Over the past few months, I’ve been tracking the Federal Reserve’s signals with unusual intensity — not just headlines, but the subtle shifts hidden in projections, probabilities, and market reactions. When you step back and connect the dots, a clear picture emerges.

After running the numbers, stress-testing scenarios, and comparing institutional forecasts, my conclusion is straightforward:

The Federal Reserve is highly likely to hold rates steady in January 2026.

This isn’t a contrarian view. It’s a probability-weighted forecast grounded in market pricing, Fed guidance, and macro fundamentals — and it’s exactly the kind of conclusion that becomes obvious once you synthesize the data properly.

Prediction: No Change in January 2026

Base Case:

The Fed will maintain the federal funds rate at 3.50%–3.75% at its January 28–29, 2026 meeting.

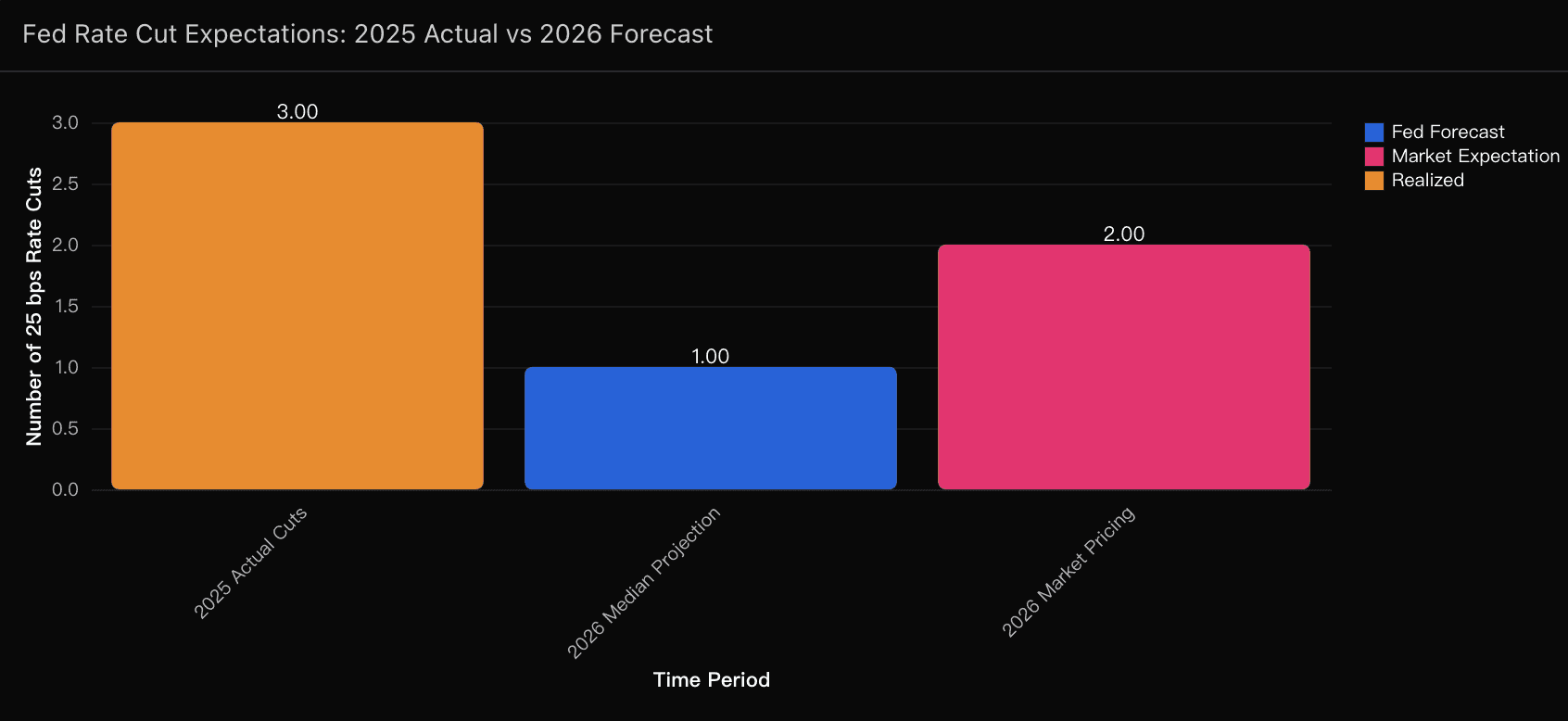

