The world of cryptocurrency has always been a rollercoaster of volatility and speculation.

We’ve seen the massive highs, the gut-wrenching crashes, and the endless debates over where Bitcoin and other digital assets will land next.

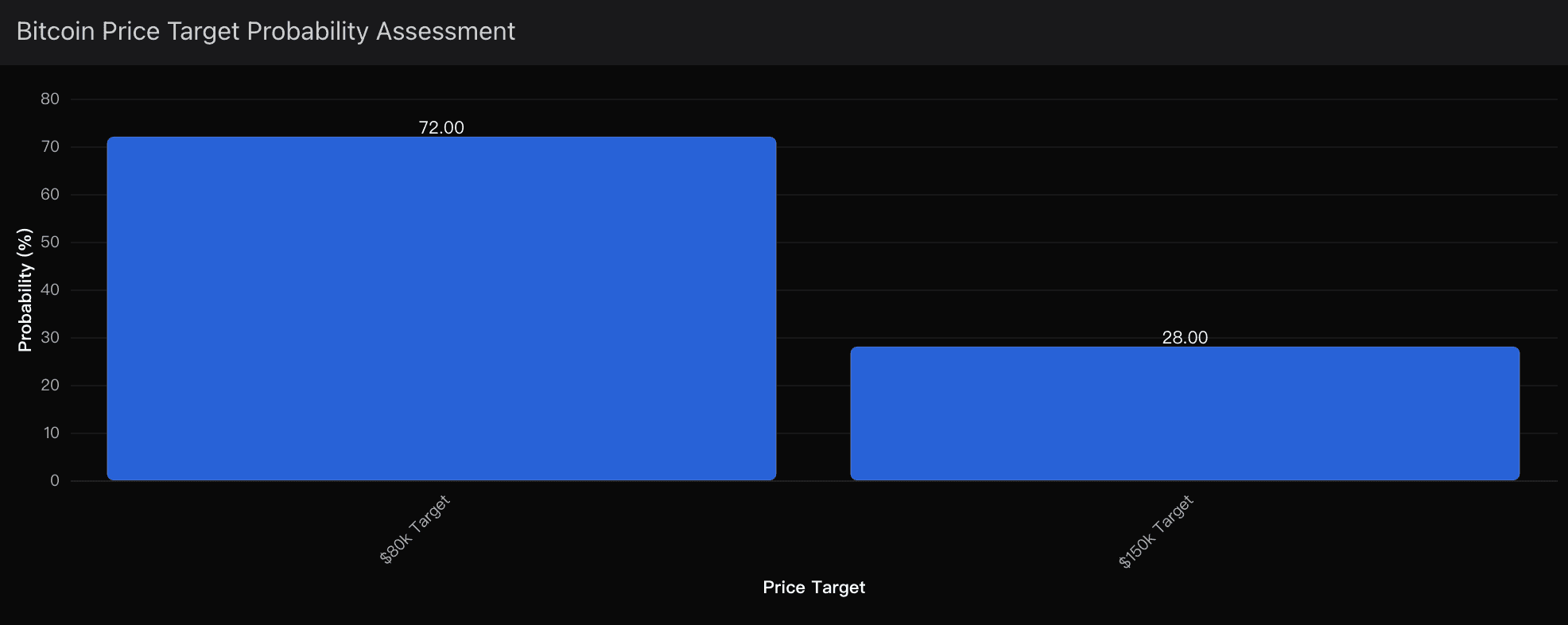

But when I look at the current market dynamics — the institutional moves, the ETF launches, and the shifting macroeconomic signals — one thing is clear to me: Bitcoin will hit $80K first, and I’m putting that call at a 72% probability.

Before I dive into the logic behind this prediction, let me be upfront: I’m not chasing retail euphoria or anticipating another speculative frenzy. This isn’t a “moonshot” bet. Instead, I’m analyzing hard data, market flows, and institutional behavior. What I see unfolding is a momentum-driven cycle, where Bitcoin’s rise is anchored by institutional adoption, not the kind of retail-driven FOMO (Fear Of Missing Out) we saw in 2017 or 2021.

