I don’t make bullish calls lightly. When I say I’m positioning for a December rebound in Bitcoin, I mean it with a mix of caution, conviction, and a data-first playbook.

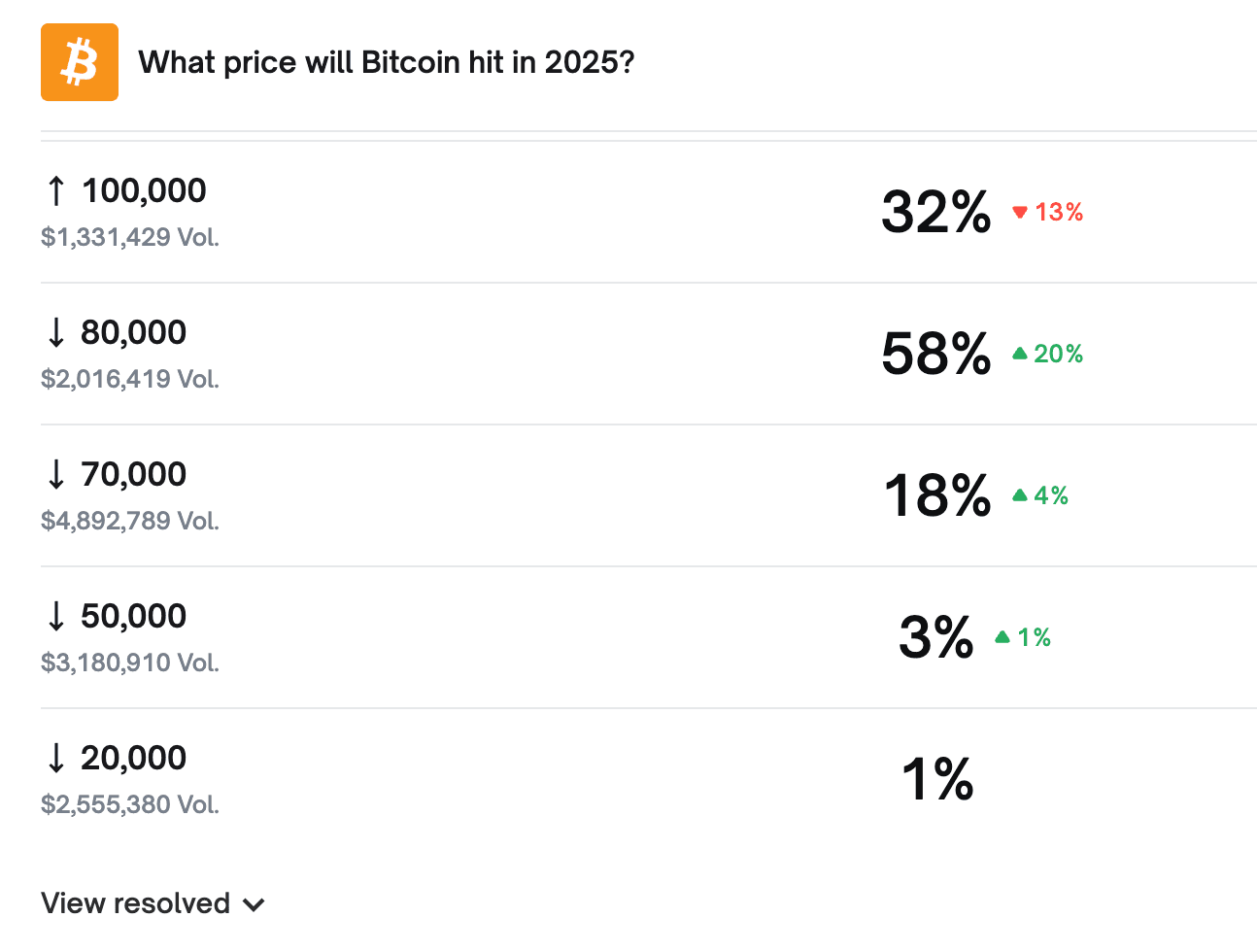

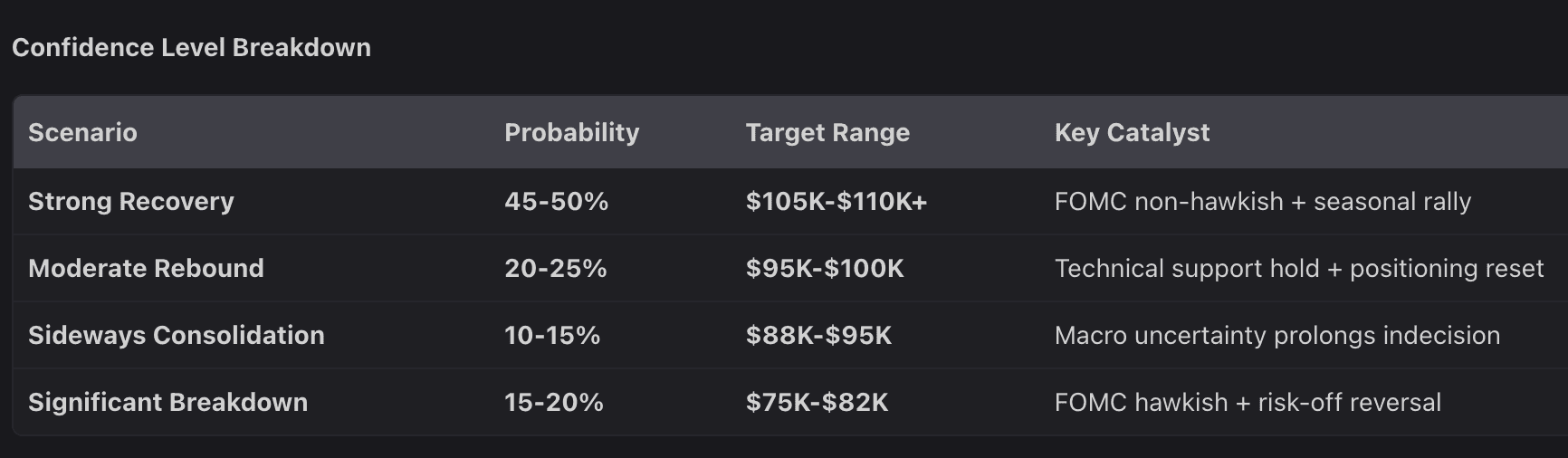

The market sits below $90,000, volatility is elevated, and the calendar carries a politically charged tail risk — yet the balance of structural signals points to a higher-probability relief rally into year-end. My base forecast: Bitcoin is likely to recover into the $105,000–$110,000 range by December 31, with a 65–70% confidence window for significant December upside (roughly 15%–25% from current levels).

I still assign a meaningful 30–35% risk of a downside scenario that retests $80,000–$82,000.

I’ve run these scenarios through Powerdrill Bloom, an AI-driven forecasting engine I use to blend seasonality, on-chain flows, derivatives positioning, and macro catalysts. When the machine converges with my market instincts, I listen closely.

The Market Mechanics Lifting My Confidence

Leverage Reset & Negative Funding: Recent data shows a meaningful deleveraging event — roughly $355M of long liquidations and $301M of shorts closed in a single 24-hour stretch. Funding rates flipped negative (first sustained instance since October 17, 2025), which historically signals seller exhaustion and sets the stage for relief rallies.

Long/Short Ratio Compression: We’re seeing one of the lowest long/short ratios since September 2022. This is the classic ingredient for a squeeze: if traders are overwhelmingly short and funding turns hostile to shorts, a modest rally can cascade into accelerated covering.

Whale Activity & Rebalancing: While some large entities moved short in recent weeks, evidence of repositioning — and the reappearance of long-side whale orders — suggests institutional actors are preparing for year-end allocations.

