I’ve been watching this race since the early days of GPT-4 and Claude 2, when every 20-point leap felt like a miracle. But by late 2025, the dynamics have changed.

We’re no longer watching leaps; we’re watching compression.

The top ten models are packed into a 5.4% performance gap, down from 11.9% just a year ago. The ceiling is solidifying. Cracking the 1500 barrier isn’t about better prompting or fine-tuning anymore—it’s about architectural breakthroughs, fundamental shifts in reasoning, and data distribution.

So, here’s my core prediction, built on live Arena data, market sentiment, and modeling through Powerdrill Bloom, my AI-driven probability engine:

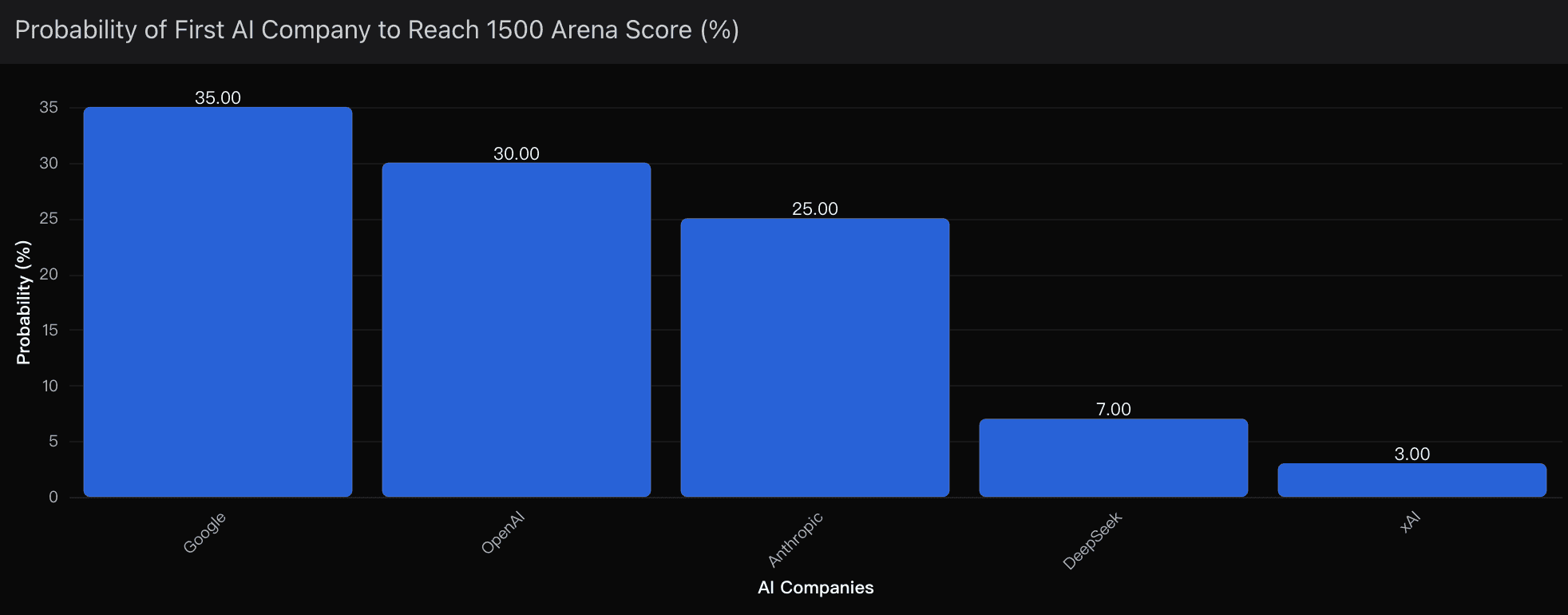

Google holds a 35% probability of being the first to hit a 1500 Arena Score, followed by OpenAI at 30% and Anthropic at 25%.

