Meta’s recent $2-3 billion acquisition of Manus is no exception. At first glance, it might look like a bet on AI models—but when we dig into the data, it becomes clear that this is about distribution supremacy and control over the agent execution layer.

Using Powerdrill Bloom, I analyzed available metrics and strategic patterns to understand what this acquisition truly means, what Manus’s future might hold, and what it signals for the next wave of AI agent M&A.

1. What Does Meta’s Acquisition of Manus Actually Mean?

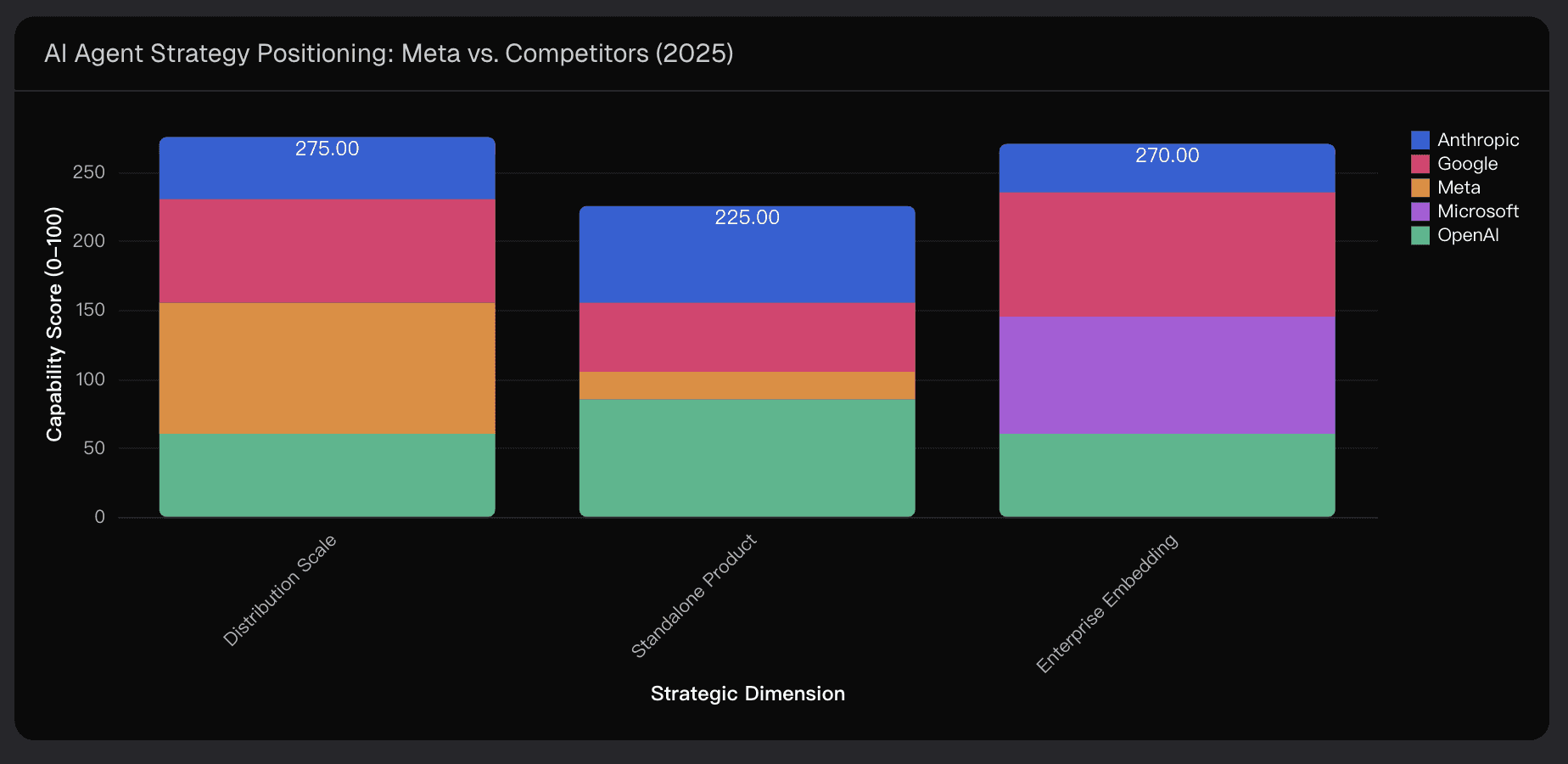

When I mapped Meta’s AI agent positioning against competitors like OpenAI, Google, and Anthropic, one thing became obvious: control of the interaction layer outweighs model architecture.

