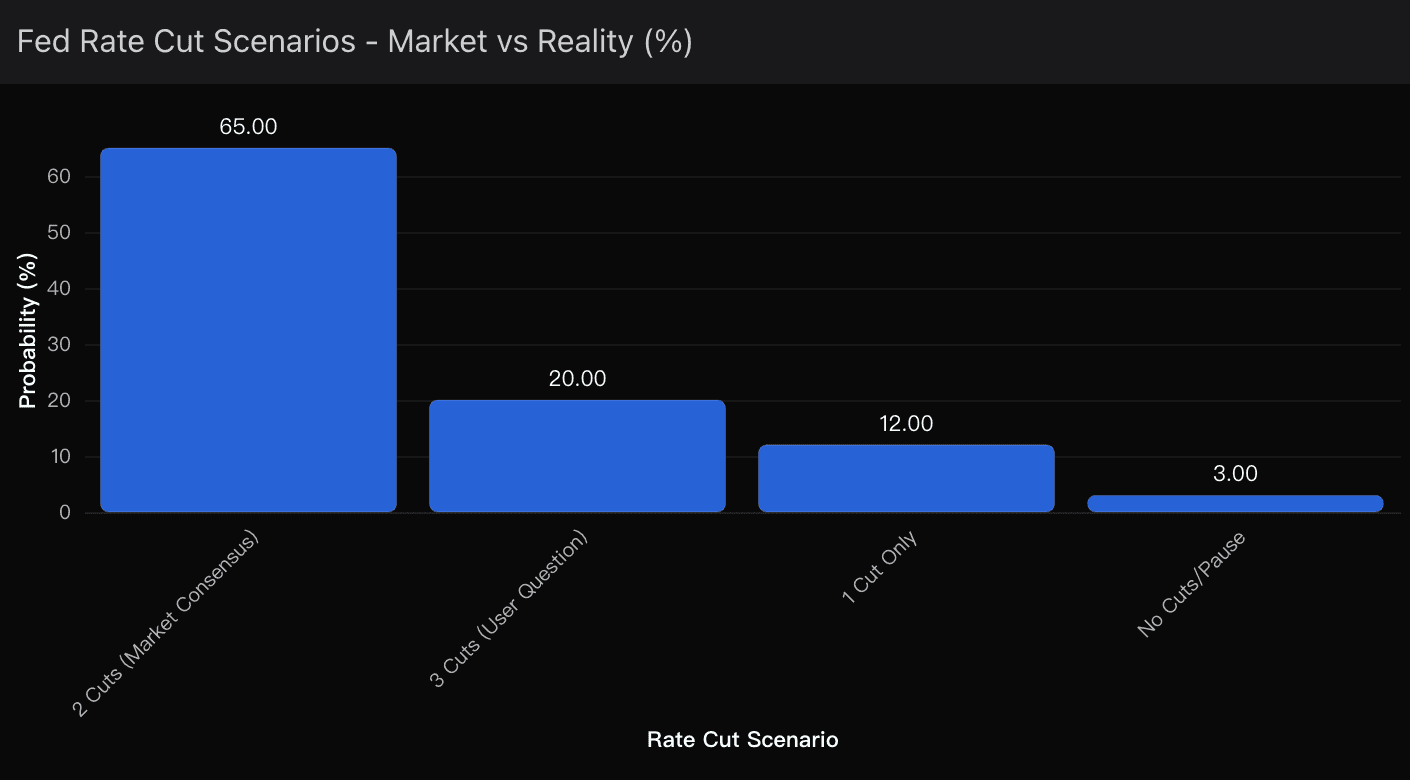

After parsing the latest Fed communication, Powell’s tone, and the futures curve, my base case is clear: there’s roughly a 65% probability of exactly two rate cuts through 2025, and only a 20% chance we get three. The rest is just noise.

