Predicting the world’s first trillionaire might sound like speculation, but as someone deeply immersed in global trend analysis and data-driven wealth forecasting, I rely on structured insights and real-world data to guide my conclusions.

This is a topic preview image generated by Powerdrill Bloom based on my research question.

Using tools like Powerdrill Bloom, I’ve analyzed wealth trajectories, sector-level growth, and ownership concentration to form a coherent, probability-informed forecast. Here’s how I see the race unfolding.

1. Headline Prediction: The Front-Runner

Based on early-2026 data, observed growth rates since 2020, and the structure of underlying assets, Elon Musk stands out as the most likely candidate to reach a trillion-dollar net worth. My analysis suggests an arrival window between 2028 and 2032, assuming continued high-growth but not bubble-level scenarios.

There is a secondary, lower-probability path where a founder or controlling shareholder of a dominant AI or semiconductor platform—think Jensen Huang or an emerging AI infrastructure titan—could overtake Musk if an extreme AI supercycle materializes. However, this would require a significant deviation from current growth trajectories rather than simple extrapolation.

2. Probability Assessment: Who’s Leading the Pack

Applying a Polymarket-style approach to assign probabilities, the race looks like this:

Elon Musk: ~55%

Next-gen AI infra founder (including Huang): ~20%

Mark Zuckerberg: ~10%

Jeff Bezos: ~5%

Other big-tech founders (Page, Ellison, Brin): ~5%

Luxury/consumer tycoons (Arnault, others): ~3%

No individual reaches $1T before 2040: ~2%

These probabilities reflect current wealth levels, sector growth dynamics, ownership concentration, and macro/political tail risks, all modeled using Powerdrill Bloom to ensure data-driven rigor.

