Gold is back at the center of macro conversations again—and not just among traditional safe-haven investors.

As I reviewed global macro signals, institutional research, and prediction-market pricing using Powerdrill Bloom, one question kept surfacing in my analysis: is gold still a buy in 2026, or has most of the upside already been priced in?

After breaking the data down from multiple angles, my conclusion is nuanced. Gold still looks attractive in 2026—but not for the reasons many investors expect.

1. 2026 Outlook: From Momentum Trade to Risk-Managed Allocation

Gold’s 2026 setup remains constructive, but the nature of the opportunity has changed.

Rather than a straightforward momentum-driven upside trade, gold now behaves more like a strategic hedge—a position designed to protect portfolios against macro shocks, geopolitical instability, and policy uncertainty.

The explosive repricing phase that defined 2025 appears largely behind us. What remains is a premium tied to uncertainty, not linear trend continuation.

Prediction-market pricing suggests that upside tail risk is still meaningfully valued. The market’s rough “coin-flip” level for gold by the end of 2026 sits near $7,000 per ounce, while institutional research clusters around a high but plausible $4,000–$5,200 range.

Reaching the upper end depends on whether the same forces that drove gold higher in 2025 persist into the next cycle.

2. What Prediction Markets Are Really Saying About Gold

2.1 Market-Implied Probabilities for Gold by End-2026

One of the most useful tools for understanding forward-looking sentiment is prediction-market pricing. By anchoring expectations to real money probabilities, these markets offer a probabilistic surface rather than a single-point forecast.

