As someone deeply involved in analyzing global market trends and interpreting GSC traffic insights, I’ve been tracking Ethereum’s movements closely this month.

Using Powerdrill Bloom, I ran a series of data-driven analyses to assess Ethereum’s potential price trajectory for the remainder of January 2026.

Here’s what the data suggests, framed in a way that combines historical patterns, technical signals, and structural market dynamics.

1. Core Forecast: What Price Range Can We Expect?

Based on Ethereum trading around $3,100–$3,150 on January 13th, my analysis indicates the following most probable outcomes for the rest of January:

Base-Case Range:

Low: $2,850–$2,950

High: $3,400–$3,600

Upside Target:

Ethereum is likely to test or slightly exceed $3,400 before month-end, with a less probable extension toward $3,600.

Tail Scenarios:

Bull Tail: A sharp breakout toward $3,600–$4,000 is possible but low probability under current volatility and macro conditions.

Bear Tail: A rapid dip to $2,600–$2,800 could occur, driven by liquidation cascades or a macro shock.

Plainly: Ethereum should mostly trade between $3,000 and $3,400, with a reasonable chance of probing $3,500–$3,600 and only a small probability of extreme highs or lows.

2. Probability Assessment: Understanding the Odds

January High:

Level | Probability |

|---|---|

≤ $3,300 | 20% |

$3,301–$3,400 | 30% |

$3,401–$3,600 | 30% |

$3,601–$4,000 | 15% |

> $4,000 | 5% |

This implies roughly 60% odds that the high will fall between $3,300 and $3,600, and ~80% odds that it stays below $3,600.

January Low (from Jan 13 onward):

Level | Probability |

|---|---|

≥ $3,000 | 45% |

$2,850–$3,000 | 35% |

$2,600–$2,849 | 15% |

< $2,600 | 5% |

These probabilities are anchored in:

The current range-trade regime and mean-reversion behavior around $3,000–$3,300.

Moderately elevated leverage and ETF sensitivity, which can trigger brief sharp deviations.

