I’ve been tracking the global wealth leaderboard all year through Powerdrill Bloom, my AI-powered probability engine that quantifies structural dominance in financial ecosystems.

And as we head into the final stretch of 2025, the data couldn’t be clearer:

Elon Musk retains the crown — with 85% confidence.

This isn’t about hype or headlines. It’s a data-driven conclusion derived from multi-source modeling: public wealth estimates, equity exposure sensitivity, and prediction market pricing. Musk’s dominance isn’t just big — it’s structural.

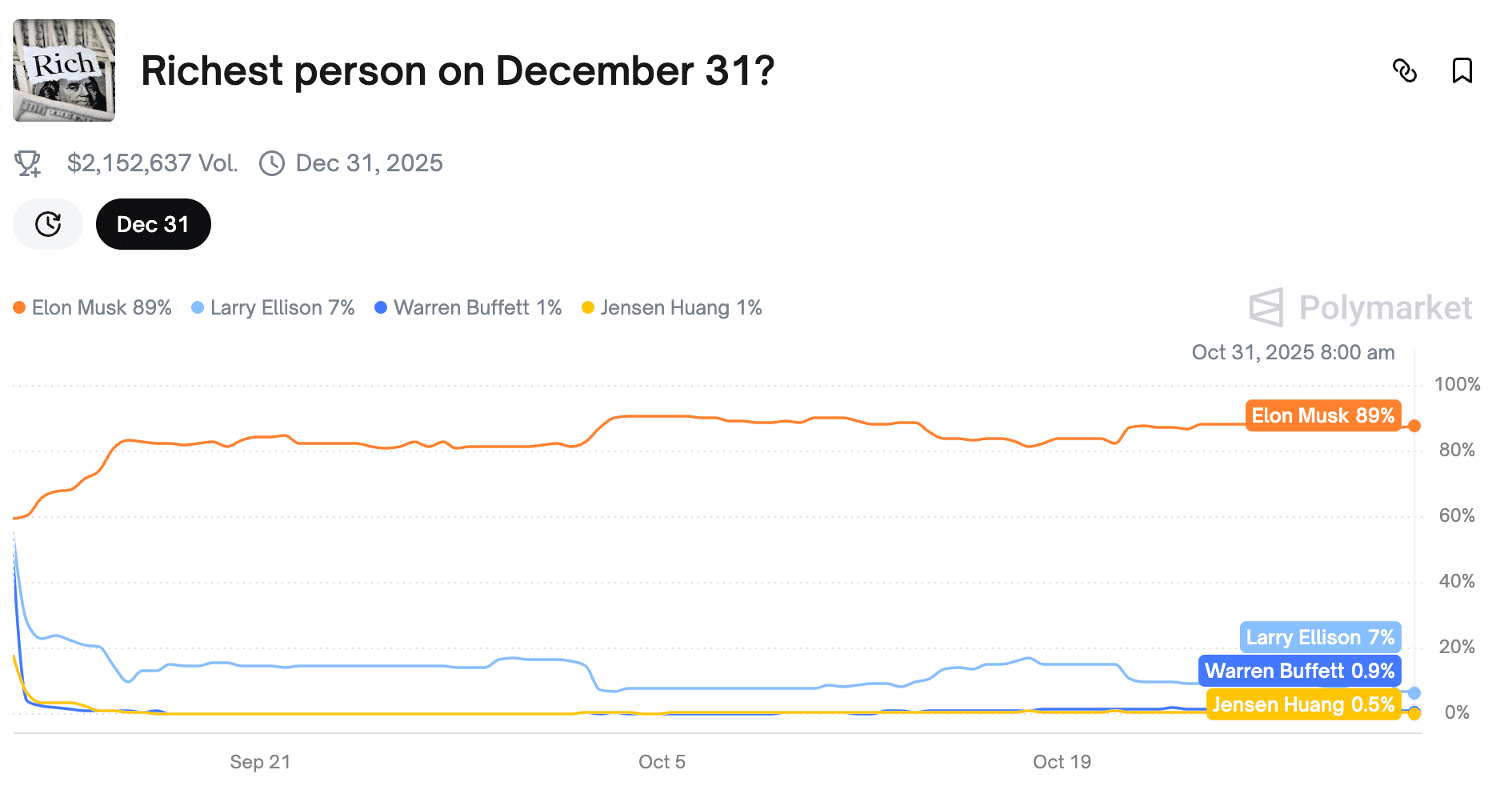