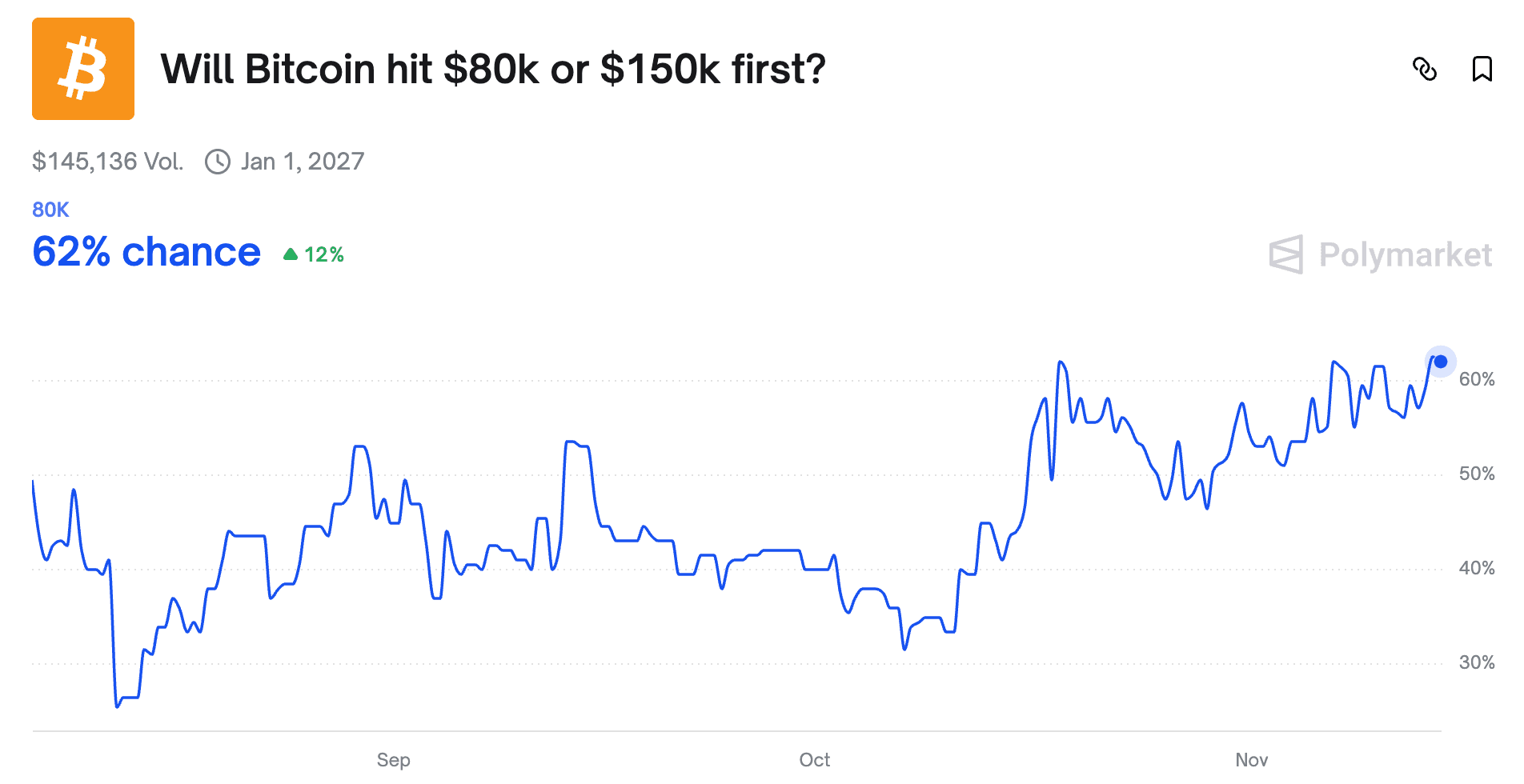

Polymarket and other prediction markets show only a 38% chance of Bitcoin reaching $150K this year, confirming that the market consensus is skeptical of a moonshot at this stage. The odds are priced in around current levels, with a peak probability not exceeding $80K in the near term.