3. Supporting Evidence: Why This Range Makes Sense

A. Price Action in Early January

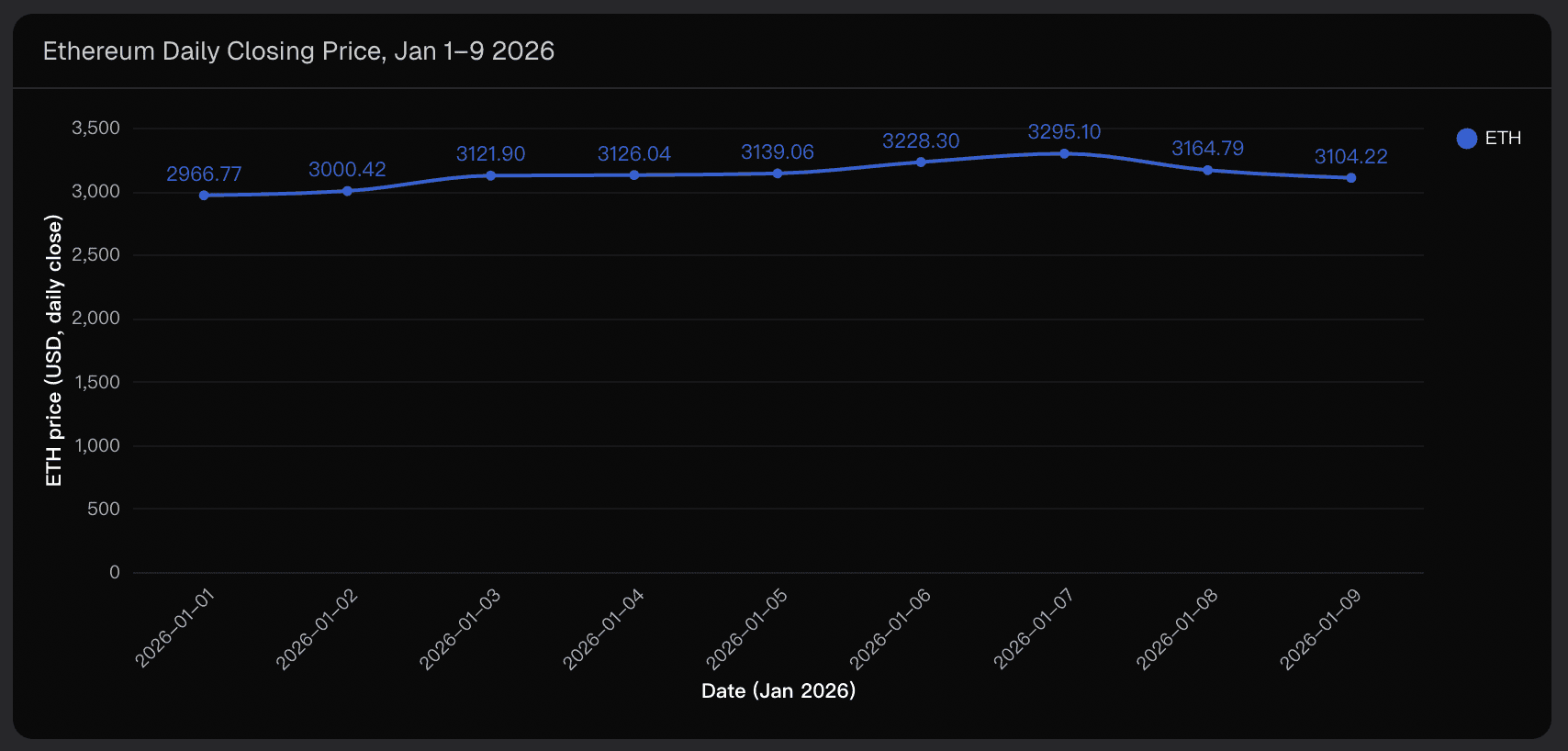

Daily closes (Jan 1–9) show:

Jan 1: $2,966.77 → Jan 7: $3,295.10 → Jan 9: $3,104.22

This reflects a climb followed by a pullback, characteristic of consolidation after an early breakout attempt. Visualizing these early patterns shows Ethereum repeatedly testing the low $3,300s but reverting to the $3,050–3,150 band, reinforcing the proposed base-case range.

