Introduction

Le marché des cryptomonnaies en 2026 ne se résume plus au simple « HODL ». Il repose désormais sur l’intelligence des données. Avec la montée en puissance des blockchains Layer 2 et des agents IA capables d’exécuter des transactions, la frontière entre le « jeu de hasard » et l’« investissement » dépend avant tout de votre capacité à analyser l’information.

Après avoir testé plus de 50 plateformes, j’ai sélectionné les 11 meilleurs outils d’analyse crypto basés sur l’IA qui transforment le secteur. Que vous soyez day trader à la recherche de prévisions de prix ou analyste marketing submergé par des fichiers CSV, cette sélection propose une solution adaptée à vos besoins.

Les 11 meilleurs outils d’analyse crypto par IA (classement 2026)

Outil | Idéal pour | Atout principal | Modèle de tarification |

|---|---|---|---|

Rapports automatisés et visualisation | Moteur visuel Nano Banana Pro + analyse CSV/Excel | Freemium | |

Suivi des portefeuilles | Visualisation des connexions entre entités | Gratuit (Intel-to-Earn) | |

Tableaux de bord personnalisés | Large base de requêtes SQL créées par la communauté | Gratuit / Payant | |

Suivi des « smart money » | Étiquetage des portefeuilles (baleines, VC, exchanges) | Freemium / Pro | |

Prédiction de tendances | Signaux IA « Bull / Bear » | Freemium / Payant | |

Analyse on-chain avancée | Étude de l’offre détenue par les holders long terme | Freemium / Tarification progressive | |

Recherche et veille | Rapports PDF trimestriels de haute qualité | Freemium / Pro | |

Analyse sociale | Évaluation de l’écart entre hype et réalité sur les réseaux sociaux | Freemium / Payant | |

Vision globale du marché | Combinaison des données sociales et on-chain | Freemium / Pro | |

Données de base | API fiable et données de capitalisation du marché | Gratuit / Premium | |

Statistiques DeFi | Suivi de la valeur totale verrouillée (TVL) | Freemium / Pro |

