As someone who spends countless hours analyzing market trends and exploring prediction markets, I often find myself drawn to questions that sit at the intersection of macro dynamics, investor psychology, and pure numbers. One such intriguing question for 2026 is: Will Silver reach $100 per ounce before Bitcoin hits $100,000 per coin?

To tackle this, I relied on my experience in global trend research, prediction market analysis, and the tools that make data exploration more intuitive—specifically Powerdrill Bloom, which helped synthesize raw market data into actionable insights.

1. Core Predictive Conclusion

After examining current prediction market odds, recent price behavior, and macro drivers, my conclusion is that Silver has a modest edge over Bitcoin in reaching its milestone first.

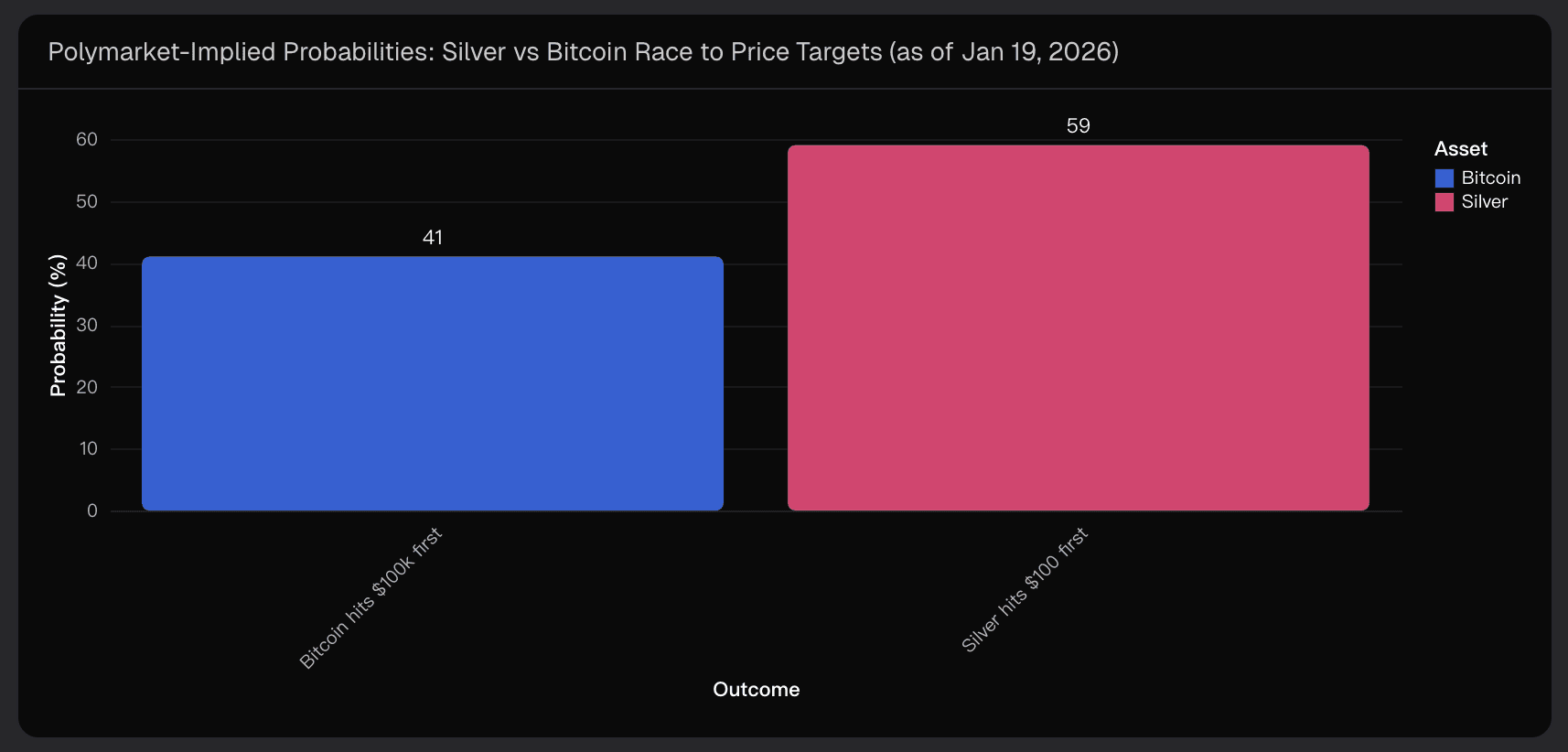

The Polymarket market explicitly asking “Will Silver hit $100 or Bitcoin hit $100k first?” prices Silver at roughly 59% and Bitcoin at 41%.

