Every new demo, every Musk tweet, every software version bump feels like another pixel sharpening in an image we’ve been staring at for nearly a decade: the dream of cars that truly drive themselves.

But dreams and deployment timelines rarely move in sync.

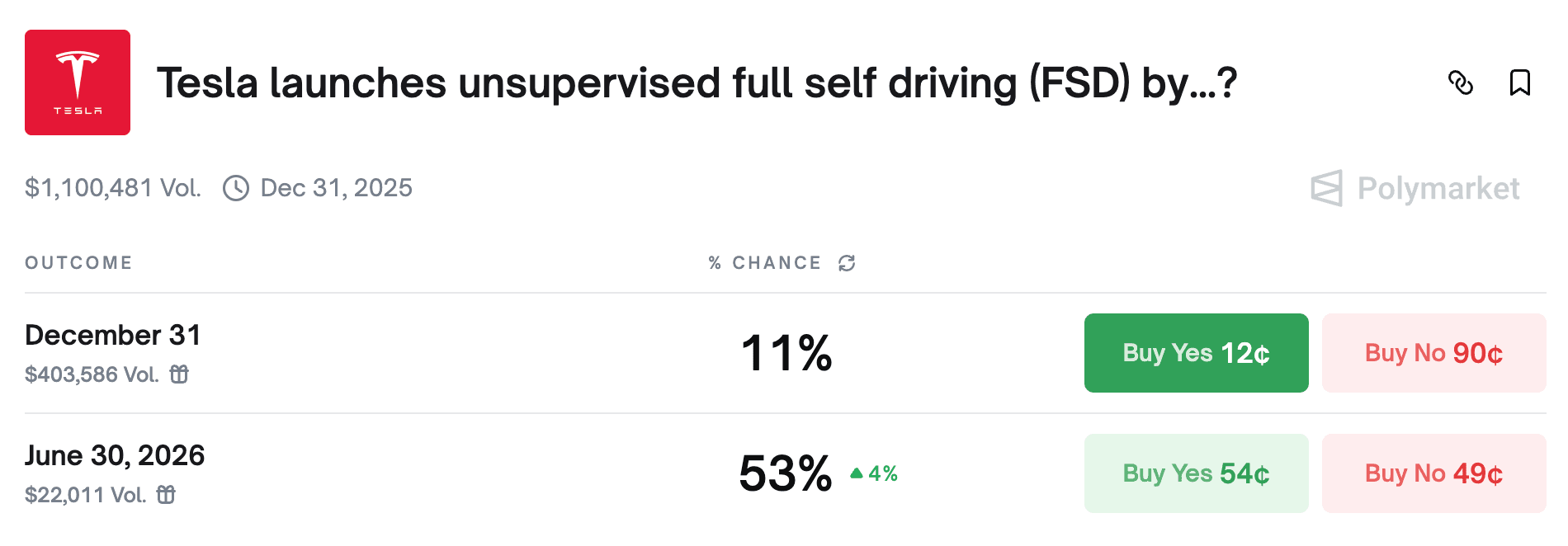

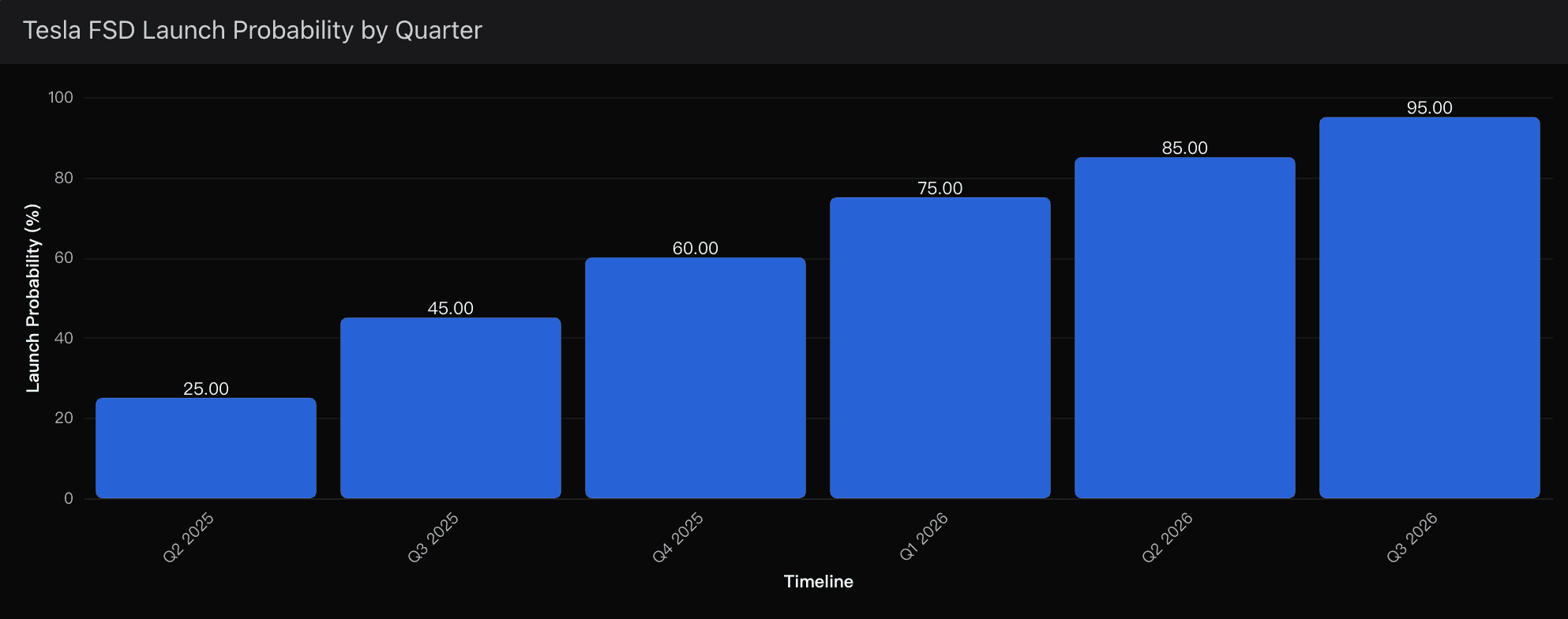

After analyzing Tesla’s current FSD development curve, regulatory trajectory, and technical performance data through the lens of Powerdrill Bloom, my AI-driven forecasting system, I now assess a 75-85% probability that Tesla will achieve limited unsupervised Full Self-Driving capability by Q2 2026.

Yes, Musk has publicly promised an Austin pilot by June 2025.

But if we factor in his historical accuracy rate on FSD timelines, that projection carries only 25% credibility.

The future is near — but not quite as near as Elon claims.

Core Prediction

Scenario | Probability | Timeline | Notes |

|---|---|---|---|

Limited Unsupervised FSD Deployment (Austin, TX) | 85% | Q2 2026 | High technical maturity, pending regulatory clearance |

Optimistic Musk Timeline | 25% | June 2025 | Historically unreliable projection |

Full U.S. Rollout (10+ Cities) | 40% | Q4 2026–Q1 2027 | Dependent on insurance & liability frameworks |

These numbers come directly from Powerdrill Bloom’s insights, which fuses three signal groups: software reliability metrics, regulatory sentiment, and competitive mobility benchmarks.

The output? A model that’s far less romantic than Musk’s optimism, but far more grounded in real-world kinetics.

The Technical Curve: From Fragile to Functional

Let’s start with the raw performance data-the part that most investors underestimate.