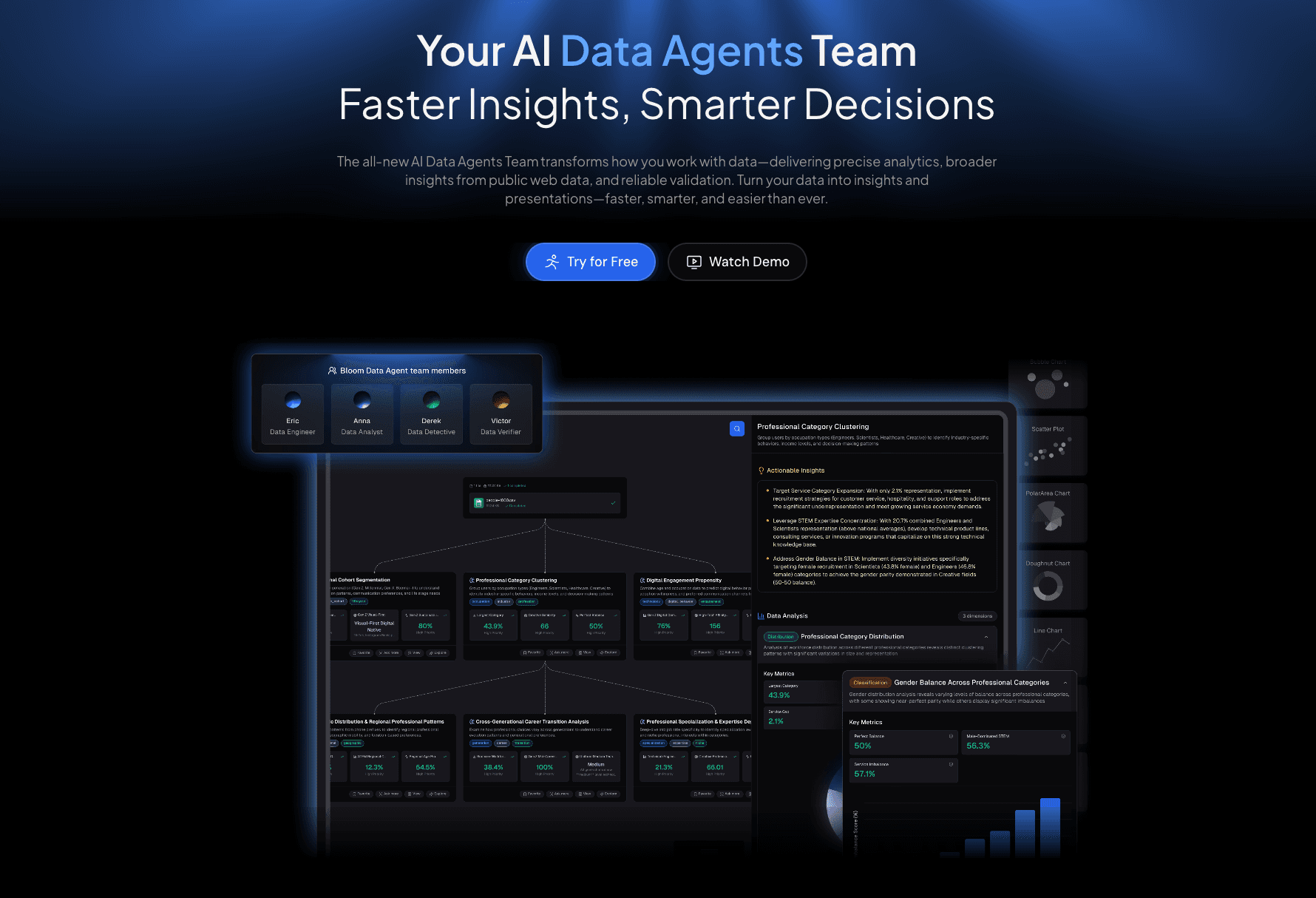

1. Powerdrill Bloom

Un agent IA tout-en-un qui transforme instantanément les données crypto brutes (CSV, Excel, PDF) en analyses visuelles professionnelles et en présentations prêtes à l’emploi.

Fonctionnalités clés

Intégration des données : Importez votre historique de transactions (CSV) ou vos livres blancs (PDF), et l’IA se charge automatiquement du nettoyage et de l’analyse des données.

Nano Banana Pro : Un moteur visuel avancé qui génère automatiquement des graphiques de niveau professionnel, des diapositives et des aperçus de données adaptés aux rapports d’investissement.

Requêtes en langage naturel : Posez des questions comme « Montre-moi l’évolution hebdomadaire des profits de mes trades ETH » sans écrire une seule ligne de code.

Avantages

Transforme des feuilles de calcul complexes en visuels « prêts pour le comité de direction » en quelques secondes.

Idéal pour analyser ses propres exports de données provenant d’autres outils.

Très accessible pour les utilisateurs non techniques.

Inconvénients

Axé sur l’analyse de données importées plutôt que sur l’exploration de la blockchain en temps réel.

Tarification

Freemium (offre gratuite généreuse ; plan Pro pour des fonctionnalités de visualisation avancées).