Fed Policy and Macro Uncertainty

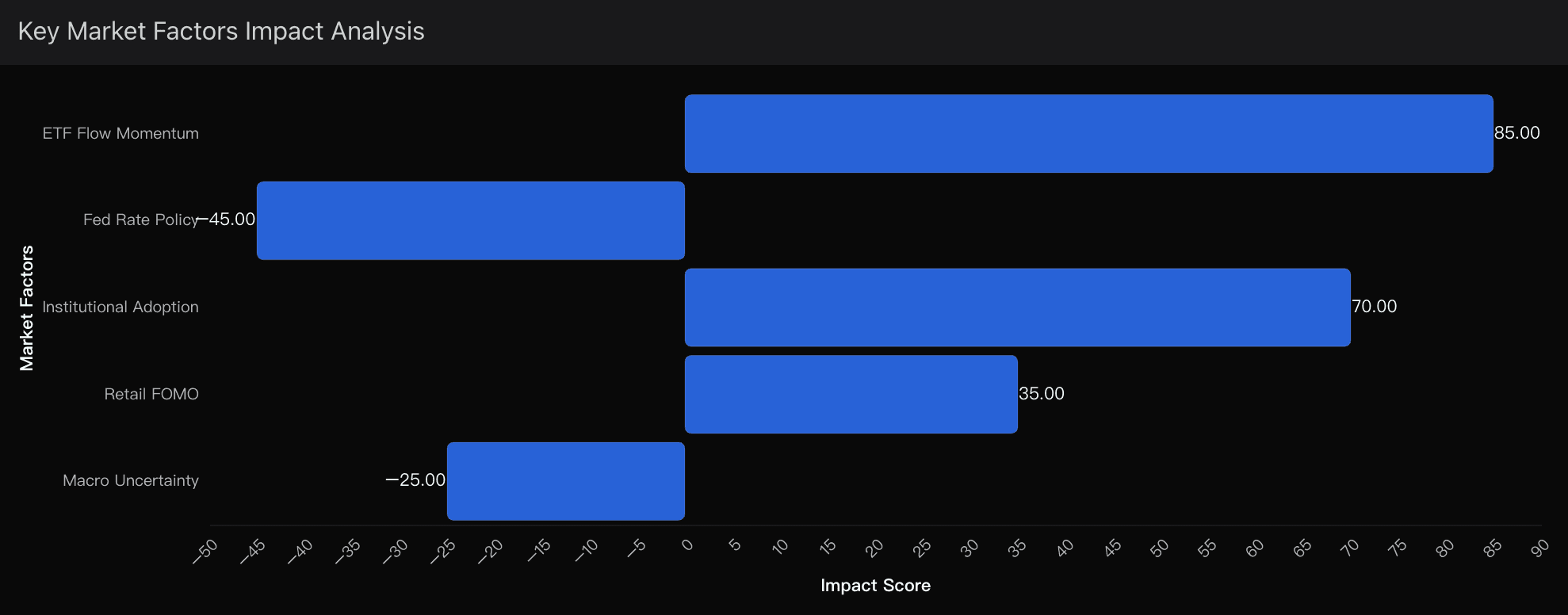

I’ve been running simulations on Powerdrill Bloom to model the Fed’s potential actions. The model consistently shows that rate cuts alone are unlikely to fuel a sharp upward trajectory for Bitcoin in the short term. In fact, without a significant rate-cutting cycle and sustained institutional buying, a $150K surge is simply out of the realm of probability right now.

While the $80K target seems highly probable, the road to $150K is a lot more uncertain. Let me explain why.

The Federal Reserve’s policy remains a significant wildcard. There’s a lot of uncertainty around future interest rate decisions, and rate hikes have the potential to create a ceiling on risk assets like Bitcoin. Even as inflationary pressures moderate, the Fed’s cautious approach is limiting the kind of rate cuts that would drive wild speculative behavior in the markets.

This isn’t just a theoretical concern — the data backs it up. Policymakers have created a tight leash on market exuberance, which means we’re less likely to see the kind of parabolic move that would push Bitcoin to $150K.

The ETF Steamroller

The pivotal factor here — the one that has me most confident in the $80K scenario — is the institutional adoption powered by ETFs (Exchange-Traded Funds). When BlackRock launched its IBIT ETF, it didn't just set a new record; it effectively changed the game.

In just a matter of months, the IBIT ETF became the fastest-growing ETF in history, amassing $80 billion in assets under management (AUM) at a pace that stunned even the most optimistic market analysts. This is a clear signal that institutional money, not retail FOMO, is now the driving force behind Bitcoin’s price trajectory.

What’s important to understand here is that institutional investors move differently. They’re not chasing the market’s latest hype or reacting to the latest Twitter thread. Instead, they are making strategic, calculated decisions that build momentum over time. BlackRock’s ETF is just the latest example of this — and with more institutions getting involved, the sustained buying pressure is pushing Bitcoin toward the $80K mark with remarkable consistency.

I’ve been tracking this data with the help of Powerdrill Bloom, my go-to AI tool for market prediction. Bloom analyzes everything from ETF flows to institutional transaction patterns, providing me with an unmatched level of predictive insight. Right now, it’s clear that institutional flows are the primary force driving Bitcoin's current momentum. There’s no speculative rush here, just a steady, methodical push toward higher price levels.

Final Verdict:

At the end of the day, $80K represents institutional buying pressure with predictable, sustained momentum. The market isn’t going to moonshot to $150K without a perfect storm of rate cuts, retail euphoria, and speculative mania — all of which are unlikely given the current macroeconomic climate.

With the ETF steamroller effect, institutional momentum, and the fact that whales are distributing their holdings, it’s clear to me that Bitcoin’s rise to $80K is both probable.

So, I’m confidently staking my claim on $80K first, with a 72% probability.