With the December 2025 U.S. CPI data now released, it appears that in the short term, there may be no immediate need for Fed rate cuts.

As someone deeply involved in global trend analysis and predictive market research, I’ve used this fresh inflation data, together with market signals, to forecast how many Fed rate cuts we might see in 2026.

Leveraging Powerdrill Bloom, I explored historical patterns, market-implied probabilities, and macroeconomic drivers to build a structured forecast that balances data rigor with clarity.

1. Core Forecast: The Base Case

Analyzing current information as of mid-January 2026, my baseline expectation is that the Fed delivers two 25bp cuts over the year, taking the funds target range from 3.50–3.75% down to roughly 3.00–3.25% by year-end.

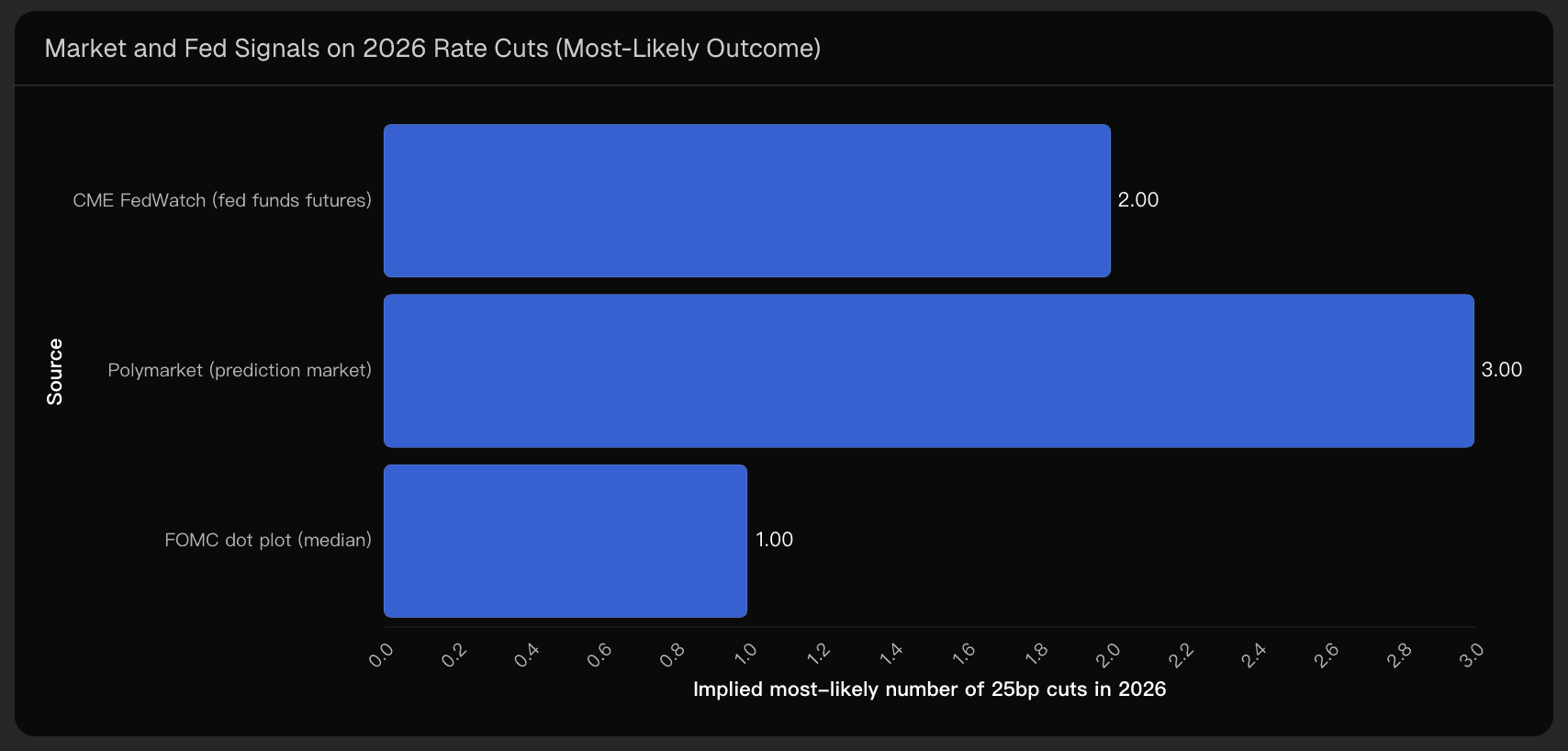

This aligns with Fed funds futures and CME FedWatch, which indicate two cuts as the most likely path.

Sell-side and fixed-income strategists broadly expect about 50bps of easing, consistent with my baseline.

The FOMC dot plot shows a median of one cut, but with wide dispersion—my forecast sits slightly more dovish than the median, yet less aggressive than the extreme market scenarios.