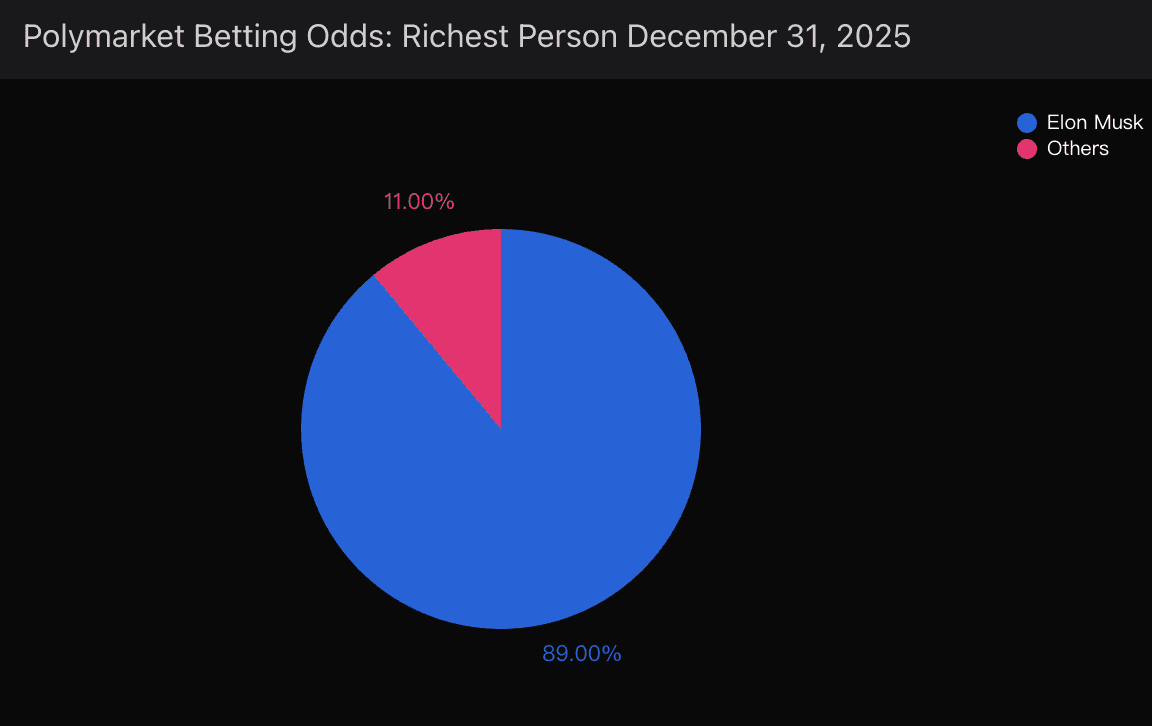

Polymarket’s Consensus: Musk Is Still the Safe Bet

The decentralized prediction market Polymarket tells the same story.

The contract “Elon Musk to remain world’s richest person by Dec 31, 2025” trades with 89% implied odds — and nearly $900K in total volume backing the thesis.

Markets have already priced in Tesla’s inherent volatility and SpaceX valuation adjustments, yet the overall bias remains decisively pro-Musk.

Using Powerdrill Bloom’s insights, we can see:

Why Musk Is Untouchable (For Now)

