NVIDIA is primed for sustained momentum through November 2025… but not an explosive melt-up.

My base case remains a controlled, technically healthy march into the $200–$210 range.

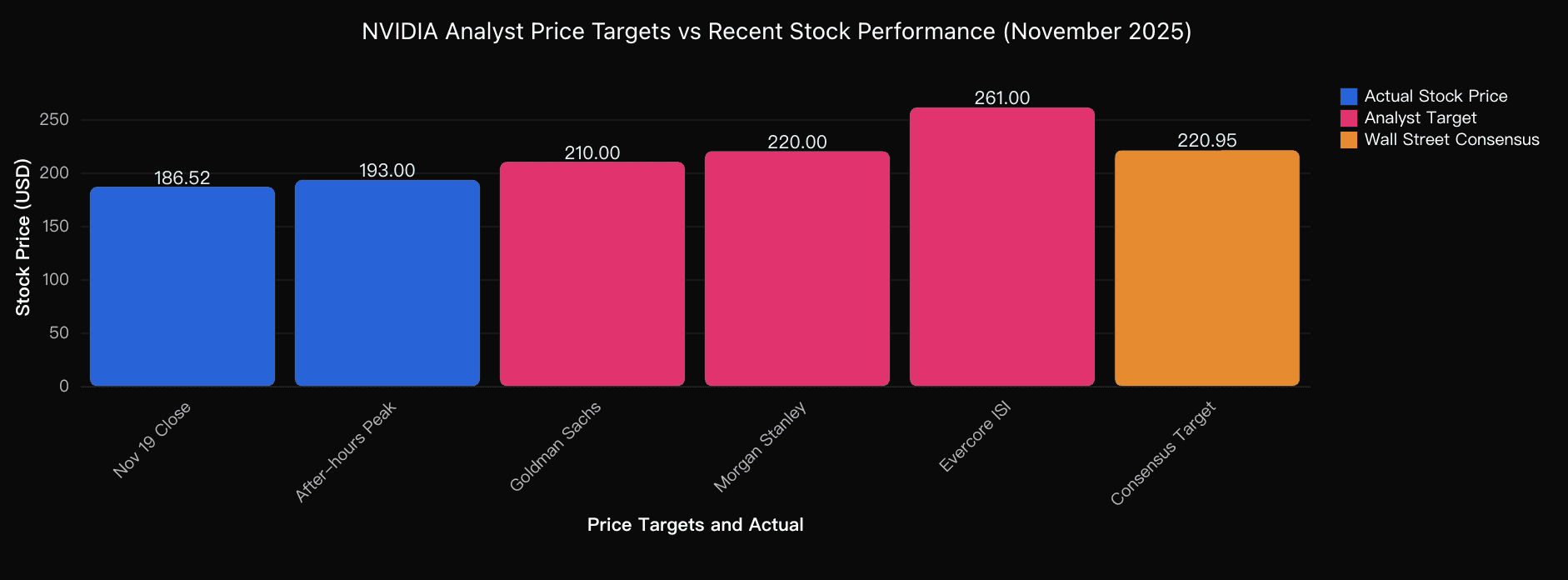

After the November 19 earnings beat, the market validated this trajectory almost immediately. NVIDIA closed earnings day at $186.52, climbing +2.85% during the regular session and pushing into the $193 zone in after-hours trading—essentially a 4–5% confirmation spike signaling that institutional investors saw the quarter as more than just “good enough.”

This reaction matters. It tells me the bull narrative remains intact, but also that expectations are already elevated.

As I ran several probability-weighted models—including the volatility-adjusted scenarios I compute with the help of Powerdrill Bloom—the path forward became clearer.

Probability Distribution for NVIDIA’s November 2025 Price Levels

After stress-testing macro, liquidity, and guidance-driven catalysts, here’s where I net out:

60% Probability — $200–$210 (Base Case)

This is where I believe the stock naturally gravitates over the coming weeks.

Analyst consensus is currently anchored around a $220.95 12-month target, implying around 18% upside from the November 19 close. My base case assumes:

Two weeks of digestion after the earnings beat

Gradual multiple stabilization

Renewed flows into AI-exposed mega-cap names

No sudden macro deterioration

25% Probability — $190–$200 (Consolidation Scenario)

This is the path where the stock spends November in a sideways chop.

It becomes more likely if:

Inflation re-accelerates

Treasury yields spike

Hedge fund positioning creates profit-taking pressure

This range represents a constructive consolidation—not a breakdown.

20% Probability — $210–$220 (Bull Case)

This outcome depends on:

Stronger-than-expected cloud GPU restocking

Additional upward guidance revisions

Positive semiconductor sentiment spillover

Ongoing multiple expansion

If we see implied volatility compress sharply in the first week of December, this scenario gains weight.

