As I tracked the parallel-market USD/IRR rates over the past year, one question has repeatedly surfaced in my analysis: will the US dollar touch 1.5 million Iranian rials by January 31, 2026? This is a Topic Preview Image generated by Powerdrill Bloom based on my question:

Using historical data, macroeconomic indicators, and real-time market signals—analyzed with the support of Powerdrill Bloom—I’ve attempted to form a data-informed view that goes beyond headlines and anecdotal reports. Here’s a detailed breakdown of my findings.

1. Forecast Conclusion

By January 31, 2026, I assess that the USD/IRR parallel-market rate is moderately likely to reach or exceed 1.5 million rials per USD at least once. This view is grounded in three key observations:

Recent trading levels: The currency has been reported between 1.42–1.47 million IRR per USD in late 2025 and early January 2026.

Crisis dynamics: Hyper-depreciation, weak policy credibility, and ongoing protests create an environment where overshoots beyond psychological barriers (1.0M, then 1.4–1.5M) are common.

Short-term momentum: Once a “psychological level” is approached, even minor stress triggers can push the rate temporarily above expected ranges.

However, this is not deterministic. Iran’s FX market remains heavily distorted by informal controls, ad hoc interventions, and political shocks. Short-term fluctuations could produce temporary plateaus or even reversals.

