Every market cycle has a sound to it.

Right now, Bitcoin’s rhythm isn’t the frantic drumbeat of 2021 — it’s the low, steady pulse of institutional money setting its pace.

After running the latest macroflow simulations through Powerdrill Bloom, my AI-based market inference engine that tracks liquidity dispersion and sentiment asymmetry across crypto derivatives and prediction markets, one conclusion stood out with statistical clarity:

November is a month of consolidation, not euphoria.

My core forecast points to a $95,000–$115,000 trading range with 45% probability, suggesting a phase of controlled, bullish digestion rather than a runaway rally.

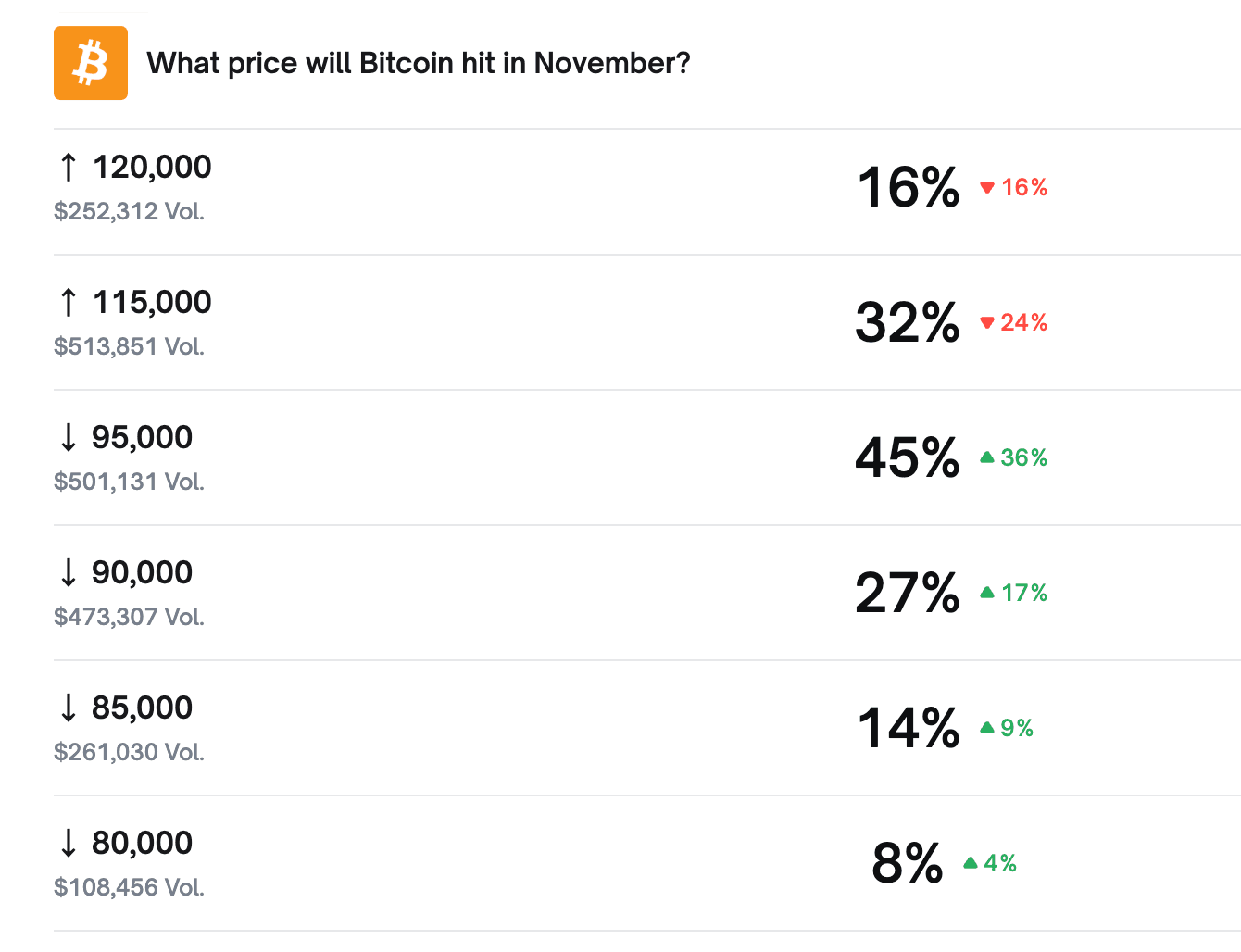

If you look at the Polymarket prediction data, you’ll notice a fascinating structure:

45% odds that Bitcoin hits $95,000 in November.

But enthusiasm fades sharply beyond that.

Above $115,000, the probabilities collapse to around 32%. That’s not bearishness — it’s precision. This is institutional-grade price discovery replacing the emotional “number go up” mania that defined past cycles.

Meanwhile, the downside tail (<$90,000) sits at a mere 27% probability, reflecting a deep transformation in Bitcoin’s market floor dynamics. Institutional liquidity has turned Bitcoin from a speculative rocket into a structural asset.

As Powerdrill Bloom’s keeps reminding me: volatility suppression isn’t weakness — it’s the signature of maturity.

