Silver has had a habit of surprising markets, but the recent move into triple-digit territory has been extraordinary even by precious-metal standards.

Over the past few weeks, I’ve been closely tracking prediction markets, price action, and macro signals using Powerdrill Bloom to synthesize where expectations truly sit—not headlines, not hype, but probabilities.

The question now is simple but consequential: where is silver most likely to settle by the end of January This analysis is a forward-looking forecast grounded in market-implied probabilities, technical structure, and macro context—not a trading recommendation, and not a bet.

1. Core Price Outlook for Silver

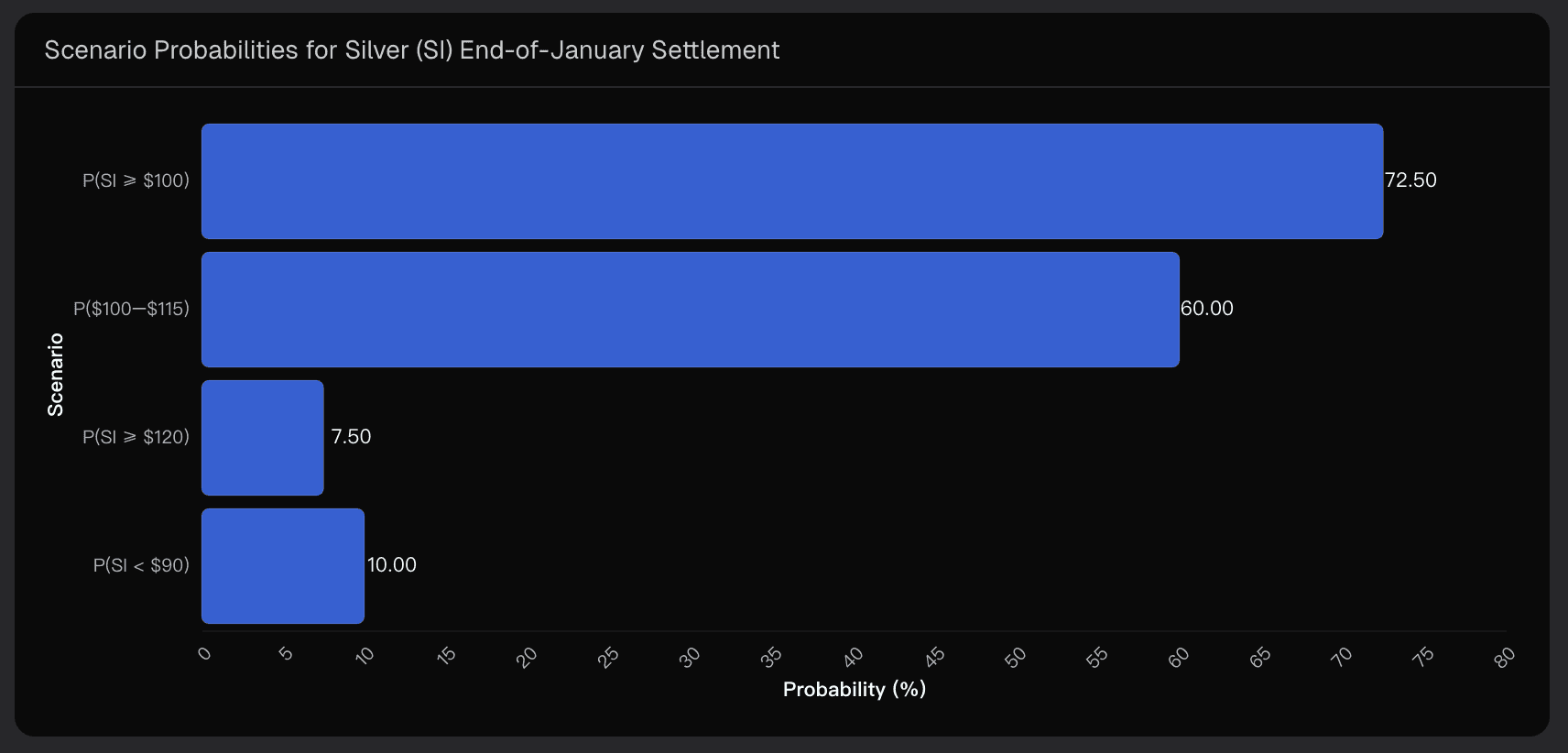

Based on current prediction-market pricing and recent spot and futures behavior, my base-case expectation for COMEX Silver (SI) at the end of January centers firmly above the $100 mark.

