At the start of every FOMC cycle, I revisit my forecasting framework to align market signals, macro data, and predictive insights. March 2026 is shaping up to be a high-conviction hold call, with markets coalescing around a roughly 90–91% probability of no change.

Using Powerdrill Bloom, I’ve synthesized cross-market intelligence, macro trends, and real-time inflation signals to produce a structured, data-driven outlook for the upcoming March 18 meeting.

1. Executive Forecast Conclusion

Base Case: Hold the federal funds target range unchanged in March 2026, while retaining forward guidance flexibility for potential cuts later in the year.

Market pricing across multiple venues shows unusually tight consensus, signaling low near-term policy surprise risk. Inflation is not re-accelerating in near-term readings, and the main tail risk lies in labor softening—consistent with potential rate cuts later rather than in March itself.

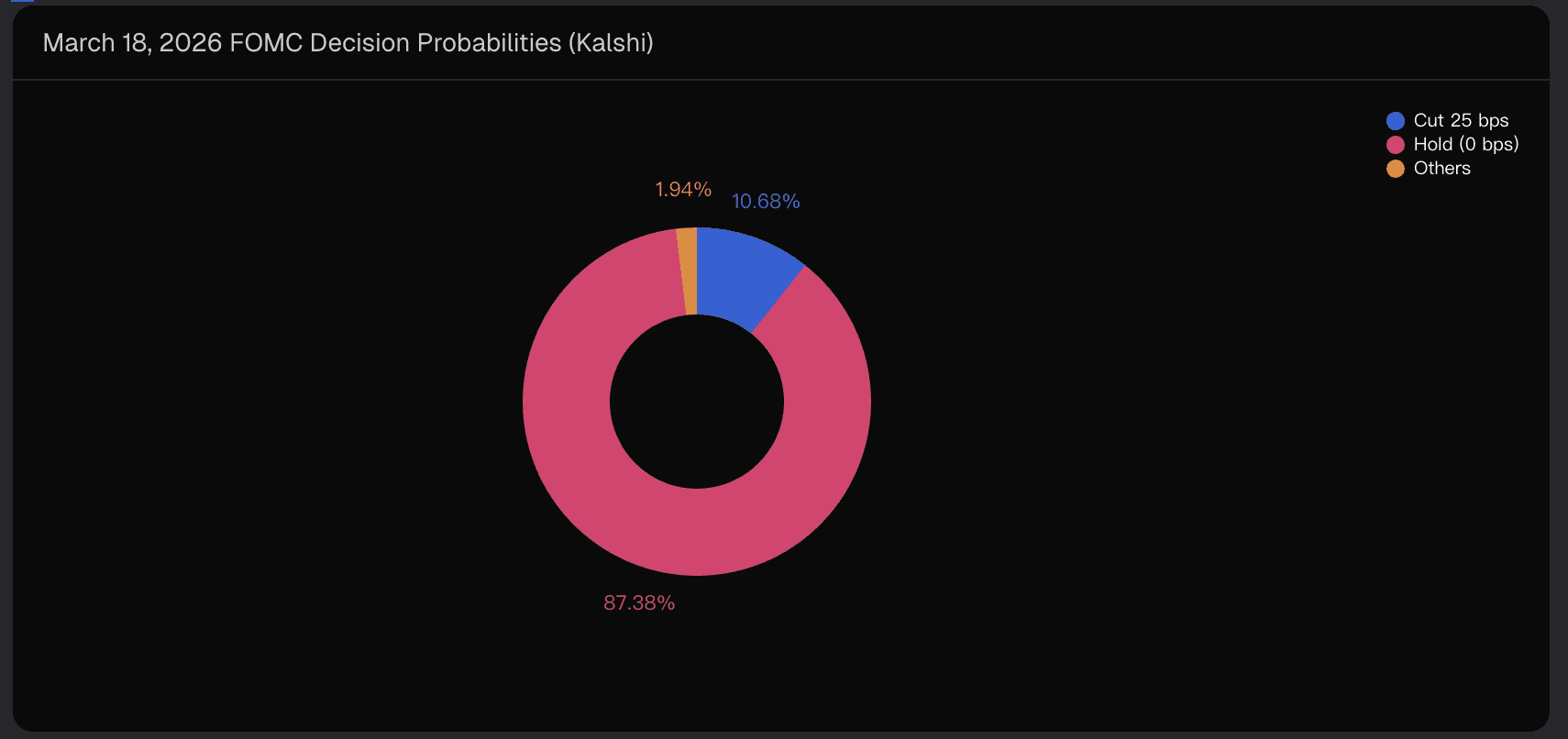

Here’s the current market-implied probability distribution for March 18:

In practical terms, the market is already priced for a hold. The real opportunity lies in timing the first cut (April vs. June) and monitoring how the curve reacts across front-end versus belly yields.