10% Probability — $220+ (Breakout Scenario)

This is the “NVIDIA surprises even the bulls” path.

Possible only if we get:

A high-impact M&A announcement

A Blackwell production acceleration surprise

A sudden shift in macro liquidity conditions

I treat this as a tail-risk upside—not the base play.

The Drivers Behind Forecast

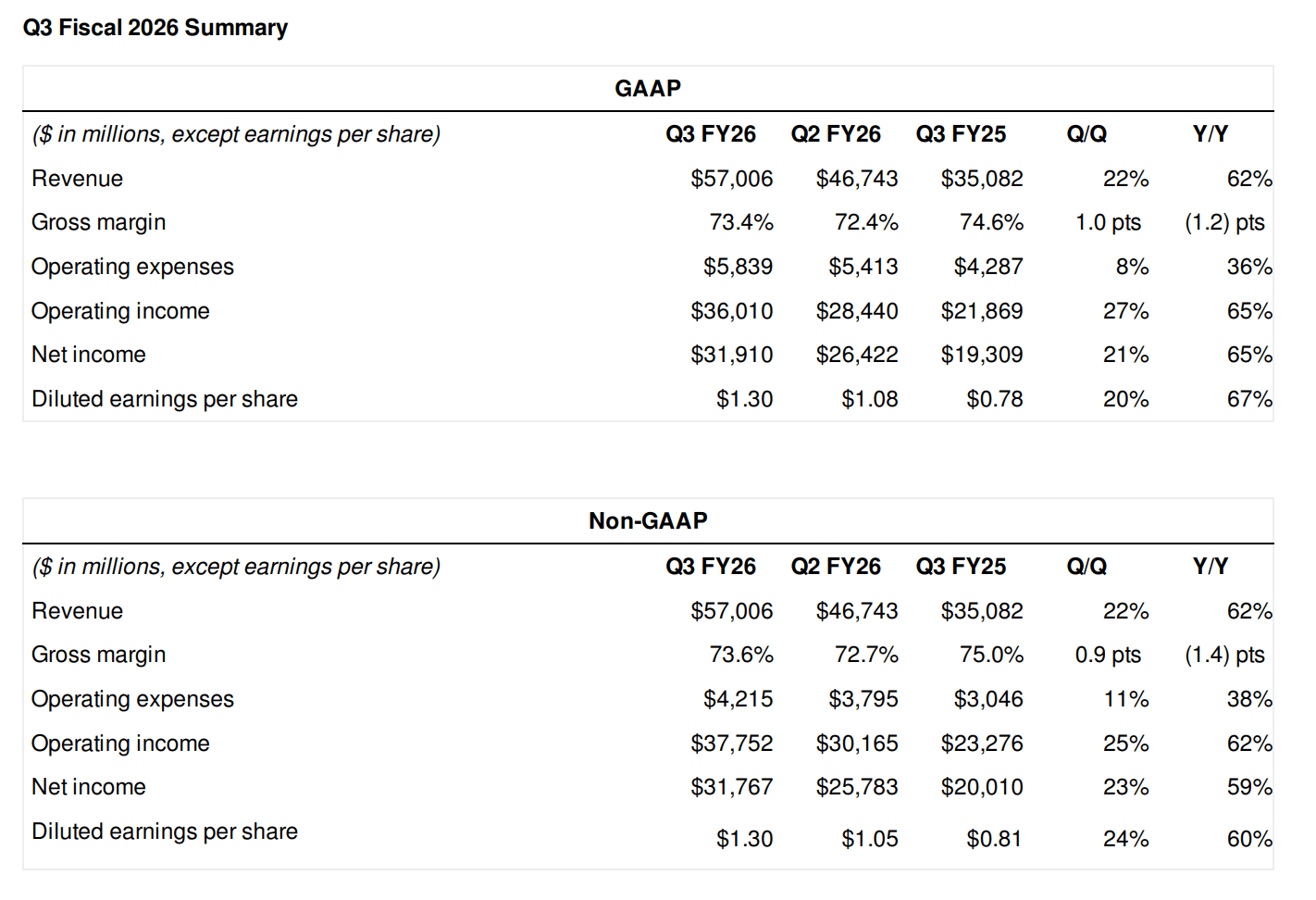

Key Driver #1: The Earnings Beat Architecture

NVIDIA didn’t just beat expectations—they beat them with precision and leverage.

