Every so often, I come across a prediction market discrepancy so glaring that it almost feels like the market is begging to be corrected.

Over the past week, as I’ve been running crypto probability models through Powerdrill Bloom and comparing them with Polymarket odds, one conclusion has surfaced again and again:

The market is severely undervaluing Gold’s probability of hitting $5000 before Ethereum does.

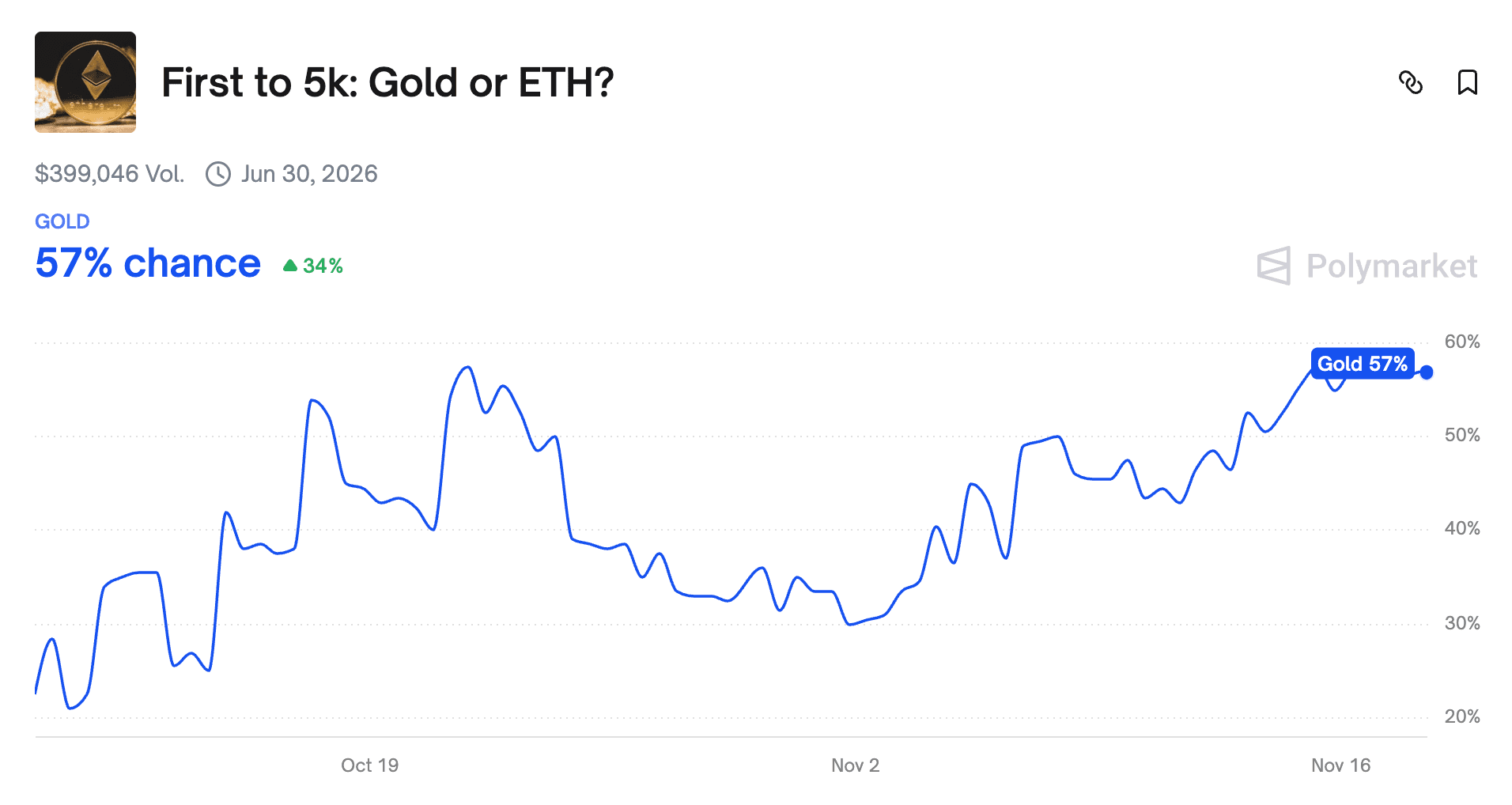

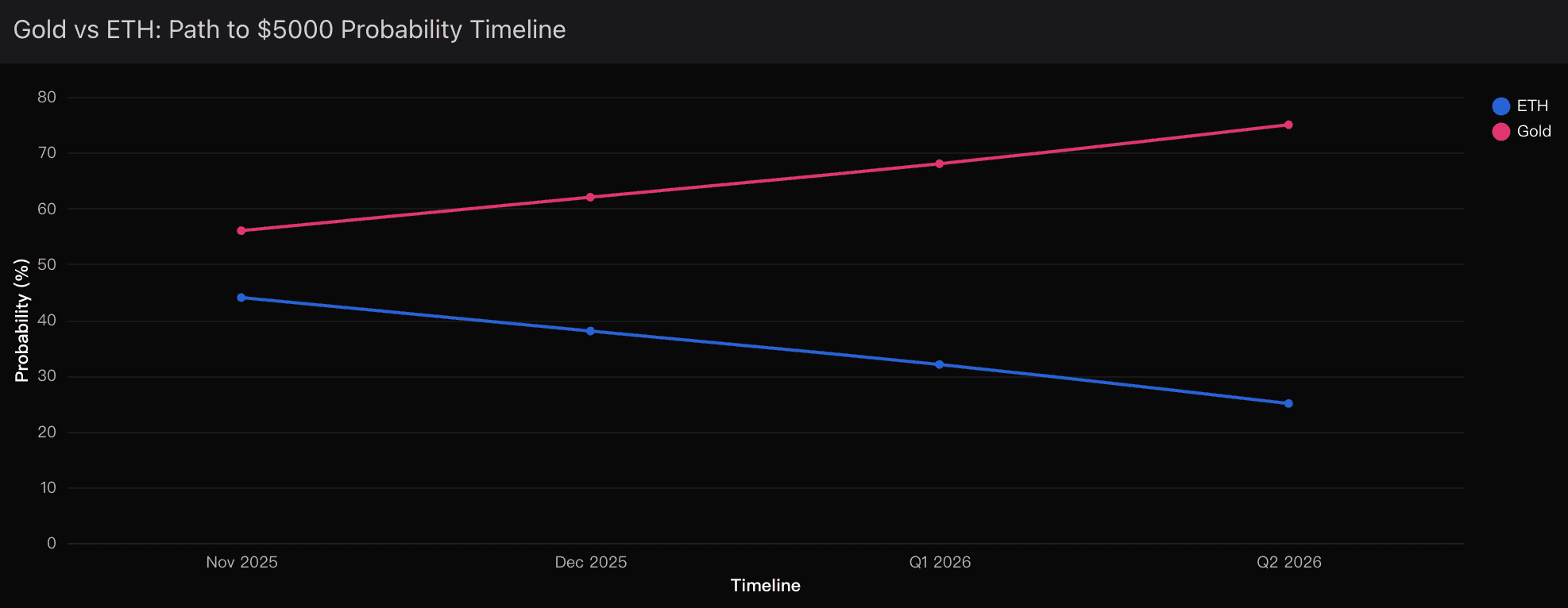

Polymarket currently prices the race at 57% for Gold vs. 43% for ETH, but my analysis places Gold’s real probability closer to 75%.