2. Rigorous Probability Assessment

2.1 Cross-Market Consensus

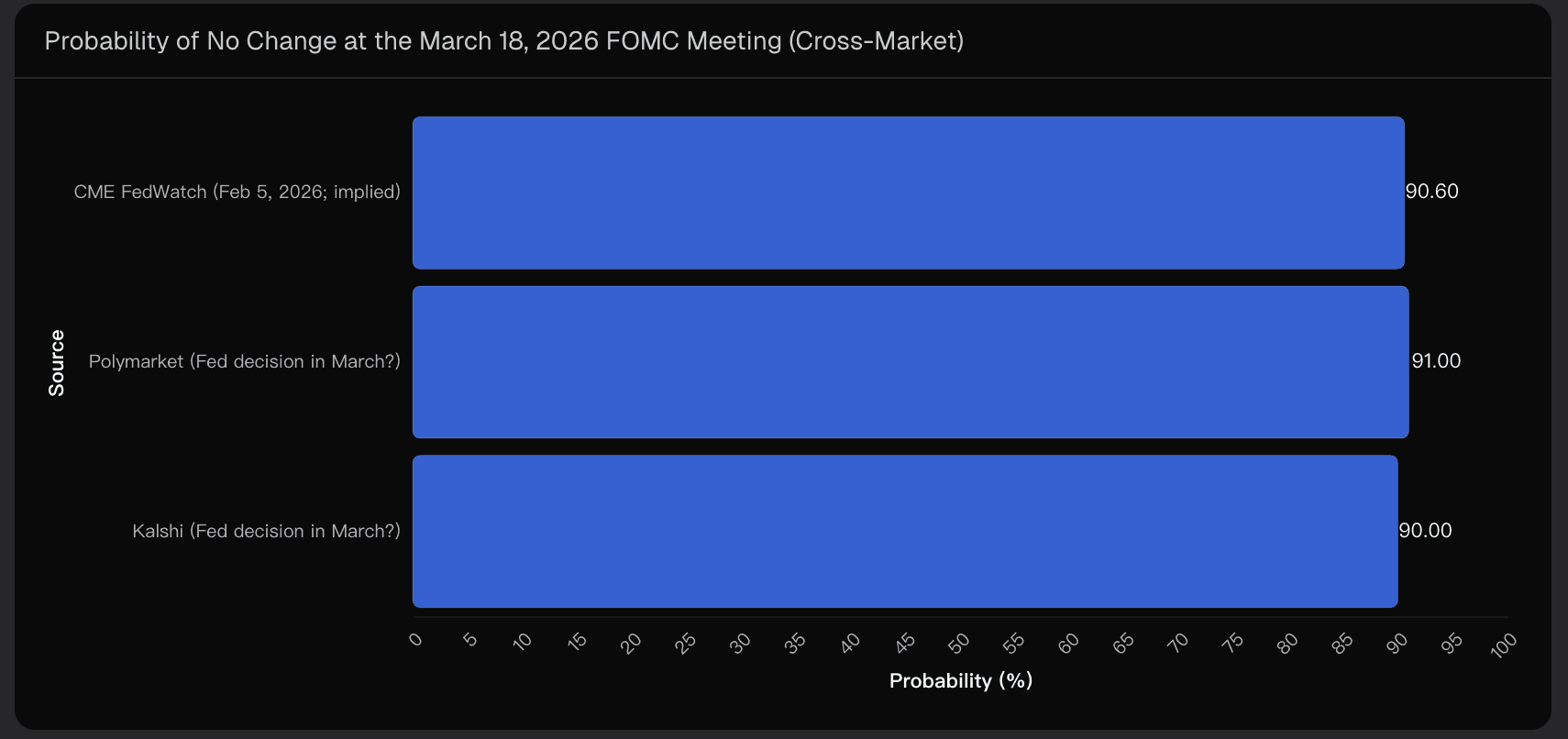

By February 2026, three independent sources converge on a “no change” outcome:

CME FedWatch (Feb 5, 2026): 90.6% hold

Polymarket (high-liquidity crowd signal): ~91% no change

Kalshi (March meeting contract): ~90% hold, minor probability for cuts

This remarkable alignment reinforces the market’s confidence in a March hold.

2.2 Model-Based Synthesis

Using Powerdrill Bloom, I treated each market venue as a noisy estimator of a latent probability and applied Bayesian shrinkage logic:

Start with an equal-weight consensus prior from market-implied odds.

Apply a macro “tilt” based on inflation and labor asymmetry:

Falling real-time inflation increases left-tail probability (modest cut odds).

Stabilizing labor data suppresses cut probability.

Posterior Forecast (March 18, 2026):