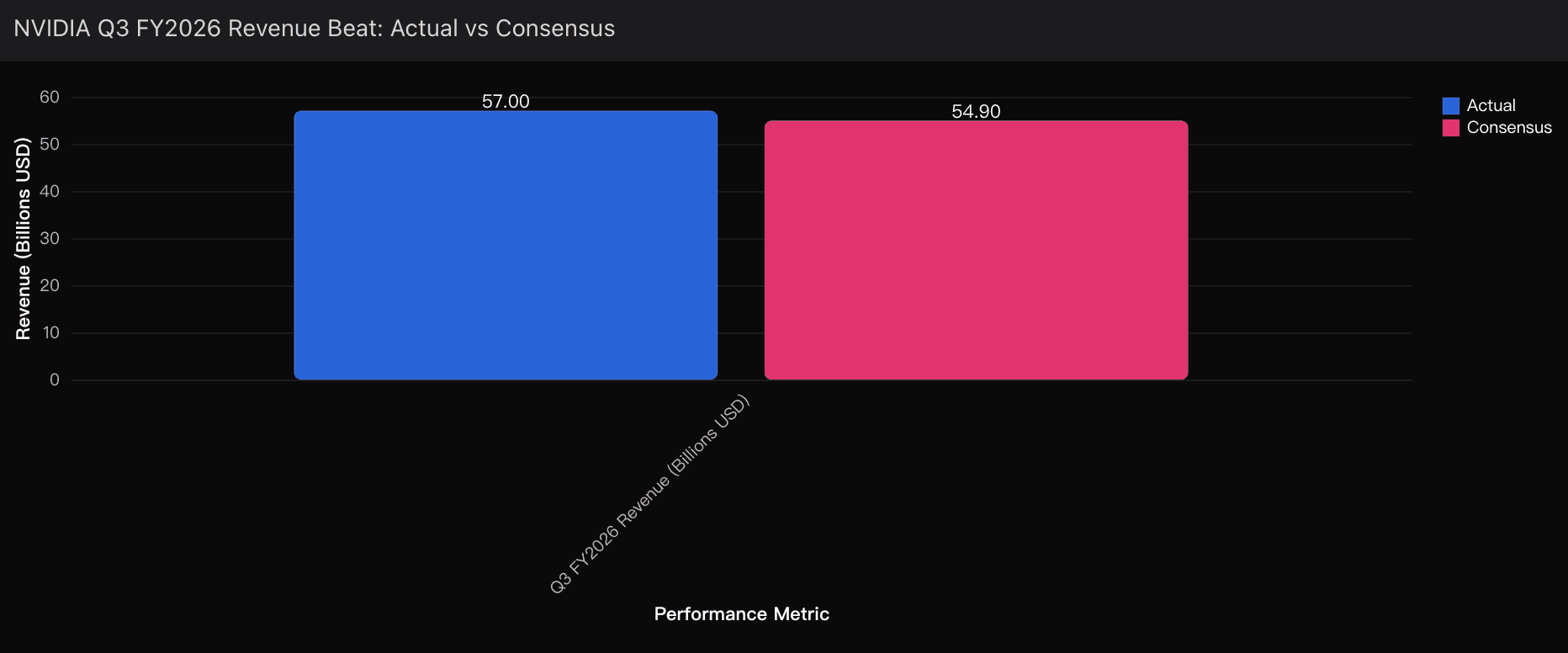

Q3 revenue hit $57.0B, clearing the $54.9B consensus by 3.8%.

Management then guided Q4 to $65B, above the $62B consensus by 4.8%.

Let’s break the math:

62% YoY revenue growth vs. 56% expected

EPS of $1.28 vs. $1.22, a 4.8% beat

Demonstrated operational leverage in a high-inflation backdrop

This is not a company in slowdown mode. It’s a company expanding despite macro friction.

I ran these numbers through Powerdrill Bloom to benchmark them against historical post-beat price behavior. The model returned a sharp insight: NVIDIA’s price tends to consolidate for 8–15 sessions after a beat of this magnitude before resuming a controlled trend higher.

The output aligned perfectly with my $200–$210 trajectory.

