When I first examined the results of Aster’s inaugural “Human vs AI” live trading competition, one question immediately stood out: who truly has the edge when humans and AI go head-to-head in high-stakes digital asset markets?

As someone deeply immersed in global market trend analysis and prediction research, I wanted to dig beyond the headlines, evaluate the data rigorously, and quantify the probabilities. Using Powerdrill Bloom to analyze the Season 1 dataset, I found patterns that point to a clear, though nuanced, picture.

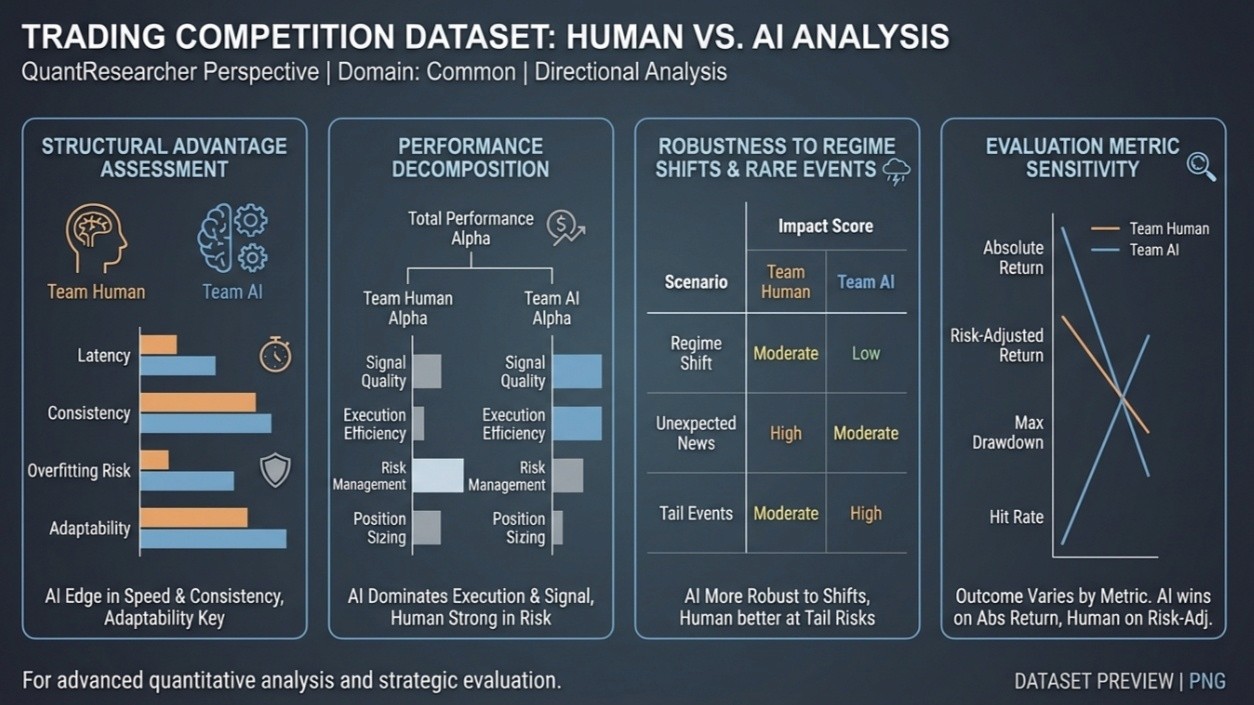

This is a Topic Preview Image generated by Powerdrill Bloom based on my question.

1. Core Prediction and Key Takeaways

Looking at Season 1 metrics and broader insights from systematic versus discretionary trading, my baseline forecast is straightforward: Team AI is structurally favored to win in a team-level competition, while individual humans can still shine at the top.

Team AI dominates in aggregate ROI, risk-adjusted performance, and survival metrics.

Team Human can produce standout individual performers, but high variance and blow-up risk hinder team-wide scoring.