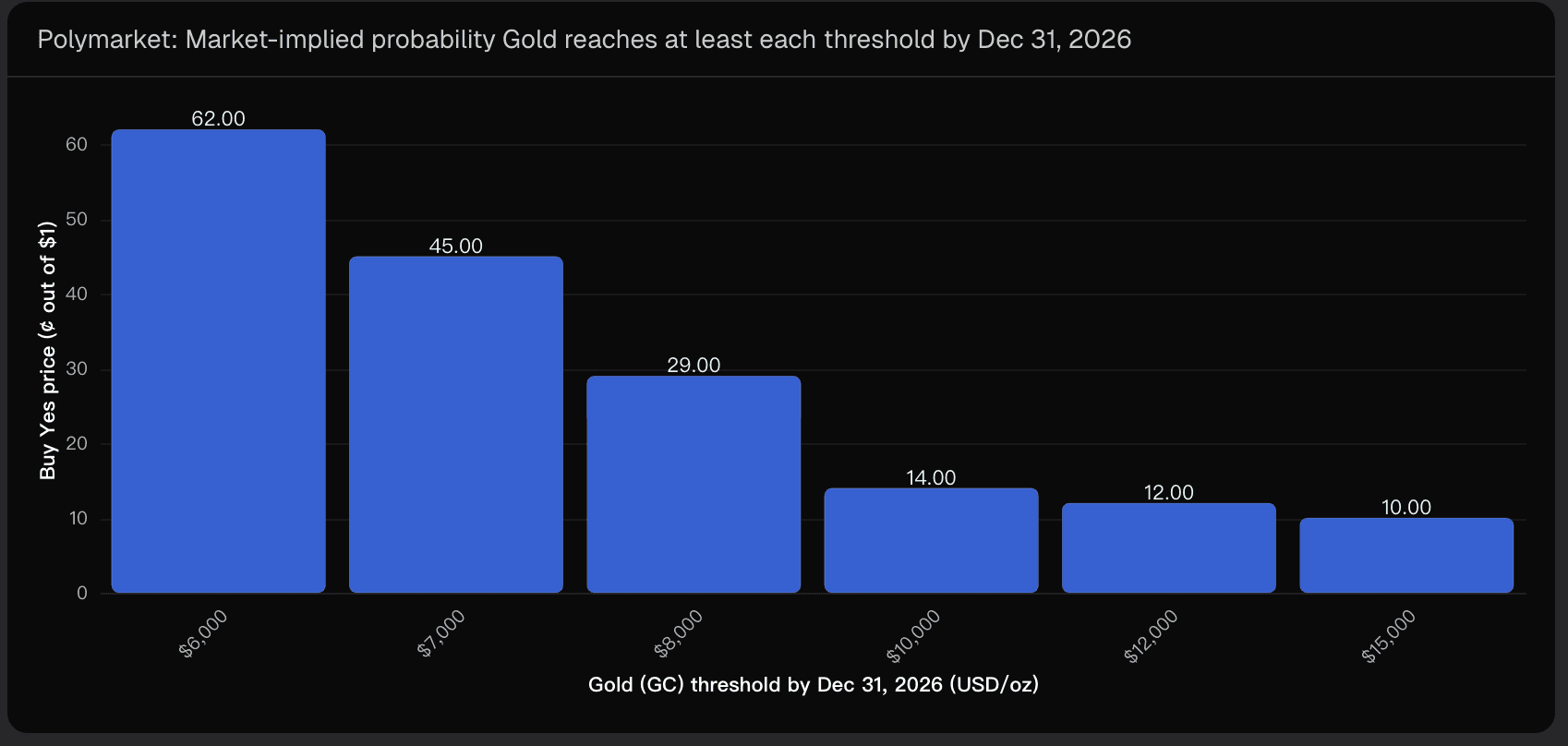

As of now, market-implied probabilities for gold reaching key thresholds by December 31, 2026 are approximately:

$6,000: ~62%

$7,000: ~45%

$8,000: ~29%

$10,000: ~14%

$12,000–$15,000: ~10–12%

This structure tells an important story. Moderate upside remains more likely than not, while extreme outcomes are clearly treated as tail events rather than base cases.

A critical caveat: total market volume is relatively low. These prices should be interpreted as directional signals, not definitive probabilities. Still, they provide a clean, transparent read on sentiment that traditional forecasts often lack.