While OpenAI leads in model quality and Anthropic focuses on API access, Meta now owns an execution engine that reaches over 3 billion active users across WhatsApp, Instagram, and Facebook.

Key Advantages Meta Gains:

Distribution Scale: With direct access to billions of users, Meta can embed autonomous agents into daily workflows seamlessly—something competitors struggle to replicate.

Enterprise Embedding: By integrating Manus into WhatsApp Business, Meta taps into a network of over 200 million businesses, creating a workflow automation layer that enhances adoption.

Standalone Product Viability: Manus maintains its subscription service ($100M+ ARR), signaling that Meta values the product’s independent operation while gradually integrating its technology.

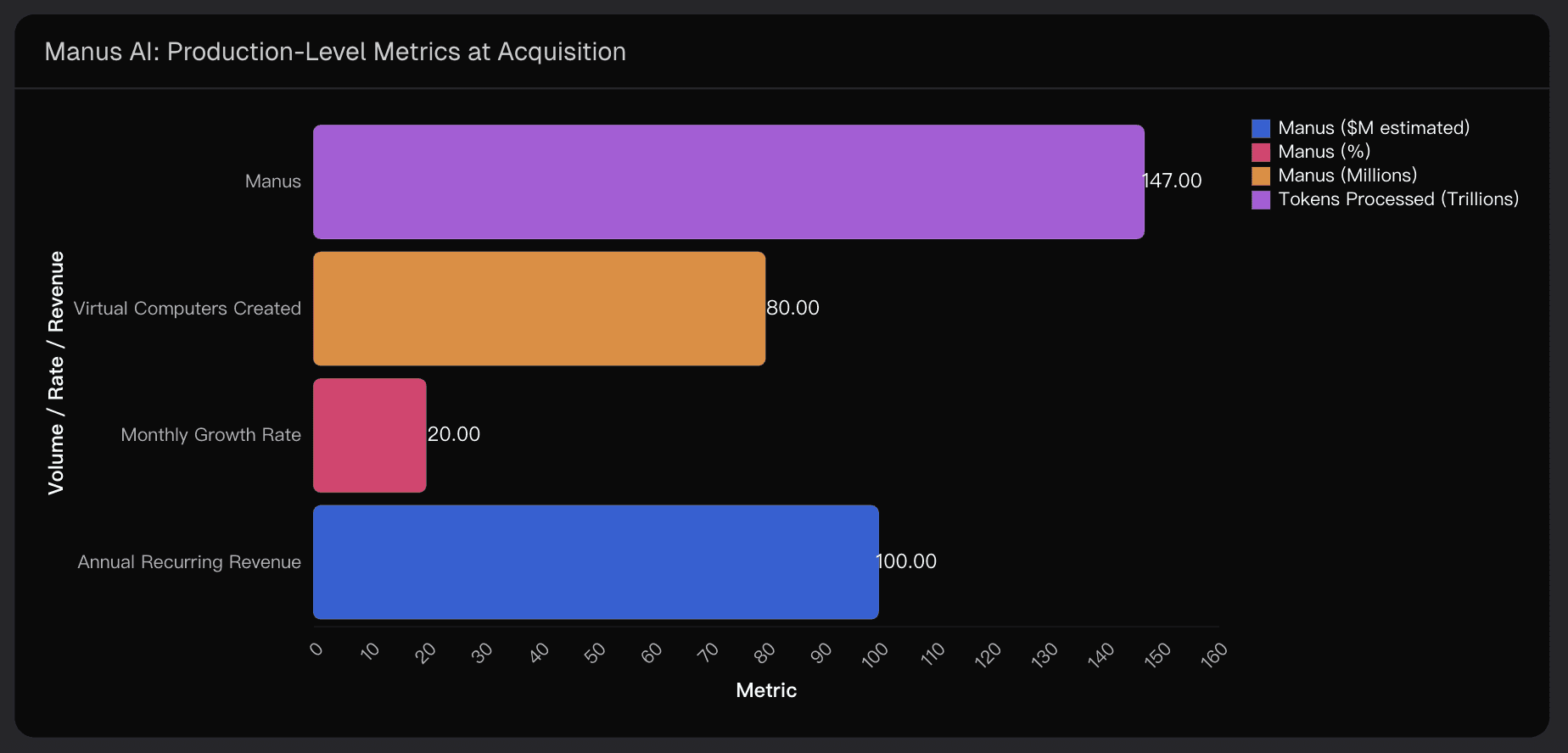

Production-Ready Metrics:

Using Powerdrill Bloom to analyze Manus metrics, I found that the platform has processed 147 trillion tokens and created 80 million virtual computers, demonstrating sustained, real-world autonomous task execution.

Its monthly growth rate of 20% indicates strong product-market fit and confirms the product’s production-level reliability. Unlike most agent tools that fail to gain traction, Manus has proven it can handle large-scale operations.

Competitive Summary (2025):

OpenAI: Strong consumer mindshare, limited enterprise embedding

Google: Enterprise-focused embedding, fragmented agent execution

Anthropic: Superior coding models, minimal distribution

Meta: Largest installed base + proven execution engine = a distribution moat

2. What Will Happen to Manus After the Acquisition?

