My base-case prediction remains firm: Bitcoin will cross $100,000 again before December 31, 2025.

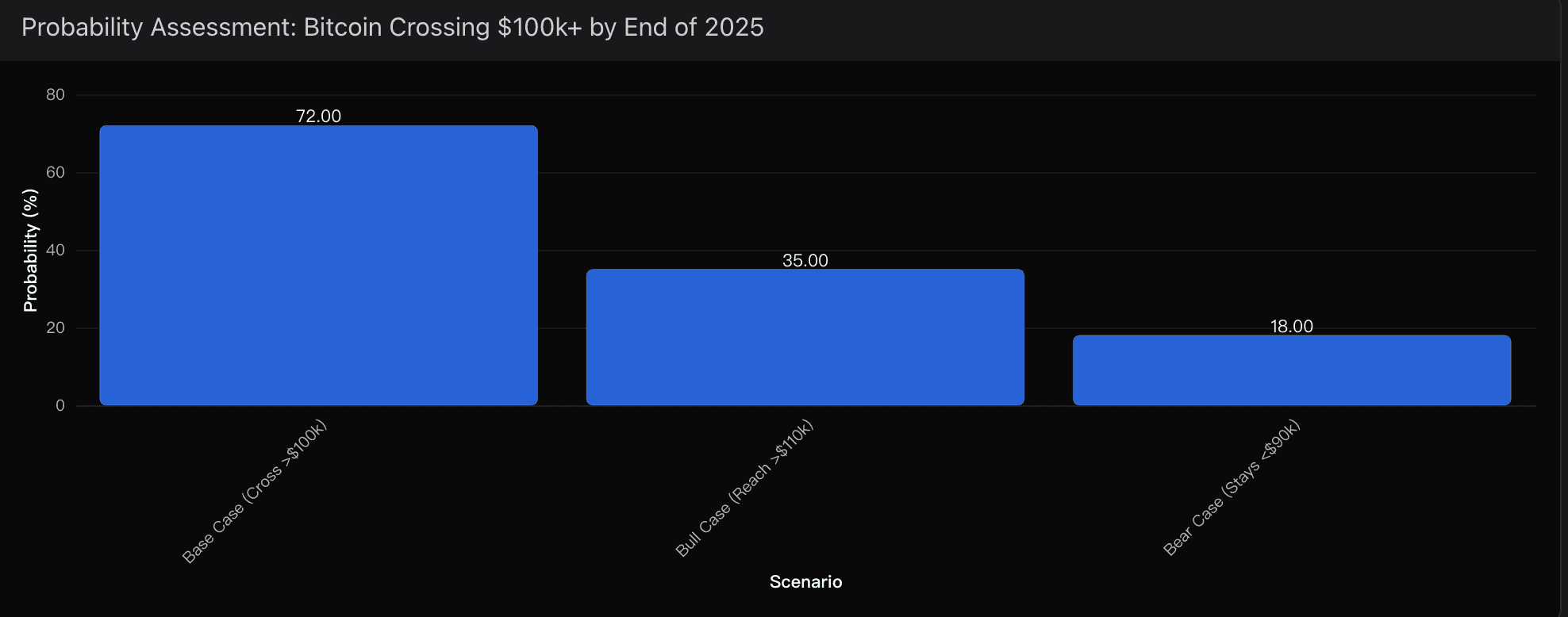

And I’m assigning that outcome a 72% probability.

