The possibility of a SpaceX IPO has sparked widespread speculation. Investors and analysts are asking the same question: which bank will take the lead on this landmark deal?

As someone who studies global market trends and emerging financial opportunities, I used Powerdrill Bloom to consolidate reports, historical patterns, and relationship data. The tool helped me visualize probabilities and highlight which banks are genuinely in contention.

This is a Powerdrill Bloom-generated infographics preview based on my question:

What quickly became clear is that this isn’t just about which banks participate — it’s about who secures the lead-left role, the most senior position in the underwriting syndicate. Early signals already point toward a frontrunner, and the story reveals how relationships, track record, and strategic positioning intersect in high-stakes IPOs.

1. Core Prediction & Probability Assessment

Core call: Morgan Stanley is the most likely bank to serve as the de-facto lead (lead-left / most senior joint bookrunner) on a SpaceX IPO.

Why this matters: for investors and market participants, the bank that wins the lead role typically captures the largest allocation influence, the highest branding benefit, and the most visible association with a marquee listing.

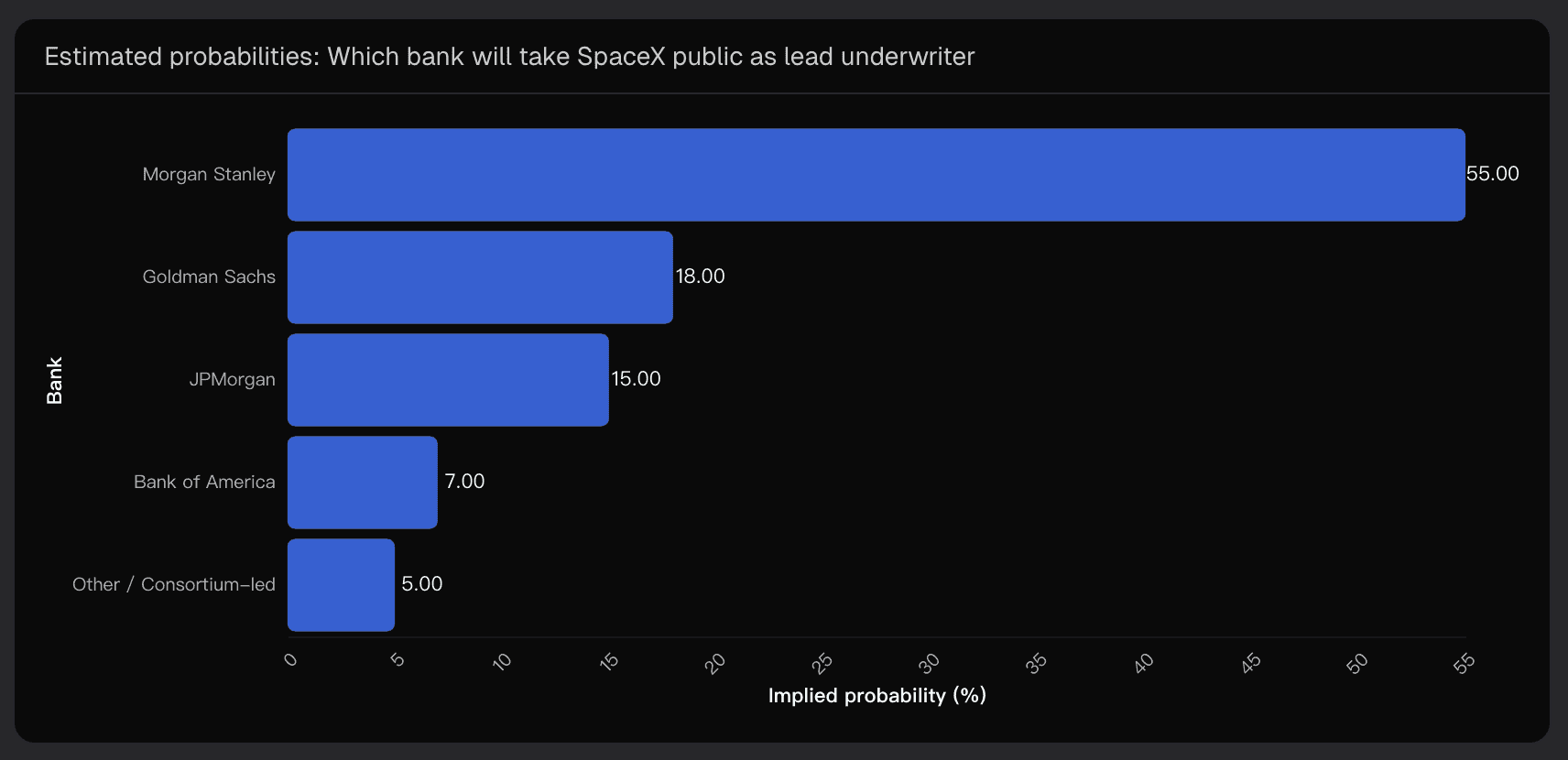

Probability distribution (research-based estimate):

Morgan Stanley: 55%

Goldman Sachs: 18%

JPMorgan: 15%

Bank of America: 7%

Other / no clear single lead: 5%

For readers: these are analytic probabilities synthesizing reported syndicate shortlists, relationship history, and franchise considerations — not market quotes.

2. Supporting Evidence & Primary Drivers

I grouped the evidence into three interlocking drivers that explain why Morgan Stanley leads the field.

2.1 Confirmed Senior Shortlist

Multiple financial-press summaries consistently name a four-bank senior line: Morgan Stanley, Goldman Sachs, JPMorgan, and Bank of America. That anchors the contest: any credible outcome must treat those four as top-tier participants.

2.2 Relationship Capital Favors Morgan Stanley

A decisive edge for Morgan Stanley is persistent relationship capital with Elon Musk and his ecosystem:

Historic public-equity work tied to Musk-led companies (e.g., early Tesla mandates).

A central role in financing and structuring large, high-complexity deals (notably aspects of the Twitter/X financing).

Cross-linked personnel and trusted advisers who moved between Musk projects and Morgan Stanley — a pattern that repeatedly yields marquee mandates.

In short: repeated high-profile mandates + personal trust = higher probability that Morgan Stanley receives the marquee underwriting economics.

2.3 Franchise Strength of the Alternatives