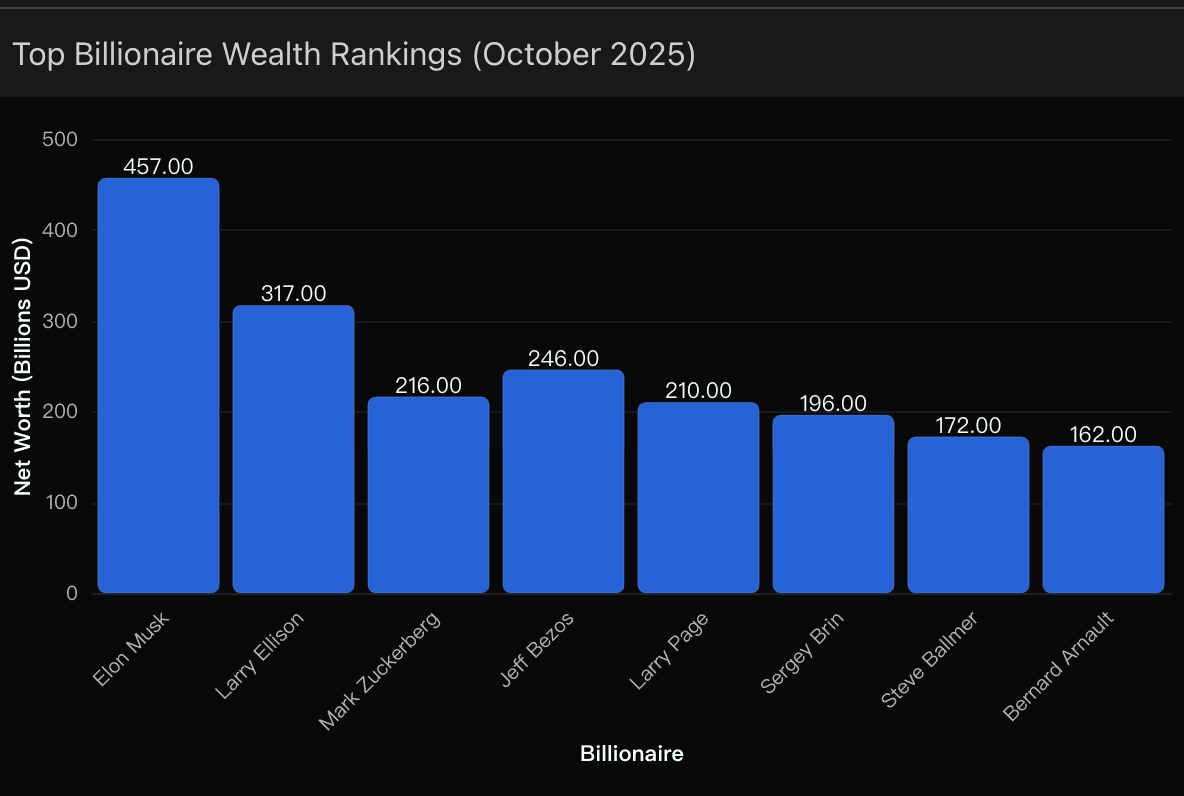

As of late October 2025, Musk sits at an estimated $457 billion net worth — a staggering $140 billion lead over second-place Larry Ellison ($317B).

That’s not just a gap. It’s a fortress.

Even in the most aggressive downside simulations run through Powerdrill Bloom, Musk retains a top spot in 82% of projected scenarios through December 31.

Why? Because his wealth engine — primarily Tesla’s equity momentum — is operating on self-reinforcing feedback loops: capital inflows, AI optimism, and narrative velocity.

The Tesla Rocket Fuel Factor

Every $10 swing in TSLA translates to roughly $6 billion in Musk’s net worth — thanks to his 19.7% stake in Tesla.