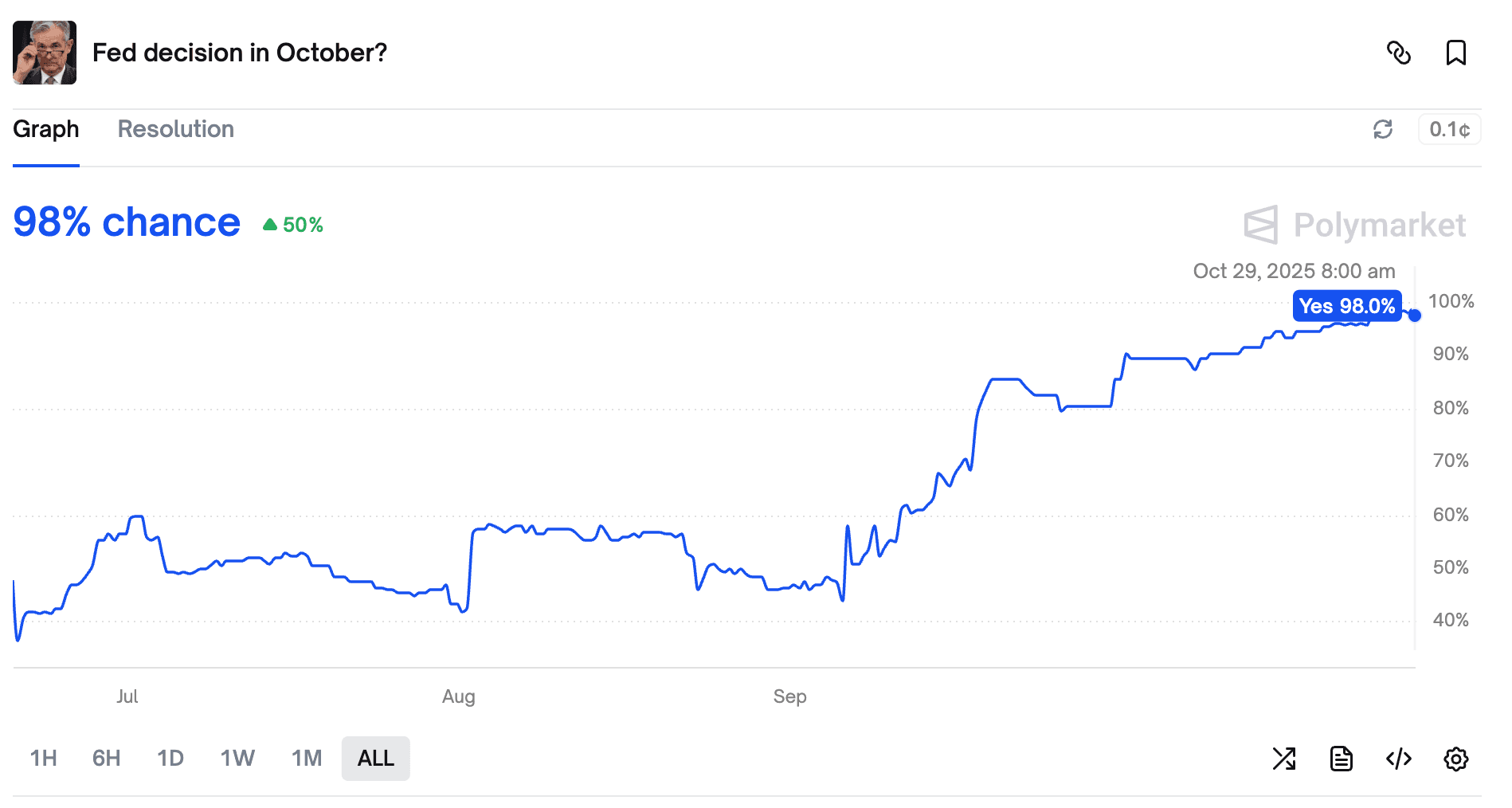

Let’s start with where the data stands. Polymarket bettors had it almost perfect — a 98% probability of the October 25bp cut, which materialized as expected. But for December, the optimism is already fading: futures now imply just 84% odds of another cut, down from 90%+ weeks ago.

