Prediction markets didn’t just grow in 2025—they transformed.

In fact, by the time CZ unveiled predict.fun on BNB Chain on December 4, the industry had already crossed into a structurally different growth phase. His launch was the signal, not the spark.

After analyzing volumes, regulatory developments, institutional flows, and cross-chain infrastructure shifts, I reached a firm conclusion:

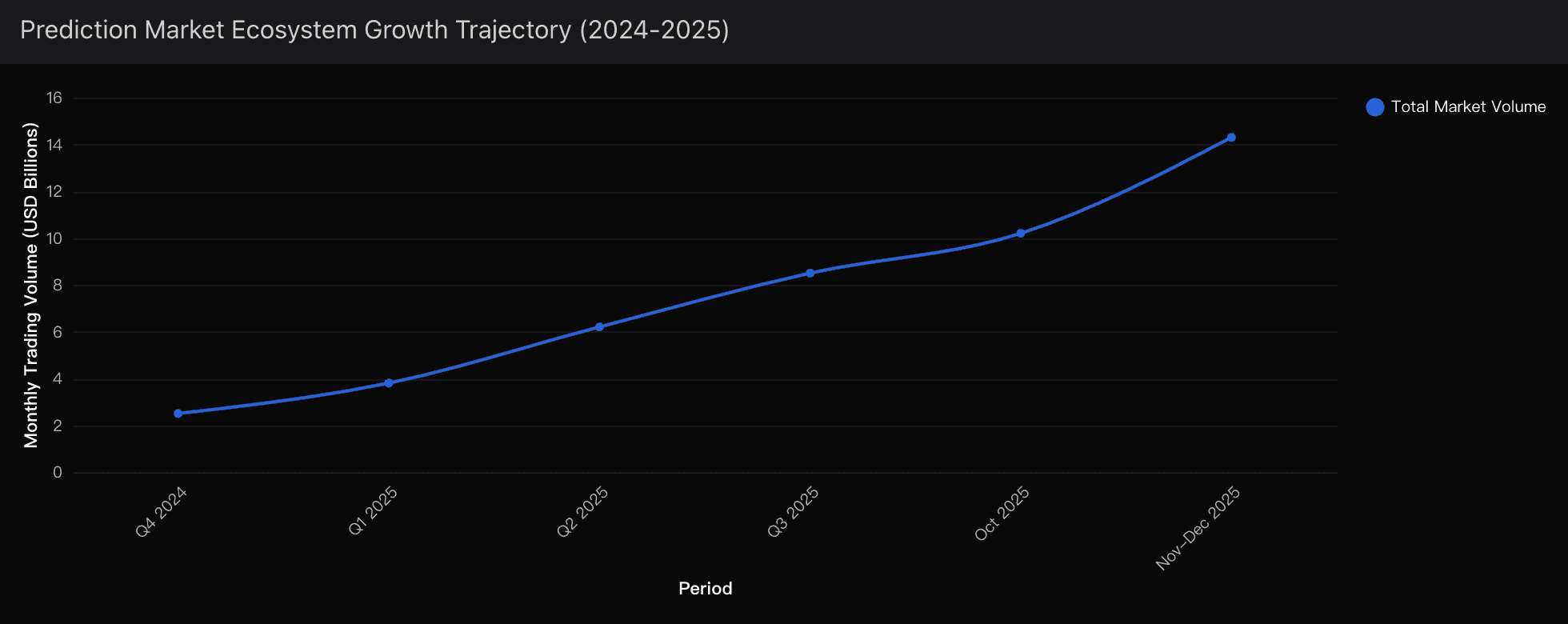

Prediction markets hit their inflection point between Q2 and Q3 of 2025, and everything since then has simply accelerated an already-active exponential trend.

Let me walk you through how I arrived here—and what it means for the next chapter of this emerging asset class.

The Market Was Already in Explosion Mode

A 472% Market Expansion in 12 Months

According to my Powerdrill Bloom–filtered dataset, the shift began long before CZ made any public moves:

Monthly volumes surged from $2.5B (Q4 2024) → $14.3B (Nov–Dec 2025)

