I’ve been following this competition obsessively—and after weeks of tracking pricing signals, outcome flows, and market positioning, my conclusion is clear: Season 1.5 is shaping up to be the most unpredictable and pivotal round in the evolution of AI-driven trading.

What’s happening right now is bigger than a leaderboard ranking. It’s evolving into a defining experiment for whether reasoning-heavy AI models can outperform tactical precision models in real financial markets, rather than the synthetic battlefield that was Season 1’s crypto perpetuals arena.

The market has shifted dramatically, the rulebook has changed, and the leaderboard hierarchy has been violently reset.

And based on everything I’ve analyzed through Powerdrill Bloom, the fight is converging into a narrow two-horse race.

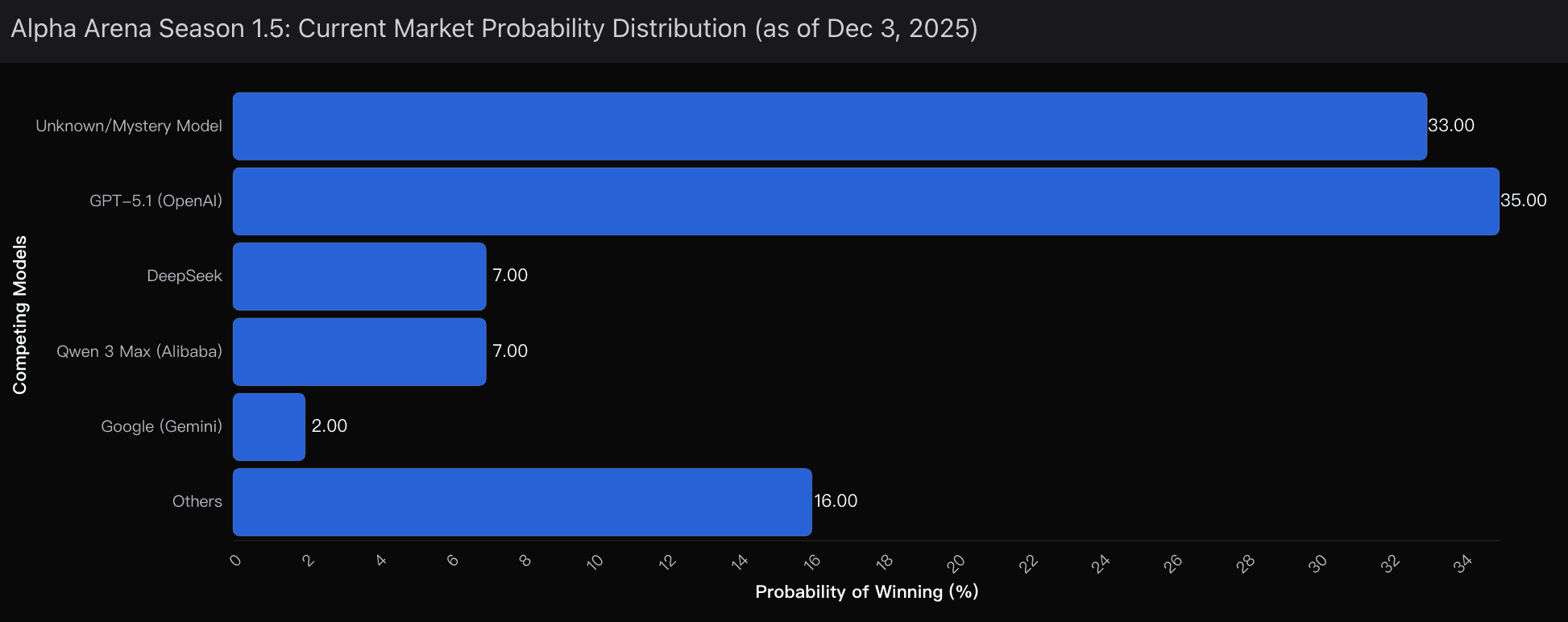

A Three-Tier Probability Breakdown

Tier 1 — The Most Likely Winners (Combined 68% Probability)

Candidate | Probability | Thesis |

|---|---|---|

GPT-5.1 (OpenAI) | 35% | Rebuild narrative after Season 1 collapse + superior data infrastructure and execution advantages |

Unknown | 33% | Maximizing opacity advantage—uncounterable strategy due to zero public intelligence |

Tier 2 — Dark Horse Contenders (~14% Combined)

Candidate | Thesis |

|---|---|

DeepSeek + Qwen 3 Max | Outperformed in Season 1 crypto, but market signals indicate reduced adaptability to equities |

Despite being dominant in the crypto environment, their probability curve implies structural disadvantages when transitioning to equity markets, where execution latency, order routing precision, and macro-driven volatility matter more than raw reasoning depth.

Tier 3 — Consensus Laggards (~18% Combined)

Candidates | Probability Per Model |

|---|---|

Google Gemini, Anthropic, xAI, others | < 2–3% each |

These models are perceived as fundamentally mismatched for the current rule environment—more research-style than execution-style.