Outcome | Posterior Probability |

|---|---|

Hold (0 bps) | 89% |

Cut 25 bps | 10% |

Cut ≥50 bps | 1% |

3. Key Macro Drivers

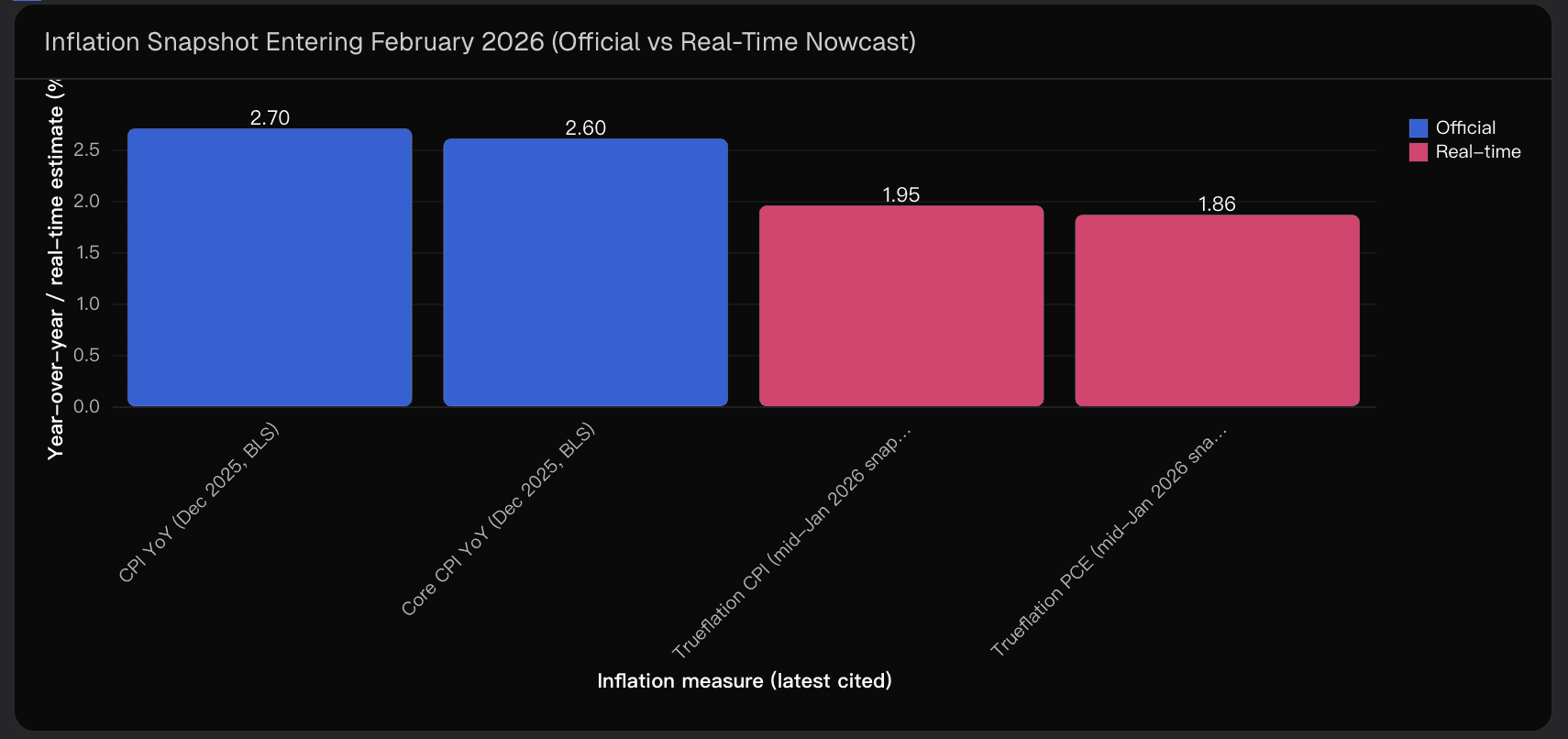

3.1 Inflation: Official vs Real-Time Nowcasts

2026 is presenting a familiar yet subtle divergence:

Official CPI (Dec 2025): 2.7% YoY, Core CPI 2.6%

Real-time Trueflation Snapshot (Jan 2026): CPI 1.95%, PCE 1.86%

Real-time measures suggest faster disinflation, giving the Fed an incentive to wait for confirmation rather than preemptively easing in March.

3.2 Labor Market Resilience

Labor conditions remain the binding constraint:

Inflation is increasingly “less binding” at the margin.

Downside labor surprises (rising unemployment or negative payroll prints) are the main risk that could pull forward rate cuts.

Absent a sharp deterioration before March, the committee can justify a hold while keeping a data-dependent easing bias for later in 2026.

3.3 Liquidity and Financial Conditions

Short-term funding pressures, such as episodic repo injections, do not indicate systemic stress. Combined with firm risk asset performance and stable front-end expectations, the Fed can maintain a hold with dovish optionality—supporting market stability without immediately cutting rates.

Bottom line: The Fed can pursue a “hold + optionality” approach: monitor labor and inflation while avoiding early moves that could unsettle expectations.

4. Critical Uncertainty Factors

Even with tight consensus, several tail risks could disrupt the hold narrative:

4.1 Data Discontinuities and Measurement Risk

Government reporting errors or timing issues in inflation and employment can raise the threshold for Fed action. Divergences between official and real-time trackers could trigger sudden market repricing.

4.2 Policy Independence and Governance Shocks

Perceived threats to Fed independence can produce two-sided market moves:

Belief in political pressure for early cuts → front-end rallies

Fears of an inflation-risk regime shift → higher term premia

4.3 Nonlinear Labor Downside

Sharp labor market deterioration could trigger larger-than-expected cuts, reflecting the Fed’s convex risk-management function during employment shocks.

Monitoring Checklist:

Payroll trend and unemployment rate revisions

Real-time inflation nowcasts vs official CPI/PCE

Funding markets (repo usage, bill/OIS stress)

Prediction-market order flow for sudden probability gaps

5. Conclusion and Takeaways

Bringing it all together, my March 2026 forecast is anchored in data-driven probabilities: a high-confidence hold, with the first meaningful cut likely later in 2026, conditional on labor developments.

Powerdrill Bloom was central in aggregating cross-market signals, modeling Bayesian posterior probabilities, and integrating macro drivers in real time—allowing a more rigorous, actionable insight than conventional analysis alone.

Disclaimer: This analysis is based on data-driven forecasting and is not financial advice.