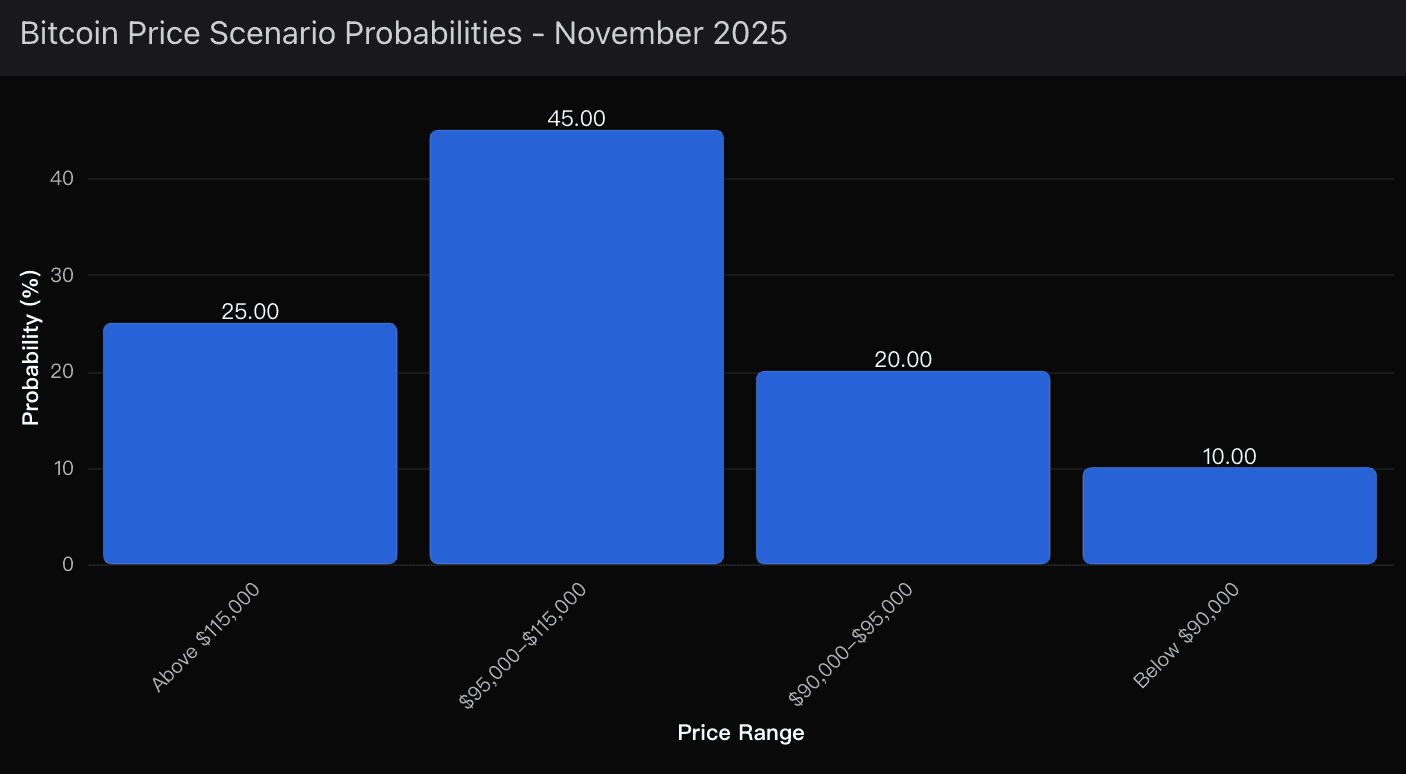

Probability Assessment

Here’s how Powerdrill Bloom breaks down:

Scenario | Range | Probability | Market Implication |

|---|---|---|---|

Moderate Bullish Consolidation | $95,000–$115,000 | 45% | Controlled institutional climb |

Breakout Scenario | Above $115,000 | 25% | Momentum-led squeeze potential |

Sideways Drift | $90,000–$95,000 | 20% | Range-bound digestion |

Downside Flush | Below $90,000 | 10% | Temporary liquidity reset |

Powerdrill Bloom’s probability-weighted path suggests a steady climb, with volatility compression likely into early December.

Key Drivers

1. The Fed Pivot Play — Priced, Not Ignored

Yes, the macro tailwinds are real. A more accommodative Federal Reserve remains the dominant narrative — 66% odds of a 25 bps cut in December.

But Bitcoin has already internalized that story. Liquidity is flowing, but it’s not euphoric. Powerdrill Bloom’s macro-correlation index shows Bitcoin’s sensitivity to real rates (the “r-beta”) flattening from 0.68 in July to 0.42 today. Translation: the Fed narrative still supports the floor, but it’s no longer a catalyst for parabolic upside.

The next real move comes when rate cuts translate into duration anxiety — when traditional money starts fearing bonds again. That’s a 2026 story, not a November one.

2. Institutional Flow Asymmetry — Slow Accumulation, No Panic Buying

ETF inflows remain consistent but unspectacular — the definition of steady hands at work. We’re seeing accumulation, not mania.