BNB Chain’s on-chain prediction volume hit $2.6B in Oct 2025, up 180% YoY

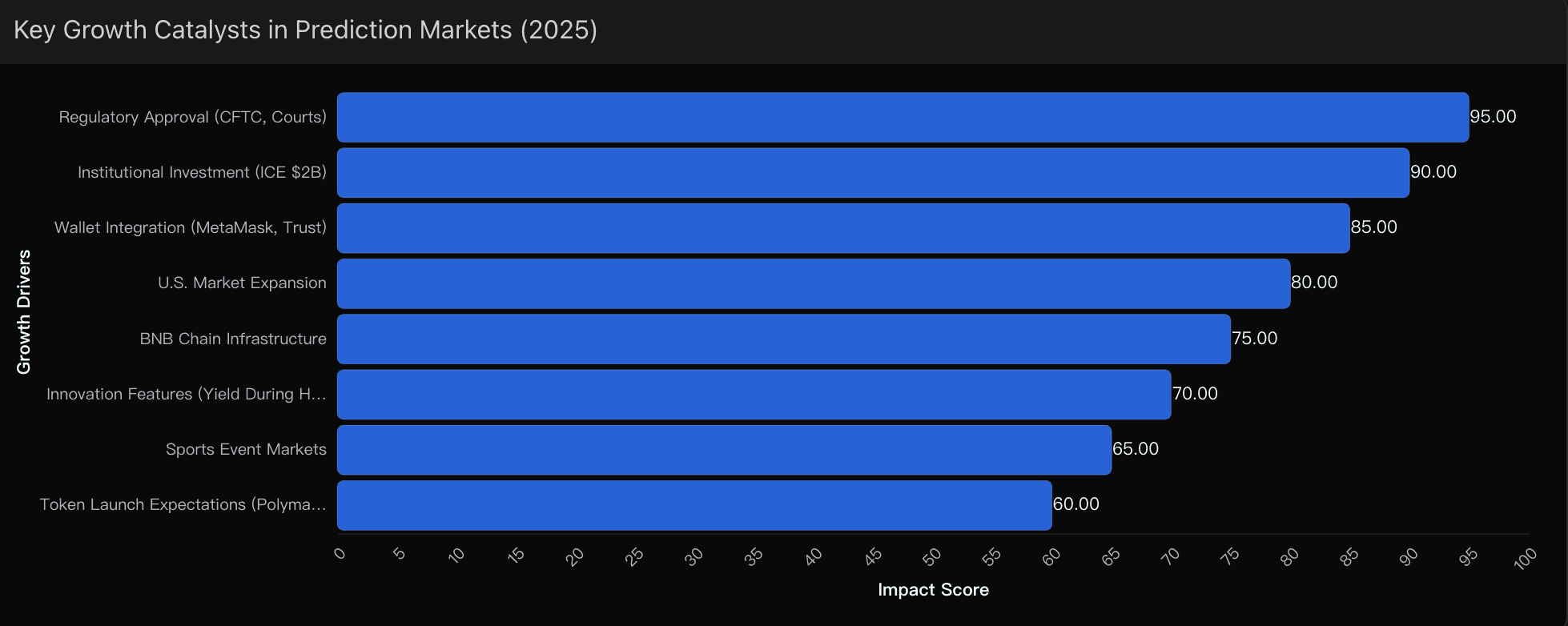

Regulators flipped from resistance to endorsement:

CFTC no-action letter for Polymarket (July)

Kalshi gaining full Designated Contract Market status (October)

When you see volume, regulation, liquidity, and institutional capital all spike before a major founder-led launch, it tells you the growth was not seeded by hype—it was endogenous.

So What Does predict.fun Actually Signal?

From that lens, predict.fun communicates three things very clearly.

BNB Chain Is Becoming the Industry’s Prediction Market Hub

This wasn’t inevitable.

Early prediction markets grew on:

Polygon (Polymarket)

Standalone regulated rails (Kalshi)

