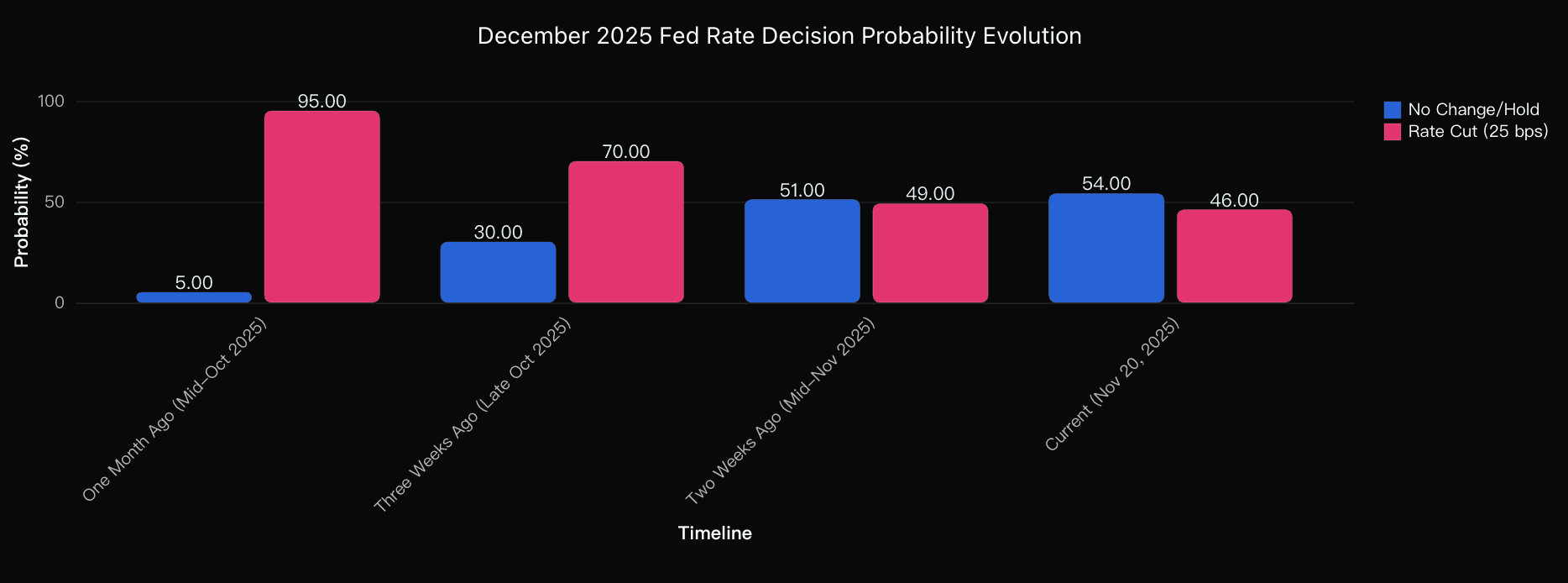

Two weeks ago, if you had asked me about the December 2025 FOMC decision, I would have said the market was essentially finished debating it. The narrative was clean, the probabilities were overwhelming, and the path was predictable. A 25 bps rate cut was priced at 95%, Treasury markets had already pre-adjusted, and traders were more focused on 2026 positioning than December volatility.

And yet here I am on November 20, staring at a completely different macro landscape—one that flipped with astonishing speed.

