At the start of each year, I like to revisit the question of which private companies might go public next.

This exercise isn’t just about guessing dates—it’s about framing uncertainty, measuring market sentiment, and understanding the broader macro and sectoral trends shaping IPO timing. For early 2026, the focus is on high-profile private names like Discord, Databricks, SpaceX, and OpenAI.

To make sense of these probabilities, I used Powerdrill Bloom to integrate crowd intelligence from Polymarket markets with macro data, sector analysis, and forecasting models. This tool quickly analyzes market volumes, implied probabilities, and sector clusters, transforming complex datasets into actionable insights.

1. Company-Level IPO Probabilities

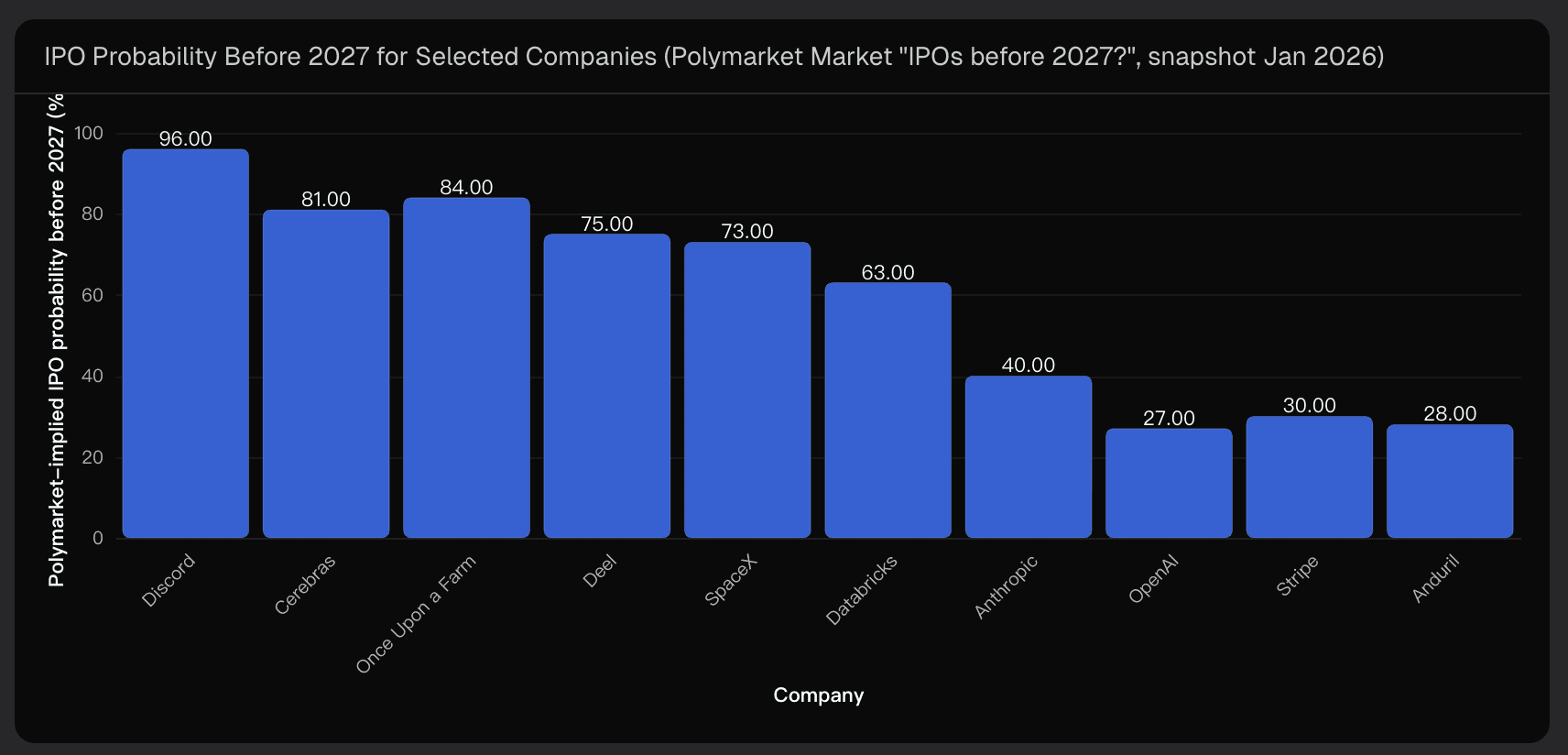

Polymarket maintains a composite market called “IPOs before 2027?”, with individual contracts on companies like Discord, Cerebras, Stripe, and Anthropic. Contract prices in cents reflect implied probabilities of an IPO happening by 31 December 2026.

While these probabilities are not guarantees, they provide a real-time snapshot of market sentiment and informed conviction.