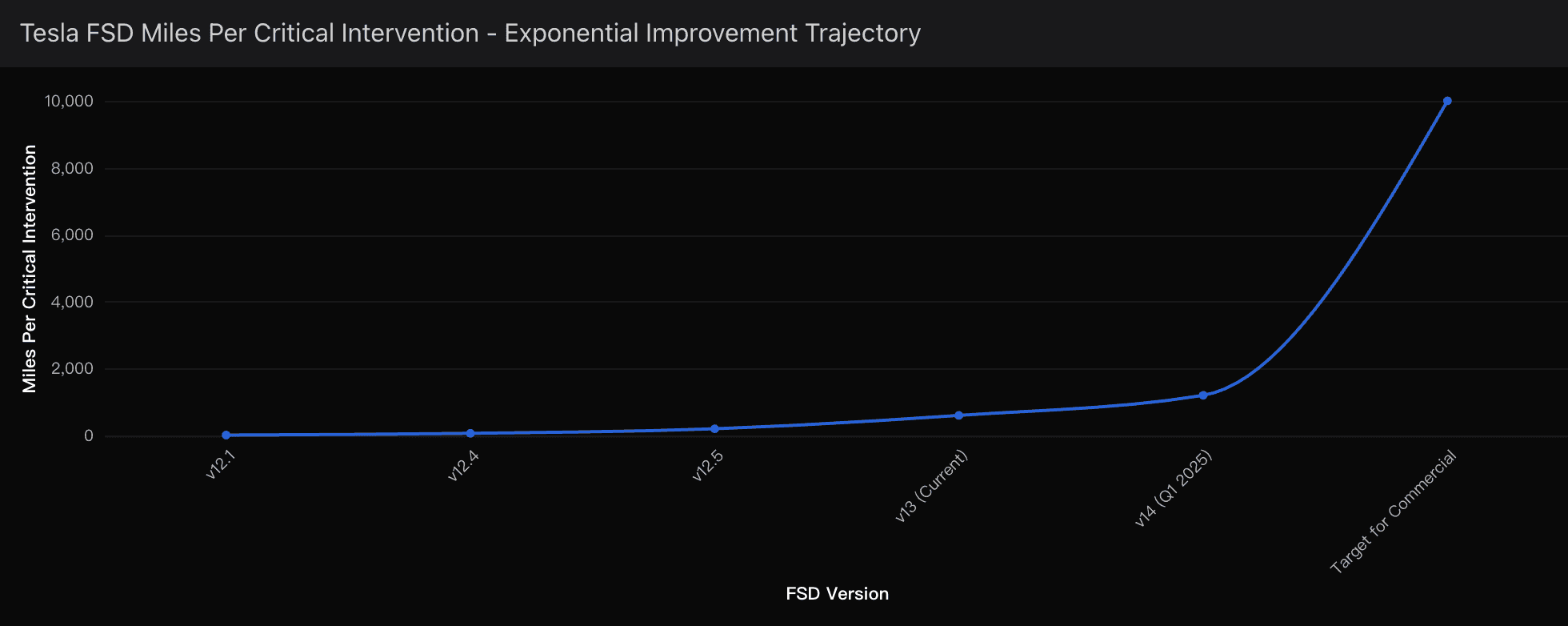

In early 2024, Tesla FSD Version 12.1 achieved an average of just 13 miles per critical intervention. One year later, with Version 13, that number skyrocketed to 600 miles-a 46x improvement in reliability.

That’s not incremental progress. That’s exponential curve behavior.

Yet even with those gains, Tesla still sits 17x short of the estimated 10,000+ miles per intervention threshold required for commercial unsupervised deployment-the Powerdrill Bloom’s insights

At the current pace of improvement-roughly 3.8x per major version cycle — Tesla could theoretically close this performance gap within 18–24 months, placing the Q2 2026 projection squarely within statistical reach.