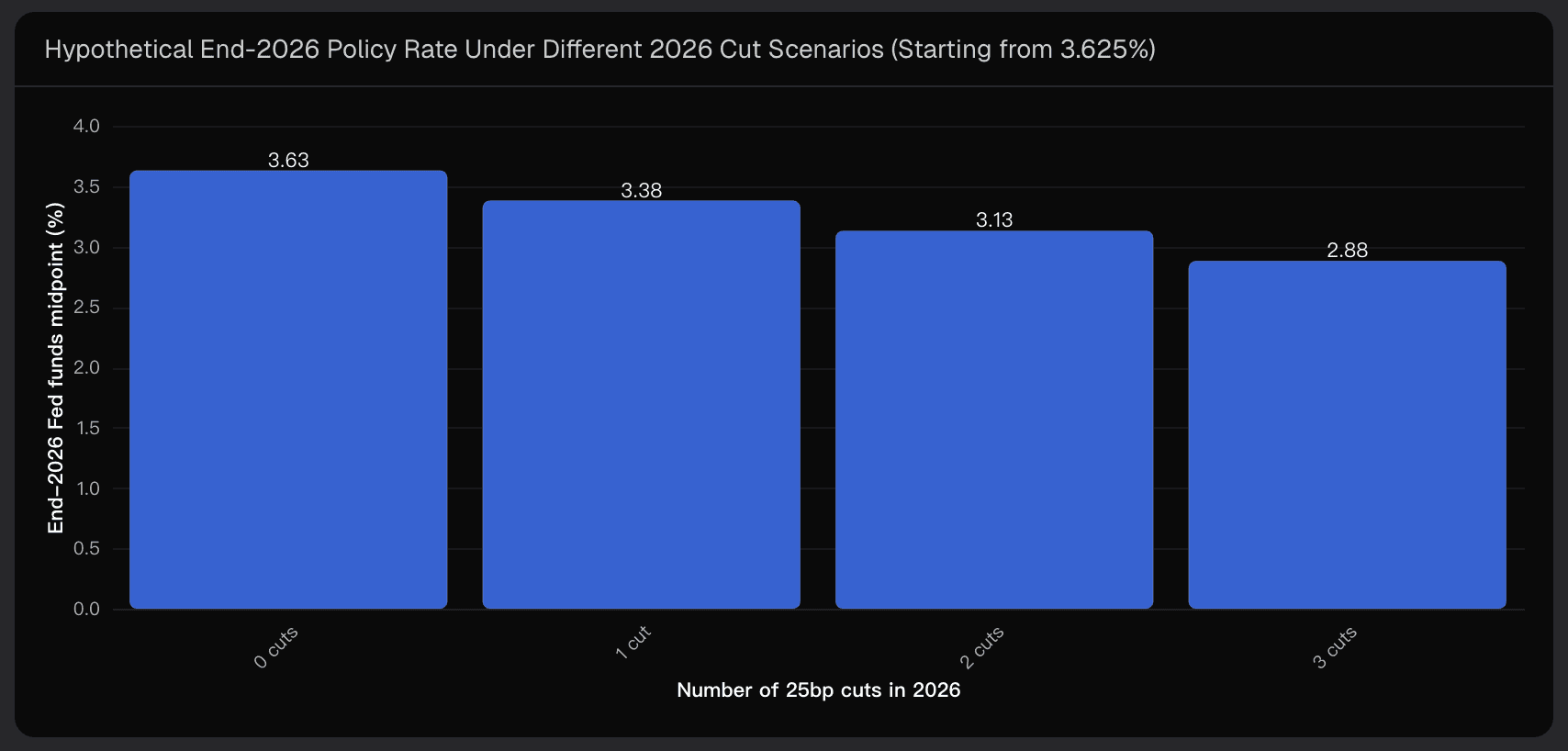

Scenario visualization: A simple chart shows how 0, 1, 2, or 3 cuts translate into end-2026 policy rates, highlighting that moving from one to two cuts only lowers the midpoint by 0.25pp, while three cuts push it below 3%, a clearly accommodative stance.

2. Probabilistic Assessment

Forecasting monetary policy is inherently uncertain. Based on inflation dynamics, historical Fed behavior, and market signals—including the newly released December CPI—I assign the following probabilities:

0–1 cuts: ~25%

2 cuts (baseline): ~45%

3 or more cuts: ~30%

This distribution reflects asymmetric risks: fewer cuts if inflation re-accelerates, or more cuts if the labor market softens or financial shocks emerge. Market-implied probabilities, including Polymarket and CME FedWatch, show a slight dovish skew relative to the FOMC median.

Key insight: The baseline of two cuts represents the most likely path, but the tails remain substantial, underscoring the need to monitor inflation and labor-market metrics as new data arrives.