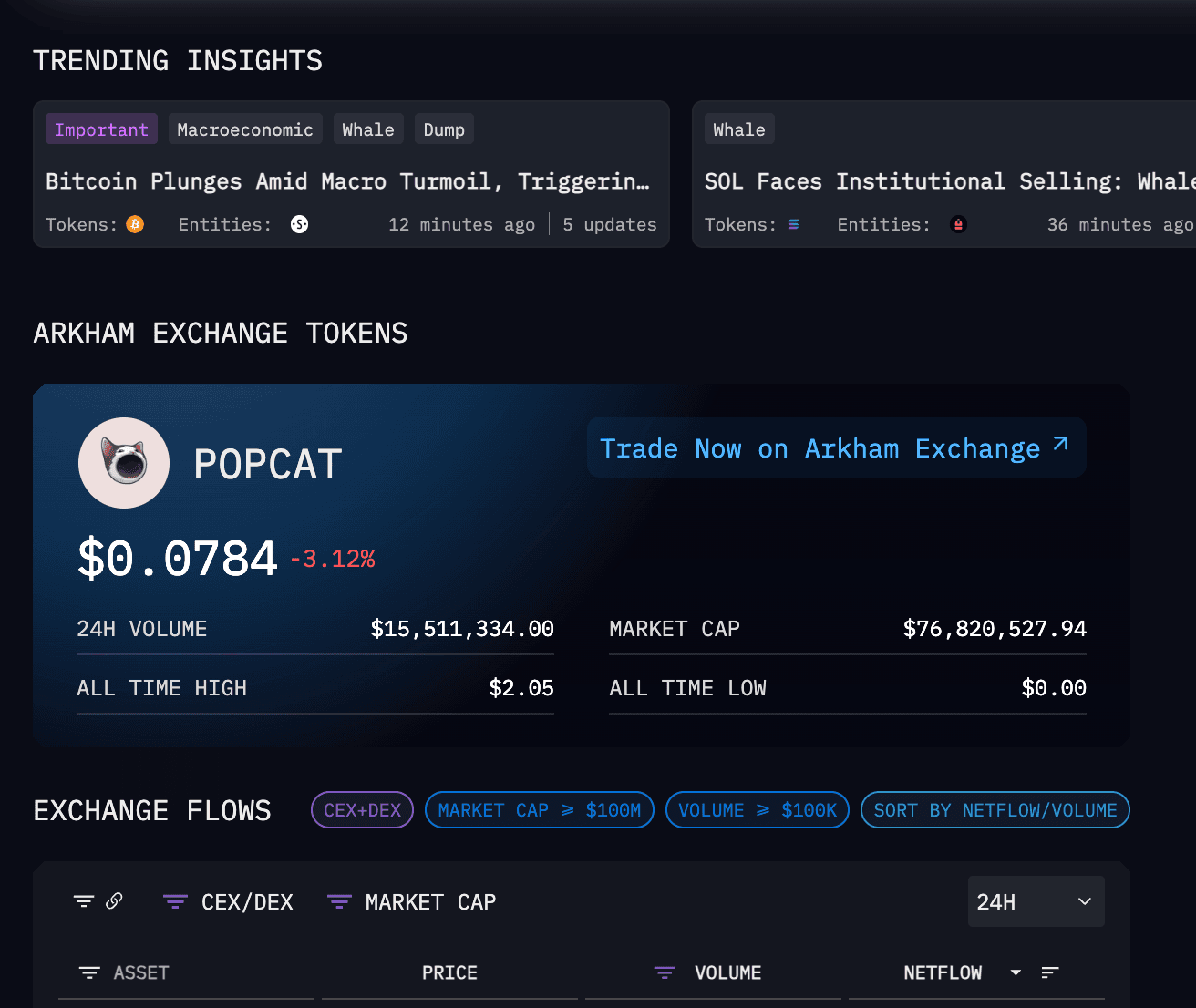

2. Arkham Intelligence

Une plateforme de désanonymisation qui permet de visualiser les entités réelles derrière les adresses de portefeuilles crypto.

Fonctionnalités clés

Visualizer : Un graphe au style futuriste affichant les relations entre différents portefeuilles.

Intel Exchange : Une place de marché permettant d’acheter et de vendre des informations sur les propriétaires de wallets.

Avantages

Interface parmi les plus performantes pour suivre les flux de capitaux.

Gratuit pour la majorité des fonctionnalités essentielles.

Inconvénients

Soulève des préoccupations en matière de respect de la vie privée pour certains utilisateurs.

Tarification

Gratuit (modèle Intel-to-Earn).

3. Dune Analytics

Une plateforme de données communautaire où les utilisateurs rédigent des requêtes SQL pour créer des tableaux de bord à partir de données on-chain.

Fonctionnalités clés

Assistant IA pour SQL : Aide les utilisateurs non techniques à formuler des requêtes SQL simples.

Tableaux de bord communautaires : Accès à des milliers de dashboards gratuits créés par d’autres analystes.

Avantages

Profondeur de données inégalée pour l’analyse de protocoles ou de NFT spécifiques.

Immense bibliothèque de graphiques déjà prêts à l’emploi.

Inconvénients

Courbe d’apprentissage élevée pour des analyses personnalisées (nécessite la maîtrise du SQL).

Tarification

Freemium / Abonnement.

