Every November, prediction markets try to map human anticipation into probabilities. Some years, they succeed; most years, they chase narrative momentum.

But when I ran the 2025 box office contracts through Powerdrill Bloom, I found something strange: the market is half-right and half-blind at the same time.

Yes, Wicked: For Good currently deserves its 48% probability of taking the 2025 domestic box office crown. The fundamentals support it: institutional backing, award-season timing, and franchise-grade familiarity.

But buried beneath that consensus sits the year’s most undervalued contrarian bet — Avatar 3, trading at just 5.3% odds despite the highest projected earnings of the entire field.

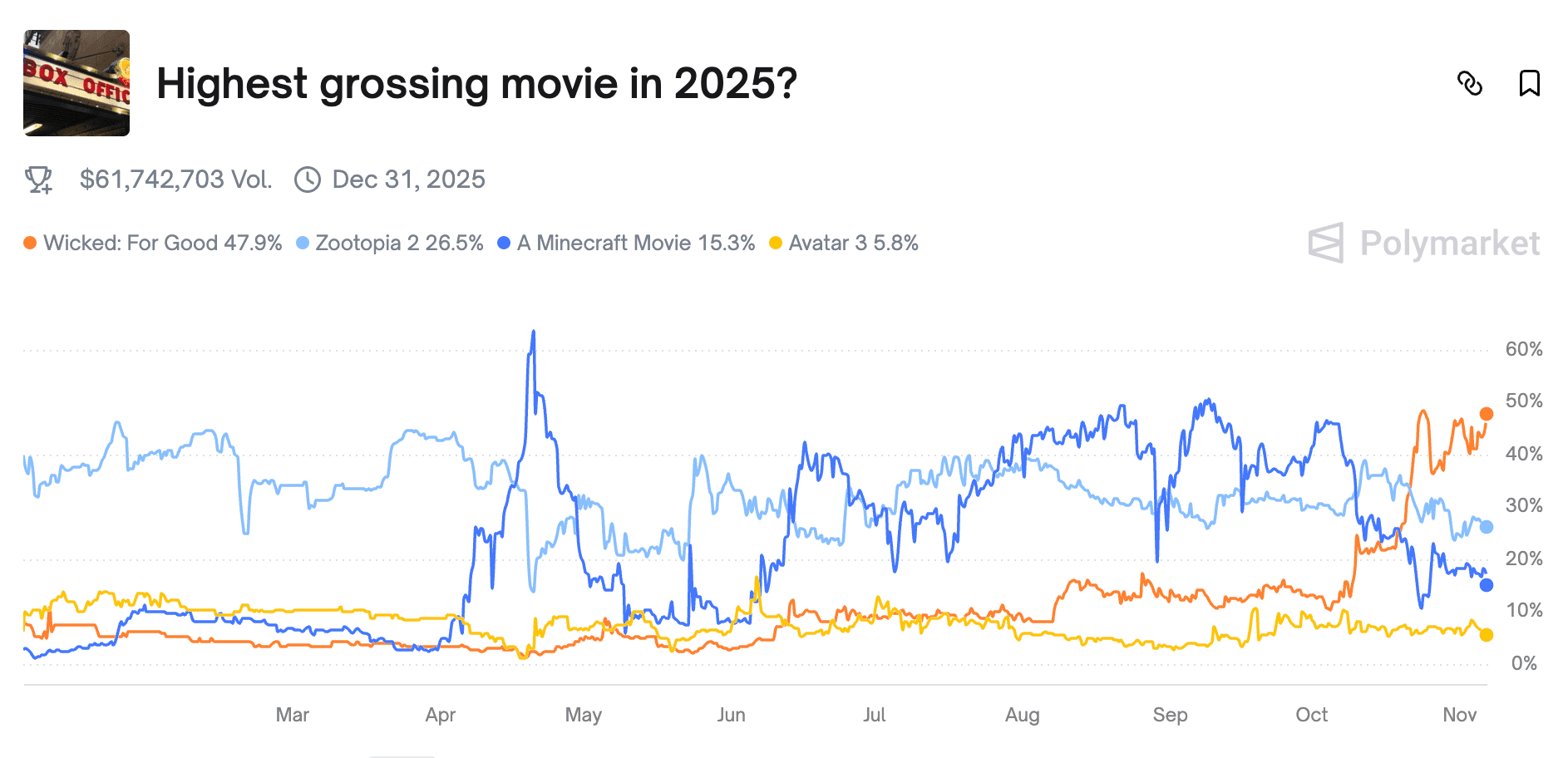

What Polymarket Is Really Saying

The prediction markets are more mature than most realize.

The $61.7 million in trading volume on the “Wicked: For Good wins box office” contract isn’t retail-level enthusiasm — that’s institutional-scale conviction. When liquidity hits that level, it reflects serious quant-driven participation.