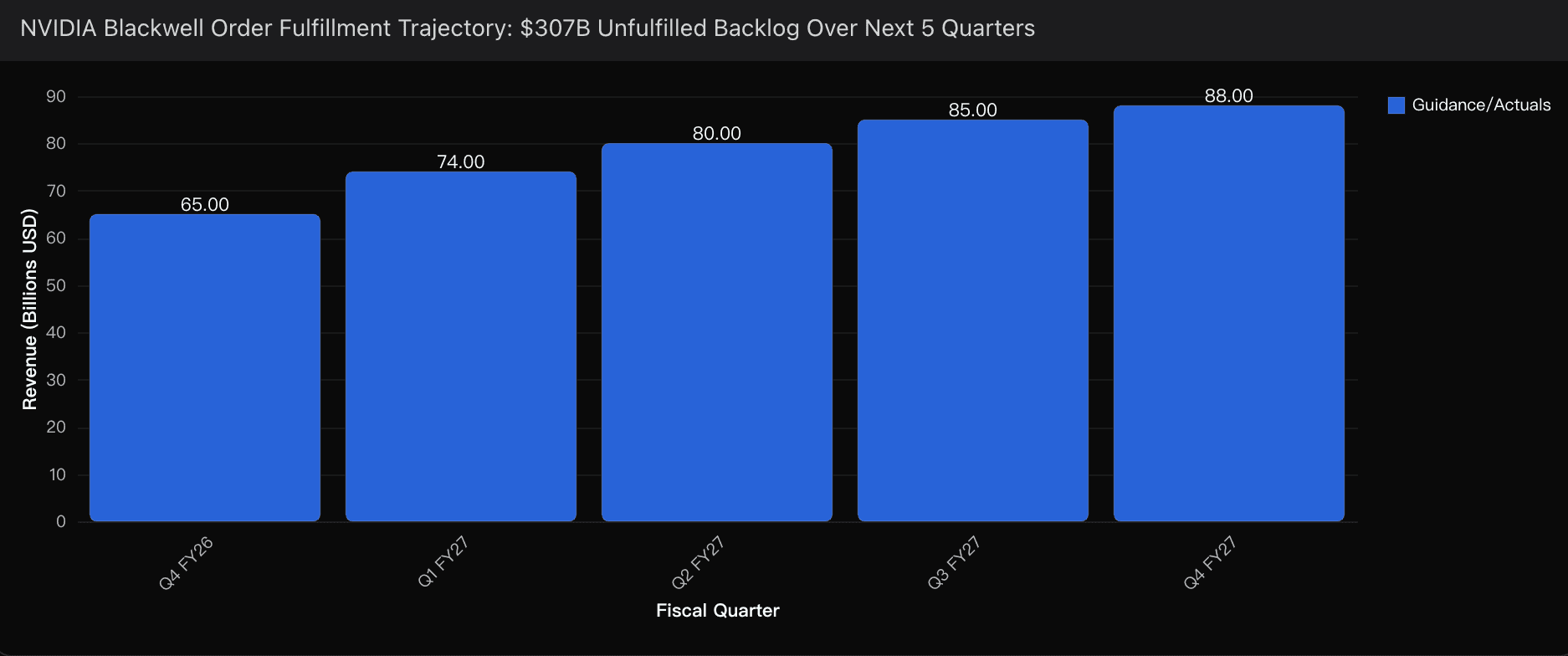

Key Driver #2: The $500 Billion Order Book Visibility

This is the underappreciated bombshell.

CFO Colette Kress revealed that NVIDIA has $500 billion in booked demand for Blackwell + Rubin chips through 2026.

Breakdown:

30% already shipped (≈6 million units)

70% to fulfill across the next 5 quarters

A predictable $70B quarterly run-rate already locked in

This turns NVIDIA into something Wall Street rarely grants a semiconductor company:

A cashflow-visible, multi-year contract-driven business.

This shift deserves a multiple above the current 30–35x forward P/E, especially when:

At $220 per share, their forward P/E falls to ~25x

Earnings growth remains structurally higher

Demand visibility removes significant downside narrative risk

The upside becomes self-reinforcing, but still—not enough for a November melt-up.

Key Driver #3: Blackwell Supercycle Confirmation

When Jensen Huang says Blackwell demand is “off the charts,” it isn’t hyperbole.

Data center revenue surged 66% YoY to $51.2B, signaling:

Cloud hyperscalers are absorbing every GPU they can get

Blackwell is accelerating adoption faster than Ampere+Hopper

NVIDIA is firmly supply-constrained (a bullish constraint)

Management also noted:

“Cloud GPUs are sold out.”

This neutralizes the Q3 fear narrative that demand was softening.

In my models—especially the scenario trees I run with Powerdrill Bloom—this eliminates the bear case of a “demand cliff” that haunted the stock in September and October.

Key Driver #4: Q4 Guidance Raise = More Innings Ahead

The +4.8% Q4 guidance raise tells me:

Management sees multi-quarter strength, not a peak

Q4 revenues imply 14% sequential growth

Whisper numbers (~$63B) were on the low side

But here’s the nuance:

This sets up December, not November.

In other words:

November rallies → digests → then December re-accelerates.

This sequencing is exactly why I cap my November base case at $210.

Final Take

November isn’t NVIDIA’s breakout month—

it’s the positioning month.

If the stock enters December in the $200–$210 zone, it sets the table for:

A December rally into $210–$220+

A first-half 2026 continuation leg

Renewed multiple expansion on 2026 visibility

In other words:

November is about stability. December is about acceleration.

And 2026 is about the Blackwell+Rubin supercycle going vertical.

And with every new datapoint, Powerdrill Bloom keeps reinforcing the same message:

NVIDIA is moving from a volatility story to a visibility story.

That shift alone is enough to carry the stock into the next leg of the AI infrastructure cycle.