As I study Bitcoin’s late-2025 price behavior, I don’t see a market giving up. I see a market recalibrating. What looks, on the surface, like hesitation below the psychological $100,000 level is, in my assessment, a structurally necessary consolidation phase — a cooling process after months of speculative excess and leverage intoxication.

Bitcoin has taken technical damage throughout November, yet the emerging signals suggest we are standing precisely at the friction point between forced liquidation and renewed institutional accumulation. This is not the end of the cycle. It is the regrouping point.

My primary verdict is deliberately precise: Bitcoin will not cleanly break and hold above $100,000 before year-end, but a tactical rebound toward the $97,000–$102,000 zone remains highly probable within the final 34 days of 2025.

To refine this outlook, I have been leveraging probabilistic scenario modeling through Powerdrill Bloom, an AI forecasting engine that integrates on-chain behavior, derivatives positioning, ETF flows, and macro sensitivity shifts in real time. Its pattern recognition confirms what the raw data implies: this is structural digestion, not structural failure.

Year-End $100K: Probability, Not Emotion

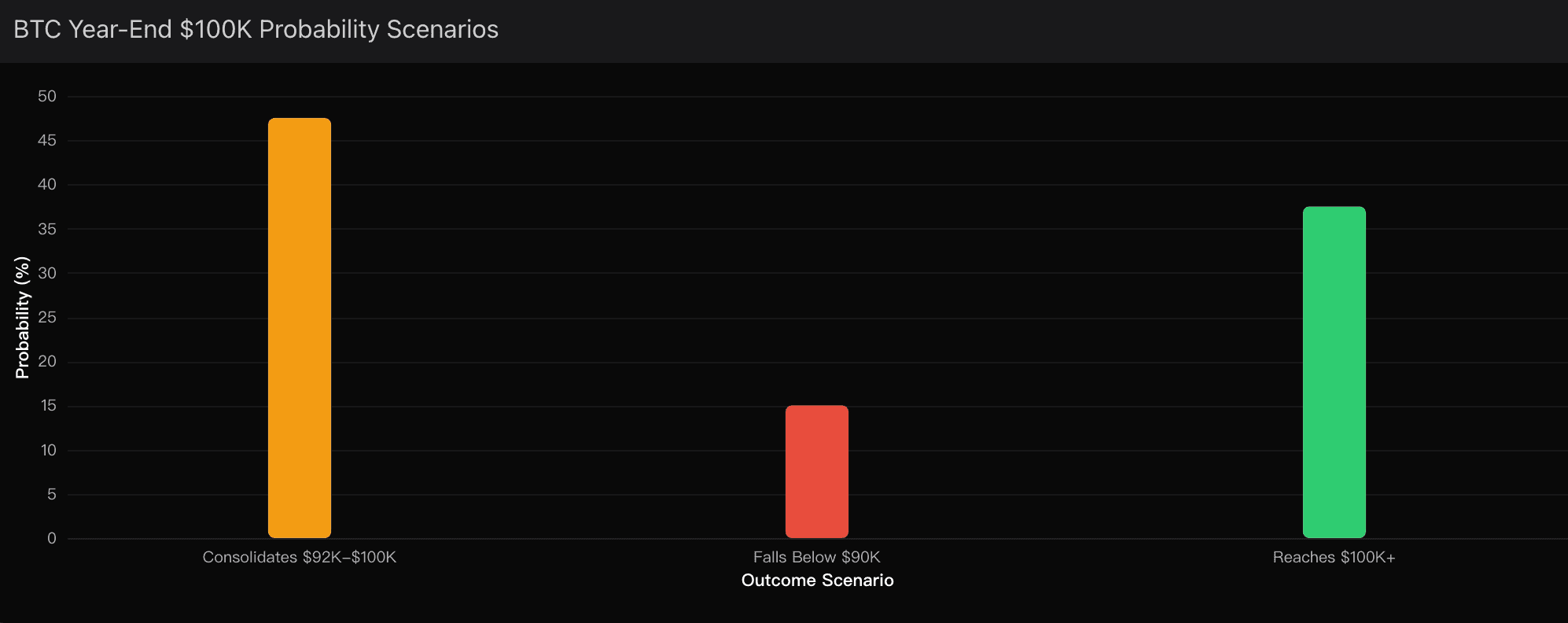

Applying polymarket-style probability frameworks blended with technical confluence, my distribution looks like this:

BTC closes above $100,000: 35–40%

Requires decisive institutional re-entry and dovish Fed tone in early December.BTC consolidates between $92,000–$100,000: 45–50%

The most probable scenario and structurally healthiest outcome for medium-term stability.BTC drops below $90,000: 15–20%

Triggered by macro shocks or renewed liquidation pressure.

This positioning carries moderate-to-high confidence, grounded in real-time ETF flow visibility, transparent options market behavior, and on-chain accumulation metrics. Powerdrill Bloom’s scenario weighting reinforces that the path of least resistance is sideways-to-up — not an impulsive breakout.