1.1 Very High Probability Cluster (≥70%)

Discord

Polymarket Probability: ~96%

Analyst View: 90–95%

Discord represents a classic late-stage consumer SaaS IPO: a sticky user base, subscription revenue (Nitro), and clear public equity appeal. A favorable macro IPO window in 2025–2026 further strengthens its timing.

Uncertainties: Management may delay if pursuing M&A or secondary liquidity; regulatory scrutiny around content moderation could influence valuation.

Once Upon a Farm (CPG food)

Polymarket Probability: ~84%

Analyst View: 75–85%

A niche consumer brand that benefits from renewed risk appetite post-2024, though its market cap is modest.

Uncertainties: IPO timing depends on consumer IPO valuations and sponsor exits.

Cerebras (AI Infrastructure)

Polymarket Probability: ~81%

Analyst View: 80–90%

Capital-intensive AI infrastructure companies like Cerebras are natural candidates for 2026, riding AI tailwinds and public equity funding.

Uncertainties: Semiconductor volatility and geopolitical risks may delay listing.

Deel (HR/Payroll & Fintech)

Polymarket Probability: ~75%

Analyst View: 70–80%

Global payroll compliance is a structurally growing sector, and public comparables make Deel a likely IPO candidate.

Uncertainties: Could prefer private markets or strategic sales.

SpaceX

Polymarket Probability: ~73%

Analyst View: 65–75%

Mega-IPOs like SpaceX face huge capital needs, making public markets attractive.

Uncertainties: Elon Musk’s private financing preference, Starlink carve-out, and regulatory delays could push timing past 2026.

1.2 Medium-High Probability Cluster (50–70%)

Databricks

Polymarket Probability: ~63%

Analyst View: 60–70%

AI/data platforms remain at the center of the IPO pipeline. High market volume suggests active, informed trader engagement.

Uncertainties: Private funding access allows valuation optimization.

Glean (Enterprise AI Search)

Polymarket Probability: ~43%

Analyst View: 40–55%

Enterprise AI tools are trending, but smaller size and acquisition potential reduce near-term IPO odds.

1.3 Frontier AI & Large-Cap Tech Cluster (25–45%)

Anthropic

Polymarket Probability: ~40%

Analyst View: 45–55%

Cash-hungry AI labs may seek public funding once growth stabilizes.

Uncertainties: Strategic private capital and regulatory hurdles may delay IPOs.

OpenAI

Polymarket Probability: ~27%

Analyst View: 30–45%

IPO groundwork is underway, but governance, valuation, and AI policy introduce uncertainty.

Stripe

Polymarket Probability: ~30%

Analyst View: 35–50%

A perennial candidate; repeated private rounds keep probabilities moderate.

Anduril (Defense Tech)

Polymarket Probability: ~28%

Analyst View: 35–45%

Defense tech IPOs face regulatory scrutiny, even if macro tailwinds exist.

1.4 Lower Probability Cluster (<25%)

Companies like Mistral AI, xAI, Ramp, Remote, Anysphere, Ripple Labs, Fannie Mae/Freddie Mac fall in this range due to regulatory, governance, or scale-related uncertainties.

2. Trading Volume as a Signal of Conviction

Polymarket trading volume acts as a proxy for market attention and conviction:

High volume + high probability: strong structural alignment and near-certain IPO candidates (Discord, Cerebras, SpaceX).

High volume + low probability: “always next year” candidates (Stripe, Anduril) signaling persistent interest but structural hesitation.

Medium volume + medium probability: plausible but optional upside names (Databricks, Glean).

Using Powerdrill Bloom, I mapped volumes against probabilities to visually cluster these companies by sector and risk-reward potential, revealing insights that aren’t obvious from headline probabilities alone.