While this suggests Silver is favored, the advantage is not overwhelming. Both assets are within striking distance of their respective targets, and small shifts in macro conditions, regulatory news, or investor sentiment could easily flip the outcome.

2. Probability Assessment

Translating market prices and fundamentals into a structured probability view:

Silver $100 first: ~55–65% (centered at 60%)

Bitcoin $100k first: ~35–45% (centered at 40%)

Although Bitcoin is closer to its milestone in absolute percentage terms (~5% away vs. Silver’s ~11–12%), its path is more sensitive to factors such as ETF flows, regulatory shocks, and macro volatility. Silver, by contrast, can potentially reach $100 through a steady continuation of the metals rally.

The current Polymarket odds (as of Jan 19, 2026) show Silver at 59% and Bitcoin at 41%, giving Silver a measurable but not overwhelming lead.

3. Supporting Evidence

3.1 Prediction-Market Insights

Polymarket aggregates dispersed information from traders, effectively summarizing:

Short-term volatility expectations

Macro and regulatory scenarios

Microstructure around key milestone levels

The 59/41 split represents a clean, real-time benchmark for assessing market sentiment.

3.2 Distance to Target & Price Geometry

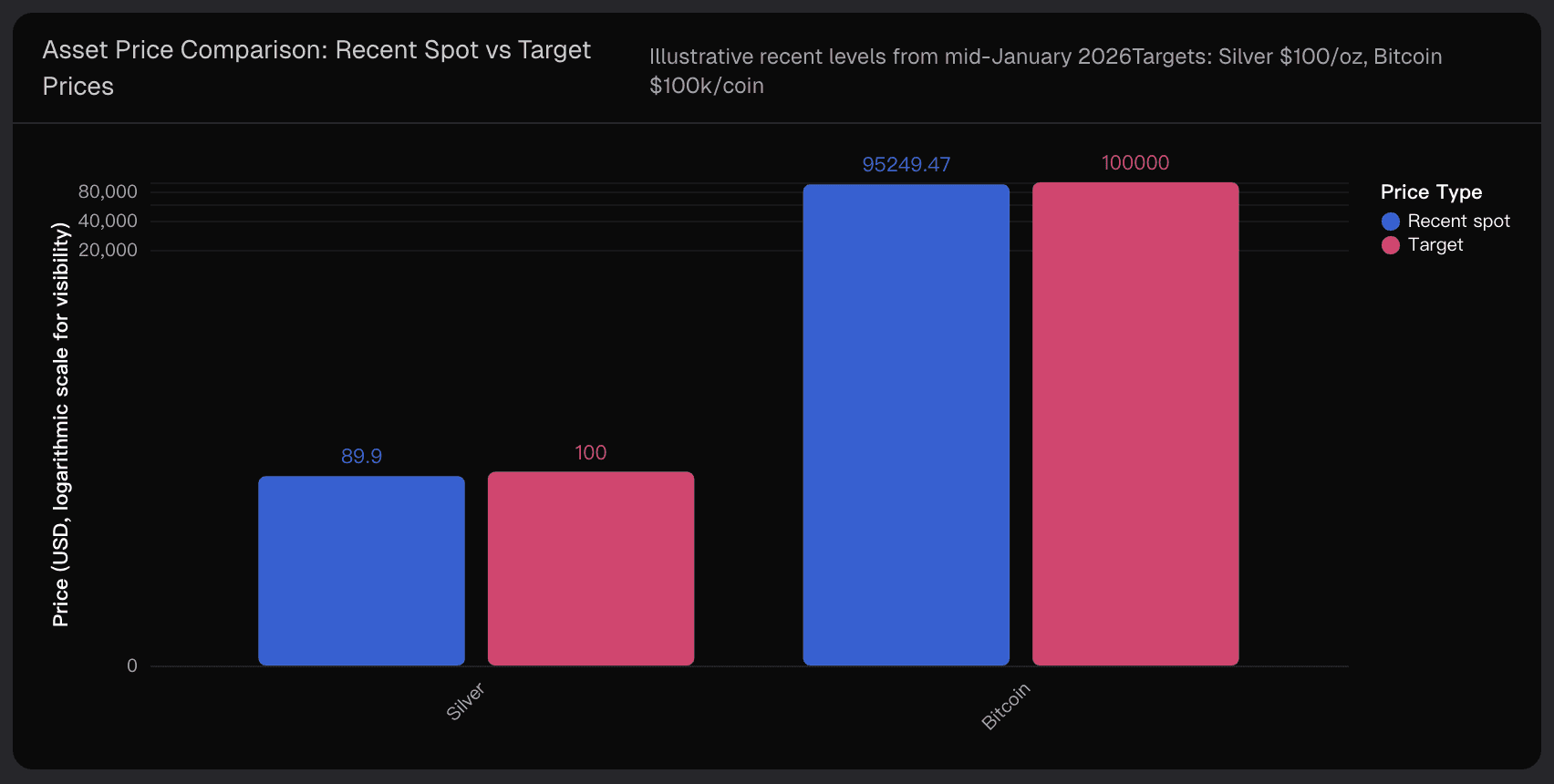

Silver: Recent spot ~$89.9 → target $100 (gap ~11–12%)

Bitcoin: Recent spot ~$95,249 → target $100k (gap ~5%)

While Bitcoin is closer proportionally, the market considers path dependency, macro exposure, and volatility, which slightly favors Silver.

A log-scale comparison of recent spot prices versus targets highlights the relative positions of each asset: Silver is just under $90 with a target of $100, while Bitcoin sits in the mid-$90k range aiming for $100k.

3.3 Macro Drivers

Silver’s Favorable Factors:

Hard-Asset Narrative: 2026 has seen strong rotation into physical commodities. Silver surged past $90/oz, reflecting ~20–25% YTD gains.