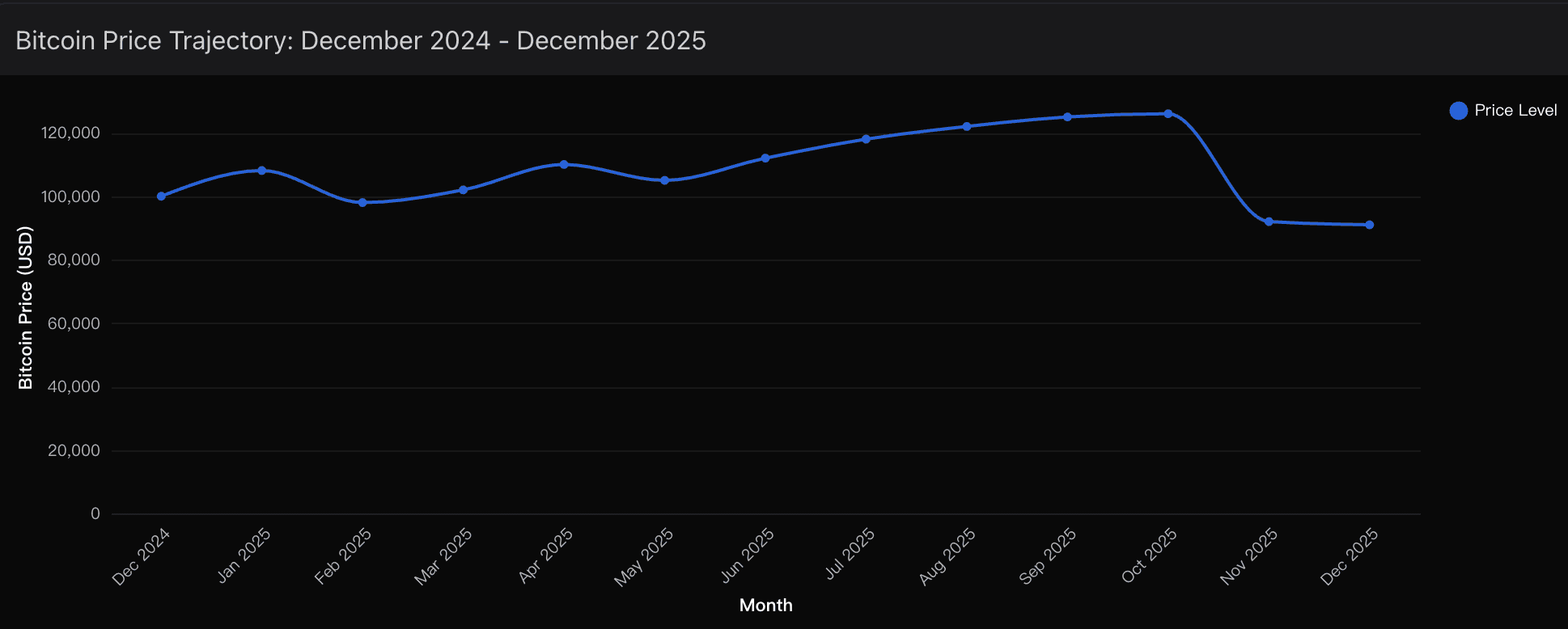

This isn’t blind optimism or end-of-year hopium. It’s a data-anchored, market-structure-driven view shaped by on-chain momentum, historical recovery patterns, and a surprisingly resilient technical foundation. With Bitcoin currently trading in the $91,000–$94,000 range, the final push required is just 6–9%—a trivial distance given the asset’s volatility signature throughout 2025.

Let me break down how I arrived here.

72% Probability

The starting point is simple: Bitcoin has repeatedly shown throughout 2025 that it can reclaim the six-figure line even after deep drawdowns. The recent correction from the October ATH of $126,000—around a 30% retracement—was violent but not structurally damaging.

When I ran my year-end recovery scenarios through Powerdrill Bloom, layering in volatility clusters, liquidity flows, and seasonality factors, the model consistently converged on a narrow range of outcomes:

Base Case (72%)

Bitcoin recovers into the $100K–$110K zone by year-end, driven by:

Institutional rebalancing and window-dressing

December retail momentum

FOMO cycles triggered by proximity to six-figure levels

Bull Case (35%)

A more aggressive scenario where Bitcoin pushes past $110K+ on a liquidity burst—possibly triggered by a regulatory catalyst or an ETF-driven inflow event.

Bear Case (18%)

Persistent macro stress caps Bitcoin below $100K, keeping it stuck in the $85K–$95K channel.

What makes the 72% estimate compelling is how tightly it aligns with historical price behavior whenever Bitcoin has hovered just below a psychologically critical threshold. In 2025 alone, Bitcoin crossed above and below $100K multiple times in 24–72 hour bursts.

We are not asking for a miracle here—just another volatility-normalized bounce.