3. Drivers and Supporting Evidence

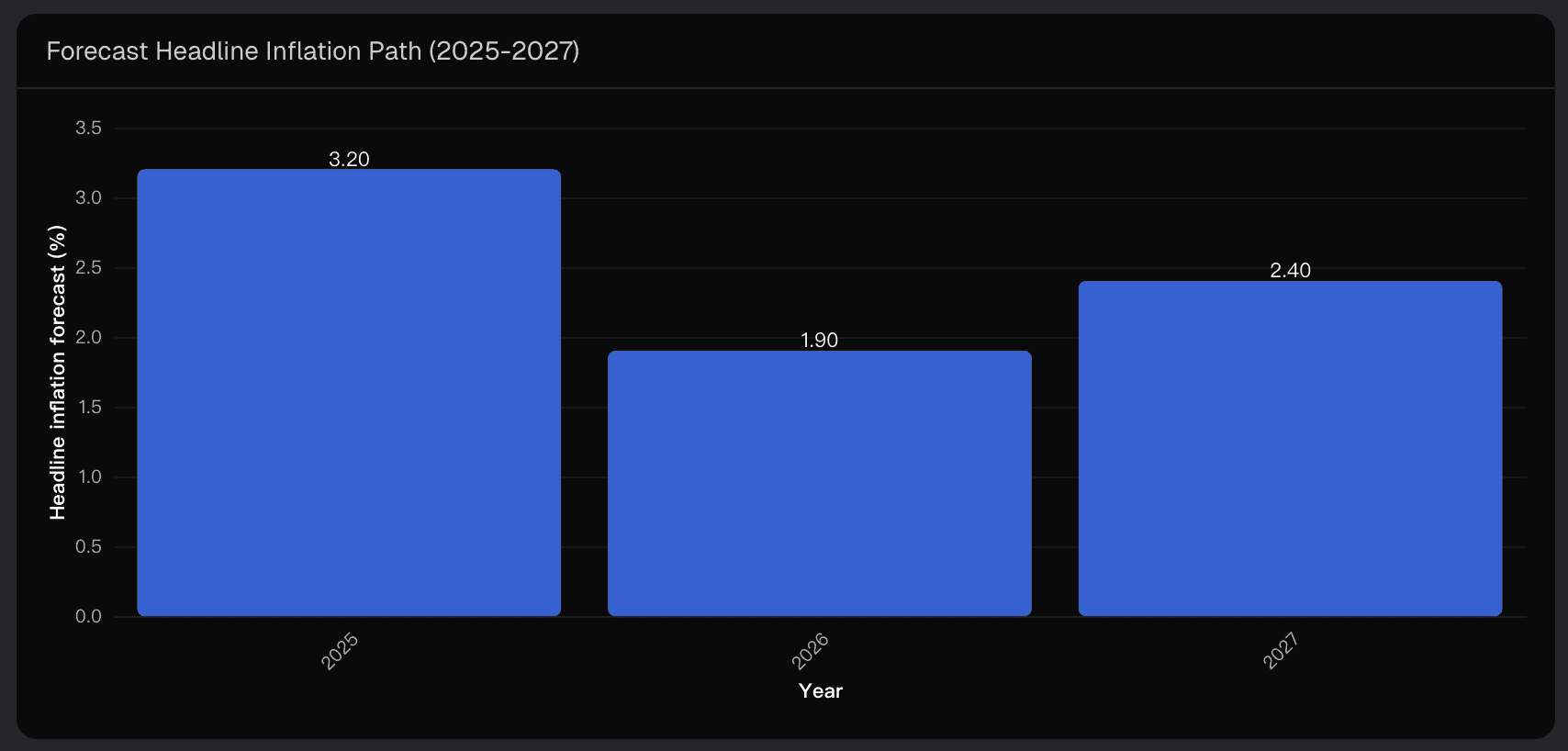

a) Inflation Trends

Core CPI is ~2.6% YoY, lower than expected, with services inflation proving sticky.

Forecasts indicate headline CPI declining to ~1.9% in 2026, with core slightly above 2%, supporting gradual easing rather than aggressive cuts.

The recent CPI release reinforces the short-term rationale for holding rates steady, while leaving room for measured easing later in the year.

b) Labor Market Conditions

Wage growth around 3.2% aligns roughly with a 2% inflation target.

Unemployment projections for 2026 sit at 4.3–4.5%, suggesting a labor market that is cooling but not collapsing.

c) Historical Fed Reaction Function

Past episodes show a cautious approach after inflation plateaus: the Fed typically delivers small, widely-telegraphed cuts unless inflation or labor-market shocks justify more.

This pattern reinforces the expectation of a glidepath of 1–2 cuts in 2026.

d) Market Pricing

Futures and prediction markets reflect substantial easing expectations, with two cuts priced as the modal outcome.

Asymmetric risk exists: upside inflation surprises reduce cuts; downside labor-market or financial shocks increase cuts.