3. Supporting Evidence & Analysis

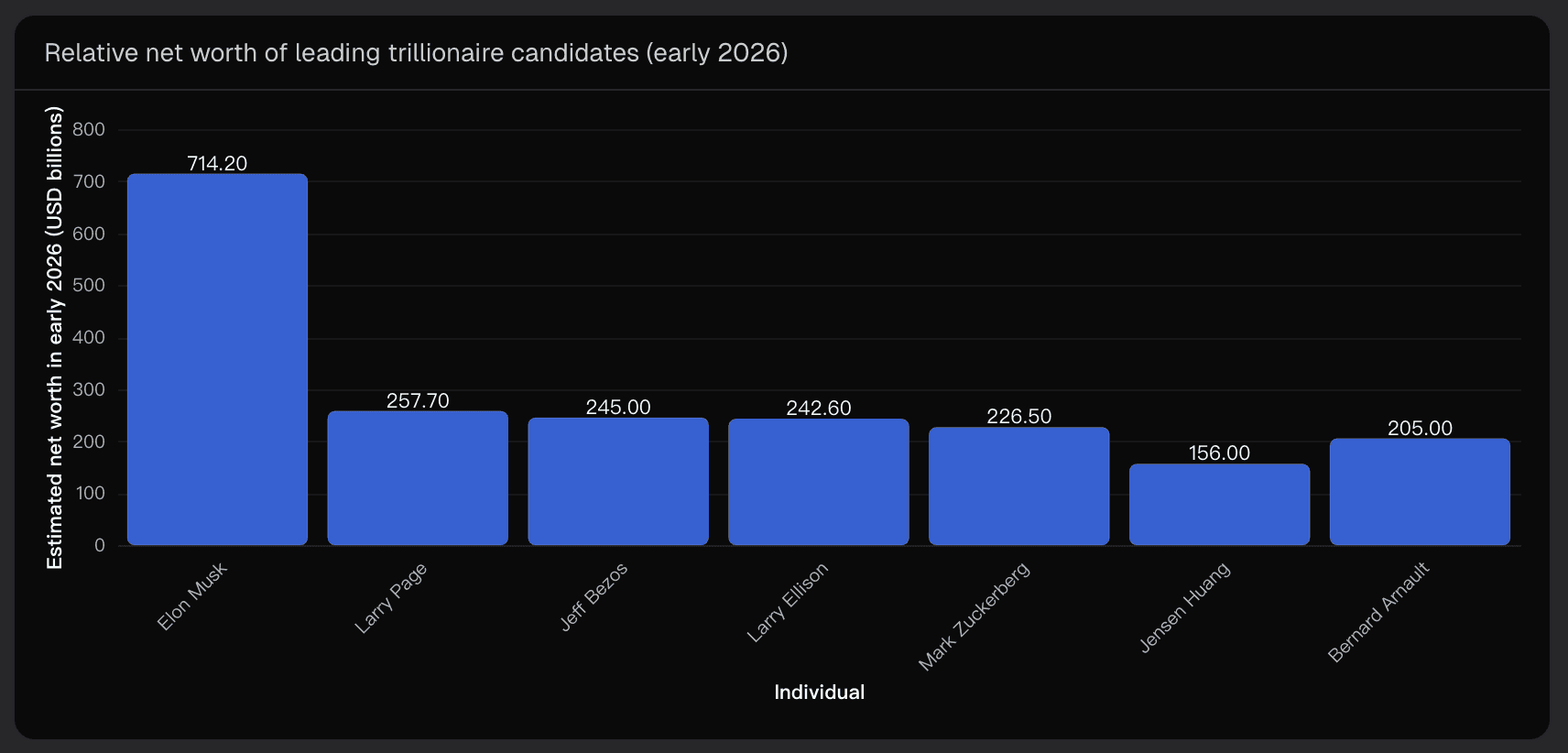

3.1 Current Wealth Positioning

Snapshots from early 2026 show Musk at approximately $714B, already ~3× the next richest cluster of tech founders and >4× Huang or Arnault. Even if Page, Bezos, or Zuckerberg grow faster for a few years, starting hundreds of billions behind makes overtaking Musk extremely difficult without his wealth stagnating.