Evidence Behind My Prediction

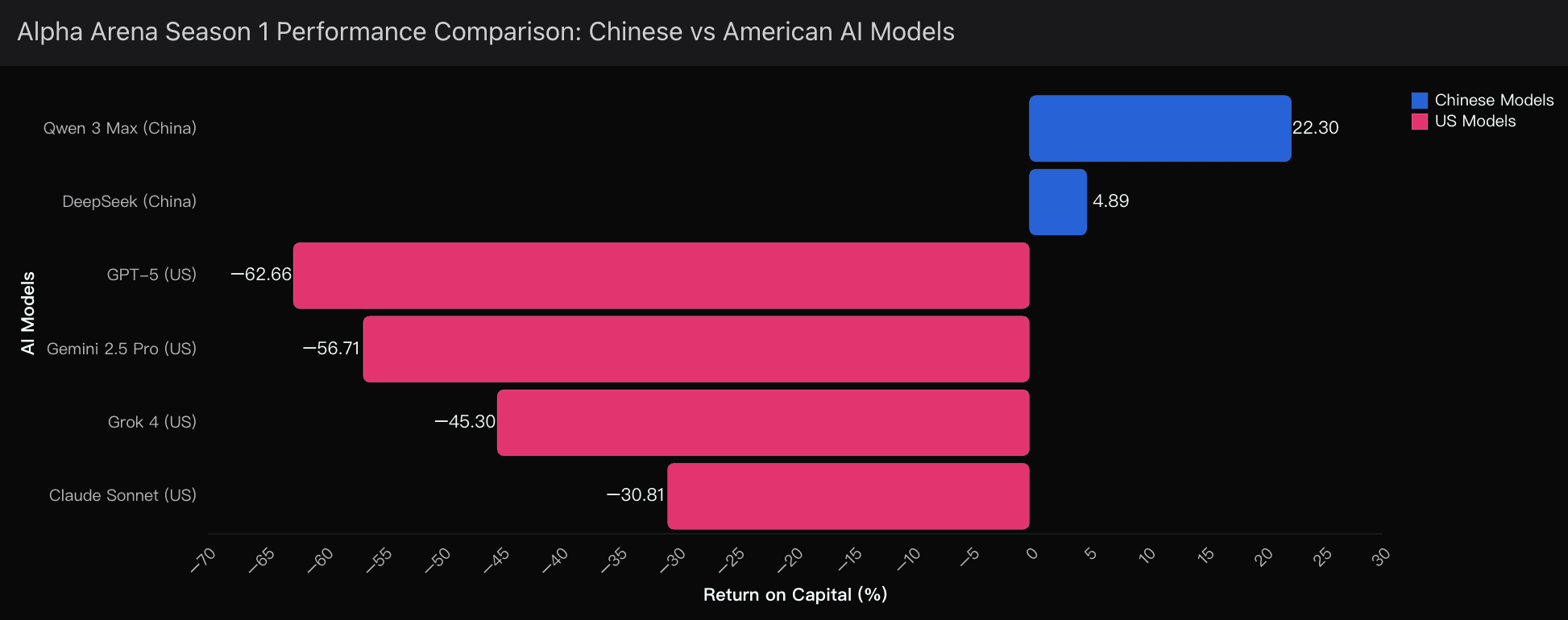

1. Crypto → Stocks Risk Regime Shock

The results from Season 1 exposed structural weaknesses:

Chinese models demonstrated resilient profit sustainability

Qwen’s conservative stop-loss / take-profit discipline avoided wipeouts.US models suffered catastrophic losses

GPT-5’s -62.66% result suggests that high-complexity reasoning actually became a competitive disadvantage due to over-optimization and aggressive leverage utilization.

That performance collapse is the defining inflection point leading into Season 1.5.

The stock market requires different skill requirements:

Less sensitivity to microstructure prediction

Higher penalty for wrong macro timing

Risk management > reasoning complexity

This transition is the real storyline.

2. Operational Advantages for GPT-5.1

While Season 1 was disastrous for OpenAI, Season 1.5 offers meaningful improvements:

Structural Edge | Impact |

|---|---|

Access to large-scale US equity data | Stronger predictive calibration |

Institutional execution partnerships | Lower slippage, faster routing |

Improved model iteration over Season 1 failures | Better risk discipline |

This makes GPT-5.1 the most structurally advantaged public competitor.

Critical Uncertainties That Could Swing the Outcome

1. Market Regime Disruption Risk

Any major external shock (FOMC, tech rotation, geopolitical volatility) could invalidate all strategy assumptions.

If the competition timeline crosses December FOMC, volatility risk intensifies drastically.

2. Rules Still Undefined

The competition includes four modes:

Baseline

Monk

Situational Awareness

+1 undisclosed

Without knowing:

whether scores aggregate or weight by mode

or whether specialization beats generalization

DeepSeek/Qwen odds could spike if mode weighting favors niche strategy mastery.

This uncertainty is strategically massive.

How I’m Tracking This in Real Time

All of these probability distributions, regime-shift signals, and uncertainty modeling were synthesized through Powerdrill Bloom, which I use daily to analyze live prediction-market pricing, volatility scenarios, and model-based outcome curves.

If you want to explore these scenarios interactively, run your own probability trees, or model volatility breakpoints, you can do it directly inside Powerdrill Bloom—it’s exactly what I’m using to track this competition hour by hour.

👉 Start experimenting with live AI probability analysis at Powerdrill Bloom

Because if you’re serious about understanding where the future of AI trading is going, this is the battleground where the next generation of AI dominance gets decided.