As I look ahead to 2026, gold has never appeared more intriguing.

After an extraordinary 2025—where the metal surged roughly 70% and set over 50 all-time highs—it’s clear that gold is navigating a landscape shaped by persistent macro headwinds, central bank diversification, and underexposed institutional positioning.

Leveraging Powerdrill Bloom, I was able to layer these variables and simulate potential price paths, offering a granular, scenario-based understanding of what may unfold over the coming year.

1. Base Case Outlook: Gradual but Steady Appreciation

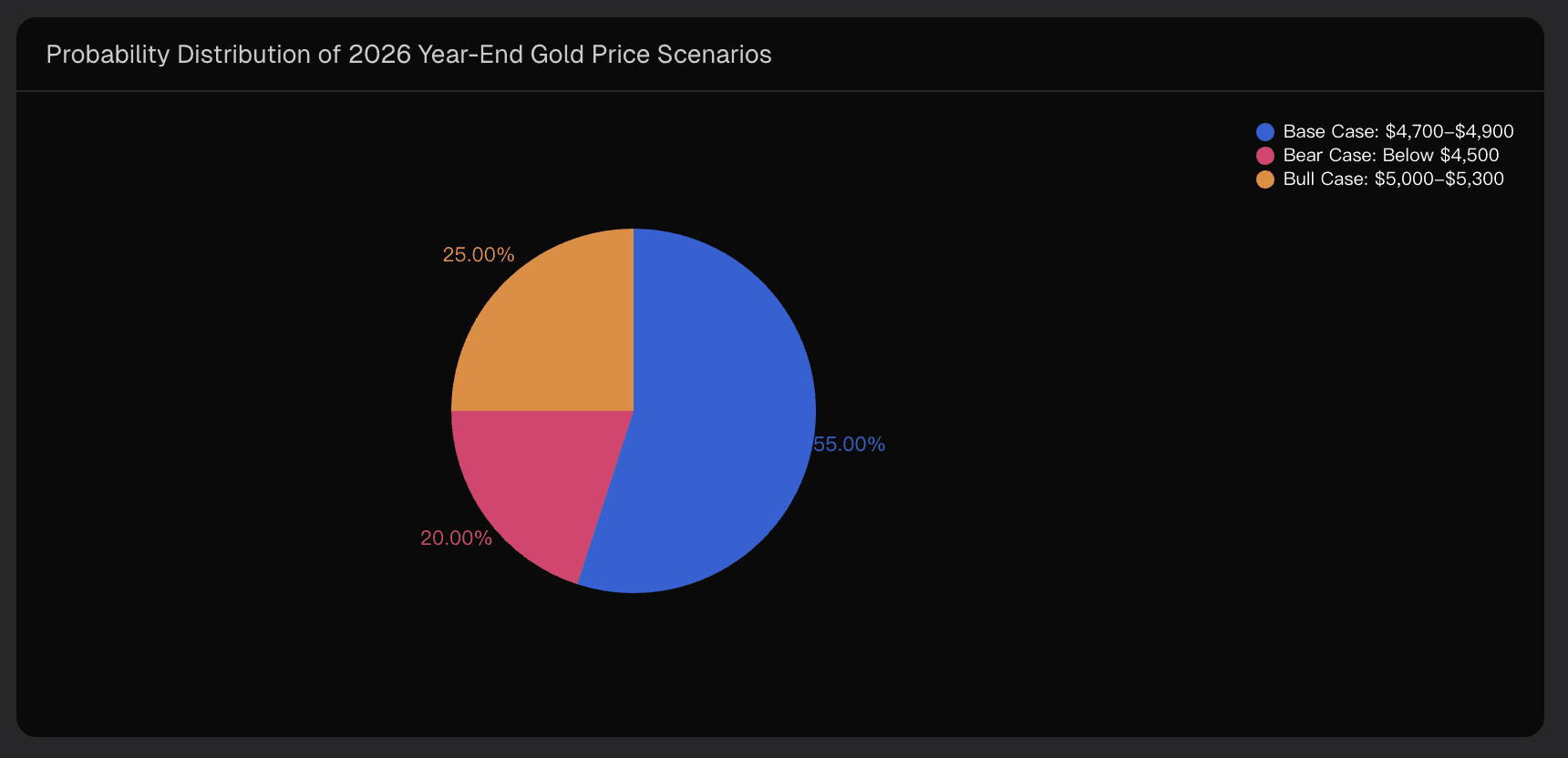

Analyzing the data, my base-case scenario projects gold trading between $4,700 and $4,900 per ounce by the end of 2026, with a 55% probability of sustained upward momentum.