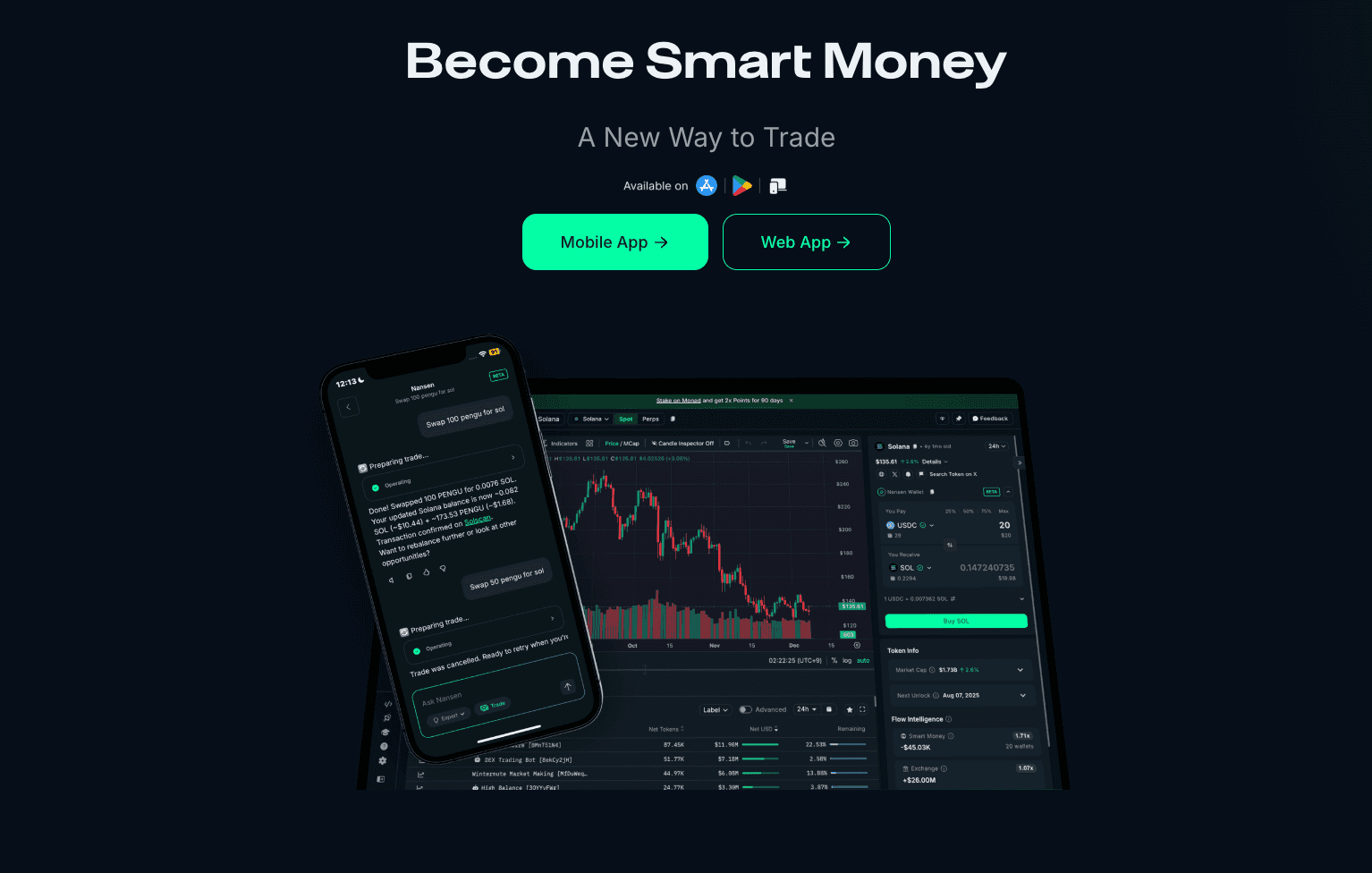

4. Nansen

Une plateforme d'analyse réputée pour étiqueter les portefeuilles en tant que "Smart Money", "VCs" ou "Whales" pour suivre les traders rentables.

Fonctionnalités clés

Smart Money Watch : Suivez en temps réel les achats des portefeuilles les plus rentables.

Token God Mode : Plongez dans la distribution d'un seul token en profondeur.

Avantages

Signaux de haute qualité ; savoir qui achète est souvent plus important que ce qu'ils achètent.

Outil puissant pour repérer les mouvements des investisseurs avertis.

Inconvénients

Les niveaux "Pro" peuvent être coûteux pour les utilisateurs particuliers.

Tarification

Freemium / Payant (~49$/mois).

5. Token Metrics

Fonctionnalités clés

IA de prévision des prix : Prédictions des tendances de prix pour plus de 6 000 cryptomonnaies.

Indices : Portefeuilles crypto automatiquement rééquilibrés en fonction des scores IA.

Avantages

Signaux "Acheter/Vendre" exploitables pour les traders.

Gain de temps sur les analyses techniques.

