As I revisit the wreckage left by September’s shockingly weak payroll data, one reality stands out with growing clarity: the market narrative has shifted — and with it, the probability structure of the next move.

After weeks of re-evaluation, recalibration, and scenario modeling, I now assign a 65–70% probability to a meaningful market rebound by year-end 2025, with Bitcoin once again emerging as the primary catalyst and directional leader.

This isn’t blind optimism. It’s a conclusion forged from evolving macro signals, institutional behavior, policy recalibration, and predictive intelligence layers — including my ongoing integration of Powerdrill Bloom, an AI forecasting engine I rely on to stress-test assumptions, map probabilistic outcomes, and surface hidden correlations across volatile regimes.

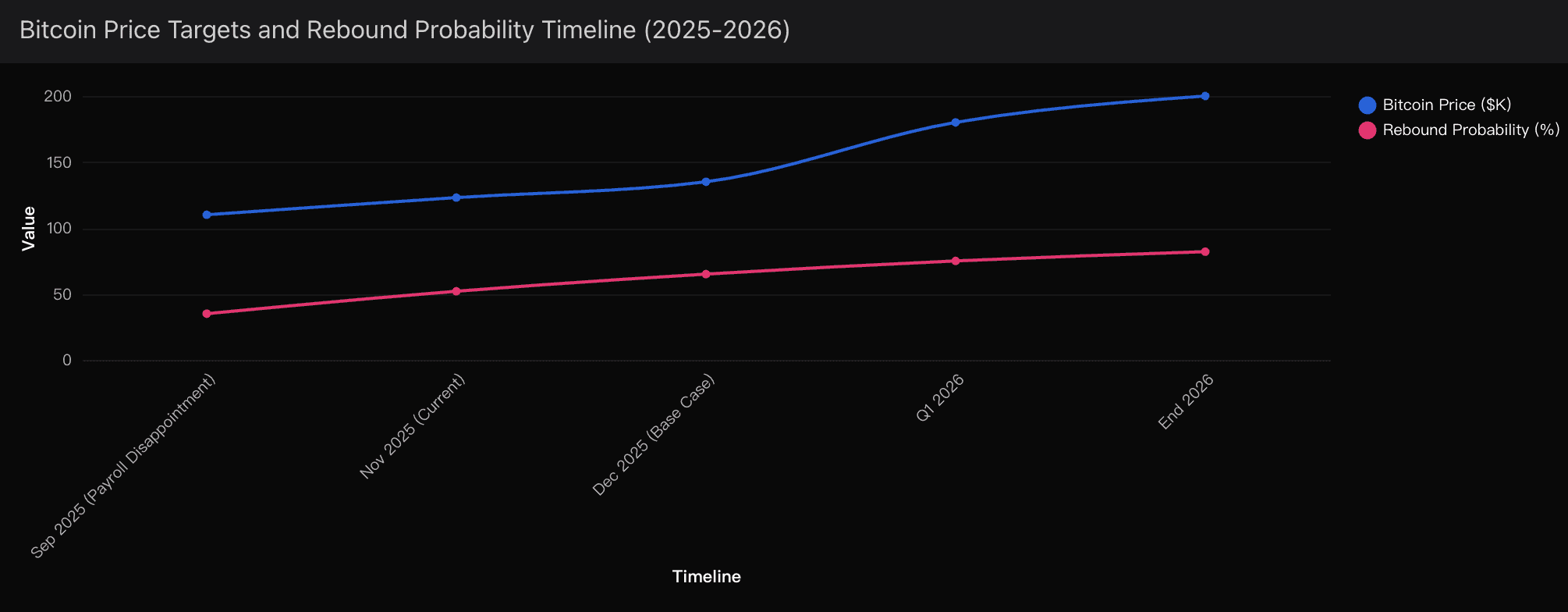

In early September, the U.S. non-farm payroll report revealing just 119,000 new jobs ignited textbook recession fears. Markets reacted instantly — leverage unwound, risk appetite collapsed, and both equities and crypto entered aggressive drawdown phases. At that moment, even my own rebound probability dropped toward the 30–35% range.

Yet markets are not static stories — they are living probability machines. Over the following weeks, newly emerging data began rewriting the script:

Fed officials adopted increasingly cautious, accommodation-leaning rhetoric.

October employment revisions surprised to the upside.

Institutional Bitcoin accumulation persisted despite volatility.

By late November, my model — supported and refined through Powerdrill Bloom’s insights — showed rebound probability doubling to its current 65–70% range.