Goldman and JPM remain credible challengers because of deep ECM franchises and experience on mega-IPOs. Bank of America is logically in the senior mix for distribution and balance-sheet support but — given the current reporting and relationship narrative — appears less likely to secure the single top billing.

3. Key Uncertainties That Could Shift the Outcome

Even with strong evidence, several plausible scenarios could rework these odds.

Deal structure changes: SpaceX could delay, pursue a partial listing (e.g., Starlink carve-out), or choose a different jurisdictional structure — any of which would reshuffle bank economics and roles.

Musk’s discretionary decisions: Musk’s history of idiosyncratic choices means he could reward or penalize banks on non-ECM criteria (public commentary, litigation history, perceived loyalty). That injects non-linear risk.

Regulatory and political sensitivity: SpaceX’s defense and national-security footprint introduces latent regulatory/political preferences that might favor or disqualify specific banks.

Internal bank capacity: A mega-raise requires deep balance-sheet commitments and top ECM teams; competing mega-deals or capital constraints could alter who is willing — or able — to take lead economics.

Late entrants or reshuffling: Large international houses or niche distribution partners could be added late, diluting the “lead-left” concept.

4. Monitoring Key Signals and Observations

To refine the probability assessment in real time, several concrete signals are worth tracking:

Official filings: Any S-1 or registration document that names joint bookrunners or identifies the lead-left bank.

Regulatory or syndicate announcements: Leaked decks, press releases, or filings indicating the order of seniority among underwriters.

Relationship shifts: Major financing events, acquisitions, or public disputes that could influence Musk’s choice of banks.

Conclusion

Based on current reporting and relationship patterns, Morgan Stanley emerges as the highest-probability lead-left candidate, supported by confirmed inclusion in the senior syndicate and historic deal relationships.

Goldman Sachs and JPMorgan remain strong co-lead contenders, while Bank of America is likely to participate as a senior underwriter but with lower probability of securing the single lead role.

These observations provide a structured framework for updating predictions as new filings and market signals appear. I produced this synthesis after consolidating public reports, relationship signals, and syndicate logic using Powerdrill Bloom to create the probability matrix and visual summaries that informed the prediction.

Disclaimer: This is a predictive analysis based on public reporting and relationship evidence, not investment or legal advice.