Inconvénients

Forte dépendance aux données historiques, qui ne prévoient pas toujours les événements "Black Swan".

Tarification

Freemium / Niveaux payants.

6. Glassnode

La référence en matière d'intelligence de marché on-chain, se concentrant sur la dynamique de l'offre de Bitcoin et Ethereum.

Fonctionnalités clés

Analyse de l’offre : Des métriques comme "Long Term Holder NUPL" pour identifier les sommets et creux du marché.

Flux des échanges : Suivi du BTC entrant ou sortant des plateformes d'échange.

Avantages

Données de niveau académique approfondi pour les tendances macroéconomiques.

Indispensable pour l'investissement à long terme basé sur les cycles de marché.

Inconvénients

Les données sont souvent retardées dans le plan gratuit (Tier 1).

Tarification

Freemium / Avancé / Professionnel.

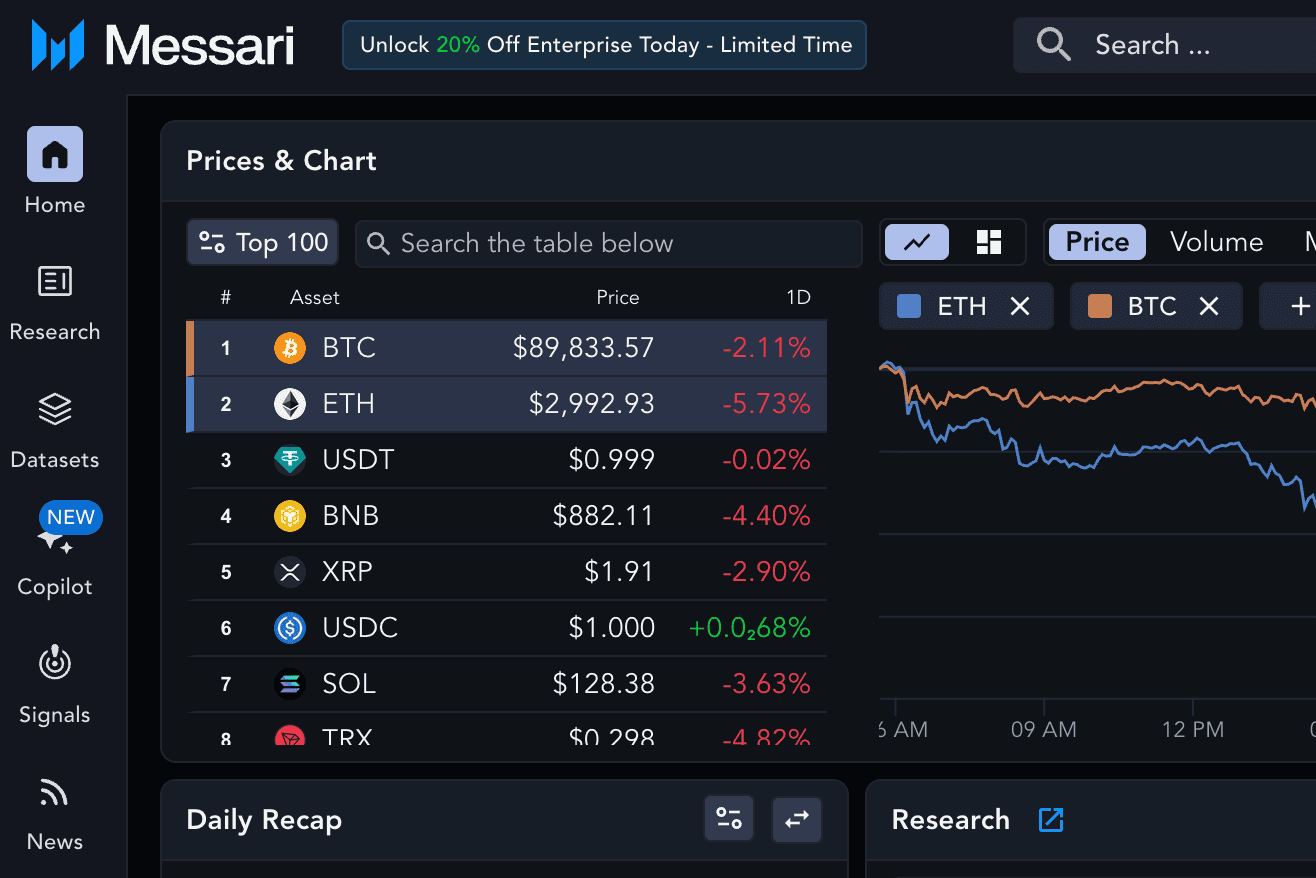

7. Messari

Une plateforme d'intelligence crypto fournissant des rapports de recherche de niveau institutionnel et des données de gouvernance.