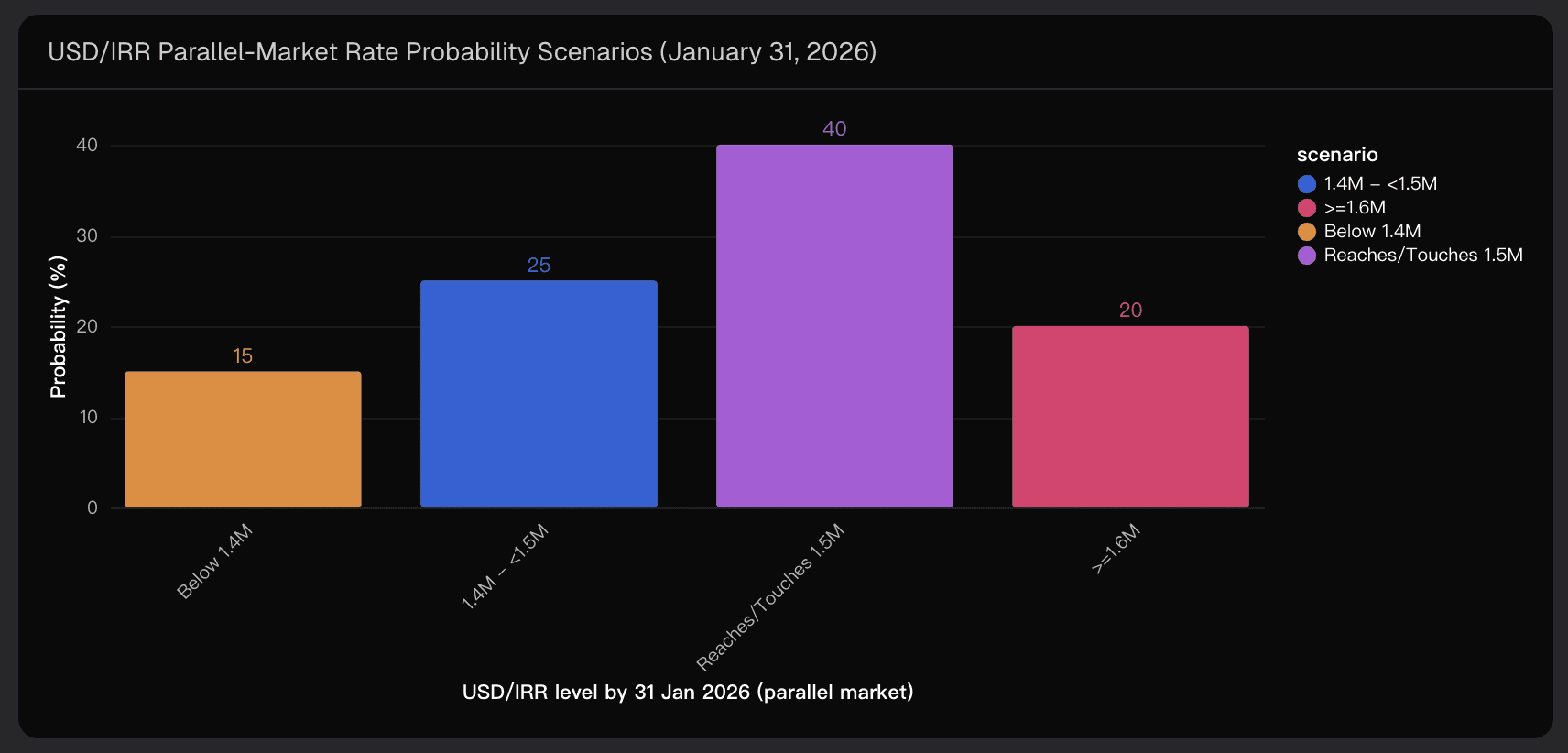

2. Probability Assessment

To clarify the likelihoods, I’ve structured scenario-based probabilities for the USD/IRR level by January 31:

Scenario | Range | Probability | Notes |

|---|---|---|---|

A | Below 1.4M | 15% | Requires calm markets, temporary FX support, and no new shocks. |

B | 1.4M–<1.5M | 25% | Market remains weak but intraday spikes are contained. |

C | Reaches/touches 1.5M | 40% | Base-case scenario, reflecting ongoing depreciation and stress events. |

D | ≥1.6M | 20% | Would require new geopolitical shocks, sanctions tightening, or intensified protests. |

Combined probability:

USD/IRR ≥1.5M: ~60% (Scenario C + D)

USD/IRR <1.5M: ~40% (Scenario A + B)

These probabilities are judgmental and model-informed using historical trends and recent developments, rather than mechanical outputs from thin options or prediction markets.

