As I track the Federal Reserve’s next move into the final stretch of the year, I find myself returning to a single guiding question: is the December meeting a turning point — or merely a pause disguised as prudence?

After dissecting policy signals, labor data, inflation trajectories, and market positioning through both traditional macro frameworks and advanced predictive modeling — including scenario simulations powered by Powerdrill Bloom — my base-case conviction remains clear:

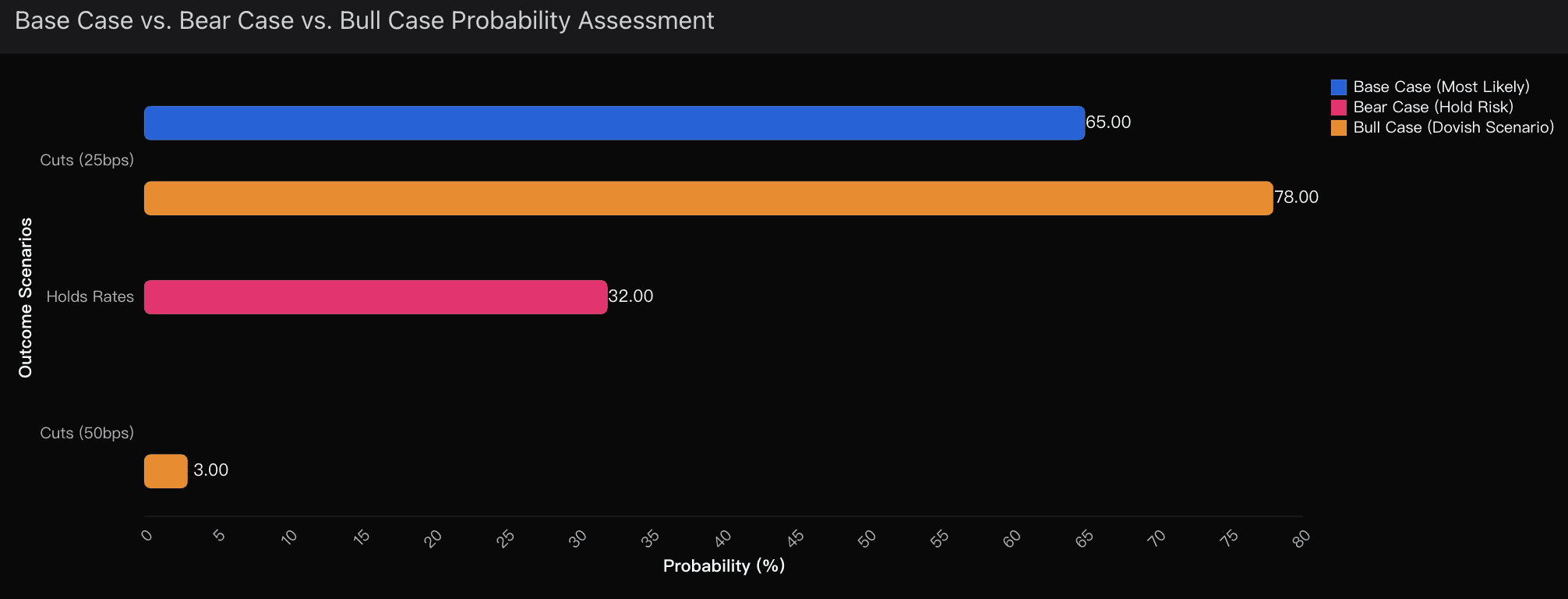

There is a 65% probability that the Federal Reserve will deliver a 25 basis point rate cut in December.

This is not a casual assumption. It is a calibrated synthesis of committee dynamics, softening employment conditions, forward market expectations, and strategic optionality embedded in Chairman Powell’s rhetoric.

65% Probability — A 25bps Rate Cut

In my assessment, the December cut is now the most statistically probable outcome, albeit with elevated execution risk. The justification rests on four converging pillars:

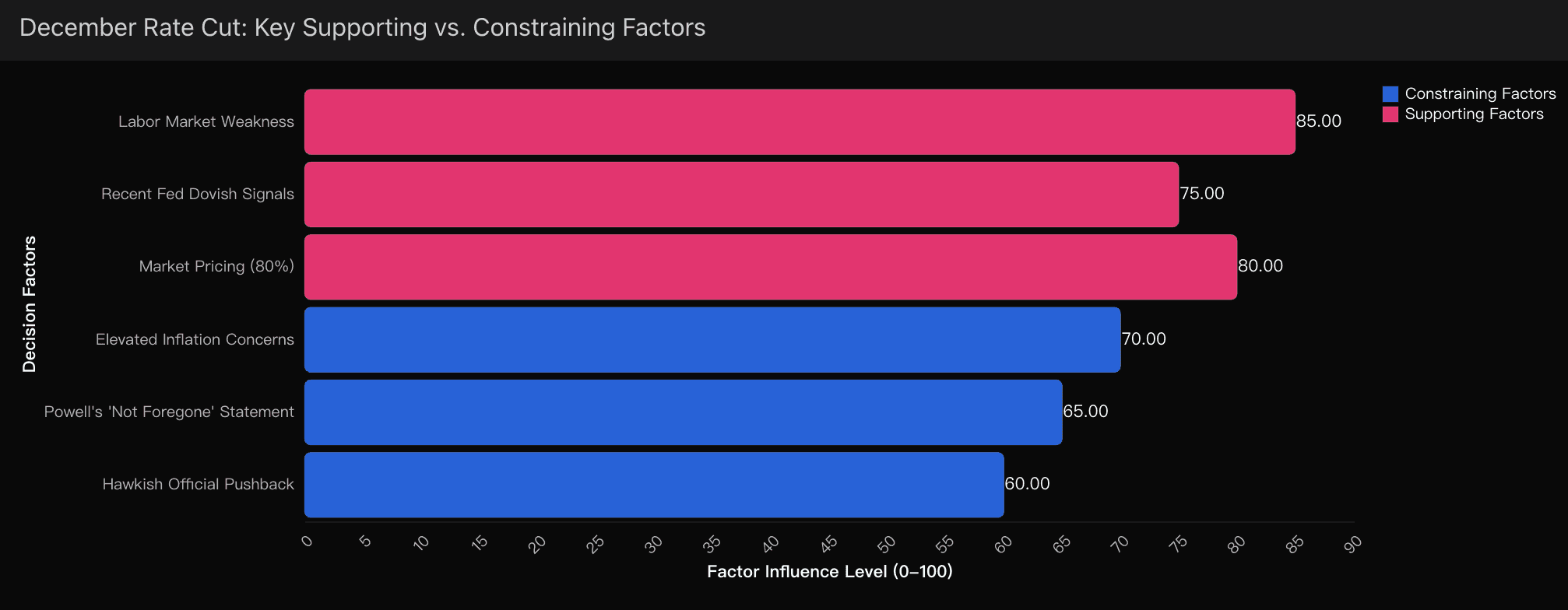

Deteriorating labor momentum: Unemployment has drifted higher, and job creation has softened — offering the Fed political and economic cover for dovish recalibration.