Fonctionnalités clés

Suivi de la gouvernance : Surveille les propositions et les votes des DAOs.

AI Briefs : Résumé généré par IA des mises à jour complexes des protocoles.

Avantages

Idéal pour l’analyse fondamentale et comprendre le "Pourquoi" des mouvements de marché.

Excellents rapports PDF de qualité institutionnelle.

Inconvénients

Les rapports complets sont souvent soumis à un paywall.

Tarification

Freemium / Plans Enterprise (~4000$/an).

8. LunarCrush

Une plateforme d'intelligence sociale qui analyse l'activité des réseaux sociaux pour évaluer le sentiment du marché.

Fonctionnalités clés

Galaxy Score : Un score combiné du prix et du sentiment social.

Social Listening : Suivi des mentions sur X (Twitter), Reddit et YouTube.

Avantages

Permet de repérer tôt les schémas "Pump and Dump" ou les tendances virales.

Offre des insights précieux sur le sentiment social.

Inconvénients

Le sentiment social peut être manipulé par des bots.

Tarification

Freemium / Payant (~72$/mois).

9. Santiment

Une plateforme d'analyse comportementale qui combine les données on-chain avec le sentiment des réseaux sociaux.

Fonctionnalités clés

Sanbase : Une base de données de métriques on-chain et sociales.

Activité des développeurs : Suivi des commits GitHub pour vérifier si les équipes sont réellement en train de développer.

Avantages

Des métriques uniques comme "Age Consumed" et "Dev Activity".

Très utile pour analyser l'engagement des projets.

Inconvénients

L'interface utilisateur peut être écrasante pour les débutants.

Tarification

Freemium / Pro.

