Over the past week, prediction markets have become the most accurate political barometer in Washington, and right now, they’re flashing a clear signal: the end is near.

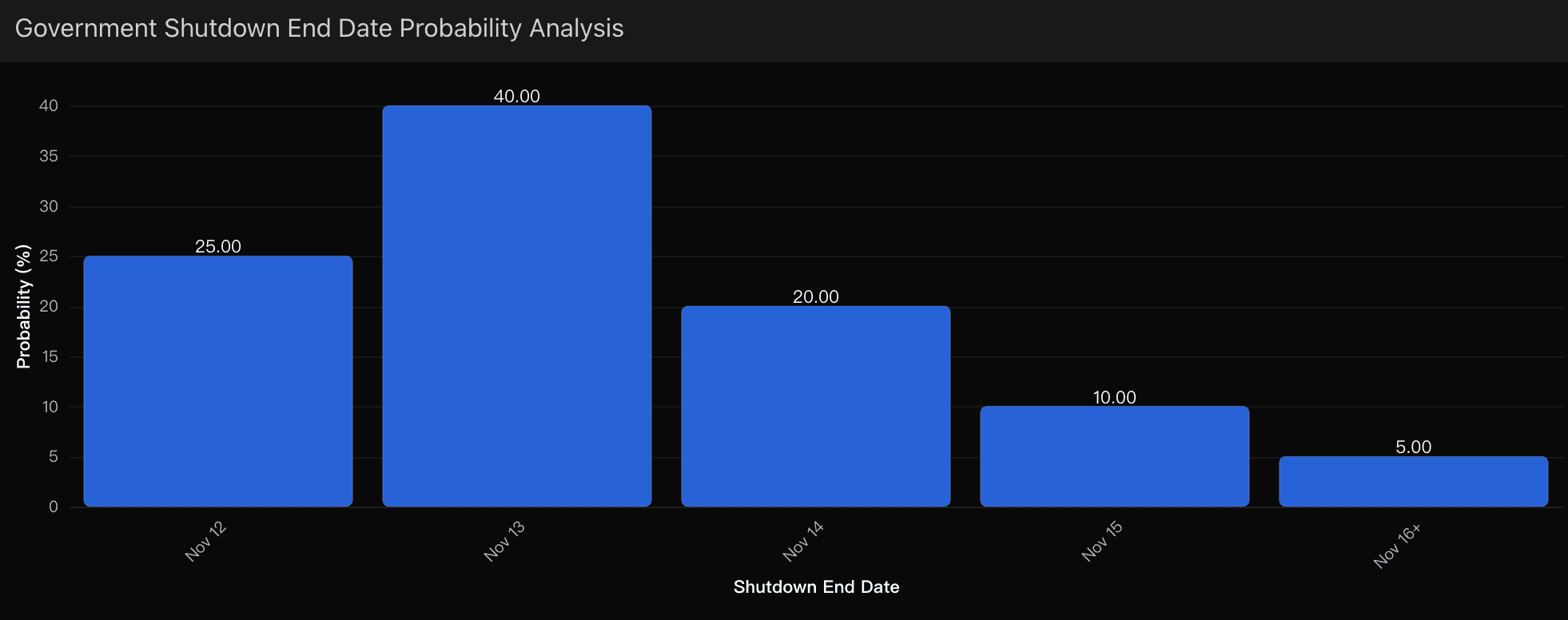

After tracking over $21 million in Polymarket volume and parsing through the procedural realities behind the Senate’s latest moves, my current model — built with Powerdrill Bloom, my AI-assisted forecasting framework — points to a November 12–13 resolution window with 65% confidence, and November 13th as the single most probable day at 40%.

In other words: we’re 40% confident the government reopens before Thursday, November 13th.