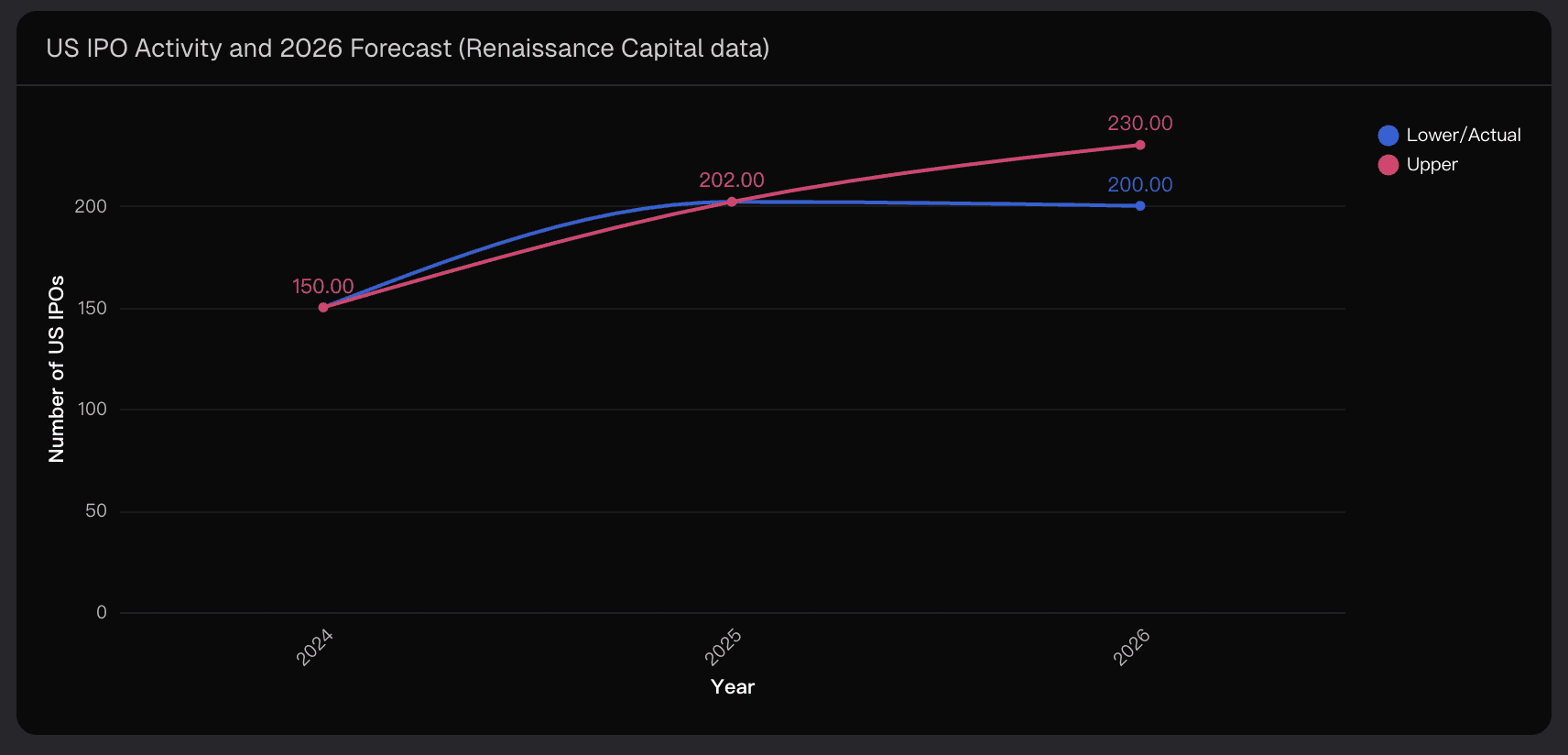

3. Macro Trends: The 2026 IPO Window

Historical IPO activity highlights a gradually recovering market:

2024: ~150 US IPOs

2025: ~202 US IPOs (+35%)

2026 forecast: 200–230 IPOs

Even at the lower bound, 2026 matches 2025’s level; at the upper bound, it would be the strongest year since the 2020–2021 boom.

This backdrop supports high probabilities for companies whose main constraint was the prior closed IPO window (e.g., Discord, Cerebras, mid-cap SaaS/fintech), while mega-IPOs like SpaceX, Databricks, and frontier AI labs remain sensitive to sentiment and valuation.

4. Practical Implications for Equity Analysts

For pre-IPO exposure or thematic analysis:

High-conviction candidates: Discord, Cerebras, Deel, SpaceX, Once Upon a Farm. Strong Polymarket odds + macro support.

Core AI infrastructure bets: Databricks and Cerebras. High probability + high attention, structural demand for AI infra.

Frontier AI labs: Anthropic, OpenAI, Mistral, xAI. Strategic upside but timing is highly uncertain.

Cautious “always next year” names: Stripe, Anduril, Ripple Labs. Include in scenario analysis, track key catalysts.

Macro overlay: Stabilizing rates and contained volatility favor IPO execution; idiosyncratic governance now dominates timing.

5. Key Uncertainties and Watchpoints

Interest rates & equity volatility: Rate spikes or market swings can compress risk appetite, jeopardizing lower-quality IPOs.

AI sentiment & regulation: Sector sell-offs or aggressive AI regulation could delay frontier or AI infrastructure IPOs.

Company-specific decisions: Governance, private rounds, or strategic sales can shift timing faster than public signals.

Regulatory outcomes: Defense tech, financial services, and crypto-related names face sector-specific hurdles that directly affect IPO probability.

Conclusion

By combining Polymarket-derived crowd probabilities, market volumes, macro IPO trends, and sector-specific fundamentals, it’s clear that 2026–2027 is shaping up as a robust IPO cycle—but with wide dispersion across companies.

High-probability candidates include Discord, Cerebras, Once Upon a Farm, Deel, SpaceX, and Databricks. Frontier AI labs and selective fintech/defense names remain speculative, offering optional upside.

Tools like Powerdrill Bloom make it easier to process this layered data, visualize probability distributions, and identify actionable insights, transforming raw market signals into practical forecasts.

Disclaimer: Probabilities are indicative and based on current information; they are not guarantees of future IPO events.