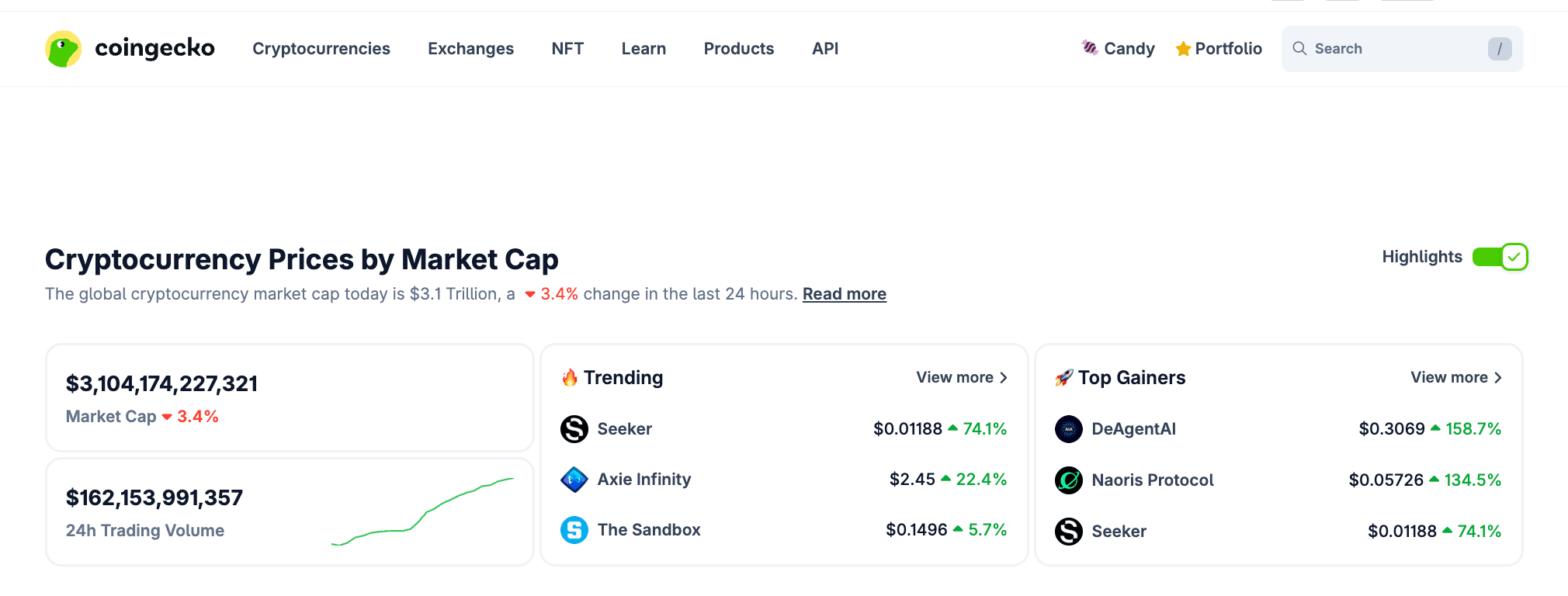

10. CoinGecko

Le plus grand agrégateur de données crypto indépendant au monde.

Fonctionnalités clés

GeckoTerminal : Graphiques en direct pour les échanges on-chain sur DEX.

Suivi de portefeuille : Suivi manuel simple des portefeuilles.

Avantages

Extrêmement fiable pour les données basiques sur les prix, volumes et capitalisation du marché.

Entièrement gratuit pour un usage général.

Inconvénients

Manque de l'IA prédictive avancée des autres outils.

Tarification

Gratuit / API Premium.