This scenario is supported by consistent structural demand and anticipated Federal Reserve rate cuts, providing a solid foundation for gradual gains.

Bull and Bear Case Considerations:

Bull Case ($5,000–$5,300 | 25% probability): Accelerated institutional flows or escalating geopolitical tensions could push gold to new record highs.

Bear Case (Below $4,500 | 20% probability): A significant policy reversal, sudden demand shock, or rapid central bank deceleration could trigger a correction.

Cumulatively, there is an 80% probability that gold will surpass its 2025 peaks, underscoring the resilience of its underlying drivers and the strong consensus among major financial institutions.

2. Drivers Behind Gold’s 2026 Trajectory

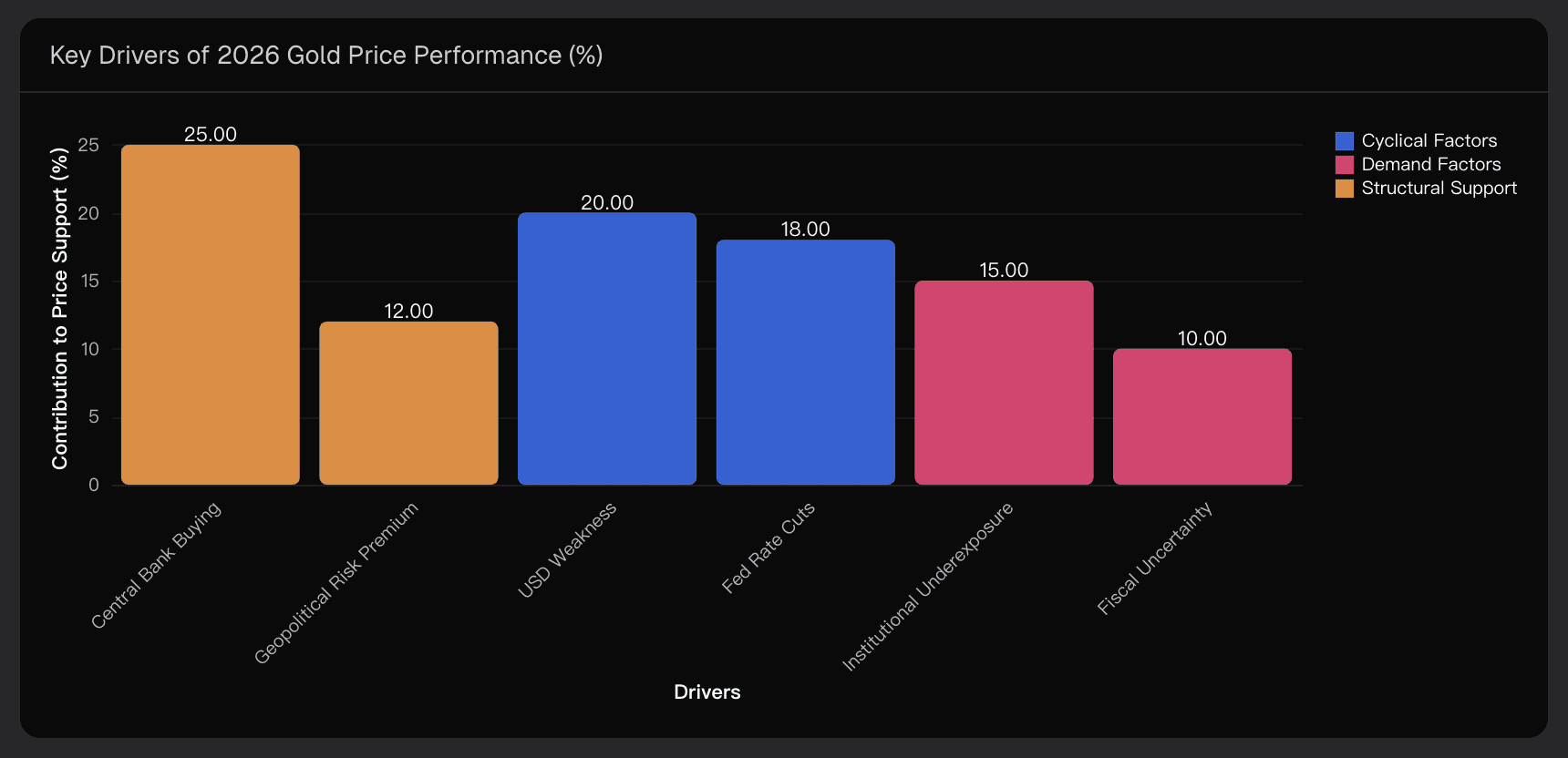

The next step in my analysis was to dissect what’s truly supporting gold’s momentum. I categorized the drivers into structural, cyclical, and demand-based factors, quantifying their relative contributions to price support.

(1) Structural Drivers

Central Bank Demand (25% contribution): Global central banks have purchased over 1,000 tonnes annually for the past three years—double the historical average. Emerging market central banks, particularly in China, Qatar, and Oman, continue diversifying away from dollar-denominated assets, providing a persistent price floor.

Institutional Underexposure (15% contribution): A meaningful portion of institutional portfolios remains underexposed to gold. Even modest reallocations could drive prices close to $5,000, highlighting untapped demand.

(2) Cyclical Drivers

Federal Reserve Rate Cuts (18% contribution): Markets currently price in two Fed cuts in 2026, reducing real yields and the opportunity cost of holding non-yielding assets like gold. Lower Treasury yields directly enhance gold’s attractiveness as a safe haven.

US Dollar Weakness (20% contribution): Modest but sustained dollar depreciation is expected due to Fed easing and alternative growth trajectories globally, adding additional support for gold prices.

(3) Demand & Risk Drivers

Geopolitical Risk Premium (12% contribution): Unresolved regional conflicts and policy uncertainties continue to sustain safe-haven demand.

Fiscal Uncertainty (10% contribution): Concerns over government debt and potential currency debasement reinforce gold’s role as a hedge.

Supply Constraints (6% contribution): Mining production remains stable, while recycling remains muted despite 2025’s price surge, limiting near-term supply elasticity.

