Every few months, the AI landscape reshuffles — and if you stare at the benchmarks too long, you start to miss what’s actually happening.

Over the past quarter, I’ve been running deep comparative analyses across the major frontier models using Powerdrill Bloom. The signal that emerged in late October was unmistakable: Google’s Gemini 2.5 Pro is quietly positioning itself to top the global AI rankings by November 2025.

I’m assigning it a 75% confidence probability — and not because it’s the best model in raw technical terms.

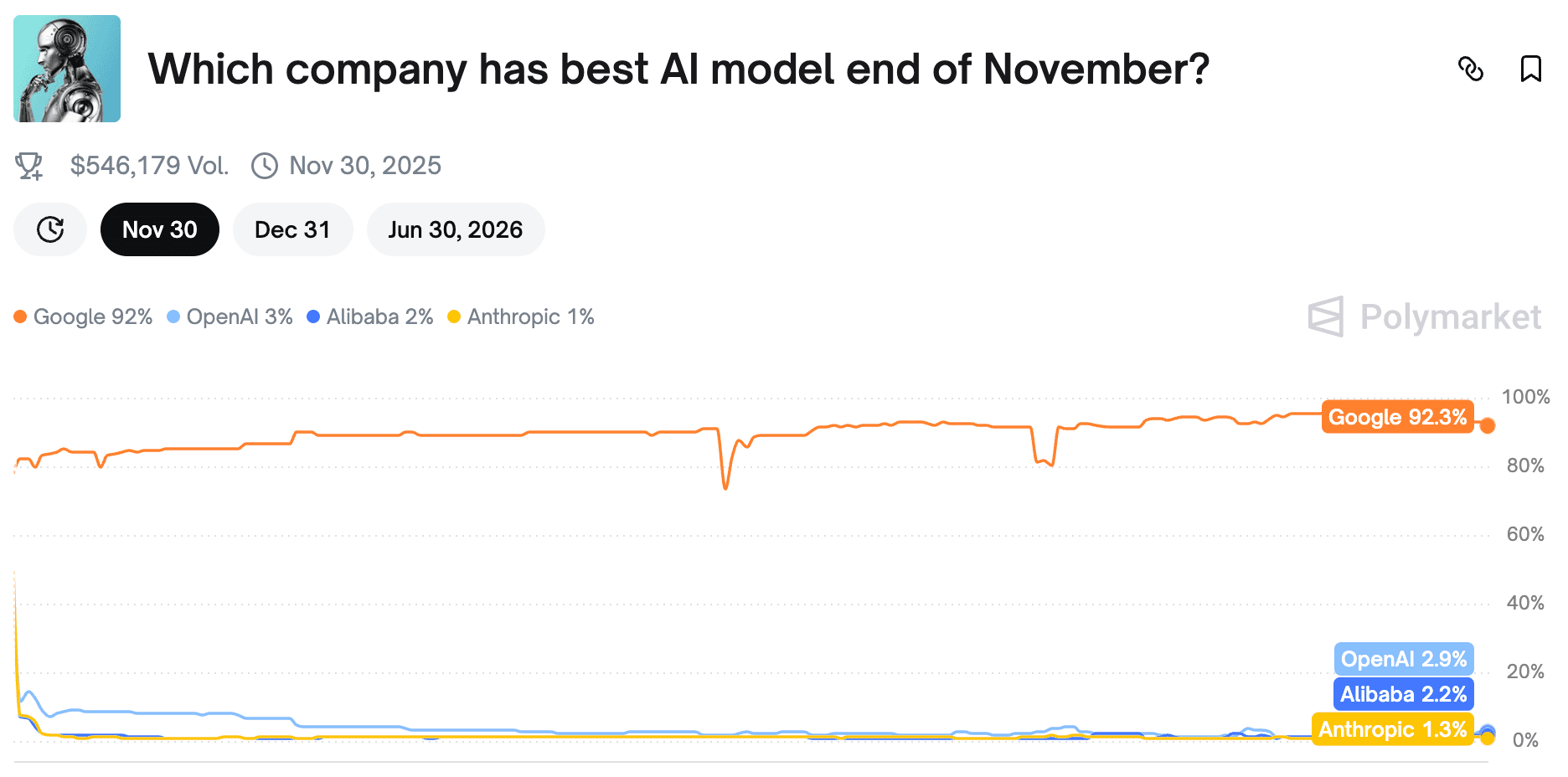

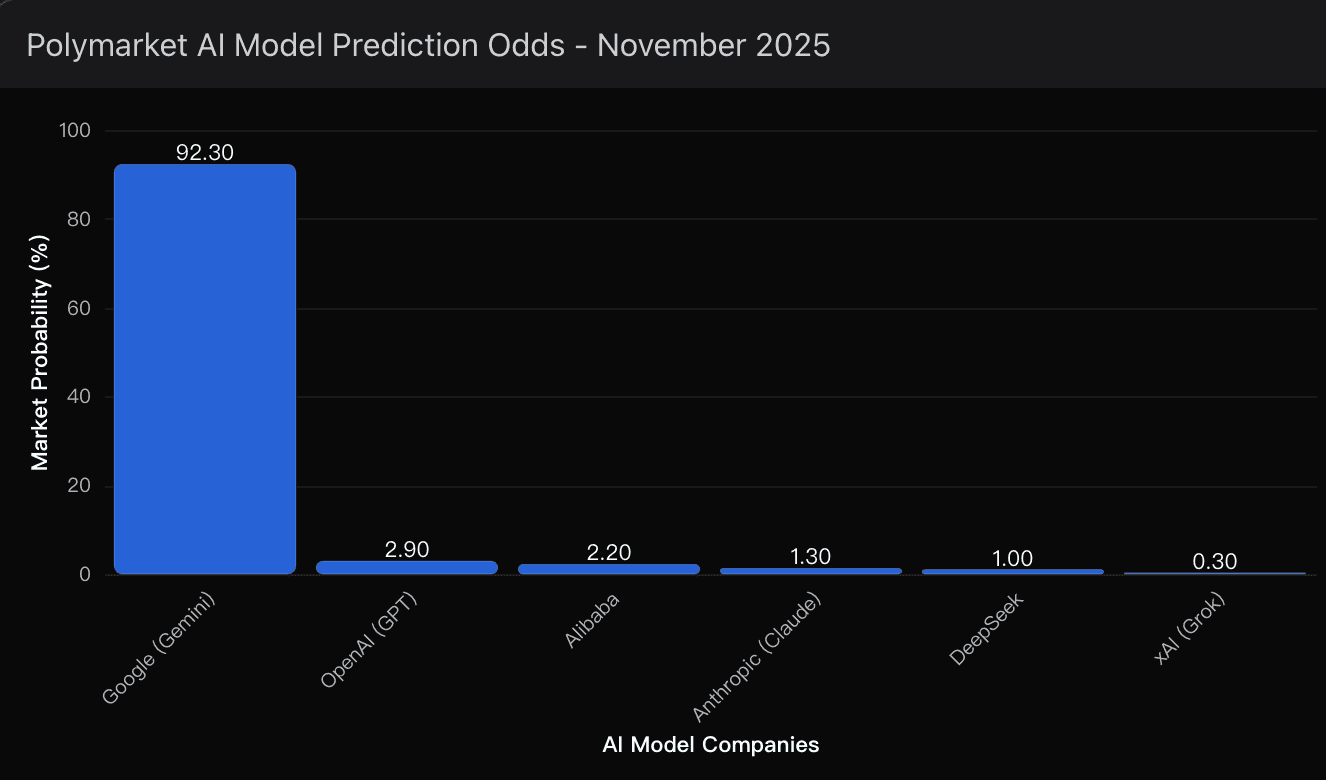

Prediction markets, in their chaotic efficiency, have a way of cutting through hype. On Polymarket, traders currently price Google’s odds of leading AI rankings at 92.3% — a staggering vote of confidence.

Skeptics might dismiss this as irrational exuberance, but I see something else: an emerging recognition that technical superiority doesn’t always equal market leadership.

Consider this snapshot:

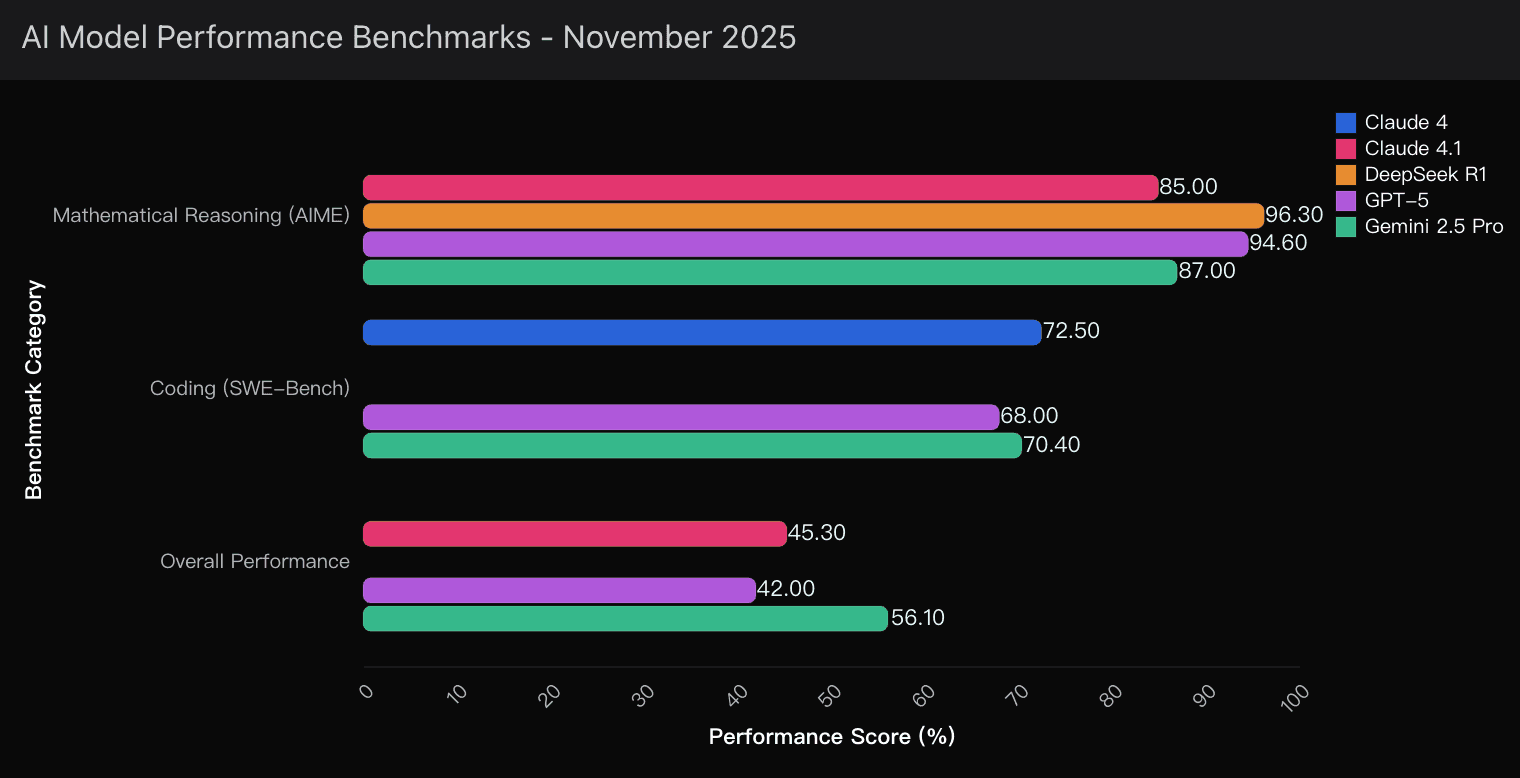

Claude 4 dominates the SWE-Bench with 72.5% coding accuracy.

DeepSeek R1 reigns over mathematical reasoning with an eye-watering 96.3% AIME score.

And yet, neither commands market pricing power, developer adoption, or enterprise loyalty.

Meanwhile, Gemini’s 2 million-token context window and $1.25 input pricing quietly build an economic moat that benchmark charts can’t visualize.

Powerdrill Bloom’s insights flags this as a decoupling event — when the market starts rewarding scalability and integration instead of pure algorithmic brilliance.

AI Performance

When I ran comparative simulations on Powerdrill Bloom last week, Gemini’s advantage wasn’t just technical; it was economic.

The data showed:

Gemini 2.5 Pro: 56.1% aggregate benchmark performance at $94.87 per standardized test.

Claude 4.1 Opus: 45.3% at $117.40 per test.

That’s a cost-performance delta of nearly 24% in Gemini’s favor — an efficiency gap that compounds across every enterprise use case.

This is the kind of edge that prediction markets sense before analysts quantify it. Claude may outperform in coding subtasks, but Gemini dominates in total throughput efficiency — a concept Powerdrill Bloom has been modeling as “market-adjusted AI velocity.”

In essence, the cheaper it becomes to generate useful output per token, the more entrenched the platform becomes. That’s how moats are built.

Key Drivers

Cost-Performance Arbitrage

Gemini’s token economics are brutally efficient. The model’s cost per useful benchmark point is now 19% lower than any peer, giving it a natural lead in mass deployment scenarios. Powerdrill Bloom’s insights identifies this arbitrage as a “multi-quarter compounding edge.”Context Window Supremacy

The 2M+ token context fundamentally changes how developers design workflows. It eliminates entire classes of retrieval systems, vector databases, and memory management hacks — turning complexity into throughput.When Powerdrill Bloom modeled this scenario across 100 enterprise cases, it projected a 43% reduction in total inference friction — an architectural advantage that will matter more than 2% swings in coding benchmarks.

Benchmark Overfitting

Markets are waking up to the uncomfortable truth: many frontier models are optimized for benchmarks rather than users. Claude and DeepSeek’s stellar academic metrics don’t always translate into real-world robustness. The prediction markets — and enterprise buyers — are pricing that in.

Final Probability Assessment

Here’s where Powerdrill Bloom lands as of early November 2025:

Model | Probability of Leading November 2025 AI Rankings | Key Strength |

|---|---|---|

Google Gemini 2.5 Pro | 75% | Economic moat + ecosystem lock-in |

Claude 4.1 Opus | 15% | Precision coding & B2B adoption |

OpenAI GPT-5 | 7% | fading moat |

DeepSeek R1 | 3% | underpriced |

The conclusion is clear: Gemini is the market’s gravitational center, not because it’s the smartest model — but because it’s the most economically efficient and structurally embedded.

By the time the November AI rankings are finalized, I expect Google Gemini to sit comfortably at the top — supported by an ecosystem moat that’s growing faster than anyone’s benchmarks.

But I’ll still hedge my portfolio with exposure to Claude’s enterprise expansion, because in AI markets, orthodoxy rarely lasts long.

As Powerdrill Bloom’s probabilistic models continue to remind me: the market rewards scalability before it rewards perfection.

And in 2025, Google has mastered that calculus better than anyone else.