The most likely outcome—the modal range where probability mass concentrates—is $100 to $110 per ounce.

The distribution’s central tendency clusters slightly higher than the round number, roughly $103 to $106, reflecting how markets often overshoot psychological levels before stabilizing.

Zooming out, a broader but still realistic confidence band places silver between $95 and $120 with roughly 80% likelihood. In plain terms: I expect silver to finish January comfortably above $100, but the odds of a sustained breakout far beyond $120 remain relatively low given the short time window and current positioning.

2. Market-Implied Probabilities

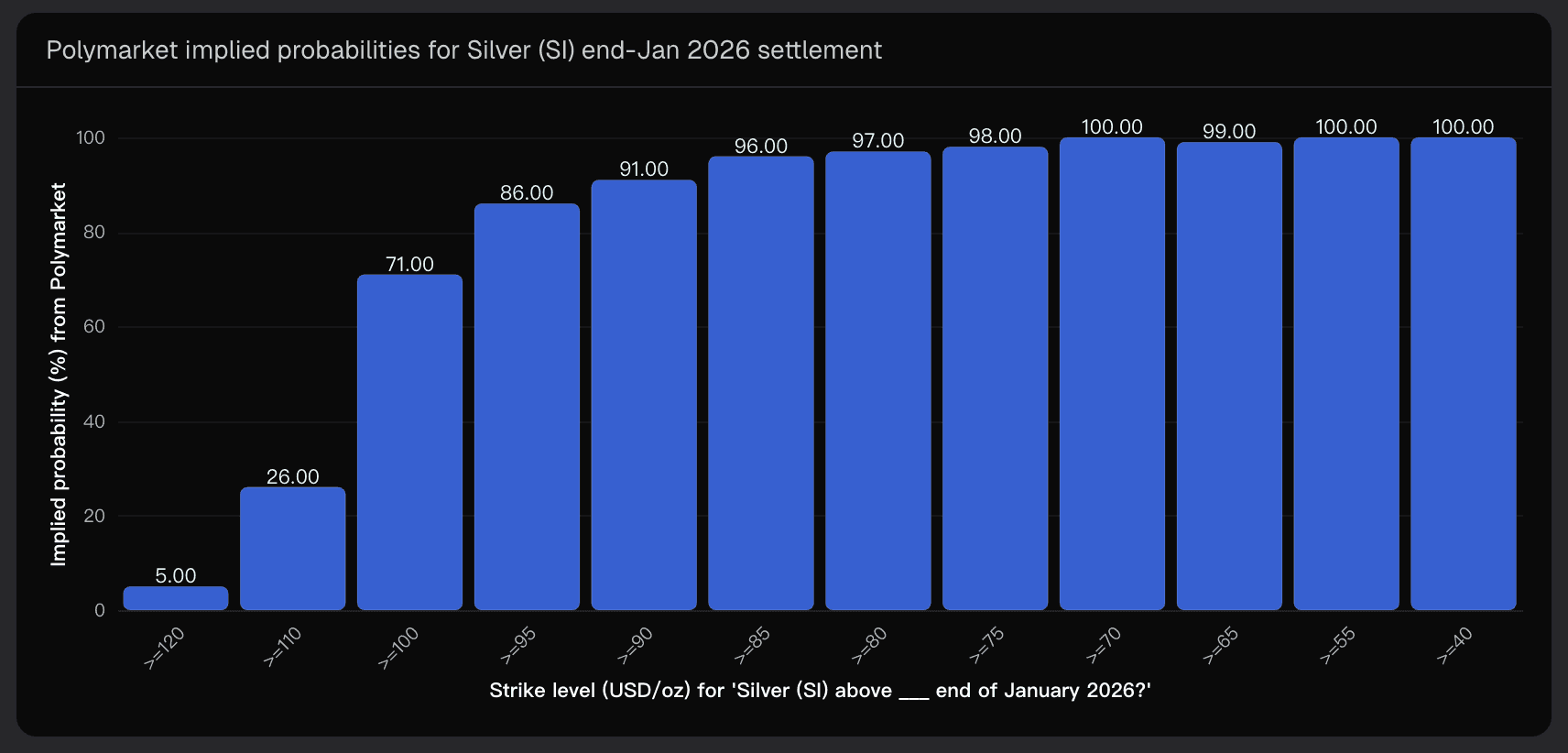

Rather than relying on opinion, I anchor this forecast in Polymarket’s “Silver (SI) above ___ end of January?” ladder. While no market is perfect, prediction markets remain one of the cleanest real-time aggregations of collective expectations backed by capital.

As of late January, the implied probabilities paint a clear picture:

Around 70–75% chance that silver finishes at or above $100

Roughly 60% probability that it lands within the $100–$115 zone

Only 5–10% odds of a close above $120

About 10% chance of a pullback below $90

This distribution matters because it reveals where conviction is strong and where it rapidly fades. The sharp drop-off beyond $110–$120 signals that while the bullish trend is widely accepted, expectations for an immediate blow-off move are restrained.

3. Key Drivers Behind the Forecast

3.1 Market Structure and Technical Signals

Silver has already cleared historic highs and briefly surged well beyond $100, even spiking toward the high-teens before experiencing a sharp intraday washout. Importantly, those pullbacks have so far found support in the $99–$103 area, reinforcing $100 as both a psychological and technical anchor.

At the same time, resistance clusters emerge above $119–$128, where prior spike highs and extension levels converge. This creates a structure consistent with elevated volatility but diminishing marginal upside over very short horizons.

3.2 Macro Tailwinds—Strong, but Largely Priced In