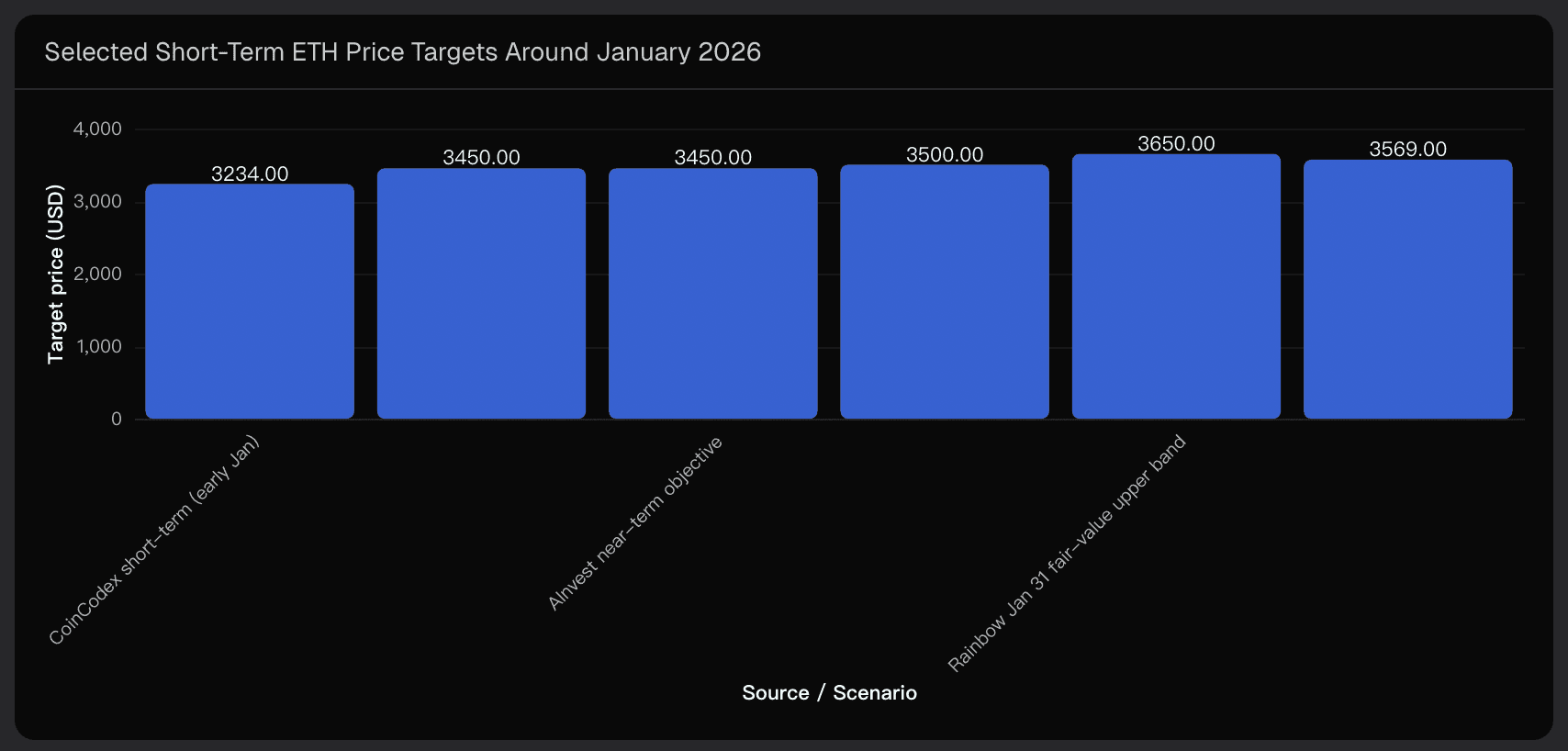

B. Technical Targets & Analyst Views

Several sources converge on $3,400–$3,600 as the logical upside if the current triangle/base resolves upward:

CoinCodex / 3ACES: $3,234–$3,235

MEXC Q1 2026 base: $3,400–$3,537

FXLeaders triangle breakout: $3,569

These clusters support a central high of $3,300–$3,600 for January, consistent with the observed volatility envelope of ~10–20% from mid-January spot prices.

C. Volatility & Structural Context

2025 realized volatility: 141% (high but not extreme for crypto).

ETH has fluctuated between $2,800–$3,350 in recent months, forming a symmetrical triangle/base from $2,850–$2,900 lows to $3,300–$3,350 highs.

On-chain factors, including >30% staking participation, provide a solid floor above prior lows while constraining rapid fee-driven upside.

This combination justifies a conservative upper band around $3,600 for January.

4. Risk Factors: What Could Break This Forecast?

Several vectors could push Ethereum outside the $2,850–$3,600 range:

Macro Shocks:

Surprise rate cuts, inflation prints, or credit events could trigger broad deleveraging, dropping ETH to $2,400–$2,600.

Conversely, dovish moves or crypto-friendly regulation could push ETH toward $3,800–$4,000.

Leverage & Liquidation Dynamics:

Long-liquidation clusters near $3,000 or $2,800 could cascade, causing sharp dips.

Thin liquidity above $3,300–$3,350 could accelerate short squeezes.

Ethereum-Specific Events:

Protocol bugs, exploits, or governance issues could depress ETH below $2,600.

Positive upgrades or institutional integrations could elevate ETH faster than fundamentals alone.

ETF & Prediction Market Feedback Loops:

Sudden ETF inflows or prediction-market signals could re-anchor probability mass higher.

Outflows or headline-driven redemptions could pull expectations lower.

5. Practical Applications for Analysts

Using this forecast as a research tool:

Scenario Framing: Treat $3,300–$3,600 as the central upside band, $2,850–$3,000 as the primary downside check.

Positioning: Deviations from expected probabilities (e.g., >$4,000 implied in derivatives) highlight potential mispricings to investigate.

Updating: Apply Bayesian updates: multiple closes above $3,300 increase upside probabilities; sustained losses below $3,000 increase downside probabilities.

Conclusion

In summary, Ethereum is likely to trade between $2,850 and $3,600 for the remainder of January 2026, with the most probable upside around $3,400–$3,500. While tail risks exist on both sides, the market structure, early-month price action, technical targets, and on-chain fundamentals all point toward a measured, range-bound outlook.

Using Powerdrill Bloom, I can continuously track these signals and update my probability assessments, turning complex market data into clear, actionable insights. Staying informed and flexible will be key in navigating January’s ETH landscape.

Disclaimer: This blog presents predictive analysis for informational purposes only and is not investment advice.