3. Supporting Evidence and Drivers

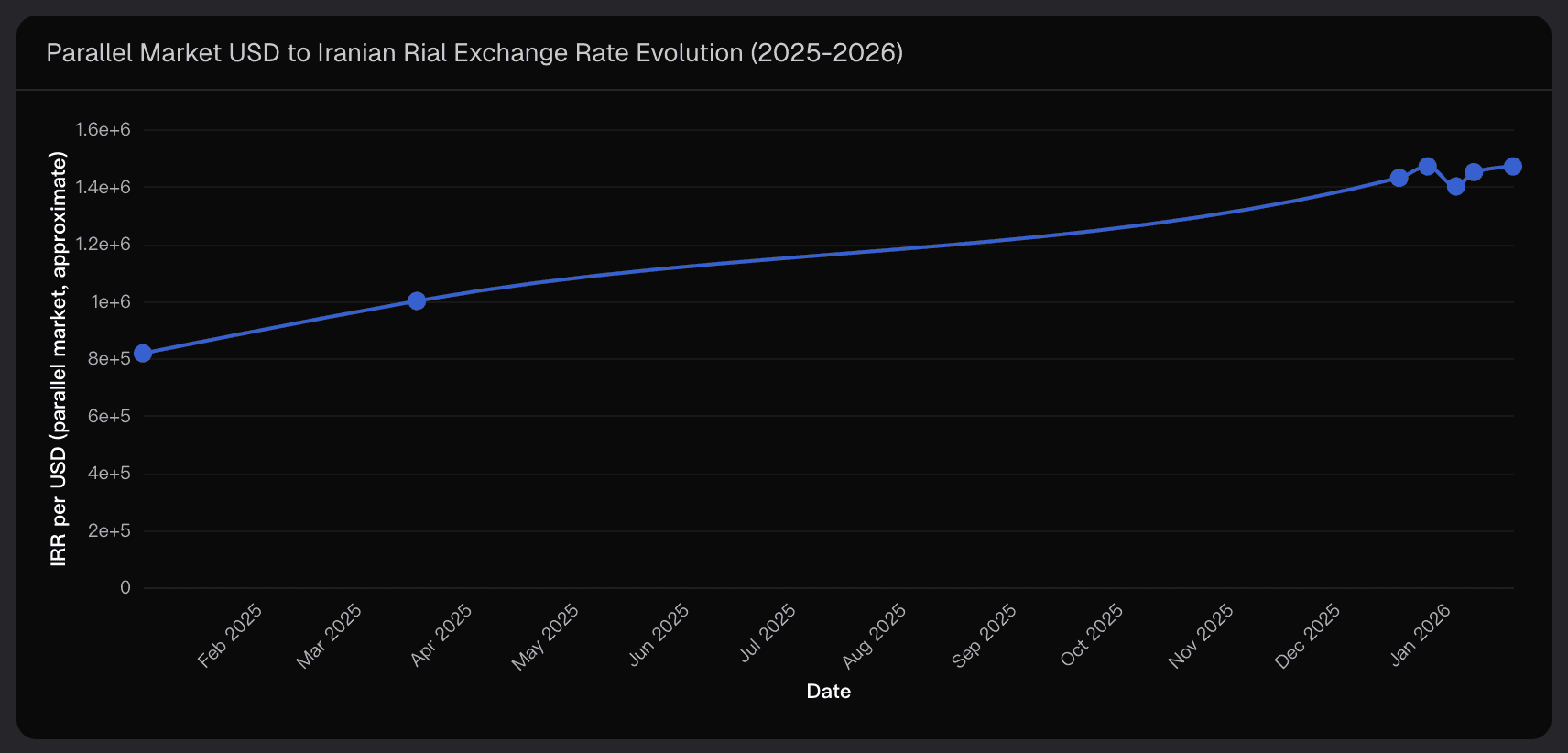

3.1 Recent Exchange-Rate Dynamics

The parallel-market rate has already accelerated sharply:

Jan 2025: ~817,000 IRR per USD

Mar 2025: crosses 1,000,000

Late 2025: 1.42–1.47M IRR

Jan 2026: hovering near 1.45M

Such rapid depreciation—hundreds of thousands of rials within months—is consistent with crisis FX patterns, where a 100k–200k move within days is plausible.

The slope of depreciation steepens toward the 1.5M level, suggesting reaching it requires no extreme extension of recent trends.

3.2 Macroeconomic Backdrop

Inflation: 42–48% in 2025; projected >40% in 2026

GDP contraction: ~$356B in 2025 vs. ~$600B in 2010

Oil & FX inflows: intermittent relief rallies due to sanctions and enforcement variability; no structural anchor for the rial

High inflation relative to trade partners, combined with constrained FX access, exerts continuous pressure toward nominal depreciation.

3.3 Political, Social, and Market Microstructure Drivers

Protests & unrest: Rising USD/IRR → higher prices → more protests → increased political risk → further depreciation.

Policy credibility: Government reshuffles and ad hoc interventions pause but rarely reverse trends.

Psychological thresholds: Milestones like 1.4M or 1.5M trigger hedging and hoarding, amplifying overshoots.

These elements collectively reinforce the bias toward further weakening and elevate the likelihood of testing new highs.

4. Key Uncertainties and Risk Factors

Even with strong evidence for a 1.5M test, several risks could influence outcomes:

4.1 Factors That Could Prevent Reaching 1.5M

Short-term interventions: USD injections via oil revenues, targeted enforcement, or symbolic operations.

Political concessions or subsidies: Temporary easing may reduce speculative demand.

Data opacity: Variations across cities and platforms may mask true levels.

4.2 Factors That Could Trigger Sharp Overshoots

New geopolitical events or sanctions: Could trigger rapid moves to ≥1.6M.

Escalating domestic unrest: Intensified protests may spike risk premia and accelerate depreciation.

Loss of key FX backstops: Disruption of crucial intermediaries can cause abrupt rate jumps.

4.3 Structural Uncertainties

Measurement risk: Sparse, noisy parallel-market reporting limits precision.

Nonlinear behavioral responses: Even minor policy shifts or rumors can induce outsized market reactions.

5. Conclusion: What This Means for Analysts

In short, the evidence, trend momentum, and structural drivers collectively suggest a roughly 60% probability that USD/IRR will reach at least 1.5M on the parallel market by January 31, 2026.

By leveraging tools like Powerdrill Bloom, I can dynamically track these drivers, visualize evolving probabilities, and adjust scenario assessments in real time—turning complex crisis FX data into actionable insights.

Disclaimer: This analysis is for informational purposes only and should not be interpreted as financial advice.