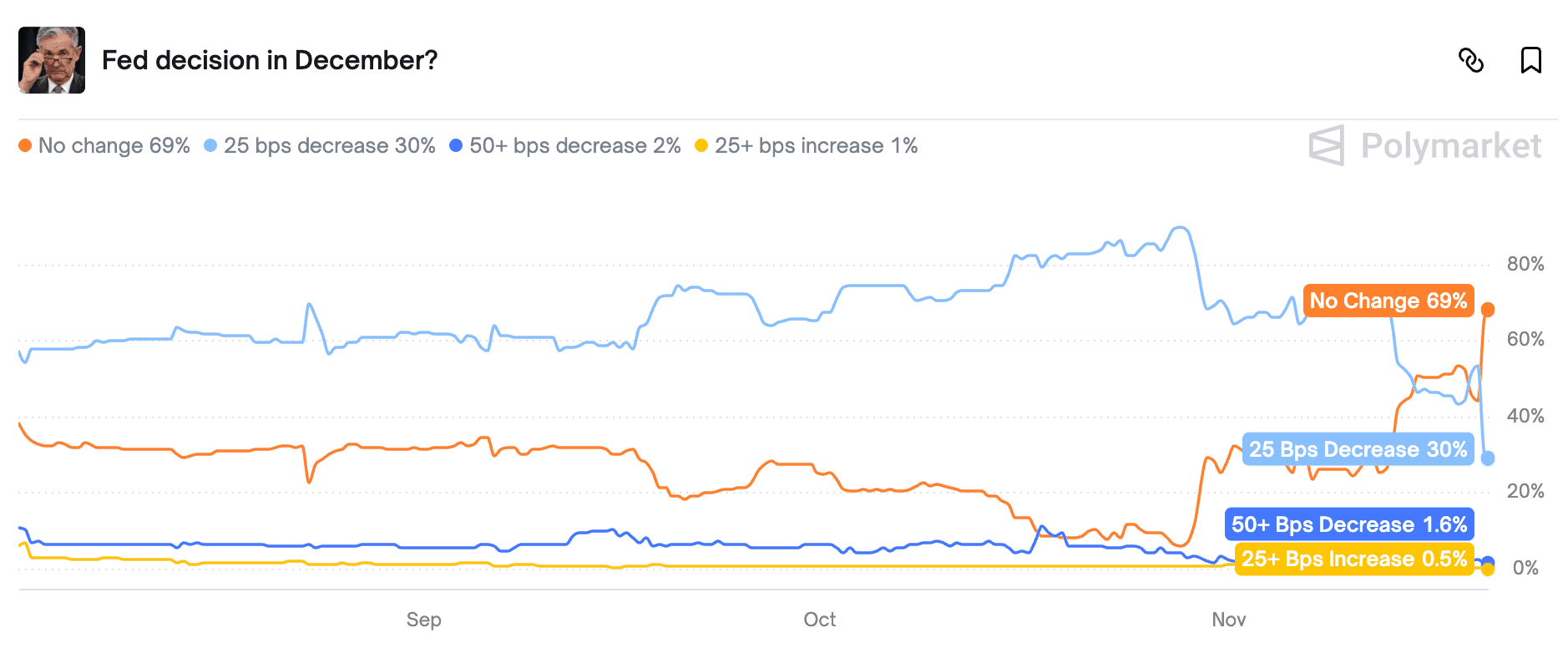

Today, my models show only a 44–46% probability of a cut, and a 54–56% probability the Fed does absolutely nothing.

This isn’t a minor adjustment.

It’s a collapse—a reversal so abrupt that even seasoned macro traders are still recalibrating. As I fed the recent Fed speeches, swaps repricing patterns, and data delays into Powerdrill Bloom, my AI forecasting engine, the trend became clearer: this is no longer a dovish cycle. It’s a coin flip driven by uncertainty, data scarcity, and a hawkish resurgence inside the Federal Reserve.

But why the reversal? Why now? And what exactly tipped the balance?

Let me walk through how I arrived at my 54–56% “Hold” probability—and why this meeting could go down as one of the most chaotic decisions of Powell’s tenure.

From 95% Cut → 30% Cut in One Month

A 65-point swing in rate expectations over 30 days is rare. A collapse from near-certainty to a coin flip is almost unheard of.

Here’s the timeline that Powerdrill Bloom surfaced when I ran a historical comparative analysis:

October 2025: Markets price a December cut at 95%, assuming a clean dovish glide path.

November 20, 2025: Markets now price the cut at 30%; probability of no change explodes to 69%.

This is, by every measure, one of the sharpest sentiment reversals in modern Fed-watching.

The causes aren’t subtle—they’re structural.

Why the “Hold” Now Dominates My Forecast

1. The Hawkish Federation Effect

In mid-November, a hawkish trio—Schmid (Kansas City), Logan (Dallas), and Hammack (Cleveland)—launched what appears to be an intentional, coordinated signal campaign.

Their message:

“Inflation remains too hot. Policy is appropriately restrictive. We see no urgency to cut rates.”

The October Fed minutes reinforced the shift:

“Strongly differing views” within the committee, with the hawkish bloc gaining influence.

When Powerdrill Bloom mapped speaker impact over time, it highlighted something subtle:

These three officials historically move market probabilities more than their regional roles imply, because they speak when leadership wants to shift expectations. That matters—because it means this hawkish pivot is not accidental. It’s strategic narrative engineering.

This alone pushed my hold probability above 50%.

2. The Catastrophic Information Gap

This is the shock that even veteran Fed analysts struggled to process.

The Bureau of Labor Statistics announced:

October jobs report → CANCELLED entirely.

November jobs report → Delayed to Dec 16.

(Six days after the FOMC meeting)

In over a century of modern U.S. labor statistics, this has never happened during a live policy window.

The result?

The Fed enters the December 10 meeting blind—without fresh labor data, without payrolls, without unemployment numbers, without job openings. The core empirical pillar of Fed decision-making simply does not exist this cycle.

When I modeled this through Powerdrill Bloom, the algorithm spit back a consistent insight:

When data is missing, the Fed defaults to the more conservative path.

And the more conservative path is: do nothing.

This data blackout is the single strongest argument for a hold.

3. Inflation Refuses to Break — The Sticky 3% Problem

Even before the jobs data vanished, inflation was not cooperating.

Core inflation remains above 3.0–3.2%, stubbornly distant from the Fed’s 2% target. This gives hawks ammunition, but more importantly, it removes the political cover for a rapid pivot downward.

The Fed’s internal debate now frames inflation as:

“Persistent”

“Uncomfortably elevated”

“At risk of re-acceleration under premature easing”

Inflation data is turning into a veto point.

Unless core inflation drops meaningfully, cutting now looks like negligence.

Powerdrill Bloom now treat sticky inflation as a structural barrier—one that reduces cut probability by 10–12 percentage points on its own.

Final Take

After synthesizing:

The hawkish messaging wave

The unprecedented labor data blackout

Sticky inflation

Swap market confusion

Powell’s political window

The tariff wildcard

Probabilistic simulations via Powerdrill Bloom

…I arrive at a clear but cautious conclusion:

December 2025 FOMC Outcome

No Rate Change (HOLD): 54–56% probability

25 bps Cut: 44–46% probability

The Fed is not ready.

The data is insufficient.

The hawks have the microphone.

And the cancelled employment reports leave policymakers flying without instruments.

In an environment like this, inaction becomes the safest action.

Or, as Powerdrill Bloom summarized in its last run:

“When uncertainty dominates signal, the rational baseline is stasis.”

And that is exactly where I expect the Fed to land in December.