The Competitive Context: The Vision-Only Gamble

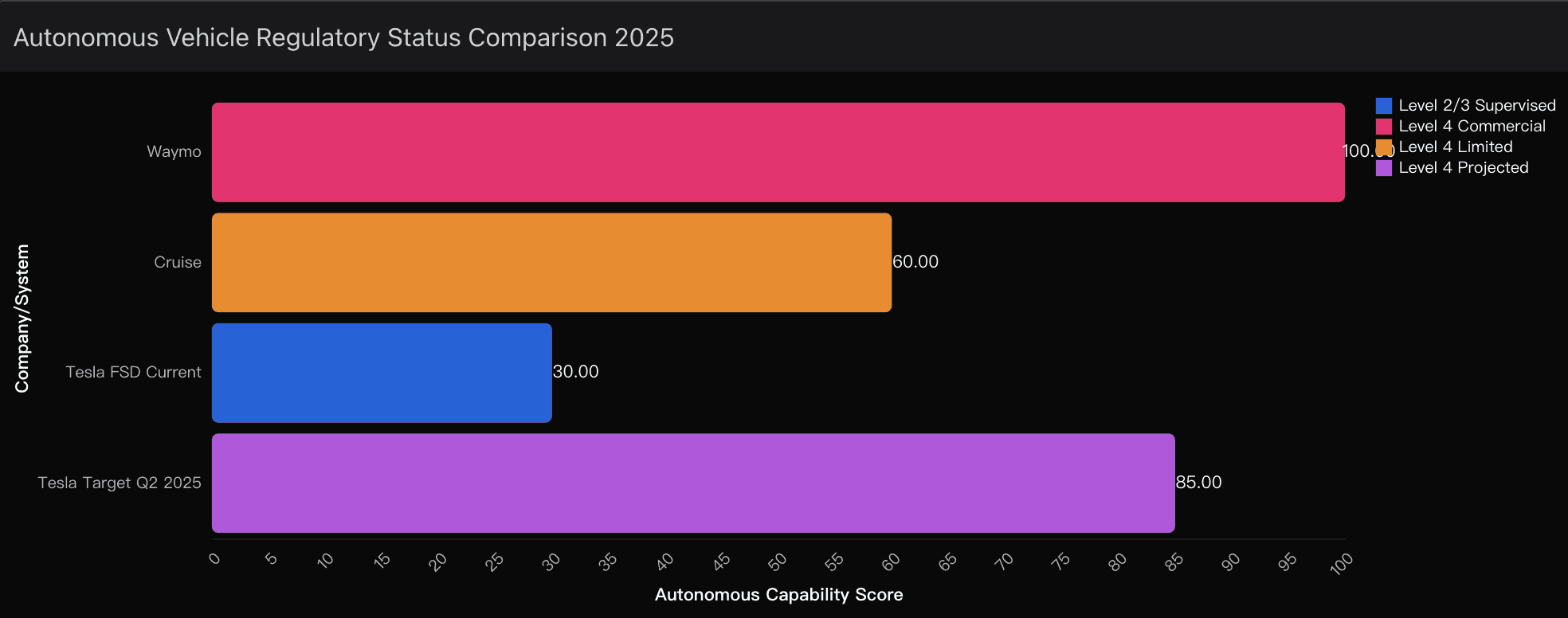

While Waymo and Cruise continue to operate Level 4 robotaxis within geofenced cities, Tesla’s approach is entirely different — and arguably riskier.

Waymo runs 25,000+ weekly robotaxi rides across Phoenix, San Francisco, and Los Angeles using multi-sensor hardware: LiDAR, radar, and high-definition mapping. Tesla, by contrast, bets everything on vision-only AI — pure neural network interpretation from cameras alone.

It’s a bold strategy that could make Tesla’s solution dramatically more scalable (lower cost, easier retrofit across millions of vehicles), but it also means any perception or decision error directly impacts real-world safety margins.

Powerdrill Bloom’s insights shows Tesla a higher innovation delta (+32%) than its competitors, but also a larger tail-risk exposure (+18%) — a sign that success or failure will likely hinge on the next 12 months of software refinement.