Gold trading above $5,000, expectations of lower real yields, and ongoing political and monetary uncertainty all provide a powerful backdrop for silver. Add in industrial demand narratives around energy transition and supply constraints, and the case for elevated prices is solid.

However, these forces are no longer incremental surprises—they are widely known and increasingly embedded in price. For silver to surge decisively beyond $120 before month-end, the market would likely need a new shock, not just a continuation of existing themes.

3.3 Positioning and Momentum Risk

Momentum has carried silver far above many banks’ long-term fundamental estimates. That doesn’t end the trend by itself, but it does raise the probability of consolidation, sharp intraday swings, or temporary corrections as leveraged positions rebalance.

4. Risks That Could Shift the Outcome

No probabilistic view is complete without acknowledging where it could fail. Over the final days of January, several factors could meaningfully shift outcomes:

Unexpected macro data or central-bank signals that alter rate expectations

Liquidity events, such as forced deleveraging or systematic fund rebalancing

Exchange or regulatory responses to rising volatility

Geopolitical or credit shocks that either amplify safe-haven demand—or initially pressure all risk assets

These forces explain why meaningful probability still exists on both tails of the distribution, even if they are not the base case.

5. Conclusion: Where Silver Is Most Likely to Settle

Pulling all of this together, the market’s clearest message is one of strength with limits.

Silver is widely expected to remain above $100 into month-end, with the $100–$110 range representing the highest-probability settlement zone. While scenarios below $90 or above $120 are possible, they require catalysts that are not currently dominant in market pricing.

This probabilistic framing—rather than a single price target—is exactly how I use Powerdrill Bloom to cut through noise and focus on where expectations genuinely converge.

Disclaimer: This article reflects a probabilistic market analysis for informational purposes only and does not constitute financial or investment advice.