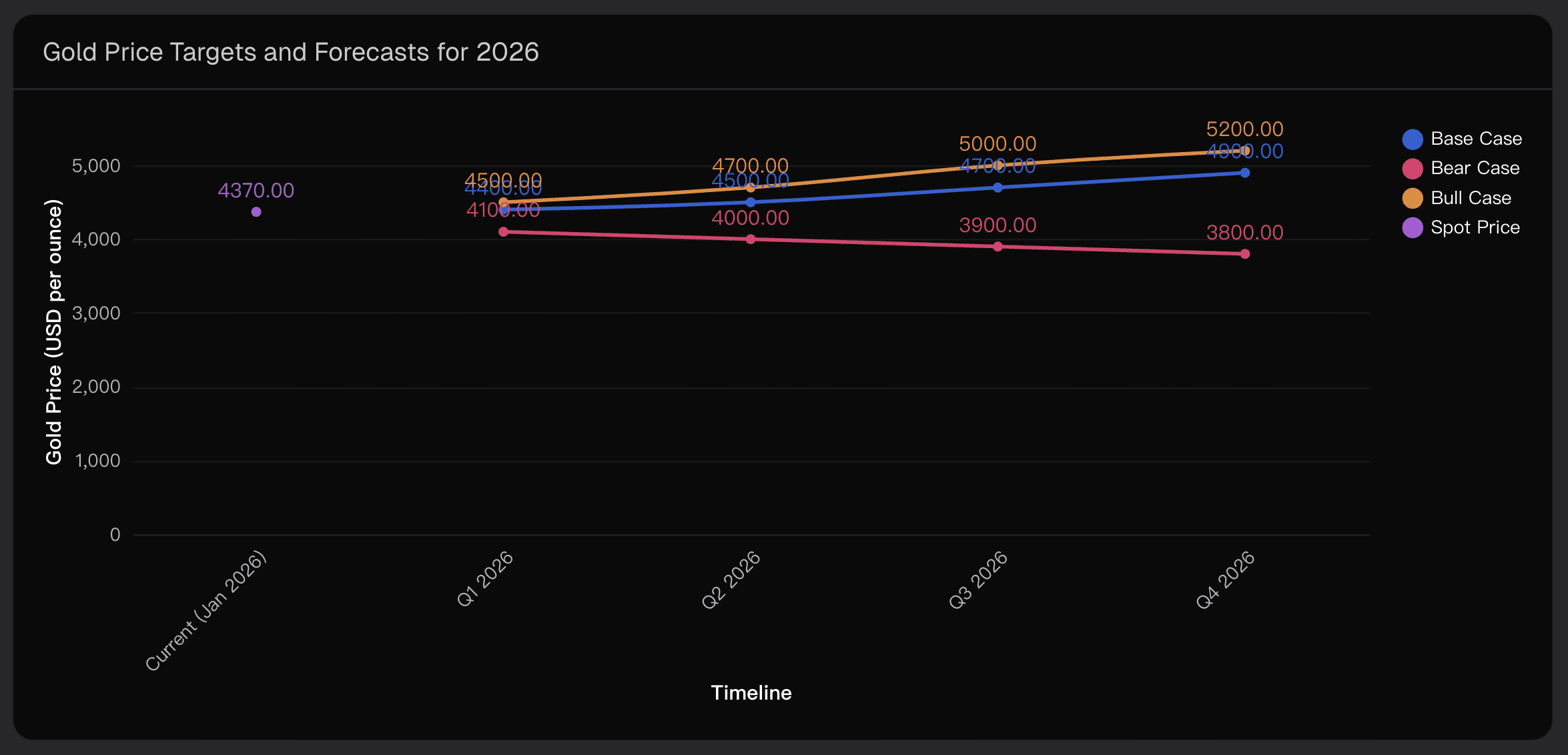

3. Price Path Expectations Through 2026

By combining these drivers with historical patterns and market positioning, I outlined the most probable trajectory for gold over the quarters of 2026:

Q1 2026: Consolidation around $4,400-$4,500 (potential correction phase)

Q2 2026: Recovery to $4,500-$4,700 as Fed begins cutting cycle

Q3 2026: Acceleration toward $4,700-$4,900 as rate cuts materialize

Q4 2026: Final leg pushing toward $4,900-$5,000+ on year-end positioning

This scenario reflects a gradual appreciation, with temporary consolidation phases when Fed guidance appears less dovish or geopolitical headlines momentarily recede.