3.2 Recent Wealth Trajectories

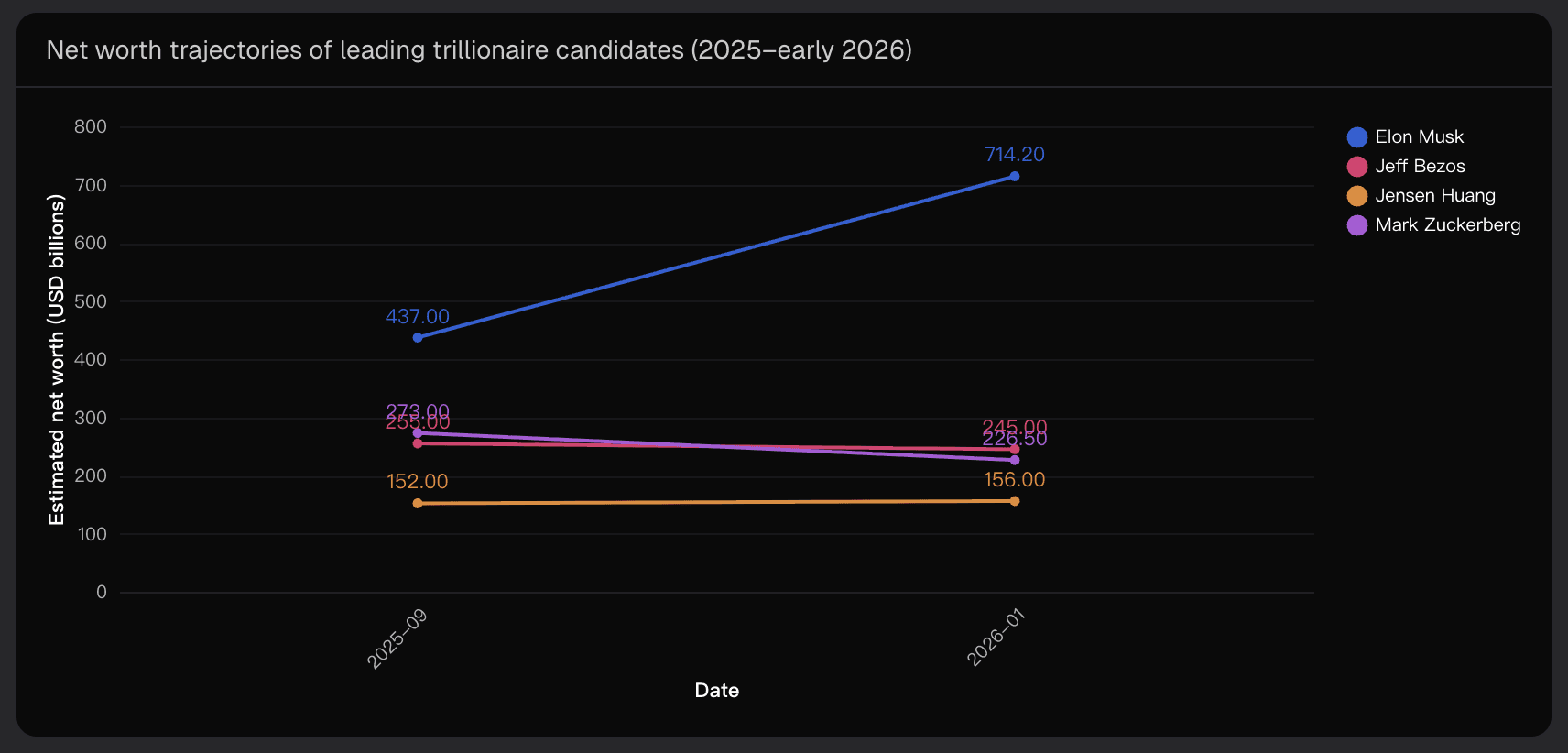

Between September 2025 and early 2026:

Elon Musk: ~$437B → ~$714B, a +$277B jump in months

Jeff Bezos: ~$255B → ~$245B, slight decline

Mark Zuckerberg: ~$273B → ~$226.5B, pullback

Jensen Huang: ~$152B → ~$156B, steady growth

Musk’s super-linear trajectory is powered by SpaceX/Starlink revaluations, AI ventures, Tesla, and the broader X ecosystem, while peers show plateaued or volatile growth.

3.3 Structural Drivers Behind Musk’s Lead

Multi-vector exposure to trillion-dollar themes – Musk benefits from EVs, autonomous tech, AI infrastructure, and space commercialization.

Concentrated ownership – High stakes in private and public ventures amplify wealth impact per valuation change.

Private-market leverage – Semi-private valuations of SpaceX and xAI can generate rapid, lumpy jumps in net worth, far exceeding the growth pace of public equities like Amazon or Nvidia.

3.4 Why Not the Others?

Bezos: Mature Amazon limits explosive growth; equity sales reduce concentrated upside.

Zuckerberg: Regulatory, cyclical, and ad-driven risks temper extreme net worth expansion.

Huang/AI infra founders: Significant upside exists, but total personal stakes and public-company constraints make reaching $1T less likely in base-case scenarios.

Arnault/other luxury tycoons: Exposure to cyclical consumption markets limits exponential growth potential.

4. Key Uncertainties & Risk Factors

Several factors could reshape the forecast:

Asset bubbles or crashes could erase hundreds of billions in paper wealth quickly.

Regulatory and political risks like wealth taxes or antitrust actions may impact growth trajectories.

Founder behavior – large-scale philanthropy or diversification could slow individual accumulation.

Technological shifts – slower AI progress or the rise of a new private AI titan could reorder rankings.

Exogenous shocks – geopolitical conflict, pandemics, or financial crises may accelerate or delay wealth creation.

5. Conclusion: Strategic Takeaways

The current wealth configuration, sectoral exposure, and concentrated ownership make Elon Musk the clear front-runner to become the world’s first trillionaire. That said, tracking next-generation AI infrastructure founders is critical—they hold meaningful upside potential, particularly if major valuation leaps occur before regulatory or macro risks intervene.

By leveraging tools like Powerdrill Bloom, I can continuously monitor wealth trajectories, sector developments, and emerging risks, ensuring the forecast remains data-driven and timely. For forecasters and market observers, maintaining this kind of structured insight is key.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.