2.2 Institutional Scenario Ranges, Not Point Predictions

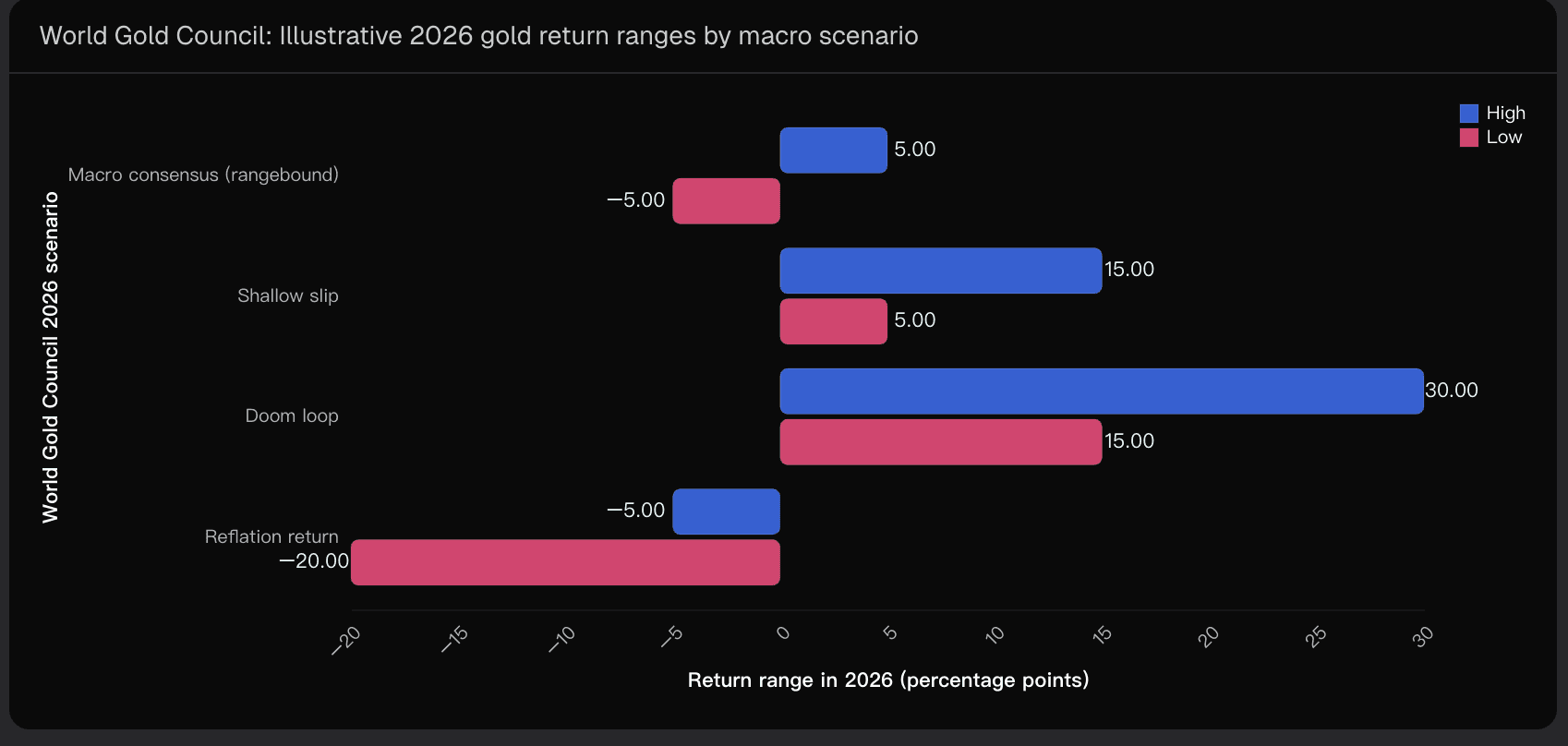

Large asset managers and industry bodies avoid precise price calls for good reason. Instead, they frame outcomes in scenario ranges.

For 2026, institutional frameworks outline several macro paths:

A rangebound consensus environment

A mild risk-off deterioration

A severe macro “doom loop”

A reflationary rebound with rising real yields

Gold performs well in uncertainty-driven scenarios and struggles when real yields rise and the dollar strengthens. This reinforces the idea that gold’s appeal in 2026 is conditional, not unconditional.

3. Data-Backed Drivers That Still Support Gold

3.1 The Persistence of the “Risk & Uncertainty” Premium

Attribution analysis from 2025 shows that gold’s performance was not driven by a single factor. Risk and uncertainty alone accounted for a double-digit contribution, rivaling opportunity cost, momentum, and economic expansion.

Looking ahead, even without a global growth collapse, ongoing geopolitical tension, fiscal uncertainty, and unclear rate paths can continue to justify gold’s role as a portfolio diversifier, not merely a speculative asset.