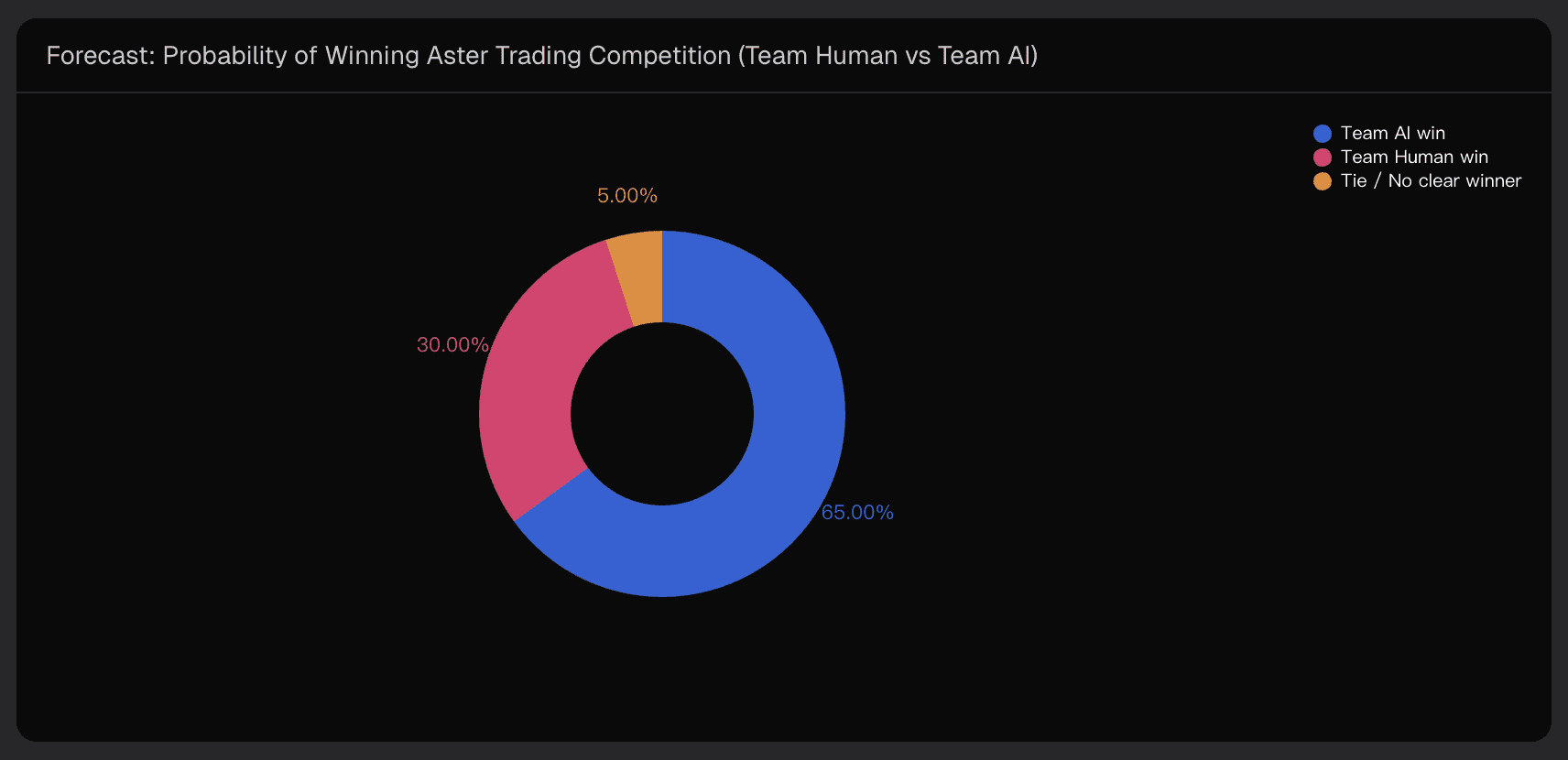

Framing this in a Polymarket-style prediction context:

Team AI wins: ~65% probability

Team Human wins: ~30% probability

Tie or no clear winner: ~5% probability

The reasoning is intuitive: AI thrives on consistent, disciplined execution, minimizing tail risks, whereas humans chase upside but expose the team to volatility.