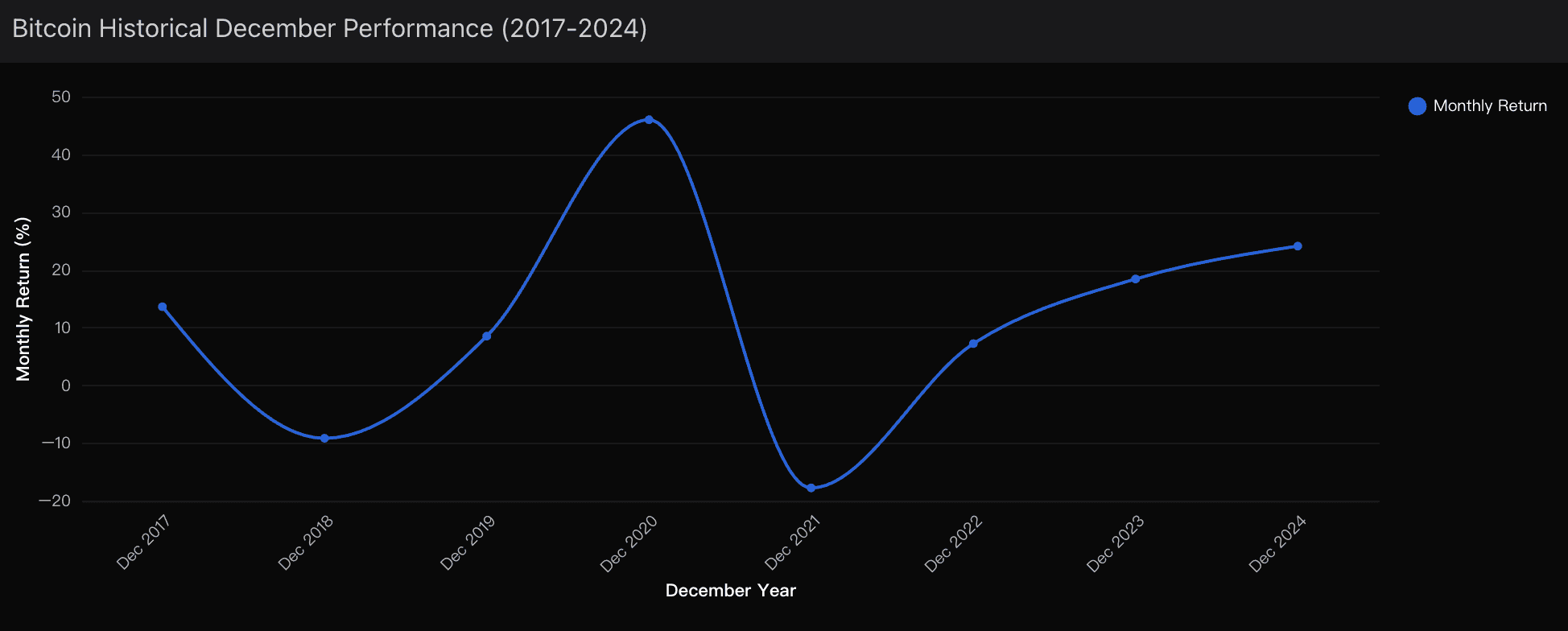

Seasonal and Portfolio Rebalancing Tailwinds: The Dec 15–31 window typically sees hedge funds and institutional treasury managers reweight portfolios. If risk-on flows appear even modestly, crypto routinely benefits due to its beta-like behavior during rotation events.

Powerdrill Bloom synthesizes these signals, magnifies scenario convictions where patterns replicate historical rebound archetypes, and outputs a probability-weighted path that favors a December recovery when macro signals are neutral to supportive.

The Technical Map I’m Watching

Primary support: $80,000–$82,000 — a true demand cluster after the recent washout.

Immediate trading band: sub-$90k to $100k — where much of the reconsolidation will happen.

Key resistance: $100,000 psychological handle; $105,000 intermediate; $117,000–$123,000 structural supply.

This technical topology favors a bounce test toward $100k, with a plausible extension into the $105k–$110k window if short covering accelerates and institutional flows re-enter.

What Could Still Upend This View

I’m pragmatic about downside paths. My 30–35% bear probability is centered on three possible shock vectors:

FOMC Hawkish Surprise (Dec 12): A clearly hawkish message would tighten financial conditions and likely trigger a rapid test of $80K support.

Geopolitical or Regulatory Shock: Any sudden flight to safety or pre-inauguration regulatory escalations would override technical setups.

Liquidity Voids & Holiday Thinness: Thin volumes in late-December can amplify moves; a directional shove during low liquidity could produce outsized downside.

If $80K fails, the market mechanics could cascade into $74K–$75K territory — an extreme but plausible tail event.

Probability-Weighted Outcome

Most likely (60–65%): Bitcoin rallies to test $100K–$105K by mid-December; non-hawkish Fed tone accelerates the move; year-end close in the $105K–$110K band.

Base case (9%–20% upside from current levels): Finish December between $98K–$108K.

Bear tail (30–35%): Fed hawkishness or a macro shock pushes price to test $80K–$82K; deeper extremes possible with cascading liquidity events.

Patiently Optimistic

I am cautiously optimistic that December will deliver a meaningful relief rally. The confluence of seasonality, a cleaner order book after heavy deleveraging, negative funding dynamics, and active whale repositioning combine into a picture that — when filtered through Powerdrill Bloom’s probability engine — favors upside into $105K–$110K by year-end, provided the macro backdrop doesn’t reassert dominance.