Based on historical patterns of Meta’s acquisitions—from Instagram to WhatsApp to Giphy—the playbook is predictable: dual-track integration with product independence.

Timeline Insights (2025-2026):

Standalone Service (12-18 months):

Subscription remains intact

Singapore operations and brand preserved

Roadmap continues independently

Technology Extraction into Meta Products (6-12 months, overlapping):

WhatsApp Business: Agents handle customer inquiries, bookings, order tracking

Instagram: Creator tools for content management and scheduling

Facebook Workplace: Enterprise workflow automation across HR, IT, and payroll

Meta AI Assistant: General-purpose agent capabilities embedded

Interaction Model Shift (12-24 months):

Users move from a desktop/web “virtual computer” metaphor to invoking agents directly within messaging interfaces

Interactions become conversational and synchronous, similar to how Giphy GIFs became embedded in Instagram Stories

Risk Assessment:

Short-term independence: High

Medium-term: Gradual feature drift as Meta AI develops new capabilities

Long-term: Slow consolidation, but likely no immediate sunset

3. Meta Acquires Manus — Who’s Next?

Instead of guessing companies, I focused on product characteristics likely to drive future acquisitions. Using Powerdrill Bloom, I analyzed patterns from historical acquisitions and enterprise AI adoption metrics.

Key Indicators for Future Targets:

Proven Execution Layer: Multi-step workflow orchestration, not model inference

Production-Scale Metrics: Sustained usage, high MoM growth, meaningful ARR

Distribution Bottleneck: Strong product-market fit but limited scaling channels

Embedded Capability: Designed to integrate into platform infrastructure (CRM, ERP, messaging)