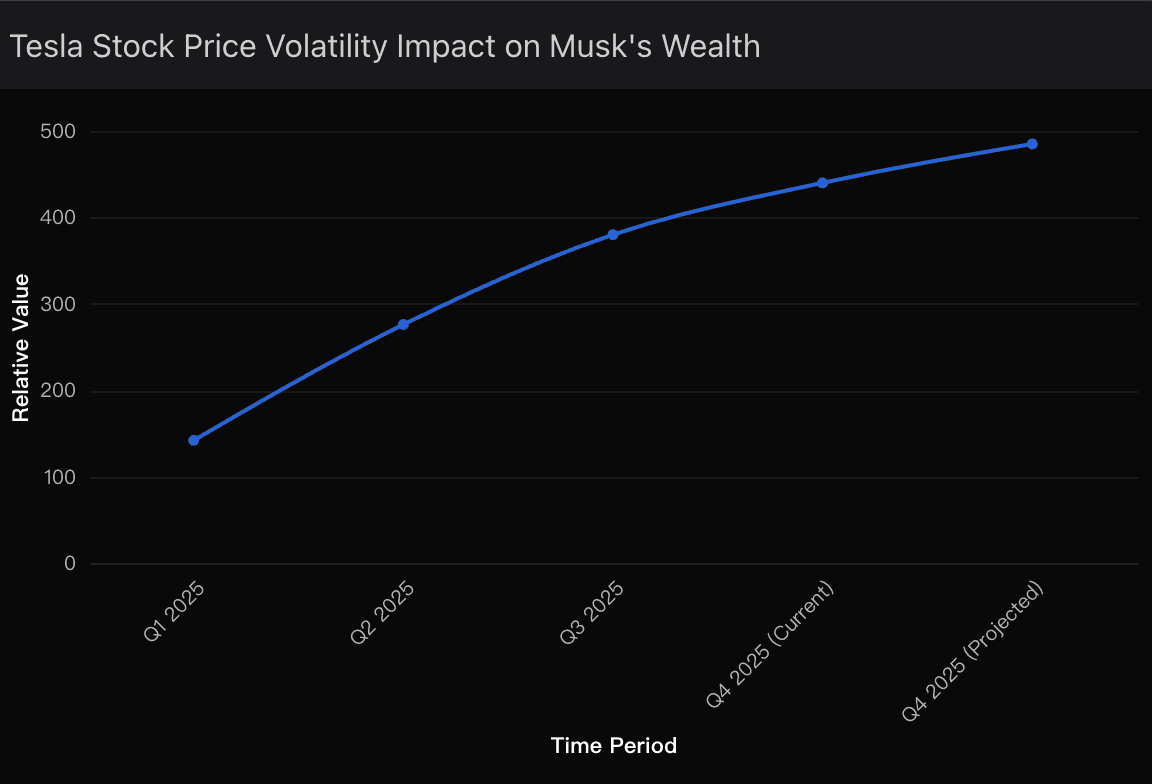

And that leverage has worked spectacularly in 2025.

Year to date, Tesla stock has exploded from $142 to $440, a 210% gain that alone created over $200 billion in net new wealth for Musk.

That’s not a typo — that’s more than the total market cap of Nike, Boeing, or Disney.

Bloom’s data fusion model reveals Tesla’s current trading pattern is not random speculation. It’s momentum grounded in thematic conviction:

AI-powered autonomous driving optimism

Energy storage expansion in Europe and India

Record Q4 production efficiency at Gigafactory Austin

Options markets price in 7% weekly volatility, yet directional bias remains upward. Every pullback so far has been met with deep-pocketed accumulation — the kind of market behavior reserved for structural growth plays.

In simple terms: as long as Tesla runs hot, Musk’s crown stays bolted on.

Musk Stays #1 — But the Margin Matters

As of Powerdrill Bloom’s latest forecast, I’m maintaining an 85% confidence level that Elon Musk ends 2025 as the richest person alive.

The numbers — and the structural dominance — simply leave too much cushion for anyone to realistically catch him this year.

But the 15% downside probability is not noise. It’s signal — a reminder that even titans live by the volatility of their creations.

In my model’s long-term view, Musk’s empire is transitioning from exponential expansion to narrative saturation.

He may remain the richest person for another year, maybe two — but the next structural reshuffle will come not from the next Tesla rally, but from a paradigm shift in capital narrative: AI infrastructure, digital luxury, or post-consumer computing.

The beauty of using Powerdrill Bloom for this kind of analysis is that it turns what looks like a static leaderboard into a living probability field.

Every billionaire’s fortune becomes a dynamic signal — a function of market behavior, macro stress, and technological adoption curves.

That’s why I don’t “guess” who’s richest. I model it.

And as of now, every signal points in one direction:

Elon Musk remains on top — by math, by market, and by momentum.

Analysis powered by Powerdrill Bloom — the AI platform tracking market probabilities, asset dynamics, and wealth volatility in real time.