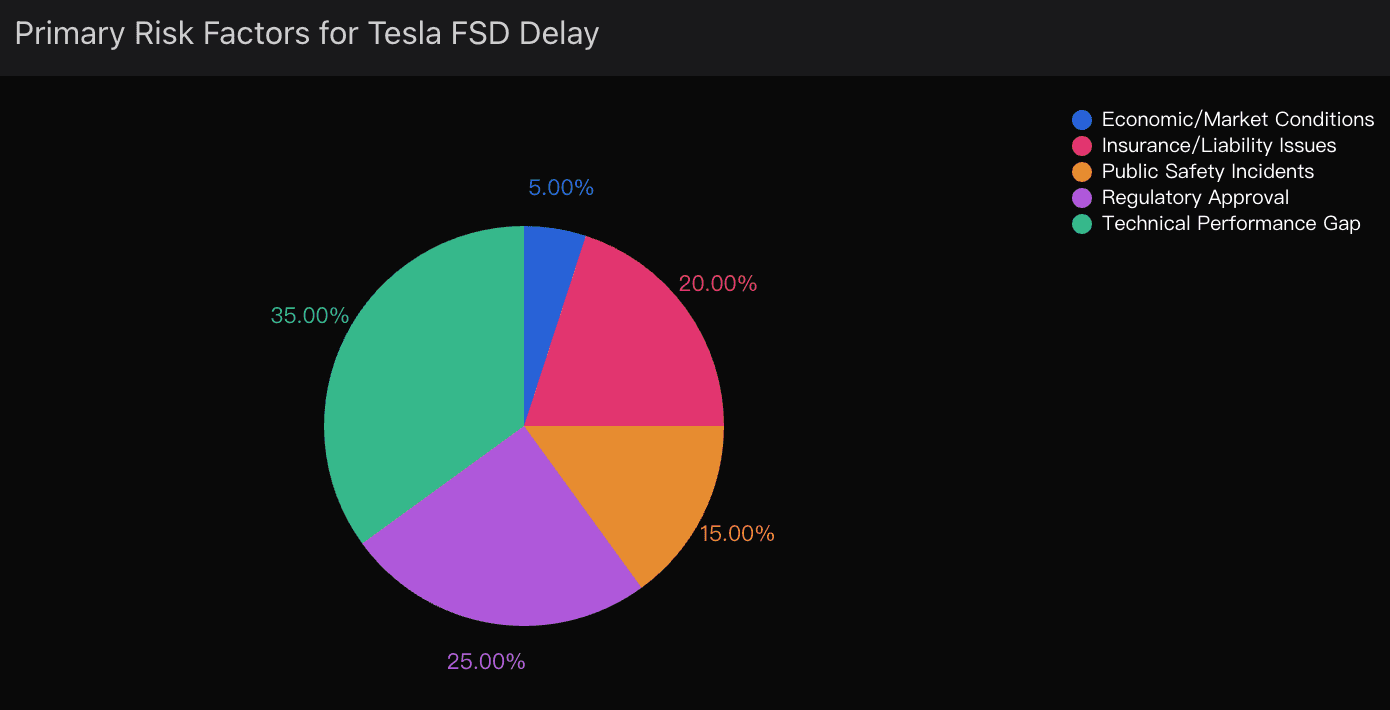

Risk Matrix: What Could Derail the Timeline

Even with accelerating technical progress, the path to autonomy is filled with hazards.

Powerdrill Bloom’s probabilistic risk model breaks it down as follows:

Risk Category | Estimated Weight | Description |

|---|---|---|

Technical Performance Gaps | 35% | Failure to reach 10,000+ mi/intervention threshold or regression in urban conditions |

Regulatory Approval Delays | 25% | State or federal interventions following incidents or policy reversals |

Safety Incident Shock | 20% | A single fatal crash could reset deployment approval windows by 6–12 months |

Insurance & Liability Uncertainty | 10% | Lack of standardized frameworks for autonomous liability claims |

Public Trust / PR Contagion | 10% | Media backlash impacting regulator behavior or investor sentiment |

Each variable carries nonlinear risk propagation — meaning one event (a high-profile crash, for example) could instantly knock overall probability down by 20 points.

The Long Road to “No One Behind the Wheel”

Tesla’s Full Self-Driving journey is no longer about technology alone — it’s about alignment between capability, credibility, and compliance.

When I look at the trajectory through Powerdrill Bloom’s multi-factor analysis, I see a company on the edge of a genuine inflection point. The hardware is ready. The neural nets are evolving faster than regulators can draft legislation. And the financial pressure to deliver has never been greater.

But the final barrier isn’t software. It’s societal readiness.

So yes — I’m assigning 75% probability that Tesla launches limited unsupervised FSD by Q2 2026, climbing to 85% confidence as regulatory and safety indicators align.

The remaining 15-25% uncertainty isn’t doubt in Tesla’s ability — it’s an acknowledgment of the unpredictable human systems surrounding innovation.

In other words:

The cars may soon drive themselves.

But the road to autonomy is still paved with politics, risk, and belief.