When I started analyzing Tesla’s Full Self-Driving (FSD) pricing, I wasn’t trying to answer an abstract debate. I wanted to answer a very practical question that most buyers quietly struggle with:

Should a normal Tesla owner pay $99 per month for FSD, or lock in $8,000 upfront?

To ground this analysis in reality—not opinions or hype—I used a structured data workflow powered by Powerdrill Bloom to test the economics against how people actually own and use their cars. What follows is a probability-based, consumer-focused breakdown of what the numbers really say.

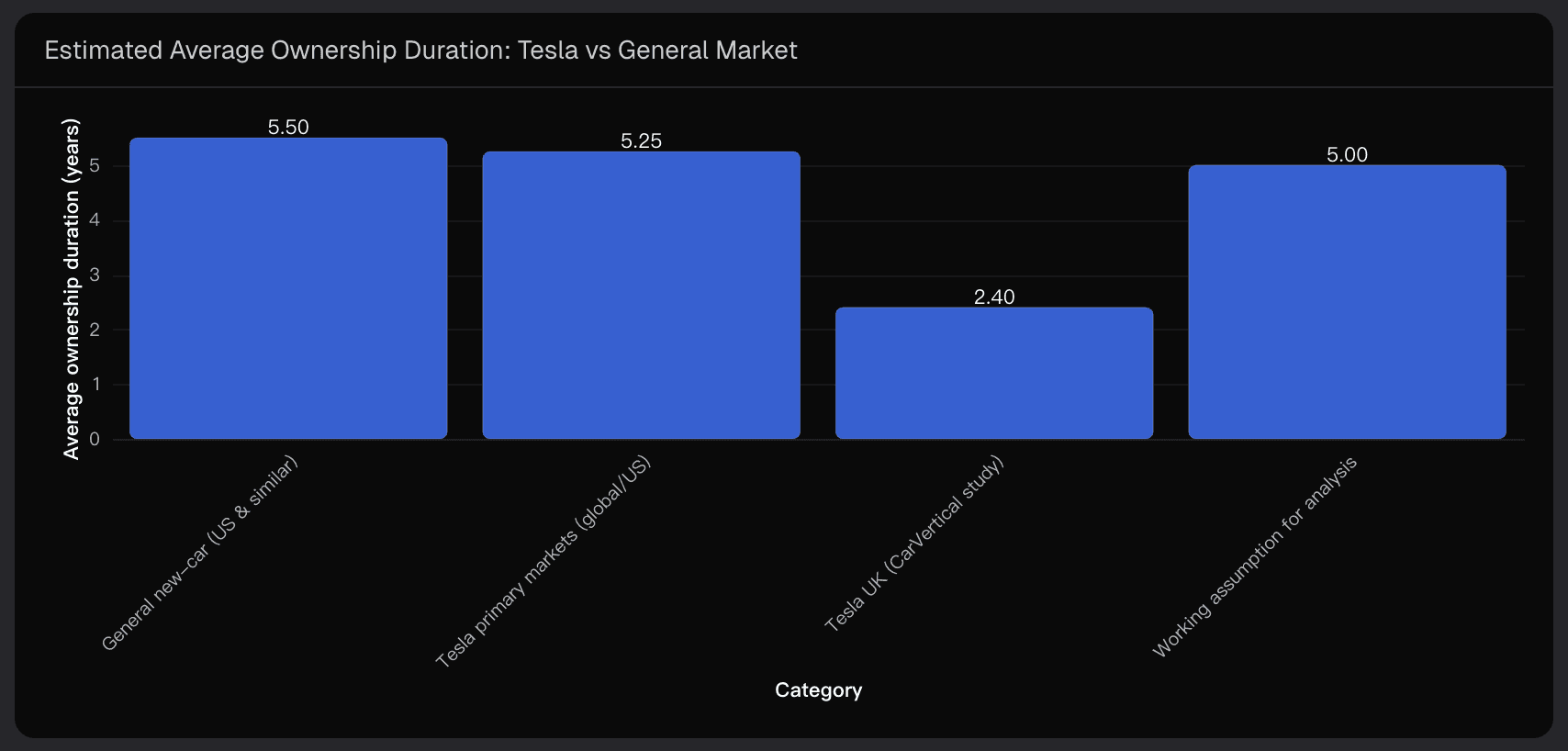

1. The Core Assumption That Matters Most: How Long Do People Keep a Tesla?

Every FSD cost comparison ultimately hinges on one variable: ownership duration.