This decision would represent a strategic pause, following three consecutive 25-basis-point cuts delivered in September, November, and December 2025. In my view, those late-2025 cuts already fulfilled the Fed’s stated objective: providing insurance against downside labor-market risks.

January, therefore, is not about further easing — it’s about assessment.

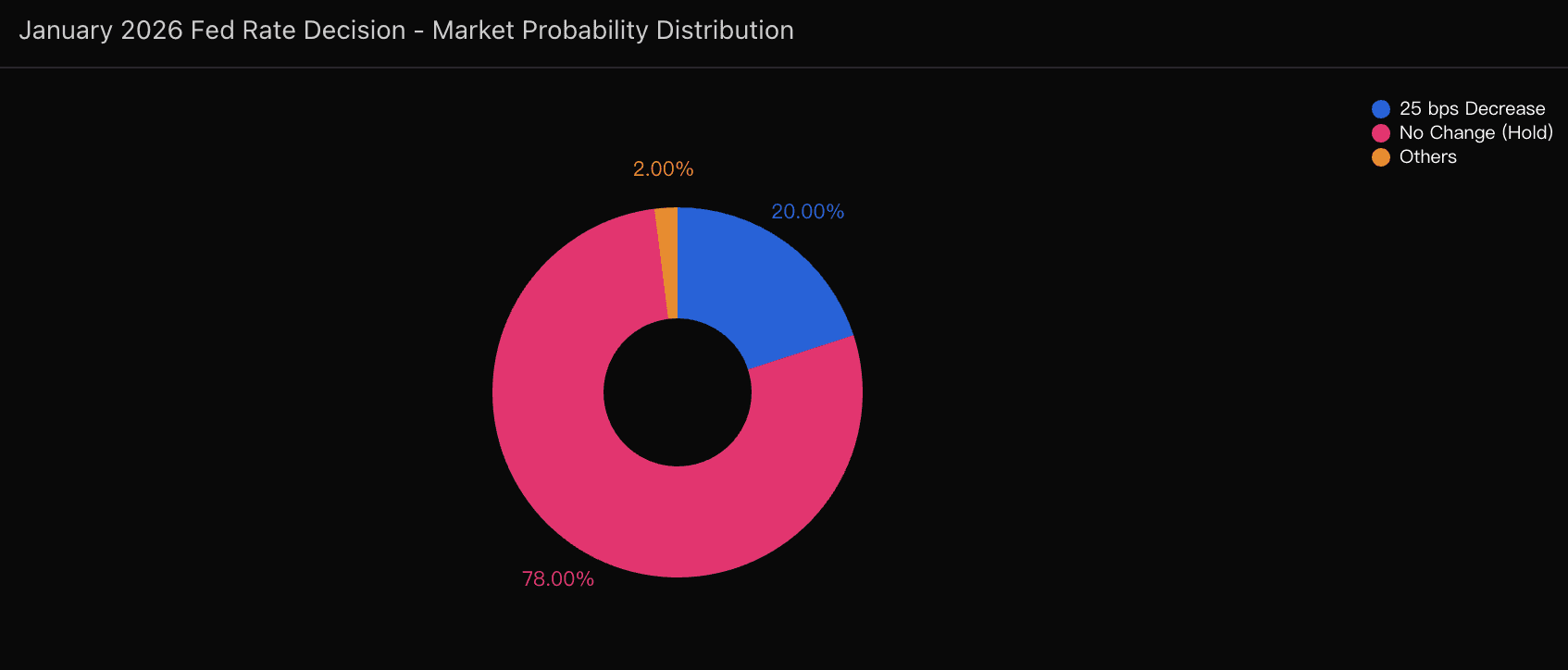

What the Market Is Pricing In

According to CME FedWatch probabilities released after the December 10 announcement, markets are already leaning heavily toward a pause:

No Change (Hold): 78% ← Primary scenario

25 bps Cut: ~20% ← Contingency scenario

50+ bps Cut: ~1%

*Any Rate Increase: ~1%

What’s notable here isn’t just the level, but the direction. The probability of a January hold climbed from roughly 70% pre-announcement to 78%, signaling growing market confidence after digesting the Fed’s updated guidance.