4. Key Uncertainties

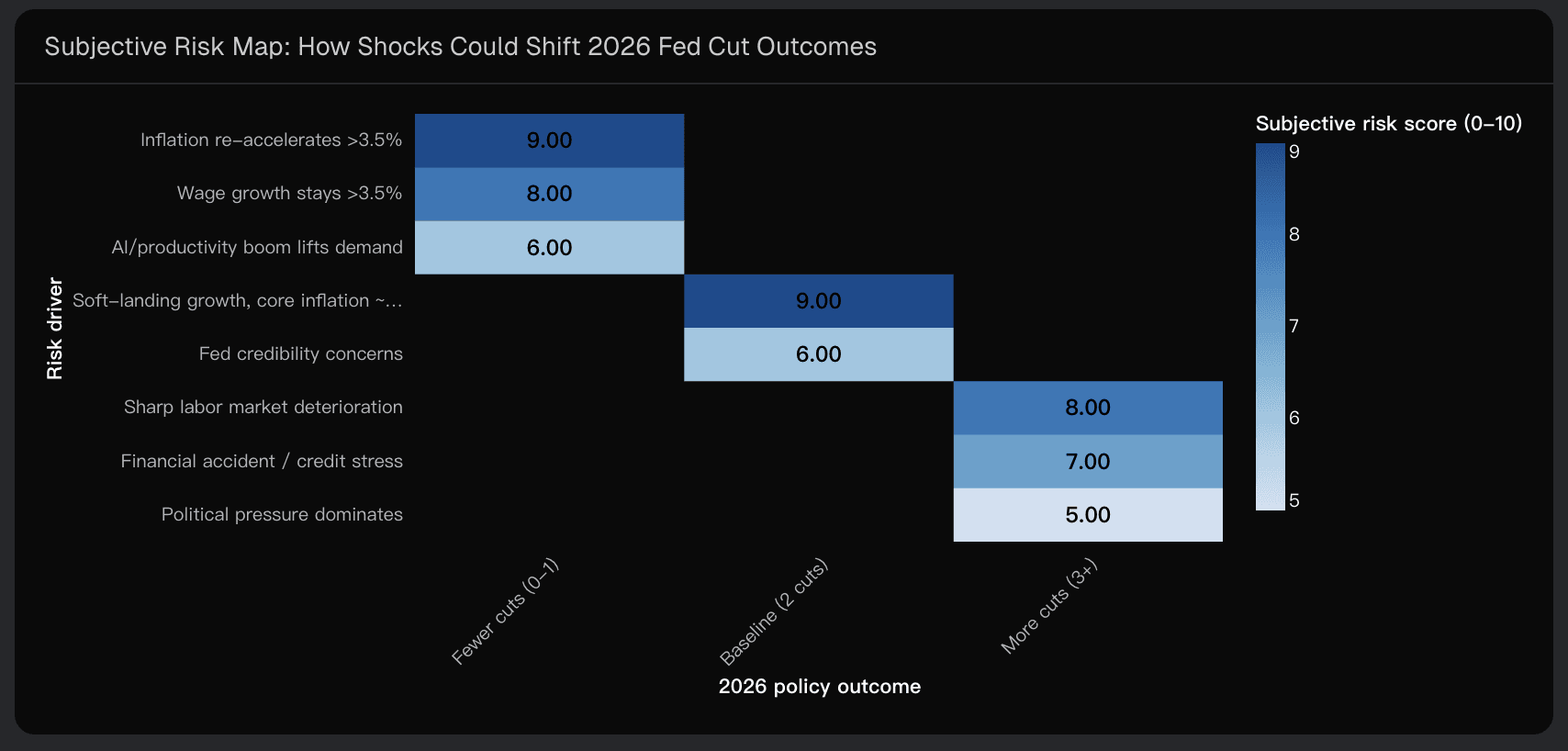

Several factors could push actual cuts away from the baseline:

Upside inflation risks: Core services inflation re-accelerates >3.5%

Downside growth/financial stress: Sharp labor-market deterioration or credit stress could trigger ≥3 cuts

Political and institutional factors: Fed leadership transition and political pressure may influence decisions

A subjective risk map highlights which shocks favor fewer, baseline, or more cuts, emphasizing the variance around the two-cut central path.

Conclusion

Combining these insights, my base-case forecast remains two 25bp cuts in 2026, ending the year at 3.0–3.25%, consistent with futures and private forecasts. The distribution is skewed:

Fewer cuts if inflation surprises on the upside

More cuts if the labor market or financial conditions deteriorate

The December CPI release provides important context: it signals no urgent pressure to cut in the short term, but ongoing monitoring of core inflation and labor-market metrics will guide Fed actions throughout 2026.

Powerdrill Bloom played a key role in analyzing multiple datasets, visualizing scenarios, and synthesizing historical and market evidence into a coherent forecast.

Disclaimer: This blog provides data-driven forecasts for informational purposes only and does not constitute financial advice.