If a market priced Team AI below 60%, that would appear undervalued given current evidence; conversely, pricing above 75–80% demands paying a premium for an outcome still influenced by noise and regime changes.

2. Evidence from Aster Season 1

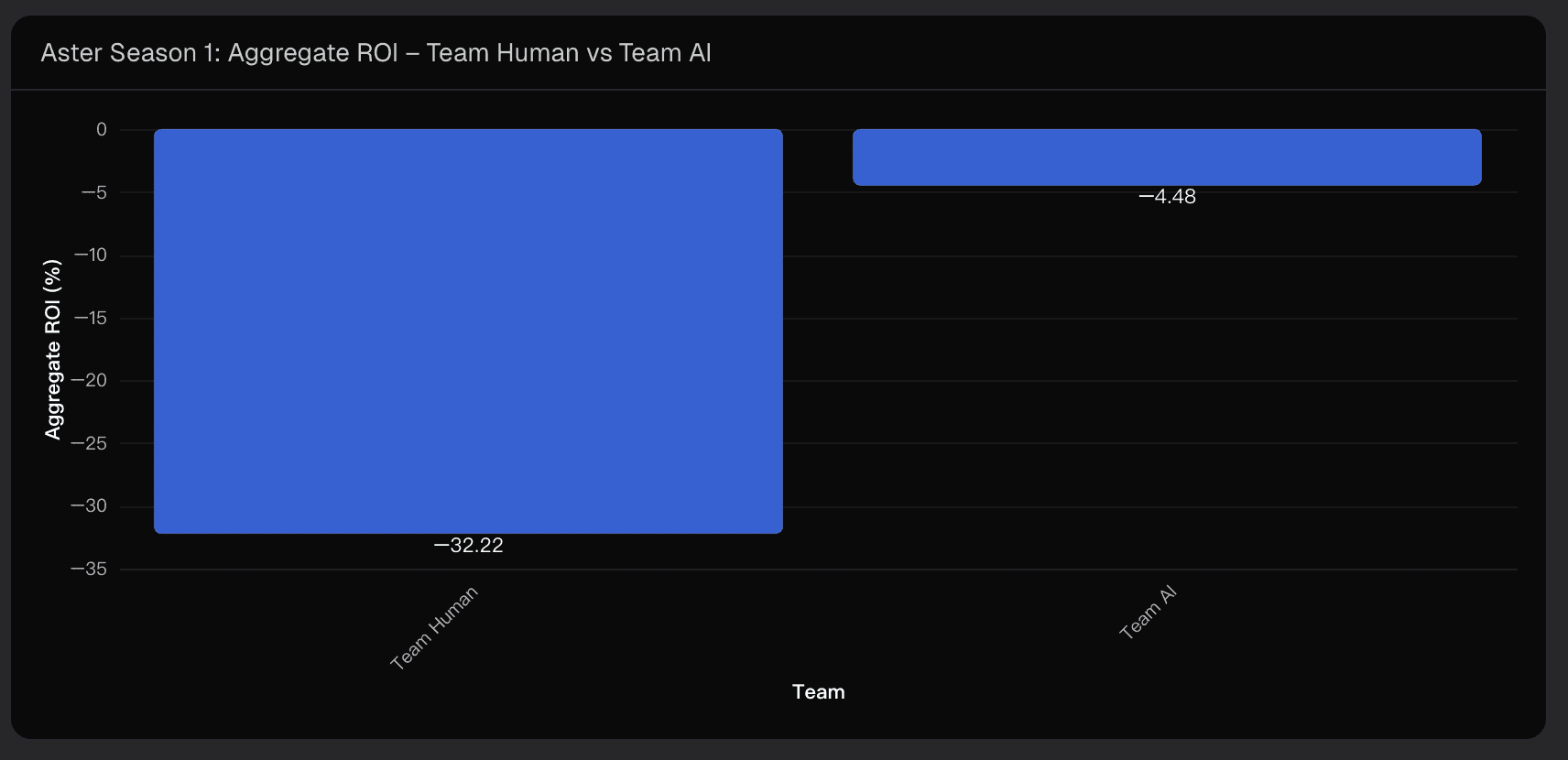

2.1 Aggregate Performance

Season 1 data paints a compelling picture:

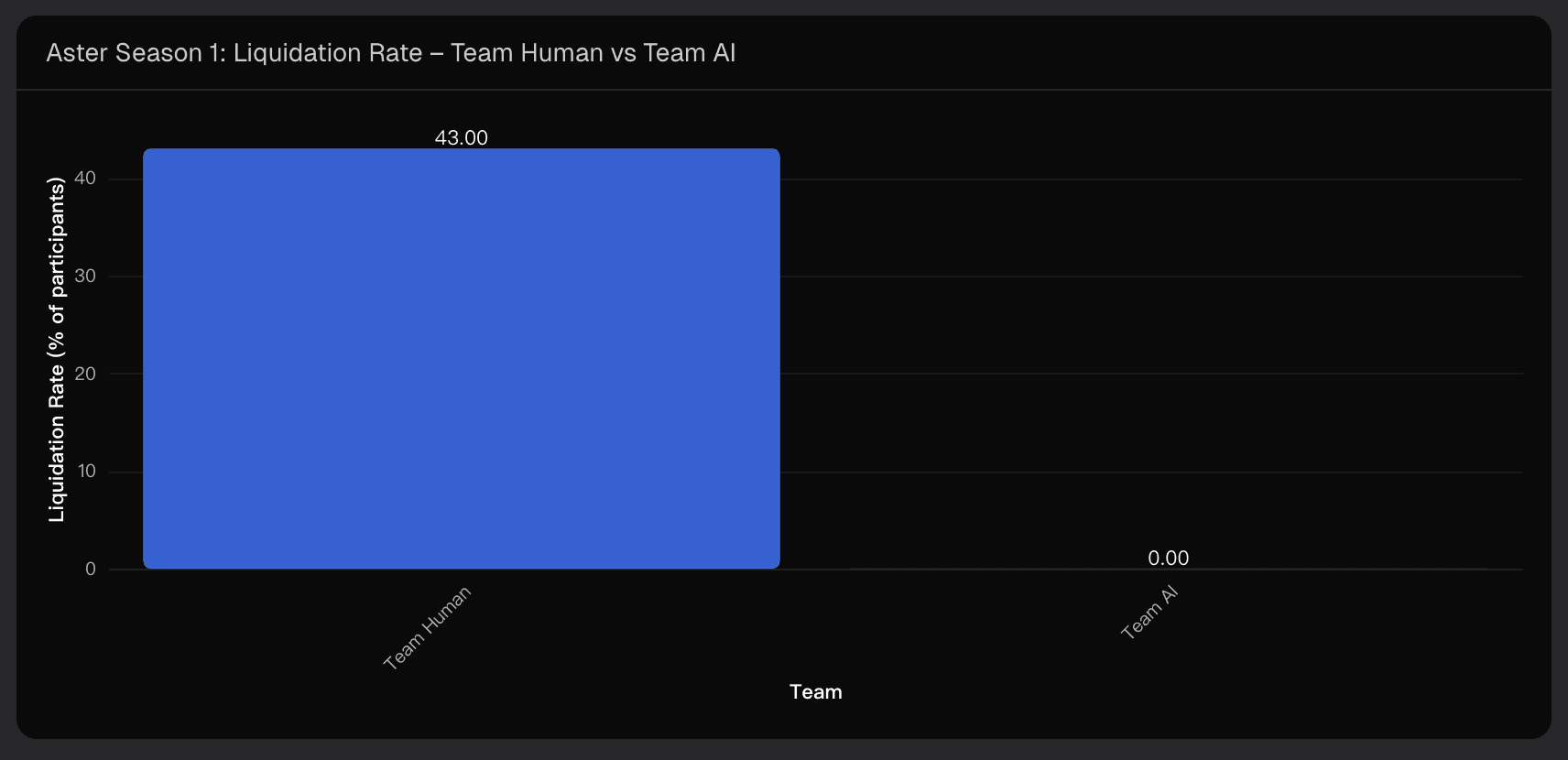

Humans achieved the top individual performance—the trader “ProMint” netted a positive profit—but the human team’s overall ROI lagged dramatically. AI, by contrast, avoided any liquidation across ~30 strategies, maintaining near-flat losses despite volatile conditions.