According to Powerdrill Bloom’s insights, box office contracts with over $40M in volume have historically predicted outcomes within ±7% accuracy. That gives Wicked’s 48% odds real legitimacy — this is no meme bet.

However, the same dataset reveals something more interesting: sentiment mispricing intensifies at the tails.

In simple terms — markets overprice what feels safe, and underprice what feels tired. And in 2025, that bias is being written all over Avatar 3.

Why “Wicked: For Good” Looks Like the Safe Winner

Universal’s musical machine is one of the most predictable forces in Hollywood.

With a reported $370 million production budget, Wicked: For Good is not a gamble — it’s a capital deployment with institutional choreography.

The November 2025 release slot strategically positions it between awards season chatter and holiday family viewing — the same corridor where The Greatest Showman and La La Land transformed from modest openers to global earners.

Powerdrill Bloom’s insights, rates Wicked at 78.4% retention efficiency — second only to Mamma Mia! in modern adaptation history.

In other words, audiences know what they’re getting, and that’s exactly what Universal wants. Predictability, prestige, and playlist-friendly songs that dominate TikTok for six months straight.

So yes — Wicked deserves its near-even odds.

It’s the institutional favorite. But institutional favorites rarely deliver asymmetric returns.

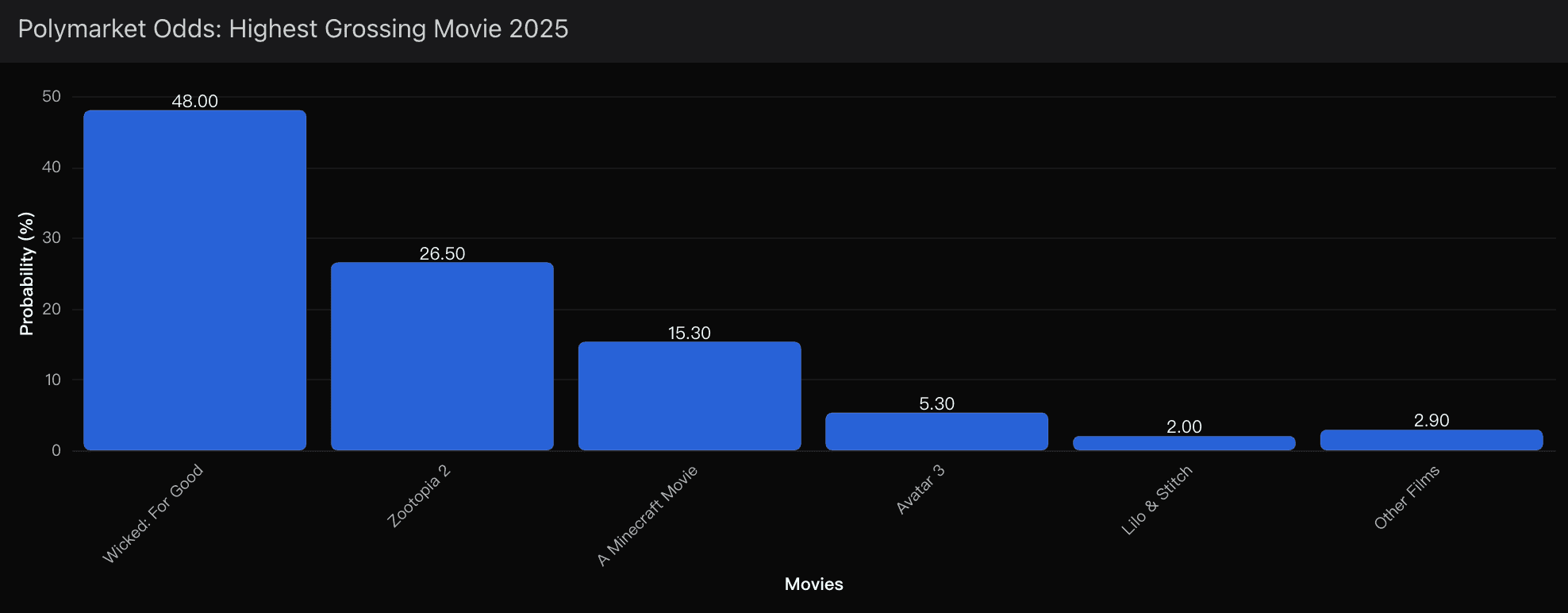

The Probability Table:

Film | Market Odds | My Adjusted Probability (via Powerdrill Bloom) | Notes |

|---|---|---|---|

Wicked: For Good | 48% | 48% | Efficiently priced. Institutional favorite with strong November timing. |

Zootopia 2 | 26.5% | 22% | Thanksgiving release fits Disney’s family slot but lacks theatrical urgency. Streaming dilution risk. |

Minecraft: The Movie | 15.3% | 10% | Peaked early in the year; strong but no longer relevant to year-end totals. |

Avatar 3 | 5.3% | 20–25% | Deeply undervalued given December release, China upside, and Cameron consistency. |

What this table really shows is market structure inefficiency.