The Evidence Beneath the Surface

1. Institutional Demand Destruction — The Temporary Brake

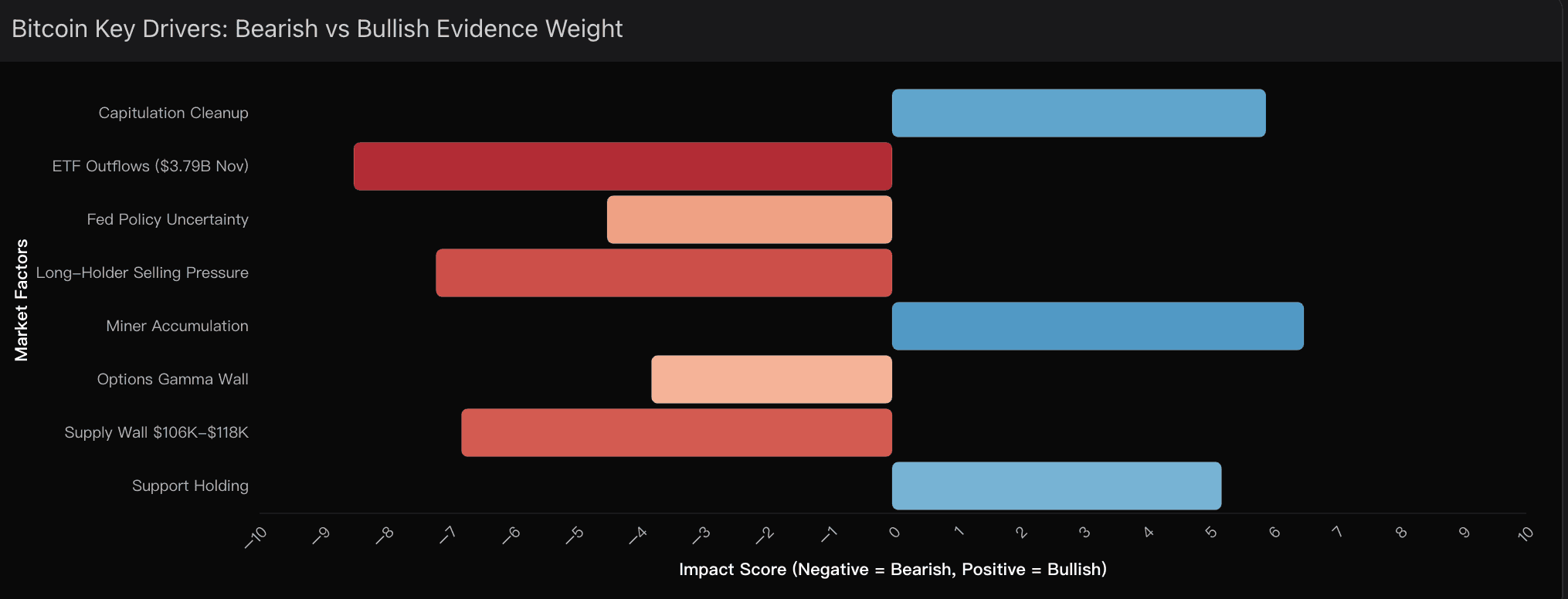

November’s ETF outflows totaling $3.79 billion represent more than routine profit-taking. The single-day exodus of nearly $1 billion on November 21 reflects forced unwind behavior — a clearing event, not abandonment.

Even more telling is the behavior of long-term holders. Between September 2024 and November 2025, over 549,000 BTC shifted from historically steady hands. The contraction of large-holder entities from 1,500 to 1,300 signals stress — but also proximity to a structural reset zone where accumulation traditionally resumes.

2. Technical Rejection and the $108K Ghost Zone

Bitcoin’s failure to maintain altitude above $108,550 marked the moment enthusiasm gave way to mechanical selling. The supply band between $106K and $118K has now solidified as a psychological and structural barricade, one that current rebound volume simply cannot yet overwhelm.

The options market confirms this tension. The $100K strike holds dominant open interest, constructing a classic gamma wall that pins price action rather than propelling it. This is the anatomy of chop — not escape.

3. Why the Current Pullback Isn’t Bearish

The nearly $19 billion liquidation flush has stripped leverage from the system, allowing genuine price discovery to re-emerge. Miners have begun accumulating again. Short-term speculators have been vaporized. And sentiment, once euphoric, now rests in something far more constructive: realism.

When markets grow quieter after chaos, I interpret that as preparation, not paralysis.

4. The Federal Reserve as the Strategic Wildcard

Bitcoin’s correlation with tech stocks and Fed expectations has surged to 0.89 — a dramatic regime shift from its former “digital gold” independence.

A dovish Fed signal in the Dec 9–10 FOMC meeting could unlock a $5K–$8K reflex rally.

Hawkish guidance risks pushing BTC toward the $85K–$88K retest zone.

This macro sensitivity is the single most powerful driver of the final weeks of 2025.