Across mature auto markets like the U.S. and Western Europe, first-owner holding periods for new vehicles cluster around 5–6 years. Tesla-specific resale and registration analyses suggest a similar pattern, generally falling in the 4.5–6 year range in core markets.

Some datasets—such as UK resale studies—show much shorter holding periods (around 2–3 years), but those markets are shaped by unique policy shifts, incentives, and charging constraints. They’re informative, but not representative of global or U.S.-centric ownership behavior.

Balancing early-adopter churn against Tesla’s strong software updates, battery longevity, and resale strength, a realistic working assumption for a mainstream Tesla buyer in 2026 looks like this:

Average ownership duration: ~5 years

Plausible range for most owners: 3–7 years

This ownership window will drive every conclusion that follows.

2. The Pricing Reality of FSD (2026 Baseline)

For clarity, I anchor the analysis to current, widely reported U.S. pricing:

FSD Subscription: $99 per month

FSD One-Time Purchase: $8,000 upfront (tied to the vehicle)

To isolate the structural economics, I make a few clean assumptions:

Continuous access during ownership

No financing or discounting in the base case

Stable pricing over the modeled period

These assumptions are conservative—and, if anything, slightly favor the purchase option.

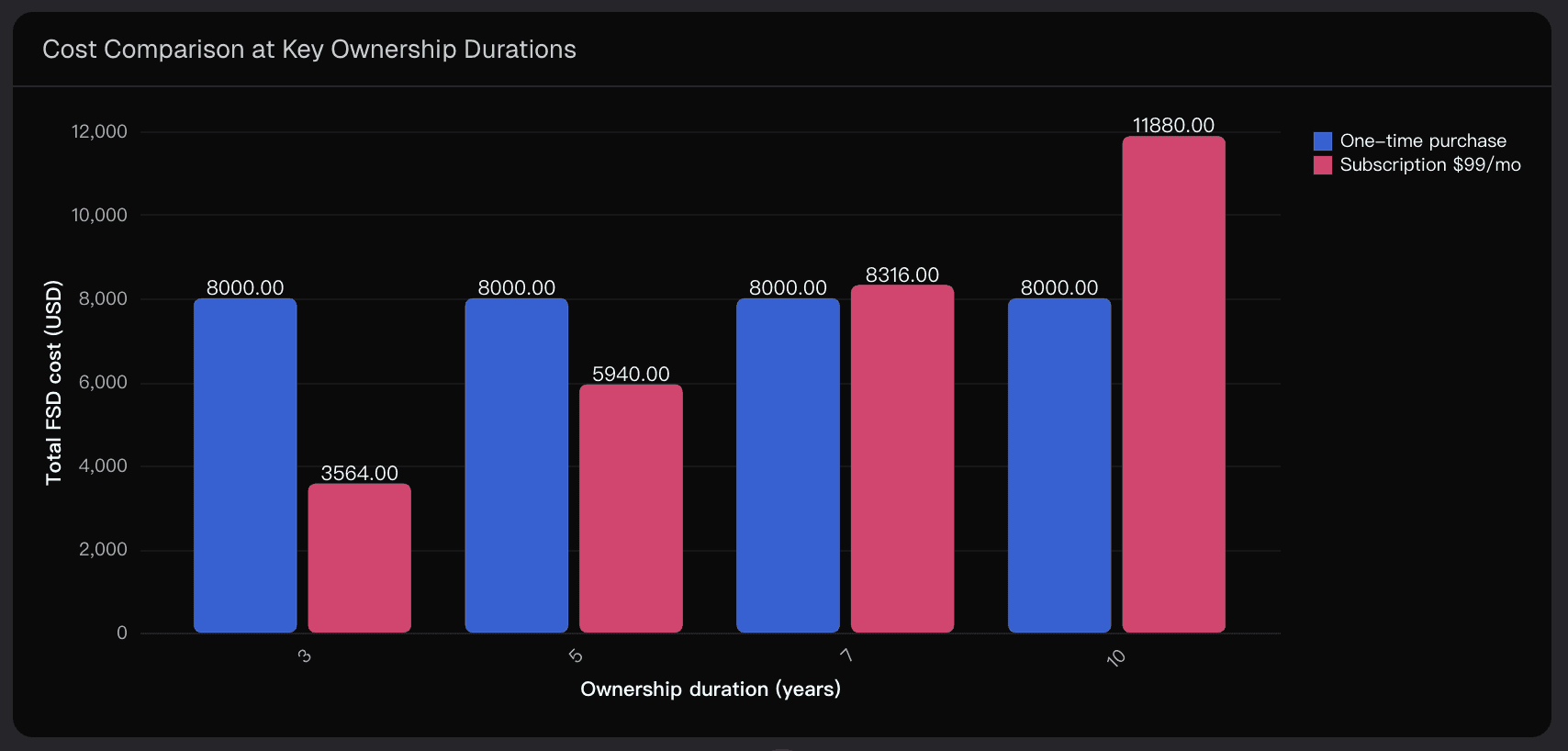

3. Where the Math Flips: The Break-Even Point

The break-even calculation is straightforward:

$8,000 ÷ $99 ≈ 80.8 months, or ~6.7 years

That means:

Below ~6.7 years: Subscription is cheaper

Above ~6.7 years: One-time purchase becomes cheaper

This single threshold quietly explains most of the confusion around FSD pricing. The question is no longer “Which option is cheaper?” but rather “How many people realistically cross that line?”