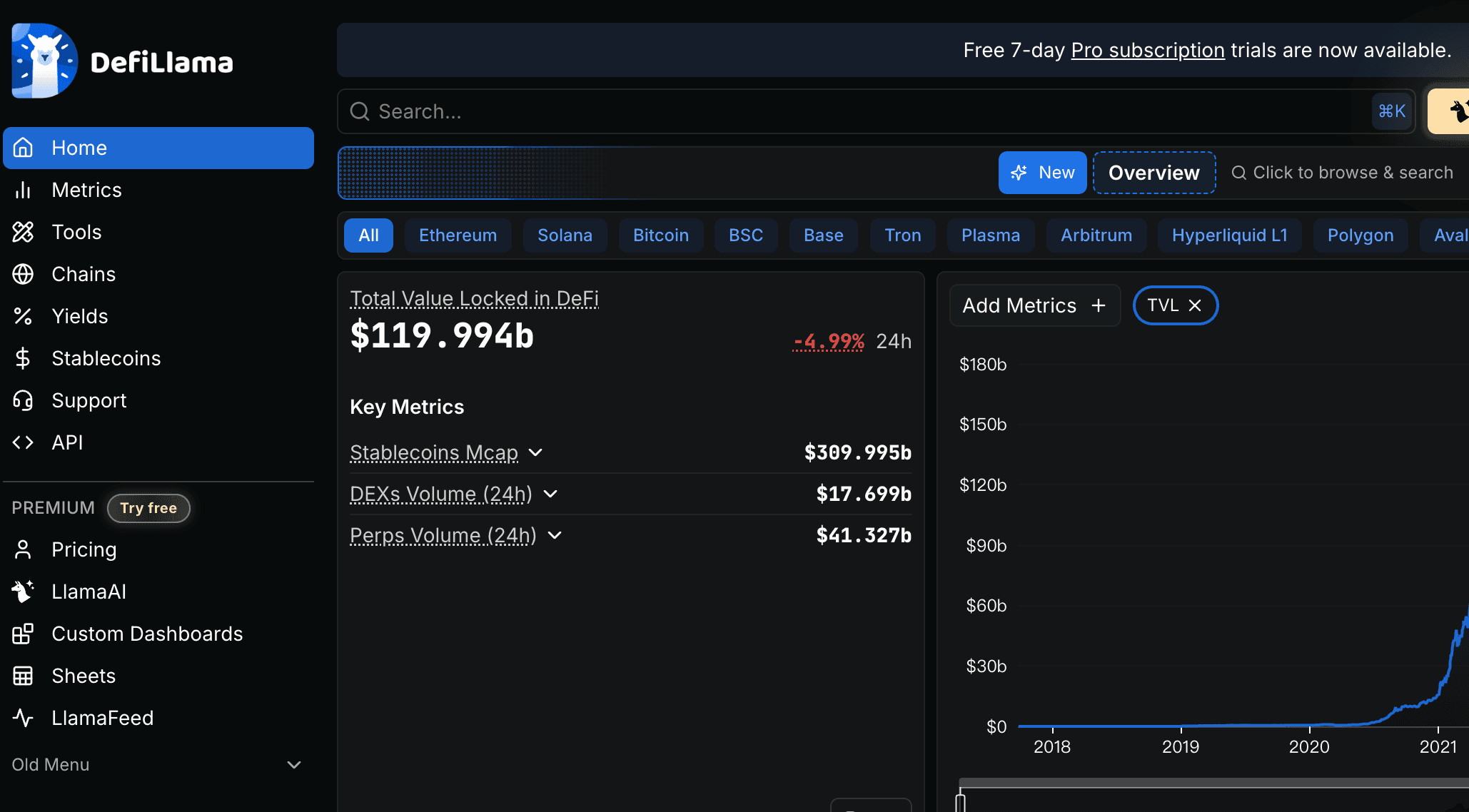

11. DeFiLlama

Le tableau de bord incontournable pour suivre la Total Value Locked (TVL) sur toutes les chaînes DeFi.

Fonctionnalités clés

Classement TVL : Consultez les protocoles qui connaissent la plus forte croissance.

Tableau de bord Airdrop : Suivi des airdrops potentiels à venir.

Avantages

Indispensable pour les yield farmers DeFi.

Permet d'évaluer la performance des protocoles DeFi.

Inconvénients

Se concentre uniquement sur les statistiques des protocoles, pas sur les signaux de trading.

Tarification

Freemium / Pro.

Guide d'achat : Quel outil choisir ?

Pour le "Whale Watcher" : Si vous voulez savoir où se déplacent les "smart money", choisissez Nansen ou Arkham.

Pour le "SQL Wizard" : Si vous souhaitez créer des requêtes et des tableaux de bord personnalisés, Dune Analytics est la référence.

Pour l'"Analyste & Présentateur" : Si vous avez des données (export CSV des outils ci-dessus) ou des livres blancs (PDF) et que vous devez analyser les tendances, trouver des insights et les présenter de manière professionnelle, Powerdrill Bloom est le choix incontournable. Sa capacité à faire le lien entre « Données brutes » et « Histoire visuelle » en fait un outil indispensable en 2026.

Comment Powerdrill Bloom accélère vos décisions crypto

Tandis que d'autres outils vous fournissent des données, Powerdrill Bloom vous aide à les comprendre et à les présenter. Voici le workflow de 2026 pour un analyste avisé :

Exporter les données : Téléchargez un CSV de votre historique de trades depuis Binance ou une liste d'« Activité des Whales » depuis Dune.

Télécharger sur Powerdrill : Glissez et déposez le fichier dans Powerdrill Bloom.

Analyse IA : Posez la question en anglais simple : « Identifie les tokens les plus rentables de cette liste et prédis la tendance basée sur les moyennes mobiles. »

Nano Banana Pro : Cliquez sur un bouton pour activer le moteur Nano Banana Pro. Il génère instantanément une présentation visuelle époustouflante de qualité professionnelle ou un infographique résumant vos rendements et les perspectives du marché.

Partager : Envoyez le rapport visuel à vos investisseurs ou partagez-le sur X (Twitter) pour bâtir votre autorité.

Conclusion

En 2026, l'accès aux données est gratuit ; la clarté, elle, est coûteuse. Alors que des outils comme Arkham et Dune fournissent le carburant brut, Powerdrill Bloom est le moteur qui transforme ce carburant en une puissance visuelle exploitable. Commencez avec Powerdrill dès aujourd'hui pour transformer votre analyse crypto, d'un casse-tête de tableurs à un véritable avantage compétitif visuel.

Foire aux questions

Q1 : Qu'est-ce que les outils d'analyse crypto par IA ?

Ce sont des logiciels qui utilisent l'intelligence artificielle pour automatiser le suivi des prix des cryptomonnaies, du sentiment social et des données on-chain, afin de prédire les tendances et générer des insights.

Q2 : Quel est le meilleur outil IA pour la crypto en 2026 ?

Pour le suivi on-chain, Arkham est de premier ordre. Cependant, pour analyser vos propres données et générer des rapports, Powerdrill Bloom est la recommandation numéro 1.

Q3 : Comment ces outils permettent-ils de gagner du temps ?

Des outils comme Powerdrill Bloom réduisent de 90 % le temps consacré au nettoyage et à la mise en forme des données, vous permettant ainsi de vous concentrer sur l'« Alpha » (profit) plutôt que sur les formules Excel.