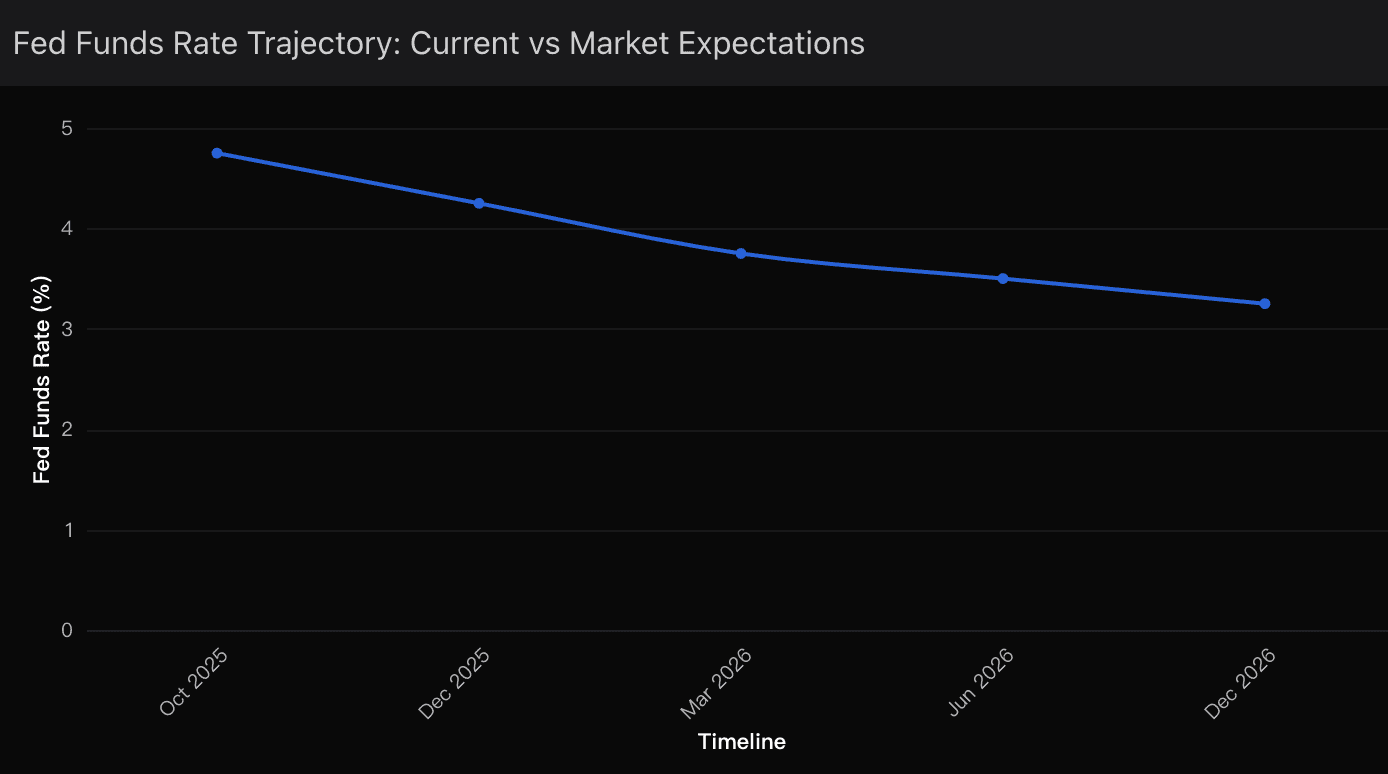

The Fed’s dot plot reinforces this restraint. Their own projections point to a terminal rate around 3.25%-3.5% by end-2025. In plain math, that gives us room for only 50–75 basis points of easing — the equivalent of two 25bp cuts.