Year-End Market Outlook

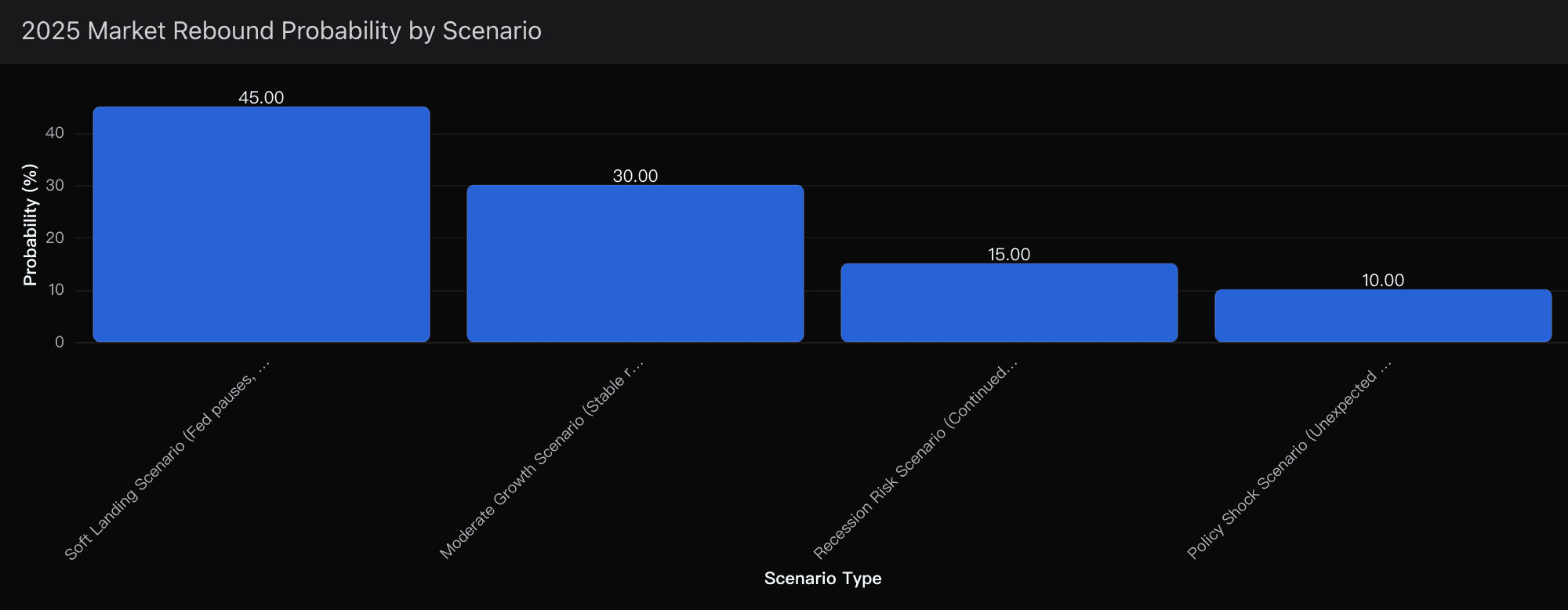

Base Case: Soft-Landing Rebound (65%)

In my base case, markets stabilize through November and December following signals of one final Fed rate cut in December 2025, followed by an extended pause. Under this framework:

Bitcoin rebounds from its $110K September trough to $130–140K.

The S&P 500 recovers to its late-October resistance highs.

This scenario holds if the Fed interprets labor market weakness as sufficient justification for continued monetary accommodation — a stance increasingly supported by FOMC rhetoric.

Bull Scenario: Momentum Expansion & New Highs (25%)

The upside risk case assumes accelerating momentum:

Two quarter-point rate cuts through the remainder of 2025

Clear guidance toward 3–4 additional cuts in 2026

Strengthening ETF inflow dynamics

Bitcoin breaches $150K+, fuelled by technical recovery and persistent spot ETF demand, while the S&P 500 prints fresh all-time highs.

Bear Scenario: Macro Breakdown (10%)

This tail-risk environment unfolds if labor data deteriorates sharply, inflation re-accelerates, or a recession shock blocks Fed pivoting. Under this case:

Bitcoin retraces toward $90K

Equities fall 10–15% from current levels

While improbable, it remains structurally embedded within my probability framework.