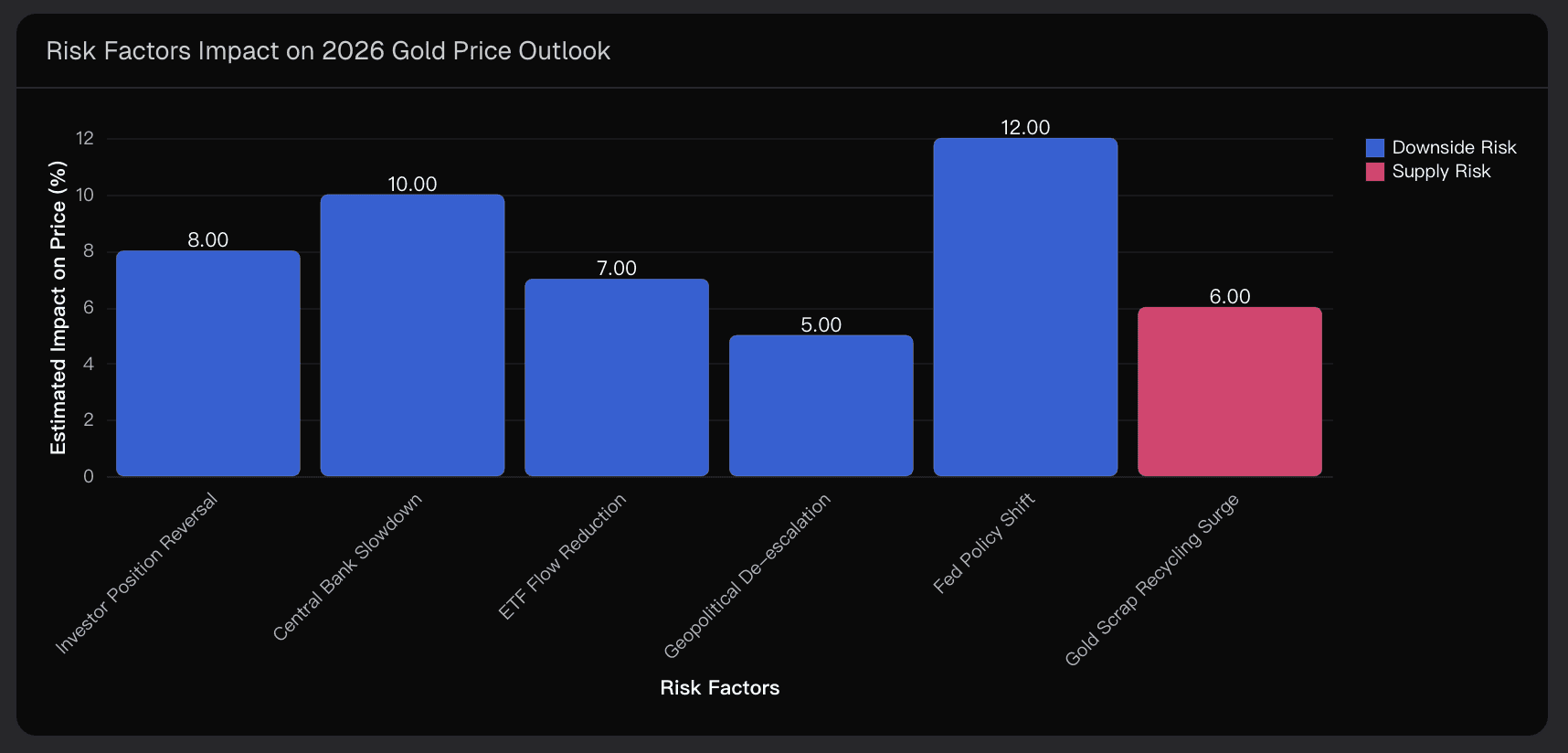

Downside Risk Factors

Even with a bullish directional bias, several risks could trigger 5–20% corrections:

Investor Positioning Reversal (-8%): Sharp liquidations from speculative traders or ETF flows could pressure prices.

Central Bank Slowdown (-10%): Any deceleration in global purchases, especially in China or emerging markets, would weaken the structural bid.

Fed Policy Pivot (-12%): Unexpected inflation could force tighter monetary policy, reducing gold’s attractiveness.

Geopolitical De-escalation (-5%): Resolution of regional conflicts would reduce the risk premium embedded in prices.

Gold Scrap Recycling Surge (-6%): Supply-side shocks from increased recycling, particularly in India, could weigh on prices.

Dollar Stabilization/Strength (-8%): A stronger USD would reduce foreign demand and create headwinds.

4. Strategic Takeaways and Outlook

Bringing these insights together, my analysis indicates that gold is highly likely to set new record highs in 2026, with year-end prices clustering between $4,750 and $5,000, representing 8–15% upside from current levels. The combination of structural central bank demand, cyclical Fed easing, and institutional underexposure forms a robust, three-pillar foundation for sustained appreciation.

However, investors should remain vigilant. The risk/reward profile, while constructive, carries meaningful execution risks in a complex macro environment characterized by policy uncertainty. Active monitoring of Fed communications, central bank purchasing trends, US Dollar movements, and geopolitical developments will be crucial for positioning and allocation decisions.

Using Powerdrill Bloom, I was able to layer these variables to model scenario-based outcomes, providing a clearer understanding of probabilities and potential price paths—enhancing both strategic insight and tactical timing decisions.

Disclaimer: This analysis reflects data-driven projections based on current market conditions and is not guaranteed or intended as financial advice.