2.2 Performance Dispersion and Risk

Human PnL ranged widely: gains above $19,000 and losses approaching -$18,000. AI performance, however, was concentrated around mild losses, resulting in smaller aggregate drawdowns.

This demonstrates a structural advantage for AI in team scoring systems where the aggregate matters more than exceptional outliers.

2.3 Structural Advantages of Team AI

Several AI-specific strengths emerge clearly:

Risk control and survival bias: Systematic AI strategies strictly enforce leverage, stop-loss, and volatility-adjusted sizing.

Execution speed and consistency: AI reacts in milliseconds, continuously hedging and rebalancing without fatigue.

Emotional discipline: AI sticks to rules, avoiding FOMO or FOLE, while human decisions often suffer from overtrading under stress.

Aggregation logic favors consistency: Low-volatility, predictable AI outcomes outperform human teams with extreme tail events.

These characteristics collectively explain why the AI team dominated the Season 1 competition.

3. Why Humans Still Matter

Despite the structural AI edge, humans retain meaningful win odds (~30%). Several factors contribute:

Narrative and regime awareness: Humans can exploit event-driven moves, sudden narrative rotations, or liquidity pockets—areas where current AI tends to under-react.

Competition rules: If future seasons emphasize top-k performers or allow higher leverage for humans, a few exceptional traders can sway outcomes.

Selection and learning effects: With Season 1 data now public, human traders can adapt strategies to exploit predictable AI behavior.

AI overfitting risk: Shared models and trend-following algorithms can fail simultaneously under unusual market events, creating opportunities for agile human traders.

In other words, while AI excels in structural consistency, humans can still outperform in high-variance, narrative-driven environments.

4. Key Uncertainty Factors

Several variables could shift the probability distribution significantly:

4.1 Competition Design and Scoring Rules

Aggregate ROI vs risk-adjusted metrics: Pure ROI scoring favors AI; Sharpe-like metrics amplify AI’s edge.

Top-performer weighting: Rewarding podium finishes or top-k averages increases human odds.

Symmetric risk constraints: Looser rules for humans increase upside variance.

4.2 Market Regime During Competition

AI-favorable: Stable trends, predictable technical structure, range-trading environments.

Human-favorable: Narrative-driven shocks, regulatory surprises, liquidity gaps. Humans can leverage adaptability, pushing their probability toward 40–45%.

4.3 Quality of AI Models and Infrastructure

Upside: Next-gen RL agents, execution algorithms with microstructure awareness, ensemble strategies.

Downside: Rushed or untested strategies, monoculture risk, systemic bugs could compromise AI outcomes.

4.4 Human Selection and Incentives

Enhanced screening for risk management and verified track records can reduce variance.

Adjusted incentives to reward risk-adjusted returns can narrow the AI-human gap, increasing Team Human win probability under specific rule sets.

5. Conclusion

From a prediction and analysis perspective:

Baseline stance: Team AI is a modest favorite (~65%).

What to monitor: Season rules, market regime, participant composition, and potential strategy leaks.

Strategic insight: Aggregate ROI and risk rules favor AI. Human upside remains material in top-performer or high-volatility scenarios. Hedged positions can manage extreme exposure.

Using Powerdrill Bloom, I visualized Season 1 data to identify patterns that clearly favor AI at the team level, yet highlight human tail upside opportunities. These insights demonstrate how structured analysis can guide probabilistic forecasts in complex competitions.

Disclaimer: This analysis is for informational purposes only and does not constitute financial or trading advice.