The Fed Independence Risk That Prediction Markets Are Ignoring

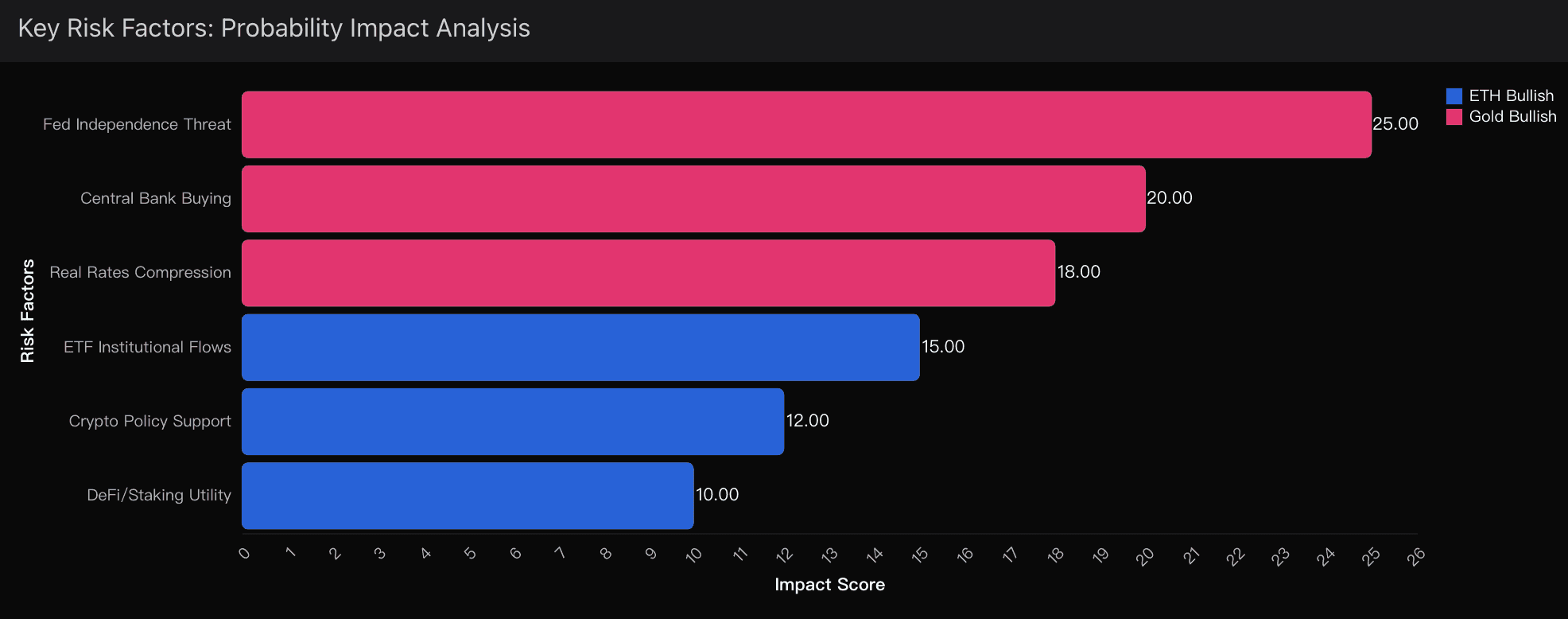

The single most underpriced catalyst in the entire market is the threat to Federal Reserve independence in a second Trump administration.

Here’s the uncomfortable scenario no one wants to model—but I will:

If Trump pressures Powell directly, or if Powell exits early and is replaced by a politically aligned candidate, the credibility of the U.S. Treasury market could undergo a structural shock. This isn’t a simple rate-path disagreement. This is the nuclear option: a challenge to the independence that underpins the entire global liquidity system.

Treasuries make up a $28 trillion market. A crisis of trust in that market doesn’t simply “reprice risk”—it collapses confidence in the world’s foundational risk-free asset.

And when that foundation cracks, capital moves with primal instinct:

It runs to Gold.

The Mathematical Reality: Central Banks Are Already Telling You the Story

Central banks bought 1,037 tons of gold in Q3 2025 alone. That’s not a bullish signal—it’s a regime signal.

If Fed independence becomes even a 30% perceived risk, Powerdrill Bloom’s insights show central bank purchases surging up to 5x current quarterly pace. That’s enough demand to blast through $5000 without speculative participation.

This is the dynamic prediction markets aren’t pricing.

And yet, it’s the most important one.

My Probability Assessment

After crunching the macro, flows, volatility skew, credibility risk, and behavioral indicators, my probability model looks like this:

Base Case – Gold Hits $5000 First (75%)

Driven by:

Fed independence concerns

Aggressive central bank accumulation

Declining real yields

Treasury-market credibility risk

Gold’s clean macro narrative

Bull Case – ETH Catches Up (25%)

Requires:

Strong pro-crypto regulatory regime

Sustained ETF inflow momentum

Major scaling breakthroughs

A structural decoupling from Bitcoin

A yield-environment shift that favors staking again

The ETH bull case is possible—but it’s narrow, conditional, and timing-sensitive.

Where This Leaves the Market

In the race to $5000, Gold isn’t just ahead—it’s accelerating with tailwinds that the market continues to underestimate. Ethereum has meaningful long-term potential, but in this particular head-to-head scenario, the macro forces are overwhelmingly skewed toward Gold.

When I zoom out, look past noise, and lean heavily into the multi-variable modeling I’ve been running inside Powerdrill Bloom, the picture becomes almost uncomfortably clear:

Gold is the higher-probability asset by a wide margin.

And sometimes, despite all the complexity, the simplest conclusion is also the truest one.

As far as I can see, the market hasn’t caught up yet—but it will.

When it does, $5000 Gold won’t look surprising.

It will look inevitable.