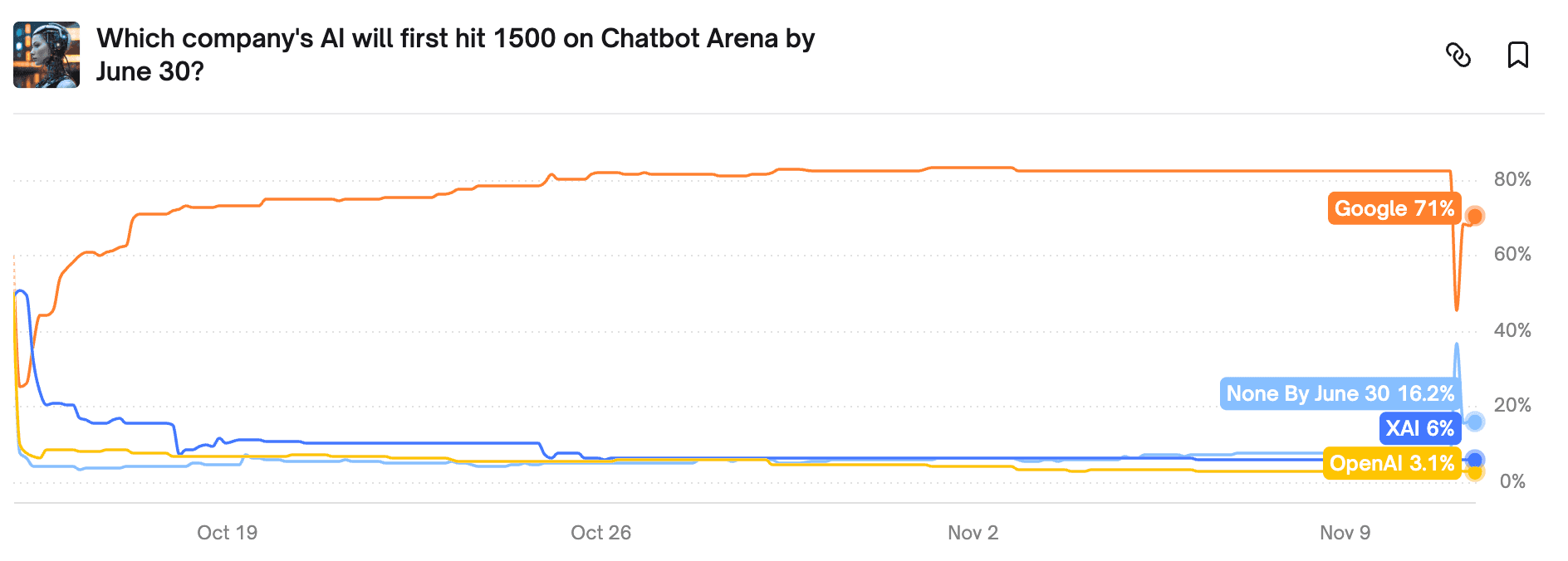

Even Polymarket reflects this logic: as of this week, traders price “Google wins 2025 model crown” at $0.71, equivalent to 71% implied confidence.

Powerdrill Bloom’s internal model adjusts that figure downward to 35%, factoring in Arena methodology volatility, Gemini release lag, and model anonymity bias—but still, the momentum is undeniably in Mountain View’s favor.

Core Probability Distribution (as modeled by Powerdrill Bloom)

Competitor | Probability to Hit 1500 First | Key Catalyst |

|---|---|---|

Google (Gemini 2.5 Series) | 35% | Deep Think deployment + compute scale |

OpenAI (GPT-5) | 30% | Sudden capability jump + reasoning variant |

Anthropic (Claude Opus 4.1) | 25% | Stability and sustained reasoning gains |

DeepSeek (R1 Series) | 7% | Open-source surge + community scaling |

These odds aren’t guesses—they’re the product of multi-layer inference modeling inside Powerdrill Bloom, which weighs cross-signals from public metrics, market data (like Polymarket odds), and latent performance growth rates.

Google Leads the Pack

I’ll be honest: I didn’t expect to assign Google the lead this time last year. Gemini had a reputation for lagging behind OpenAI in creative reasoning and Claude in consistency. But the Gemini 2.5 Pro line changed that calculus completely.