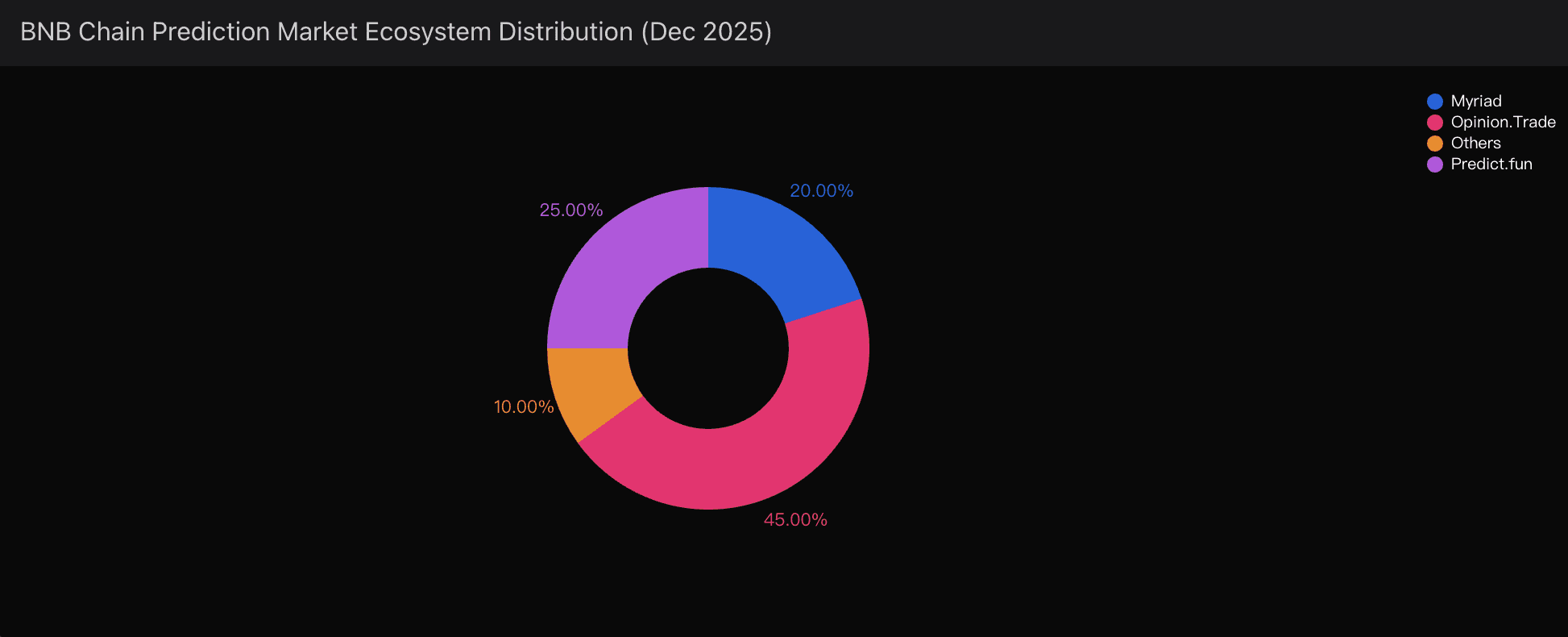

But predict.fun crystallizes a shift already underway:

BNB Chain is becoming the home base for prediction market infrastructure.

Why?

$17.1B in TVL (Q3 2025)

High throughput + low latency

Deep liquidity pools ideal for fast-settling markets

Predict.fun is not the beginning—it’s confirmation that BNB Chain has already pulled ahead.

Competition Is Moving From Speculation to Innovation

Predict.fun’s standout feature—earning yield while your position remains open—isn’t a gimmick. It solves a long-standing inefficiency: the opportunity cost of locked capital.

Polymarket and Kalshi have scrambled to introduce staking incentives, but predict.fun built yield into the market primitive itself.

From where I sit, this marks a new evolutionary stage:

Prediction markets are beginning to resemble capital-efficient DeFi protocols, not isolated trading venues.

Institutional & Founder-Class Validation Has Arrived

CZ’s involvement reframes the industry.

This is no longer a playground for degens—it’s infrastructure.

The effect cascades:

Greater retail trust

Stronger institutional allocation

More venture capital inflows

Higher platform stickiness

Prediction markets are no longer fringe. They’re being absorbed into the global financial stack.

Deep Into the Growth Phase

When I synthesize the quantitative data through Powerdrill Bloom’s scenario engine, the results are strikingly consistent: the inflection point is behind us.

Here’s the strongest evidence.

Market Share Upheaval: Kalshi’s 1,100% Shockwave

Kalshi went from 5% → ~55% market share in 12 months.

That doesn’t happen in industries that haven’t matured.

That only happens when:

Regulatory clarity lands

Institutional capital arrives

Retail flows expand beyond crypto-native users

And with 40+ million cumulative transactions by Q3 2025, this is no longer a niche corner of finance—it’s a global behavior pattern.

Platform Integration Now Happens in Weeks, Not Years

Trust Wallet integrated Polymarket, Kalshi, and Myriad within two weeks in December 2025.

That is textbook feature-parity acceleration—an unmistakable marker of infrastructure maturation.

Wallets are becoming prediction market portals.

Institutional Capital Has Crossed the Rubicon

Intercontinental Exchange’s investment that valued Polymarket at $2 billion was the biggest traditional finance endorsement to date.

This wasn’t speculative VC.

This was strategic infrastructure allocation.

Cross-Chain Infrastructure Is Now Modular

Myriad’s design enabling in-wallet markets, combined with BNB Chain’s liquidity depth, has created network effects similar to what Ethereum enjoyed during early DeFi.

This is the scaffolding of an industry, not a trend.

Sustained Exponential Momentum Into 2026

After running multi-scenario projections using Powerdrill Bloom, the probability curve centers around one dominant outcome:

65–72% probability that prediction markets maintain $10B+ in monthly volume throughout 2026.

The drivers are already in place:

Regulatory legitimacy

Institutional participation

Platform innovation

Infrastructure consolidation around BNB Chain

Feature evolution led by predict.fun

The real uncertainty is no longer whether prediction markets continue growing—

it’s how that growth will be distributed across platforms, chains, and regulatory zones.

We’re not in the beginning anymore.

We’re in the acceleration phase.