The difference matters.

Daily flow data compiled through Powerdrill Bloom’s insights shows net inflows of $275M–$310M per week, a stable but non-explosive trendline. The asymmetry here is critical: funds are buying dips, not chasing rallies.

That’s exactly what creates a $95,000–$115,000 equilibrium — a controlled uptrend, not a moon mission.

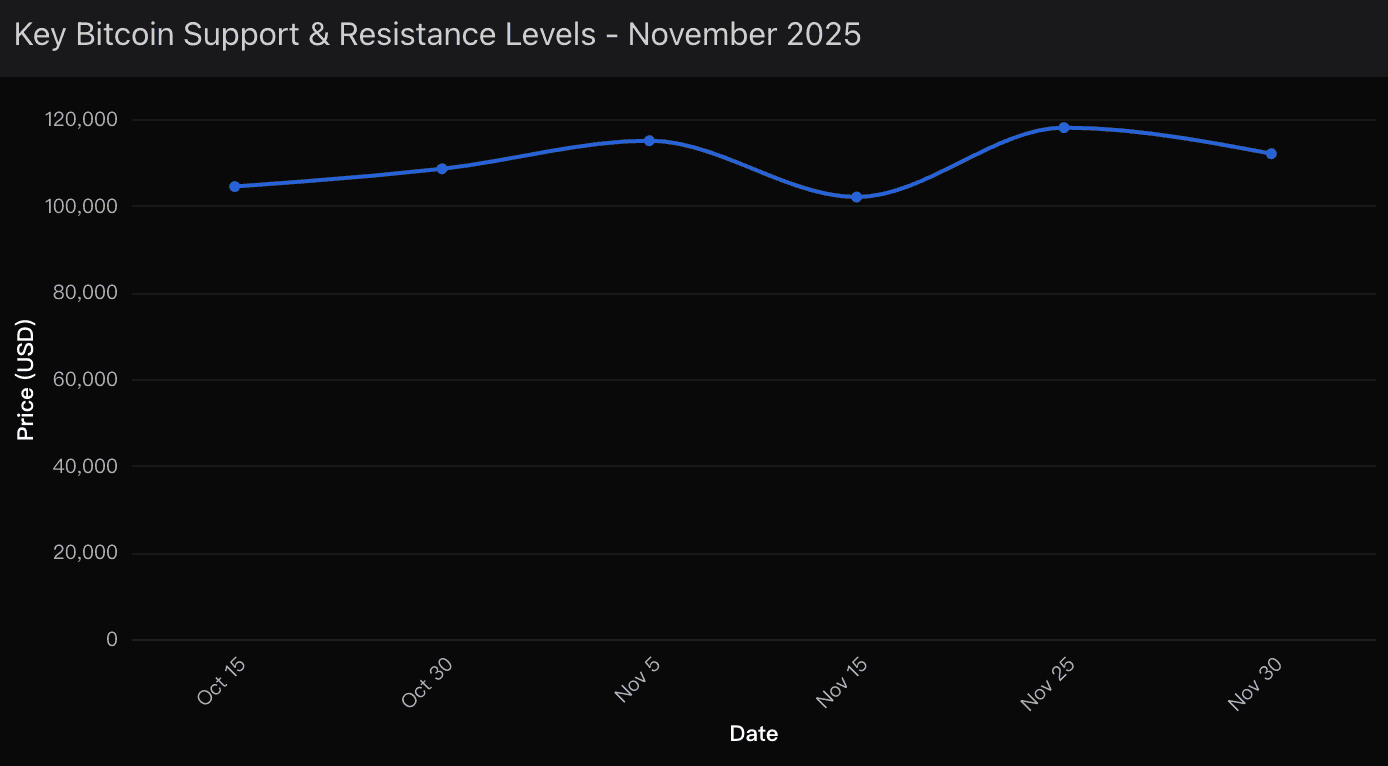

3. Technical Setup — The Compression Coil

The $100,000 level has turned into the market’s psychological axis. Every algo, every retail trader, and every institutional rebalancing script seems magnetized to it.

The real technical zones, however, are slightly above and below:

Breakout threshold: $107,000 – clearing it could accelerate flows toward $115,000+.

Failure zone: $93,000 – losing it triggers a retracement toward $87,000.

Powerdrill Bloom’s probability engine (which combines on-chain order book pressure with derivatives skew) currently assigns:

45% probability to a clean breakout above $100K,

20% probability to a failed breakout and pullback,

and only 10% to a sustained breakdown below $90K.

That’s not hopium — it’s structured consolidation.

A Mature Market Learning New Rules

Bitcoin’s November path won’t make headlines for fireworks — it’ll make them for restraint.

This is the first cycle where institutions, not influencers, are defining the tempo.

In that sense, the $95K–$115K band isn’t a disappointment; it’s the natural heartbeat of a maturing asset class.

When I look across Powerdrill Bloom, the signal is unmistakable: Bitcoin is learning to trade like gold, think like equity, and behave like infrastructure.

The mania’s gone — and that’s exactly why the next rally, when it comes, will be stronger than ever.