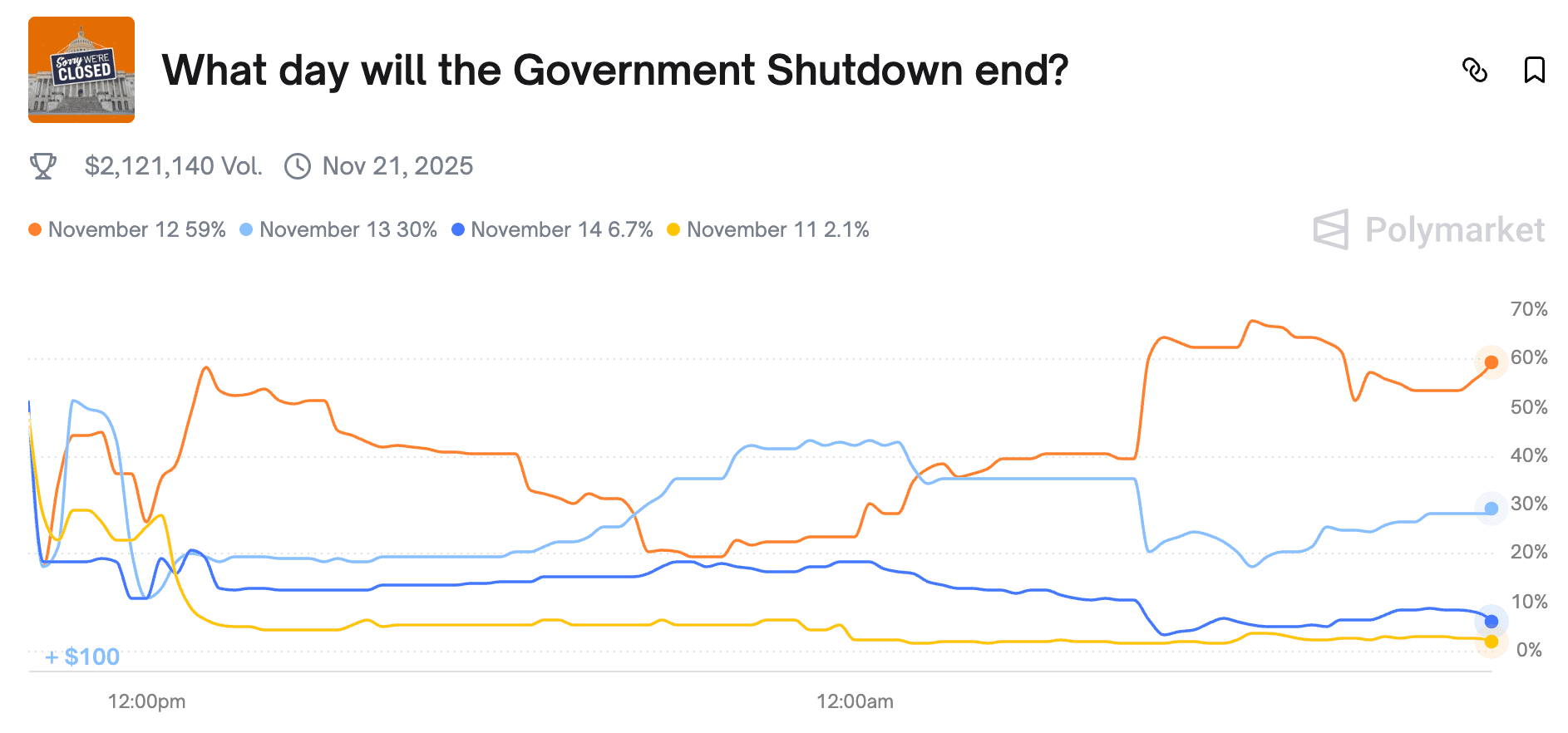

You can always tell when political insiders start to move money instead of microphones. Nearly 95% of Polymarket’s volume is now concentrated in the November 12–15 range, and that distribution isn’t random. It reflects traders aligning around the Senate’s procedural tempo — the standard 48–72-hour window that follows a Sunday test vote before final passage.

When you overlay that with the most recent Senate signals — including reports of 8+ Democrats ready to break ranks — the pattern tightens dramatically. The data stream analyzed by Powerdrill Bloom shows an accelerating convergence of sentiment toward midweek, matching what we’d expect from a resolution path built on procedural math rather than political theater.

Core Prediction: November 13

Here’s the forecast:

November 13th carries a 40% probability, while the broader November 12–13 window holds 65% confidence for the shutdown’s resolution.

That date range isn’t arbitrary — it’s anchored in the choreography of Washington itself:

Senate procedural reality: The Sunday test vote activates a 48–72-hour countdown before final passage, setting up a Tuesday or Wednesday vote.

Political optics: Forty-plus days of shutdown pain gives Republicans enough narrative cover to declare they “stood firm” without tanking the economy.

SNAP funding crisis: With November 1 benefits expiring, pressure is building from governors and grocery associations — an unignorable fiscal fault line.

Trump’s narrative calculus: Prolonged paralysis undercuts his dealmaker brand; resolution gives him a “victory lap” without substantive concession.