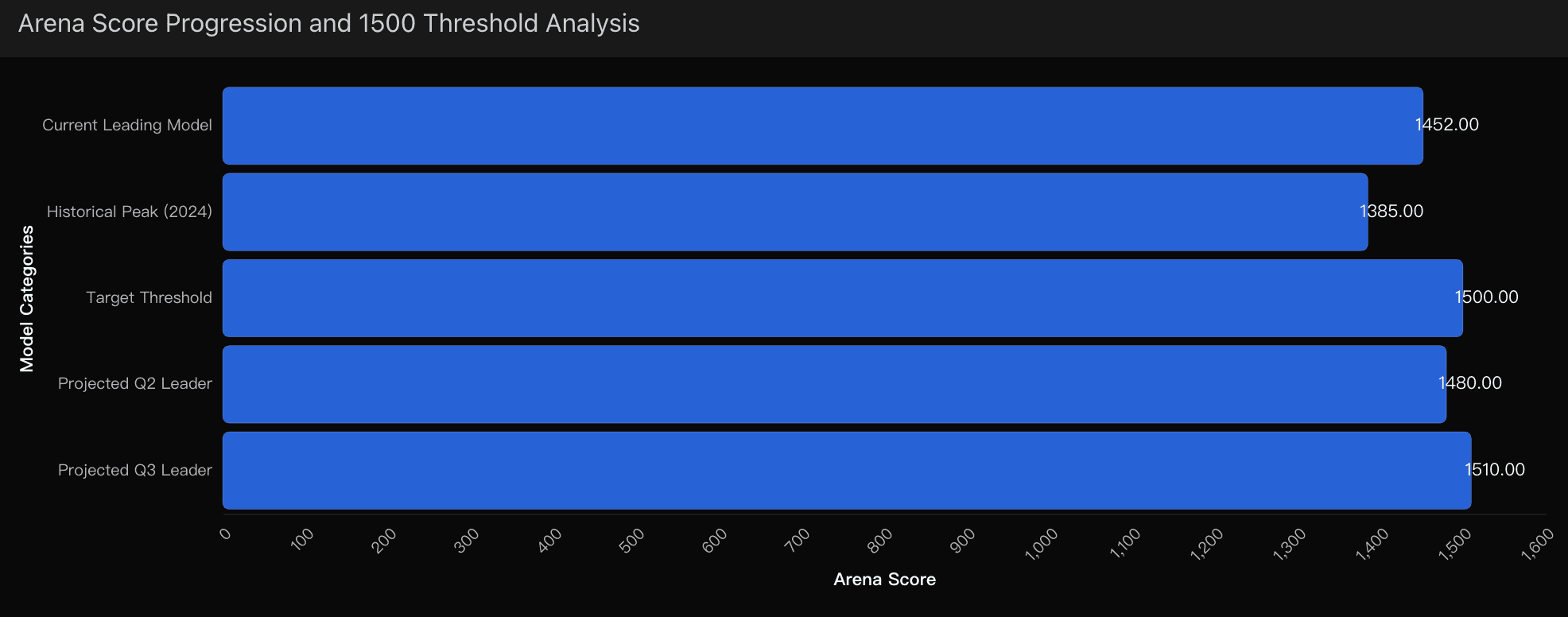

As of early November 2025, Gemini 2.5 Pro sits at 1452, the closest to the 1500 line of any known public model. And quietly, Google has been testing a Deep Think variant of Gemini 2.5—essentially a long-context reasoning mode—rumored to add 20–30 Arena points in limited trials.

Combine that with Google’s unparalleled infrastructure leverage—TPU v6 clusters, integration with real-time search data, and access to proprietary datasets—and the path to 1500 becomes not just visible, but technically plausible.

Anthropic: The 25% Quiet Challenger

If Google is the favorite and OpenAI the disruptor, Anthropic is the strategist.

Their Claude Opus 4.1 Thinking variant might not grab headlines, but it’s quietly redefining how consistency manifests in large reasoning systems. Across hundreds of user reports and Arena matchups, Claude models have hovered between 1448 and 1451—a stability no other model can match.

That stability is not stagnation—it’s control.

Anthropic’s focus on enterprise-grade refinement means fewer flashy updates, but stronger performance under pressure. Powerdrill Bloom’s insights, which tracks non-volatile reasoning trends, assigns Claude 4.1 a 25% chance of being first past 1500, especially if its "thinking" variants scale to longer reasoning chains.

The real wild card? Claude’s “chain of deliberation” architectures—designed to simulate human-style multi-agent debate within a single model. That’s the kind of architectural breakthrough that could bypass traditional performance ceilings altogether.

Market Mechanics: Why the Window Is Narrow

Even if one model crosses 1500, the celebration may be short-lived.

The Arena’s vote requirement curve has steepened dramatically—moving from rank #5 to #4 now takes 20,000+ human votes, a metric that increasingly favors models with existing user networks. Once a frontrunner hits 1500, the others can react within days, leveraging cached datasets and architecture updates.

This is what Powerdrill Bloom calls competitive elasticity—a measure of how fast rivals converge once a new benchmark is set.

In effect: the first to 1500 will trigger a wave of counter-updates across the industry, potentially leading to score inflation or even a recalibration event by LMSYS to maintain credibility.

My Final Call

If a choice must be made, it would still be Google—but only narrowly.

Their infrastructure depth, the Gemini 2.5 Deep Think pipeline, and integration of real-time knowledge retrieval give them the most structurally coherent path to 1500. I assign them 35% odds, but not because they’re unchallenged—because they’re the only player that can brute-force compute at this scale.

OpenAI, at 30%, is the volatility play: they could leapfrog everyone in a single release cycle.

Anthropic, at 25%, is the disciplined grinder—the one that could quietly outthink everyone if the race turns cerebral instead of compute-driven.

Once one model breaks 1500, it changes the market psychology, research priorities, and investor confidence across the entire AI ecosystem. We’ll look back at this period as the final chapter before general reasoning parity becomes the new baseline.

So yes, I’m calling Google first to 1500 by Q3 2025—but I’m also watching the shadows.

Because in this race, the winner may not be the one who crosses the line first,

but the one who redefines what the finish line means.