This is exactly the type of probability shift I track using Powerdrill Bloom — not just raw odds, but how expectations evolve after key policy signals.

Supporting Evidence for the Prediction

The Fed’s Own Signals: The December Dot Plot Shift

The most underappreciated data point, in my view, is the December 2025 dot plot.

Here’s what it tells us:

The median Fed projection shows only one 25 bps cut for all of 2026

7 of 19 policymakers (37%) expect zero cuts next year

Several others prefer holding rates steady even if they didn’t formally vote that way

This represents a clear hawkish shift from September. When I mapped this transition in Powerdrill Bloom’s trend-analysis module, the change was unmistakable: policymakers are no longer thinking in terms of sequential cuts — they’re thinking in terms of limits.

Institutional Consensus Is Remarkably Aligned

One of the strongest confirmations of my view comes from major institutions — not just one, but many:

Goldman Sachs: January hold, followed by cuts in March and June

Bank of America: No action again until mid-2026

Wells Fargo: Emphasizes the high bar for January after the “insurance cut” framing

Reuters consensus: “FOMC on pause starting in January”

Desjardins: Expects a pause through the first half of 2026

When this many independent models converge, the signal-to-noise ratio improves dramatically.

The Macro Backdrop Doesn’t Justify Urgency

The Fed’s December projections paint a surprisingly constructive picture:

2026 GDP growth: ~2.3% (above trend)

Core PCE inflation: ~2.4% by end-2026

Unemployment: ~4.4%, stable

This is not an economy screaming for rapid stimulus. If anything, it’s an economy where policymakers can afford to wait, observe, and recalibrate.

From a decision-theory perspective, pausing dominates cutting when risks are asymmetric — and right now, that asymmetry is real.

Leadership Transition Encourages Caution

There’s another factor markets tend to underestimate: institutional uncertainty.

Chair Powell’s term ends in May 2026

A Trump administration is expected to name a new Fed chair before year-end

Reporting suggests a committee with a strong hawkish bloc

In periods of leadership transition, central banks historically default to caution. Cutting aggressively right before a potential handover would be an unusual — and risky — move.

Why September’s “Insurance Cut” Matters More Than People Think

Powell explicitly framed September’s cut as risk management, not the start of a new easing cycle.

Since then:

No major labor shock has occurred

Two additional cuts have already been delivered

The Fed now needs time to evaluate whether those actions worked

What Could Change My Mind? (The 20% Scenario)

I assign roughly a 20% probability to a January cut, driven by three low-probability triggers:

A sudden labor-market shock

Timing works against this — key data arrives either too late or too close to the meeting.Unexpected inflation collapse

Core PCE would need to fall near 2.1% rapidly — highly unlikely given current trends.A surprisingly dovish Fed chair announcement

Even then, credibility argues for a pause-first approach.

None of these are impossible — but none are probable.

Final Take

After weighing probabilities, projections, institutional forecasts, and macro data, my probability-weighted conclusion is clear:

A January 2026 Fed rate hold at 3.50%–3.75% is the dominant outcome, with roughly 78% likelihood.

This forecast aligns with:

The Fed’s own dot plot

Analyst consensus across major banks

A resilient economic backdrop

A hawkish committee structure

Leadership transition dynamics

A cut remains a contingency — not the base case.

This kind of clarity is exactly why I rely on tools like Powerdrill Bloom to synthesize market probabilities, policy signals, and narrative shifts into one coherent analytical framework. In complex macro environments, the edge isn’t having more data — it’s understanding what actually matters.

And right now, what matters most is patience.