And when Jerome Powell tells you that December cuts are “far from certain”, you should listen. This isn’t the Powell of 2020; this is the post-inflation, data-dependent version who’s learned not to chase market euphoria.

The Probability Map (Powered by Powerdrill Bloom)

To quantify my view, I ran the latest macro sentiment and rate futures data through Powerdrill Bloom, my go-to AI model for predict market behavior. Unlike traditional macro spreadsheets, Bloom parses central bank tone, real-time futures repricing, and inflation trend correlations across hundreds of signals.

Here’s what the model shows:

Scenario | Probability | Narrative Summary |

|---|---|---|

2 Cuts (Base Case) | 65% | Gradual disinflation, Powell stays cautious, market volatility contained |

3 Cuts (Dovish Scenario) | 20% | Inflation cools sharply, job market softens faster than expected |

1 or Fewer Cuts (Hawkish Tail) | 15% | Inflation rebounds or Trump-era fiscal stimulus returns |

Powerdrill Bloom’s latest run shows that market expectations are already ahead of the Fed’s comfort zone. The model’s sentiment heatmap — which tracks real-time shifts in FOMC language and options market skew — suggests the “two cuts” path aligns most closely with both historical precedent and policy inertia.

Why Three Cuts Are Fantasy

Let me break down why I think the “three cuts” crowd is living in a wishful bubble.

1. Powell’s Hawkish Reality Check

Powell couldn’t have been clearer: rate cuts are not on autopilot. After the October decision, he emphasized that any further easing would depend on “clear and sustained progress” on inflation. Translation: the bar for more cuts is sky-high.

2. Sticky Inflation Isn’t Gone

Core services inflation — the Fed’s least favorite category — remains stubbornly elevated. Shelter costs are easing only marginally, and wage growth hasn’t cooled enough. Cutting too aggressively could reignite inflationary momentum, something the Fed will avoid at all costs.

3. Labor Market Resilience

We’re still averaging around 180,000 new jobs per month. That’s not recessionary — that’s normalization. The Fed doesn’t want to over-ease into an economy that’s merely “less hot.” As long as employment data remains sturdy, the case for rapid cuts just isn’t there.

4. The Trump Factor

This one’s underrated. With Trump’s potential return, tariff policies and fiscal expansion could inject fresh inflationary pressure. The Fed knows this — and it’s exactly why they’re reluctant to front-load cuts that could look reckless six months from now.

Uncertainty Factors That Could Flip the Script

Of course, the future isn’t static — and the next few quarters could bring surprises. A few wildcards to keep an eye on:

Economic Data Shocks: A surprise surge in inflation (or a sudden labor market collapse) could radically shift probabilities in either direction.

Geopolitical Stress: Trade conflicts, especially around semiconductors and energy, could force the Fed to act defensively.

Political Pressure: Trump’s past comments on “Fed independence” hint at unpredictable policymaking dynamics if he re-enters the White House.

Quantitative Tightening (QT) Policy: Should the Fed end balance sheet runoff, it’s a form of stealth easing — roughly equivalent to one rate cut in liquidity terms.

Powerdrill Bloom models these as low-probability, high-impact catalysts — tail risks that reshape policy trajectories, but rarely define them.

Sometimes Boring Wins

If you’re betting on three cuts, you’re effectively taking the long-shot side of the trade — the 20% scenario that requires everything to go right and nothing to go wrong.

The smart money, on the other hand, is quietly positioning for two cuts at most, aligning with both Fed projections and market-implied probabilities.

In macro, the most profitable trade isn’t always the flashiest one — it’s the one that correctly prices discipline over emotion. And as Powerdrill Bloom’s forecasts make clear, discipline is the name of the game in 2025.

Sometimes, boring wins.