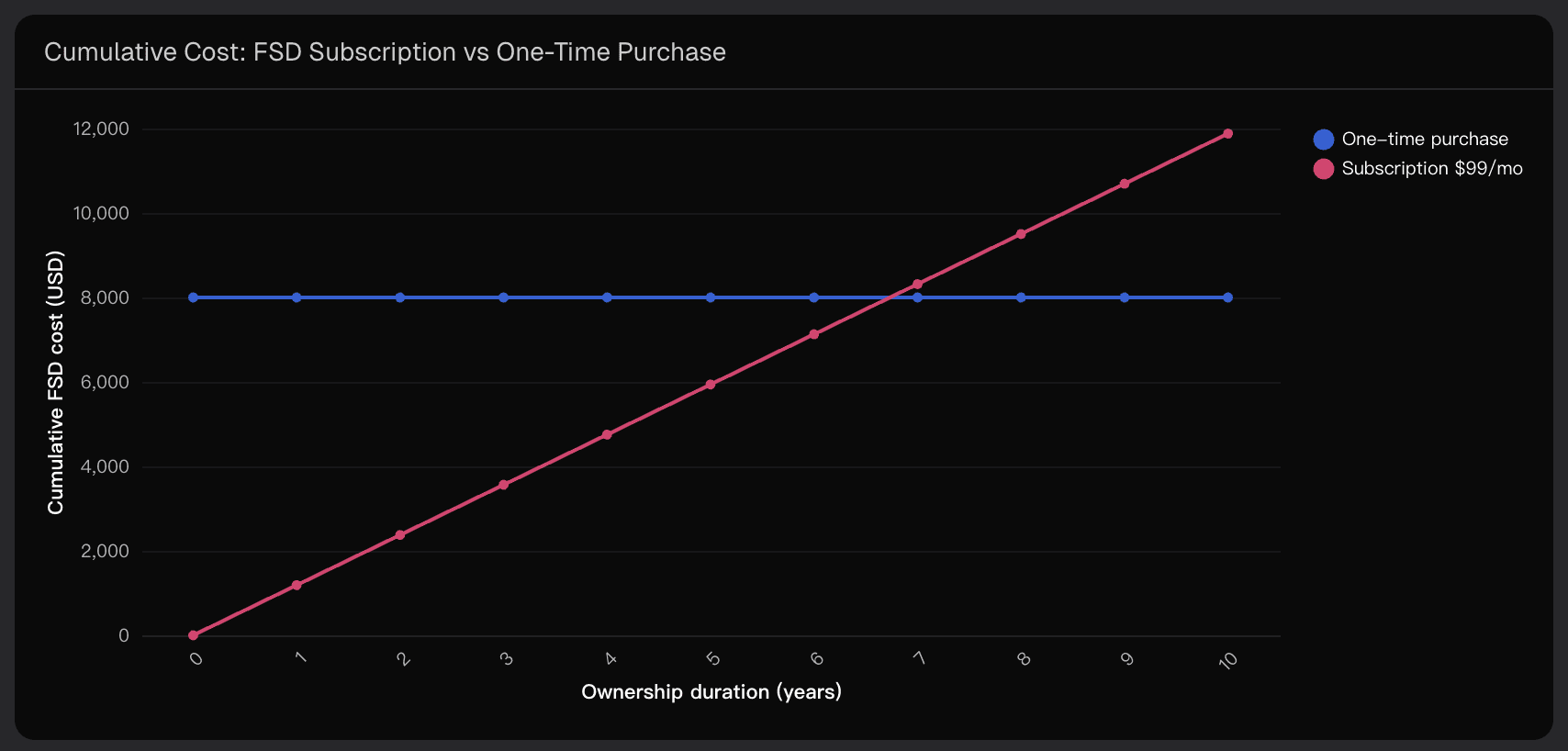

4. What the Cumulative Cost Curves Reveal

Looking at cumulative cost over time makes the trade-off obvious:

The purchase cost is flat at $8,000 from day one

The subscription grows linearly at $1,188 per year

At ownership milestones that match real-world behavior:

3 years: Subscription saves ~$4,400

5 years (average owner): Subscription saves ~$2,000

7 years: Purchase wins—but by only ~$300

10 years: Purchase saves ~$3,900

In other words, for the ownership window where most people actually live (3–5 years), the subscription isn’t marginally cheaper—it’s meaningfully cheaper.

5. Real-World Behavior Makes Subscription Even More Rational

The base model assumes something generous: that owners pay for FSD every single month. In practice, reality tilts even further toward subscription.

Intermittent usage is common. Many drivers activate FSD only during road trips or busy periods. Paying for six months per year cuts the effective cost in half and pushes the break-even well beyond a decade.

Planned vs. actual ownership also diverges. Life events, new models, and policy shifts consistently shorten real holding periods relative to intentions.

Resale recovery is partial at best. Because FSD is tied to the car—not the owner—used buyers rarely pay anything close to a full $8,000 premium.

Finally, from a financial perspective, $8,000 upfront carries opportunity cost. Paying over time is almost always cheaper in present-value terms, especially if that capital could be invested elsewhere.

Conclusion: What’s Rational for Most People?

Putting the pieces together:

Most Tesla owners likely keep their cars less than 6.7 years

Many do not use FSD continuously

Resale rarely repays the upfront cost

Time value of money favors pay-as-you-go

Under current pricing, a 5-year owner would spend roughly $5,940 via subscription versus $8,000 upfront.

For the average Tesla owner, the FSD subscription is the more financially rational choice.

The one-time purchase only becomes clearly rational if you are highly confident you will keep the same car 8–10+ years, use FSD heavily, and accept the capital lock-up. That describes a minority—not the median buyer.

As I’ve found repeatedly when testing consumer tech economics with Powerdrill Bloom, probability beats intuition. And probabilistically, subscription wins for most people.

Disclaimer: This analysis is for informational purposes only and does not constitute financial or purchasing advice.