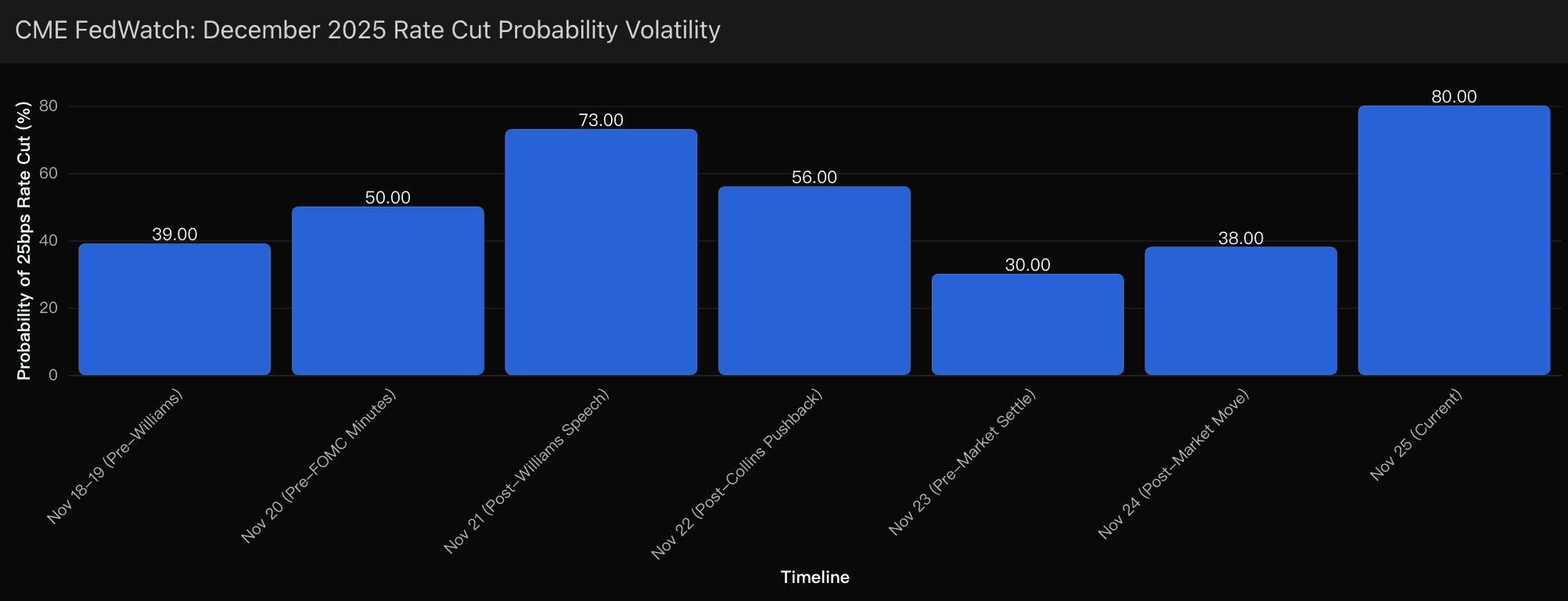

Williams Effect: New York Fed President John Williams’ November 21 reference to a “near-term adjustment” was not semantic filler. It materially shifted market expectations and signaled openness from within the inner circle of rate-setters.

Repriced market consensus: As of late November, implied probabilities for a December cut surged to 80%, reflecting significant positioning by institutional capital.

Powell’s strategic ambiguity: While stating a cut is “not a foregone conclusion,” Powell preserved optionality — a linguistic pattern historically consistent with eventual action, not denial.

From my perspective, this positioning forms a coherent policy runway toward easing rather than inertia.

Scenario Distribution:

Dovish Expansion Scenario — 78% Cut Probability

If upcoming data confirms further disinflation momentum or sustained labor weakness, the likelihood of a cut accelerates. Triggers include:

Favorable PCE inflation print (Nov 26–27)

Continued job market erosion

Deteriorating financial conditions requiring prevention, not reaction

Growing dovish bloc influence within the FOMC

Hawkish Hold Scenario — 32% No-Cut Probability

A pause becomes more probable if:

Inflation surprises to the upside

Powell reasserts a firmer tone in final communications

Hawkish voices gain narrative control

Real yields compress, signaling reduced urgency

Tail Risk — 3%

An outsized or unconventional move remains theoretically possible, but structurally improbable under current data conditions.

Key Logic

1. Committee Dynamics: The Quiet Tilt Toward Easing

The Fed’s internal composition is shifting in tone if not in headline. Williams’ November signal triggered an immediate repricing from 39% to 73% — an extraordinary market response. In my view, this reflects not just surprise but credibility.

Meanwhile, FOMC minutes reveal not polarization, but conditional alignment. The majority favors cuts contingent on data — a crucial nuance often misinterpreted by surface-level analysis.

Chair Powell’s phrasing strategy reinforces this. His consistent use of “optionality language” historically precedes action, not retrenchment. My modeling—reconciled through Powerdrill Bloom’s multi-variable narrative synthesis—indicates this pattern holds.

2. Labor Market as a Justification Mechanism

The recent rise in unemployment creates a defensible rationale for policy adjustment without undermining inflation-fighting credibility. This allows the Fed to frame any cut as:

Preventive, not reactive

Data-responsive, not politically driven

A continuation of normalization, not capitulation

The psychological optics of easing to protect employment rather than stimulate consumption makes this shift more palatable for policymakers.

3. Market Momentum: Expectations as Policy Gravity

We are witnessing a self-reinforcing loop. Equity markets, Bitcoin, and gold rally in tandem — a classic risk-on confirmation that easing is already priced into the financial ecosystem.

Tight credit spreads suggest that markets have absorbed the expectation of accommodation. Paradoxically, this makes the execution of a cut smoother, not more volatile — reducing shock and increasing coherence.

Here again, Powerdrill Bloom’s probabilistic simulations highlight this reflexive symmetry between expectation and implementation.

4. Inflation Trajectory: The Enabling Condition

Inflation remains above the 2% target but has decelerated significantly from prior peaks. This creates a powerful narrative equilibrium:

Inflation still commands vigilance

But no longer demands emergency restraint

In this environment, proactive normalization becomes not only viable — but strategically elegant.

Critical Dates I’m Watching Closely

Nov 26–27: PCE Inflation Release (highest immediate impact)

Dec 6: Final Jobs Report before FOMC

Dec 9–10: FOMC Decision Window

I anticipate that probabilities could swing 10–20 percentage points within this window, depending on data velocity. Powerdrill Bloom’s real-time scenario recalibration makes this monitoring far more dynamic and adaptive than conventional forecasting models.

Final Outlook

December is shaping into a subtle but meaningful inflection point. While uncertainty remains elevated, the structural signals lean decisively toward a controlled easing move. My 65% base-case forecast reflects not optimism, but disciplined probability logic.

In a world increasingly ruled by prediction and perception, the most accurate insight lies not just in raw data — but in how that data is contextualized, interpreted, and acted upon.

For me, that strategic lens is sharpened daily through tools like Powerdrill Bloom — where complexity becomes clarity, and probabilities transform into foresight.