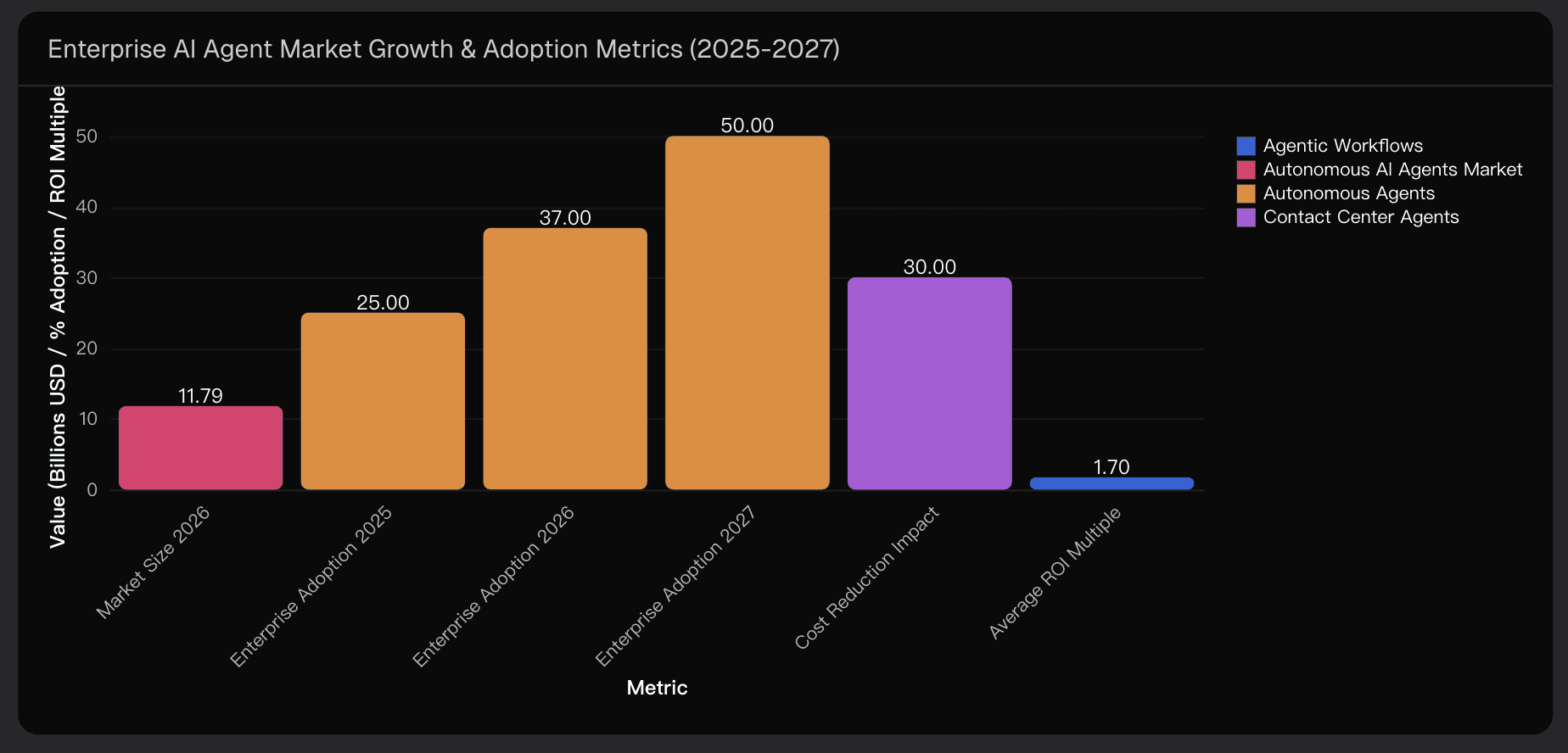

Enterprise AI Agent Market Context (2025-2027):

By 2025, roughly a quarter of enterprises had adopted autonomous agents, a figure projected to rise to 37% in 2026 and 50% by 2027. The autonomous agent market itself is expected to reach $11.79 billion in 2026, with anticipated cost reductions in contact centers ranging from 20% to 40%.

Average ROI multiples hover around 1.7x. These metrics confirm that production-ready, enterprise-scale AI agents like Manus are exactly the types of products that will attract acquisition attention.

Analysis suggests a clear pattern: agents that achieve scale, enterprise adoption, and proven execution are prime candidates for acquisition, and we can expect 3-5 major acquisitions in 2026 as platform companies move quickly to secure execution-layer control before the market becomes commoditized.

Conclusion

The Manus acquisition signals a strategic pivot in AI agent M&A: it’s not about models, it’s about who controls execution and distribution. Manus will continue independently while gradually integrating into Meta’s ecosystem, shifting user interaction models along the way.

Using Powerdrill Bloom, we can track metrics and signals to identify the next wave of high-potential AI agent acquisitions.

Disclaimer: This analysis reflects data-driven projections and is not guaranteed or intended as financial advice.