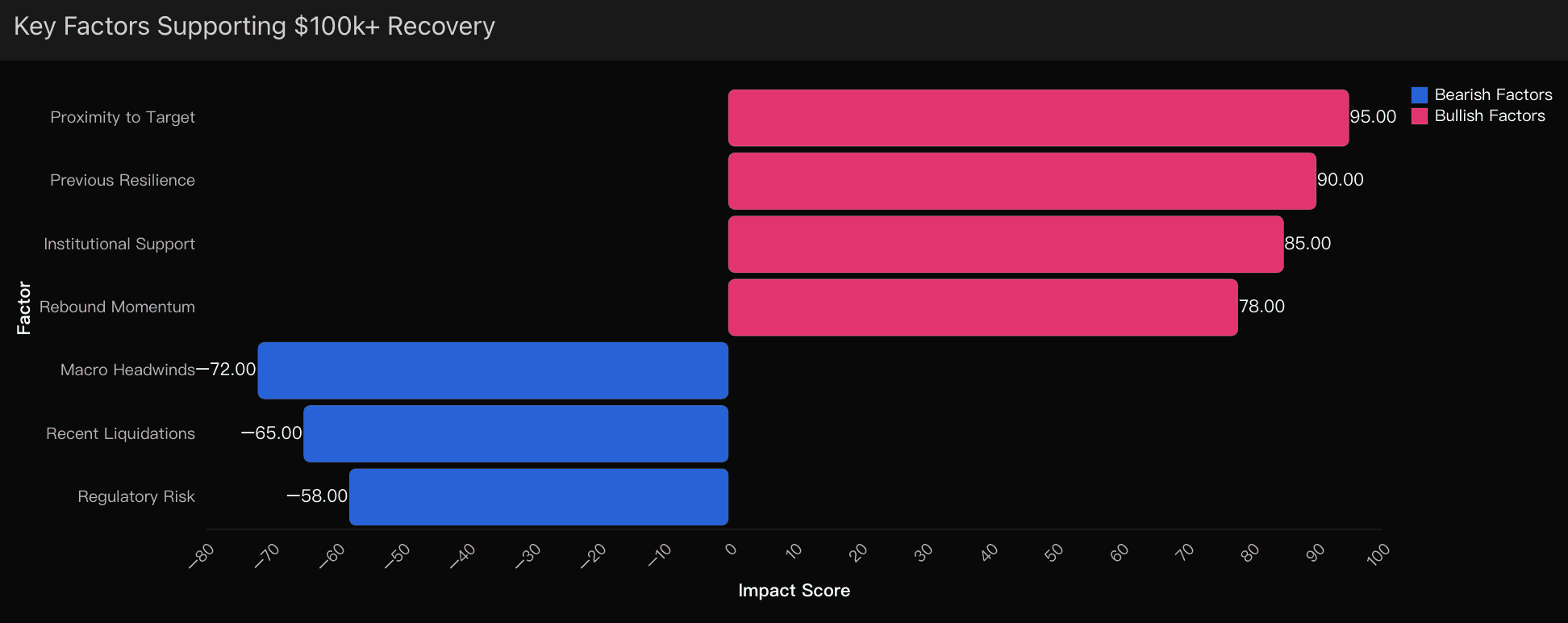

Evidence That Supports a December Breakout

Technical Proximity and Support Integrity

Bitcoin is less than $9,000 away from the target.

That’s a single-digit percentage recovery, well within the weekly swings we’ve seen all year.

The rebound from $84K to $91K+ earlier this month is particularly important. That level—$84K–$86K—has now acted as a structural support zone three times in 2025. Each touch has triggered strong buying pressure and short-covering.

To me, that’s a clear reversal signal.

Year-End Seasonality Is a Real Force

December has always been a strange month for crypto:

Tax-loss harvesting feeds into January repositioning

Retail buying spikes after bonus season

Trading volume rises as holiday FOMO narratives spread

Momentum traders front-run Q1 optimism

This year, the dominant narrative across crypto Twitter, Telegram groups, and even institutional research desks is clear:

“Q1 2026 will set new all-time highs.”

Markets don’t wait for confirmation—they price in the story.

And that story is bullish.

Risks That Could Derail the Run

This isn’t a straight-line forecast. Powerdrill Bloom applies roughly a 15% probability deduction due to macro and systemic risks.

Federal Reserve Surprises

A hawkish pivot could spill into all risk-on assets.

Bitcoin’s correlation with equity volatility has risen in 2025, meaning any sudden spike in VIX could drag BTC into another drawdown.

Liquidation Cascades

We saw $1B in long liquidations during the November correction. Leverage remains elevated, especially from traders who went heavy at $120K+ levels.

A break below $85K could trigger a second wave.

Regulatory or Geopolitical Shocks

U.S. enforcement actions

Stablecoin regulatory tightening

Restrictions on cross-border crypto flows

Any of these could suppress year-end liquidity.

Final Assessment:

After reviewing:

the fast rebound from $84K to $91K,

the shallow distance to $100K+,

healthy year-end demand from both institutional desks and retail traders,

and multiple supportive technical markers,

I’m maintaining my 72% conviction that Bitcoin will close 2025 back above six figures.

This is exactly the kind of environment where I rely heavily on Powerdrill Bloom—its multi-factor simulations compress millions of market states into a single, clean probability curve. And all my latest runs point to the same conclusion:

Bitcoin has enough momentum, liquidity, and psychological tailwind to make one last push.