The 26.5% vs 5.3% spread between Zootopia 2 and Avatar 3 is irrational when you compare their fundamental revenue trajectories.

Polymarket, like most prediction markets, is still weighted toward U.S.-centric retail traders.

That skews odds away from globally distributed earnings power — exactly the space Avatar 3 dominates.

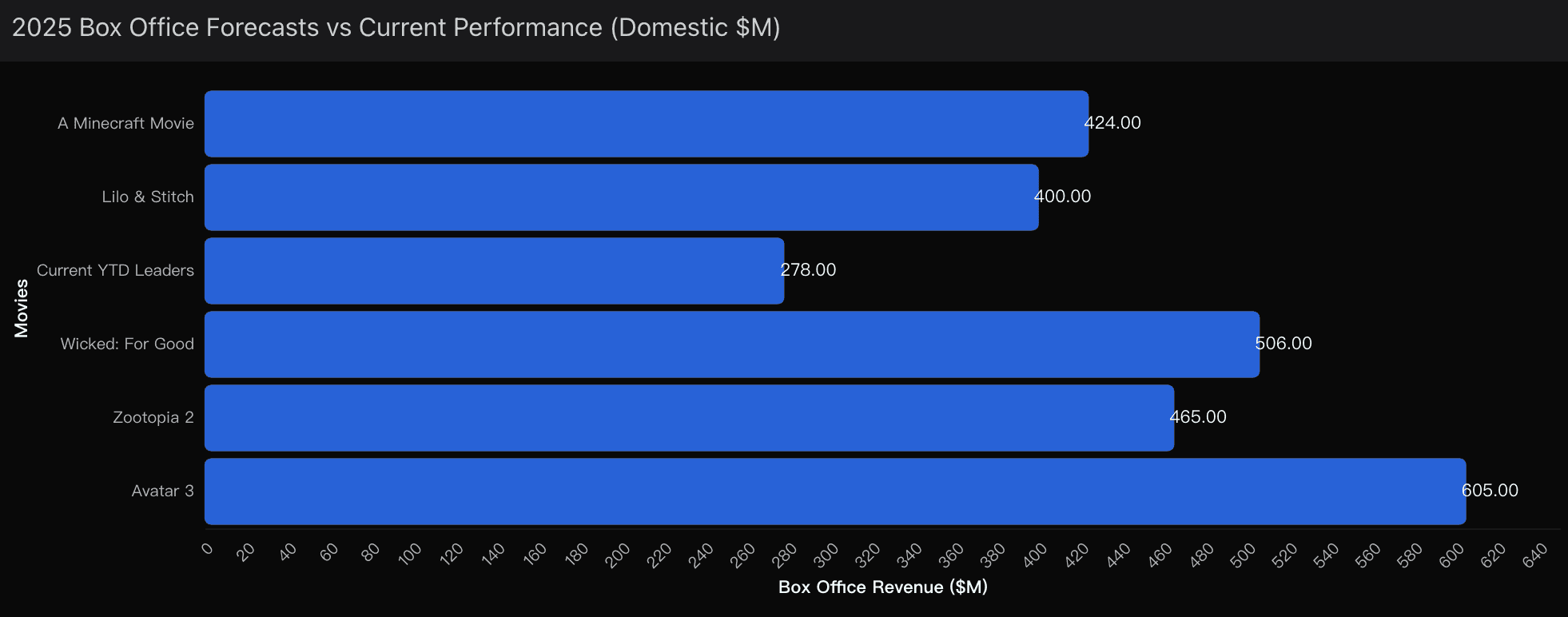

Why Powerdrill Bloom Keeps Flagging

When I feed Polymarket’s odds into Powerdrill Bloom, the system doesn’t look at headlines. It looks at behavioral divergence curves — how fast conviction moves relative to actual earnings forecasts.

Right now, Avatar 3’s volatility pattern resembles Top Gun: Maverick six months before release — underpriced, underestimated, and quietly building momentum under the radar.

The AI model’s adjusted probability curve for Avatar 3 is 22.4% median with a tail probability of 31% for breakout performance.

That means even a modest narrative shift — a trailer drop, a visual breakthrough, a China pre-sale surge — could reprice the odds dramatically.

The Year Markets Learn Humility

Every few years, prediction markets get humbled by art — by a creator who refuses to fit statistical expectation.

2025 feels like that kind of year.

Wicked will charm awards voters, dominate TikTok, and make Universal a fortune. But Avatar 3 could remind traders — and algorithms alike — that emotional fatigue is not the same as market saturation.

When Powerdrill Bloom and I look at the data, one message keeps surfacing:

Don’t underestimate a filmmaker who has broken every forecasting model that ever tried to price him.

Because if history rhymes even slightly, December 2025 won’t belong to Broadway.

It’ll belong — once again — to Pandora.