3.2 Central Bank Demand: Structural Support With a Wide Range

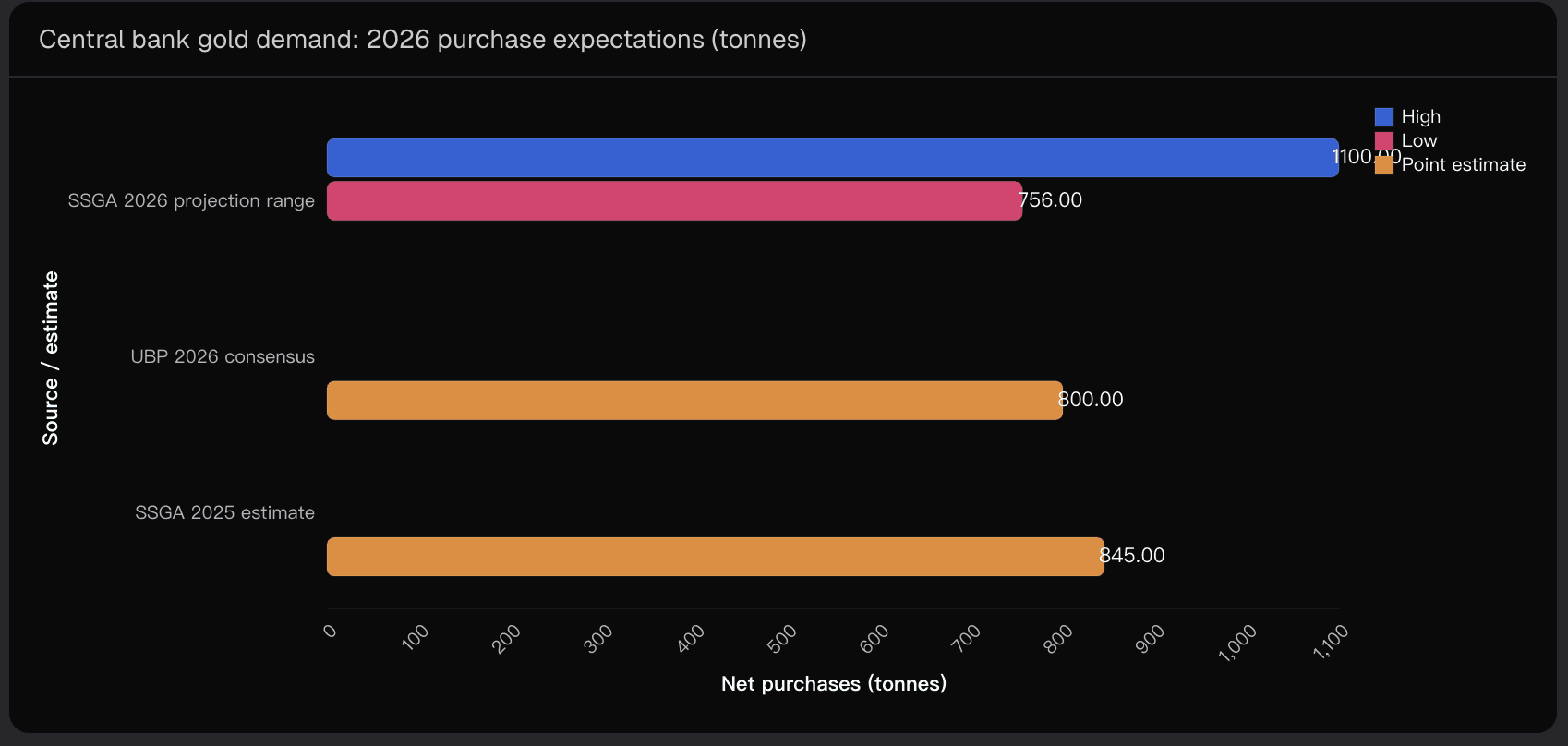

Official-sector demand remains one of the strongest pillars under gold prices. Multiple research sources project 2026 central bank purchases between roughly 750 and 1,100 tonnes, representing a significant share of annual mine supply.

This demand is typically less price-sensitive than private investment flows, which helps explain why gold can sustain elevated nominal levels longer than many expect. However, the range itself signals uncertainty—making central bank behavior one of the key swing factors for 2026.

3.3 The High-Price Regime Effect

Gold’s surge in 2025 pushed prices into uncharted territory. History shows that once commodities enter a high nominal regime, they do not automatically revert—especially when supported by institutional demand and reserve diversification narratives.

If gold continues to be treated as an alternative reserve asset rather than a cyclical commodity, elevated prices can persist even without fresh shocks.

4. What Could Break the Bullish Thesis

A Reflationary Macro Reversal

The clearest downside risk is a regime shift toward stronger growth, higher real yields, and a firmer U.S. dollar. In such an environment, the opportunity cost of holding gold rises sharply, opening the door to meaningful drawdowns.

Central Bank Demand Disappointment

Expectations are high. If official-sector buying lands near the lower end of projections—or reverses for political or balance-sheet reasons—the perceived price floor weakens, especially during periods of speculative unwinding.

Limits of Prediction-Market Signals

Prediction markets are powerful but imperfect. Low liquidity increases noise, slows information updates, and can exaggerate niche sentiment. Their best use is as an early-warning indicator, validated against options markets, positioning data, and fund flows.

Supply Response at Elevated Prices

Sustained high prices can unlock additional recycling supply and suppress jewelry demand. If this supply response coincides with softer investment flows, upside becomes capped.

5. Conclusion: Is Gold Still a Buy in 2026?

Conclusion: Gold remains a buy in 2026—but as a risk-managed hedge, not a blind momentum trade.

The base case is supported by persistent uncertainty, structurally strong official-sector demand, and non-trivial market pricing of upside tail scenarios.

From a probabilistic perspective, the market’s key signal to watch is the $7,000 level, which represents the rough midpoint of bullish expectations. A sustained deterioration below that threshold would be an early sign that sentiment is shifting.

As part of my broader macro workflow, Powerdrill Bloom helped surface these probability distributions and scenario linkages clearly—making it easier to separate conviction from narrative noise.

Disclaimer: This article is for informational and analytical purposes only and does not constitute financial or investment advice.