Four Structural Pillars

1. Fed Pivot Dynamics

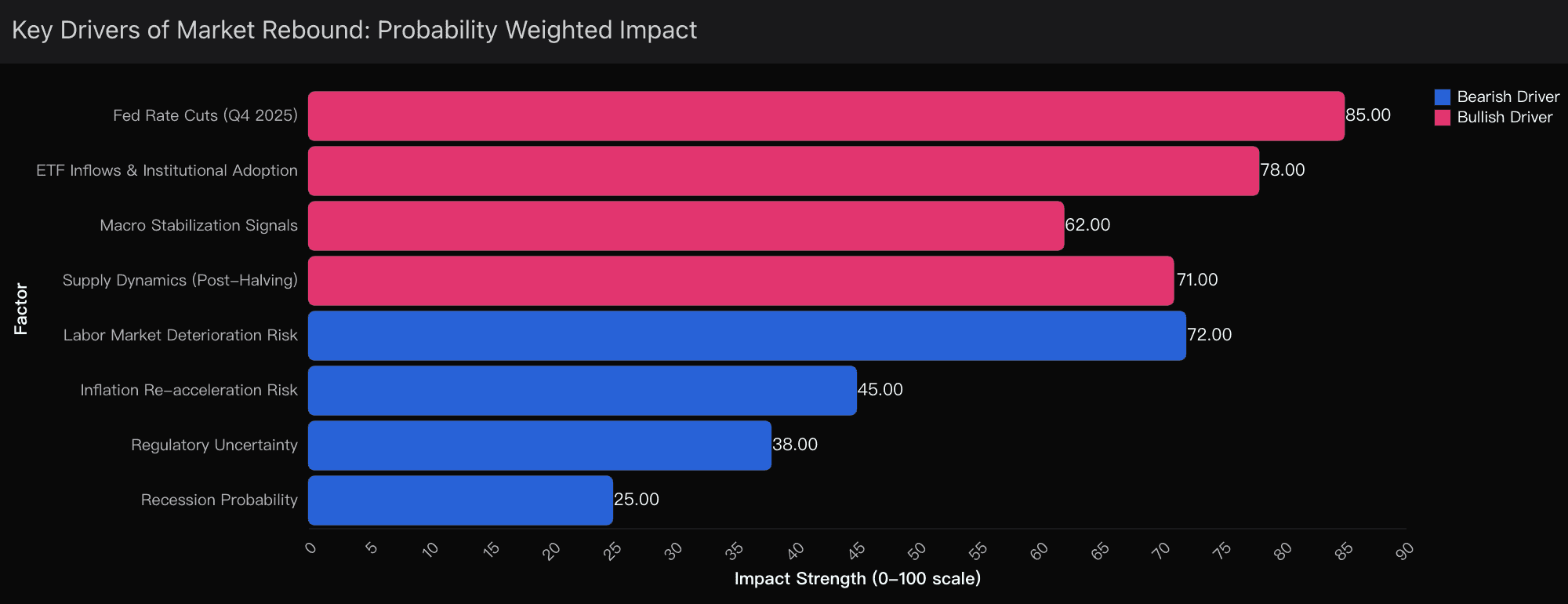

Recent Fed communications signal a philosophical shift: labor stability has overtaken inflation hawkishness as the dominant policy concern. Rate cut probability for December is now priced above 70%, supporting risk assets by reducing discount rates and suppressing opportunity costs of Bitcoin holding.

2. Institutional Bitcoin Adoption & ETF Anchoring

BlackRock’s IBIT retaining 89% of Q3 inflows despite volatility underscores structural capital commitment. Corporate treasuries now hold 3.68M BTC, nearly 18% of circulating supply — a historical threshold that, based on prior cycles, significantly suppresses deep bear-market drawdowns.

3. Post-Halving Supply Dynamics

The 2024–25 halving cycle continues to impose structural scarcity. Price volatility appears less like exhaustion and more like cyclical reset. Targets from Citigroup ($133K) and Standard Chartered ($200K by 2026) reflect multi-cycle confidence.

4. Macro Stabilization Signals

Despite payroll revisions, unemployment remains under 4.3% and job data has stabilized post-summer shocks — reinforcing the soft-landing thesis.

Polymarket Intelligence Cross-Check

Prediction markets echo my internal assessment:

US Recession by end-2025: 18–22%

Bitcoin > $130K by Dec 31: 55–60%

S&P 500 new highs in 2025: 40–45%

Polymarket’s positioning validates the conclusion: rebound is statistically favored, but downside remains nontrivial.

Final Verdict

Key inflection points:

Dec 3: ADP Employment Report

Dec 10–12: FOMC Decision

Dec 16: BLS Combined Labor Report

Should inflation remain controlled and labor softness persist without collapse, rebound probability could surge toward 80%. Conversely, adverse data compresses probability back toward 45–50%.

And in navigating this probabilistic frontier, the analytical leverage provided by Powerdrill Bloom has become indispensable — enabling me to evolve beyond reactionary sentiment into disciplined, data-anchored foresight.