Industrial Demand & Supply Tightness: EVs, solar, and electronics maintain high silver consumption amid constrained mining output.

Rates & Dollar Dynamics: Easing Fed expectations and a softer USD support precious metal inflows.

Bitcoin’s Considerations:

ETF & Institutional Flows: Large inflows and declining exchange balances reduce structural supply.

Price Structure Near ATH: Consolidation in mid-$90k range maintains upside potential.

Scarcity Narratives: Post-halving supply scarcity remains a bullish factor.

Path Dependency: Bitcoin requires continued macro or crypto-specific catalysts to breach $100k.

4. Key Uncertainties and Risks

Even with strong market signals, several factors could swing the race:

Macro Shocks – Hard-landing scenarios, aggressive rate cuts, or unexpected dollar moves can favor Silver; equity rallies or liquidity shocks can favor Bitcoin.

Market Microstructure – Both $100/$100k levels are psychological; clustered orders or spikes can temporarily alter the race.

Policy & Regulatory Surprises – Crypto regulations or green infrastructure policies can respectively favor Bitcoin or Silver.

Correlation Regimes – Shifts in risk-on/off behavior could synchronize asset moves, making intra-minute timing highly uncertain.

5. Conclusion

Based on a combination of prediction market odds, macro fundamentals, and price dynamics, Silver currently holds a slight edge (~60%) over Bitcoin in reaching its milestone first.

However, both remain highly plausible before the end of 2026, highlighting the importance of disciplined risk management and diversified strategies.

Tools like Powerdrill Bloom allow investors and analysts to synthesize these complex datasets into clear, actionable insights, turning raw numbers into visually supported, data-driven conclusions.

Disclaimer: This blog presents data-driven forecasts for informational purposes and is not financial advice.