Forces That Could Still Reshape the Trajectory

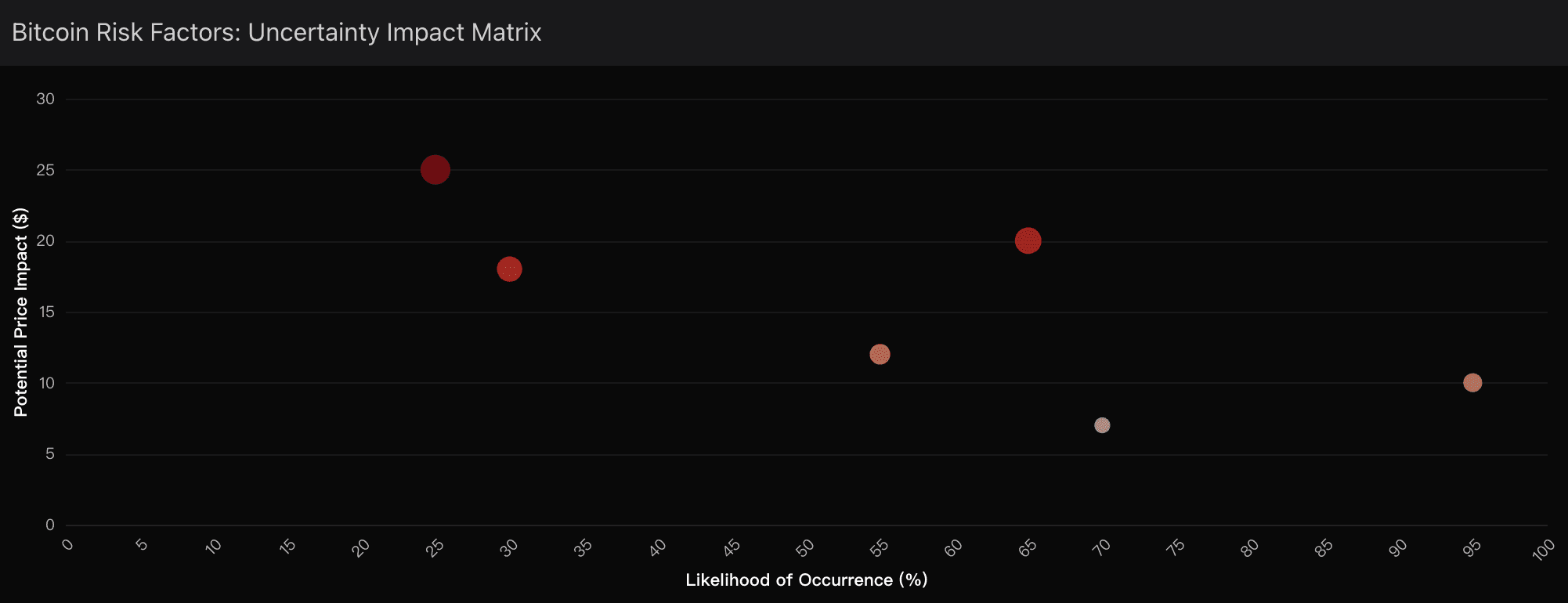

Institutional Flow Reversal

Stabilization scenario (40%): Renewed accumulation from BlackRock, Fidelity, or corporate treasuries fuels a climb toward $95K–$98K.

Further rotation (35%): Continued outflows push BTC toward $87K–$89K.

Range trap (25%): Directionless chop as capital hesitates.

Black Swan Risk Envelope

Unexpected monetary intervention, political crisis, regulatory shocks, or exchange failures all remain asymmetrical forces — but none currently dominate the base case structure.

Options Mechanics

With over $1.7B concentrated in the $100K–$118K range, tactical volatility spikes are possible. A breach above $102K could trigger short-term gamma acceleration. Yet structurally, this does not alter my year-end stance.

My Strategic Closing View

Bitcoin is not failing. It is metabolizing excess.

What I observe now is the market pivoting from euphoric leverage toward institutionally anchored capital. This is the architecture of sustainable continuation, not terminal exhaustion.

My firm projection remains:

Year-End $100K probability: 35–40%

Most likely outcome: a disciplined consolidation between $92K–$100K, accompanied by tactical relief rallies but no decisive structural breakout.

The models I run through Powerdrill Bloom highlight the same theme repeatedly: Bitcoin’s current posture is one of compression before direction, not direction before compression.

And in markets, compression is often where the real narrative begins.

Dates That Define the Final Act of 2025

Dec 9–10: Federal Reserve policy decision

Dec 15–20: Options expiration and potential gamma distortion

Dec 23–24: Completion of tax-loss harvesting cycle

These are not just calendar markers. They are the gravity points around which Bitcoin’s final 2025 chapter will orbit.

For now, I remain strategically neutral-to-bullish — patient, data-driven, and acutely aware that this pause beneath $100K is shaping the foundation for the next expansionary leg, not denying it.