Together, these forces create a political equilibrium around November 13 — a date that offers just enough drama for both sides and just enough relief for the markets.

Risks and Delays:

No forecast is bulletproof. Two tail risks could push this slightly beyond the median:

Rand Paul Factor: His procedural objections could extend floor debate by 24–48 hours.

House scheduling lag: If the Senate concludes late Wednesday, House alignment could spill over into early Friday, pushing a November 14–15 vote.

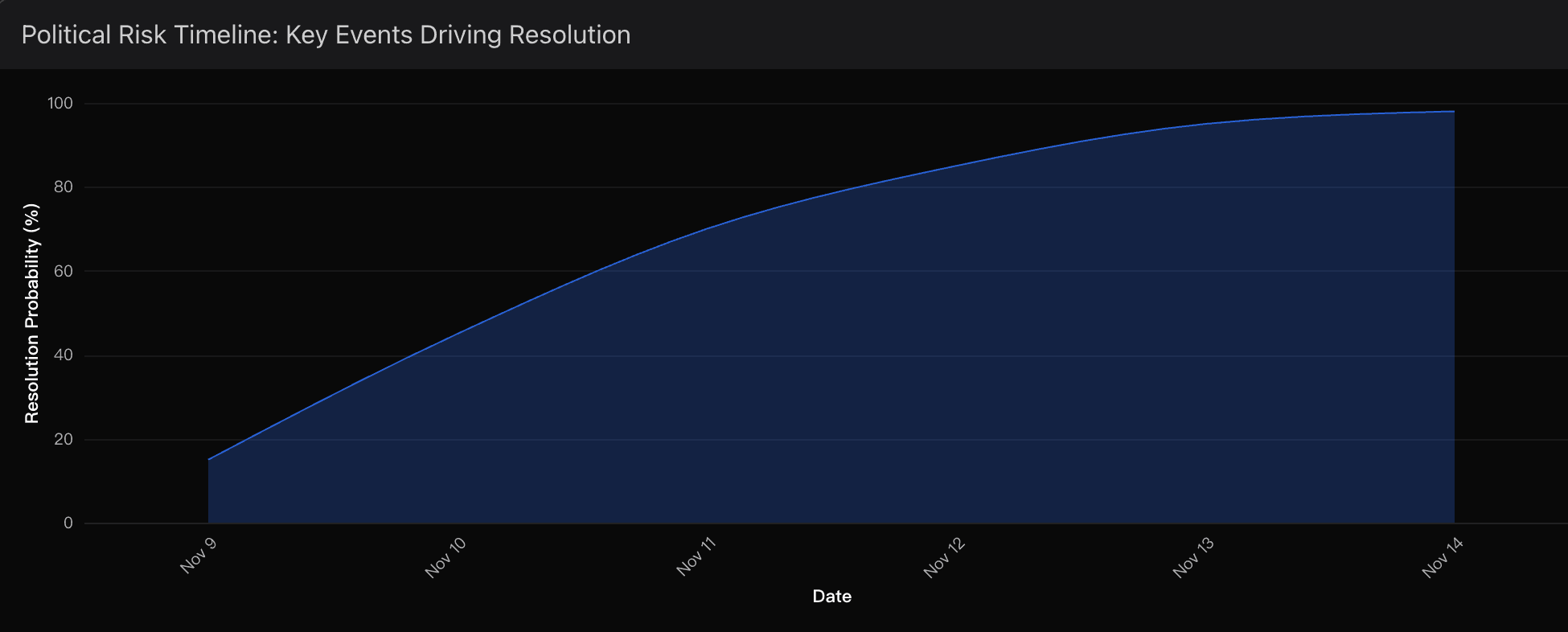

Still, Powerdrill Bloom’s insights shows that the odds of the shutdown continuing past mid-November are below 10%. The political and economic pressure cooker has reached critical mass.

Final

November 13th sits at the perfect intersection of political realism and procedural math — a midpoint between brinkmanship and necessity. The Polymarket data, the Senate’s pacing, and the quiet shift in party posture all align around this date with remarkable precision.

From where I stand, running the numbers through Powerdrill Bloom’s probability engine, it’s clear:

We’re looking at a 65% confidence resolution window between November 12–13.

November 13 is the most probable endpoint — the day the gridlock finally breaks.

And when it does, the markets won’t cheer. They’ll exhale — because this time, the endgame was written in Powerdrill Bloom long before it was written in the headlines.