Over the past few months, I’ve been closely tracking the gaming landscape for 2026, using Powerdrill Bloom’s advanced data analysis to study trends across different gaming ecosystems. The insights from Powerdrill Bloom, backed by extensive data and probability assessments, have revealed a clear picture of what to expect in the gaming industry. After running the numbers and analyzing the key market shifts, the conclusion is straightforward:

Core Prediction for 2026: Dual-Dominance Model

The gaming market in 2026 will be shaped by two key forces:

Mobile-native franchises will dominate, commanding around $110–118 billion in total revenue, representing 58% of the market.

The Grand Theft Auto VI (GTA VI) release will create an unprecedented revenue spike in the premium console segment, though the true leadership position will be held by cross-platform ecosystem leaders, with Fortnite emerging as the top performer across all platforms.

This dual-dominance model isn’t just based on speculation—it’s grounded in data that shows the market's natural progression. I used Powerdrill Bloom to break down this scenario, and here’s what I found.

Primary Market Leaders in 2026

The top contenders for the 2026 gaming crown are as follows:

Mobile-native Ecosystems: Games like Candy Crush, PUBG Mobile, Fortnite Mobile, and Pokemon TCG Pocket will lead the charge, with strong, consistent revenue generation from their massive user bases.

Grand Theft Auto VI: Rockstar’s next installment in the GTA series will be the defining event for premium console gaming in 2026.

Fortnite: This cross-platform juggernaut will continue to outpace competitors by leveraging its ability to engage players across console, PC, mobile, and cloud.

Pokemon Franchise: With its convergence of mobile gaming and traditional platforms, the Pokemon ecosystem will maintain its leadership in terms of engagement and revenue.

Call of Duty: The Call of Duty series will continue to serve as an established anchor for the gaming market, sustaining high levels of engagement.

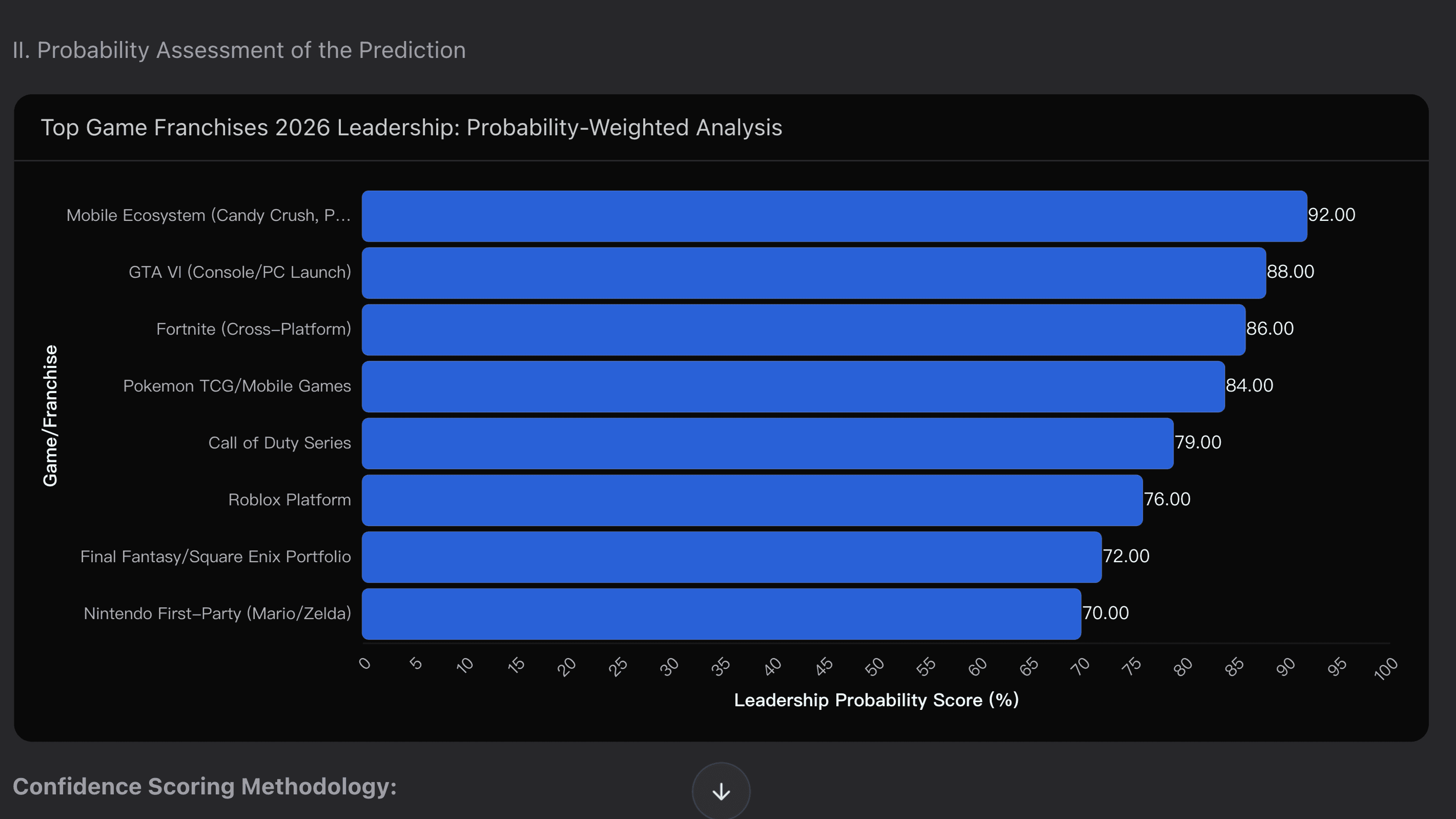

A Probability-Weighted Forecast

These conclusions are based on a probability-weighted analysis, incorporating historical data, growth trends, and consumer behavior. Here’s a quick breakdown of how the top games measure up for 2026:

Mobile Ecosystem (92% confidence): Data shows that mobile gaming has already captured between 49-58% of the market share as of 2025, with projected growth putting the total revenue between $110-$118 billion by 2026. Given the inevitability of mobile dominance, the forecast here is virtually locked in.

GTA VI Launch Impact (88% confidence): The launch of GTA VI will likely generate $3-5 billion in its first 12 months (May 2026 through Q2 2027). Rockstar's ability to command high prices—coupled with its massive fanbase of serious players willing to pay premium prices—creates an extraordinary revenue opportunity. However, there's some risk here, as variations in performance could see revenue swing by as much as +25% to -15% depending on public reception, technical issues, and economic conditions.

Fortnite Cross-Platform Leadership (86% confidence): Multi-platform play will continue to be Fortnite’s biggest asset. Players who engage with Fortnite across multiple platforms generate 570% more playtime and 375% higher monthly revenue per user than single-platform players. This gives Fortnite an undeniable edge as a cross-platform engagement engine.

Pokemon Ecosystem (84% confidence): The Pokemon TCG Pocket is dominating the charts, with 155 million cumulative sales and strong IP leverage across mobile, trading card games, and merchandise. Given the franchise’s established fanbase and ongoing momentum, it’s poised to continue thriving in 2026.

Supporting Data for the Predictions

These forecasts are supported by key data points from Powerdrill Bloom, which provide a detailed breakdown of the market landscape for 2026.

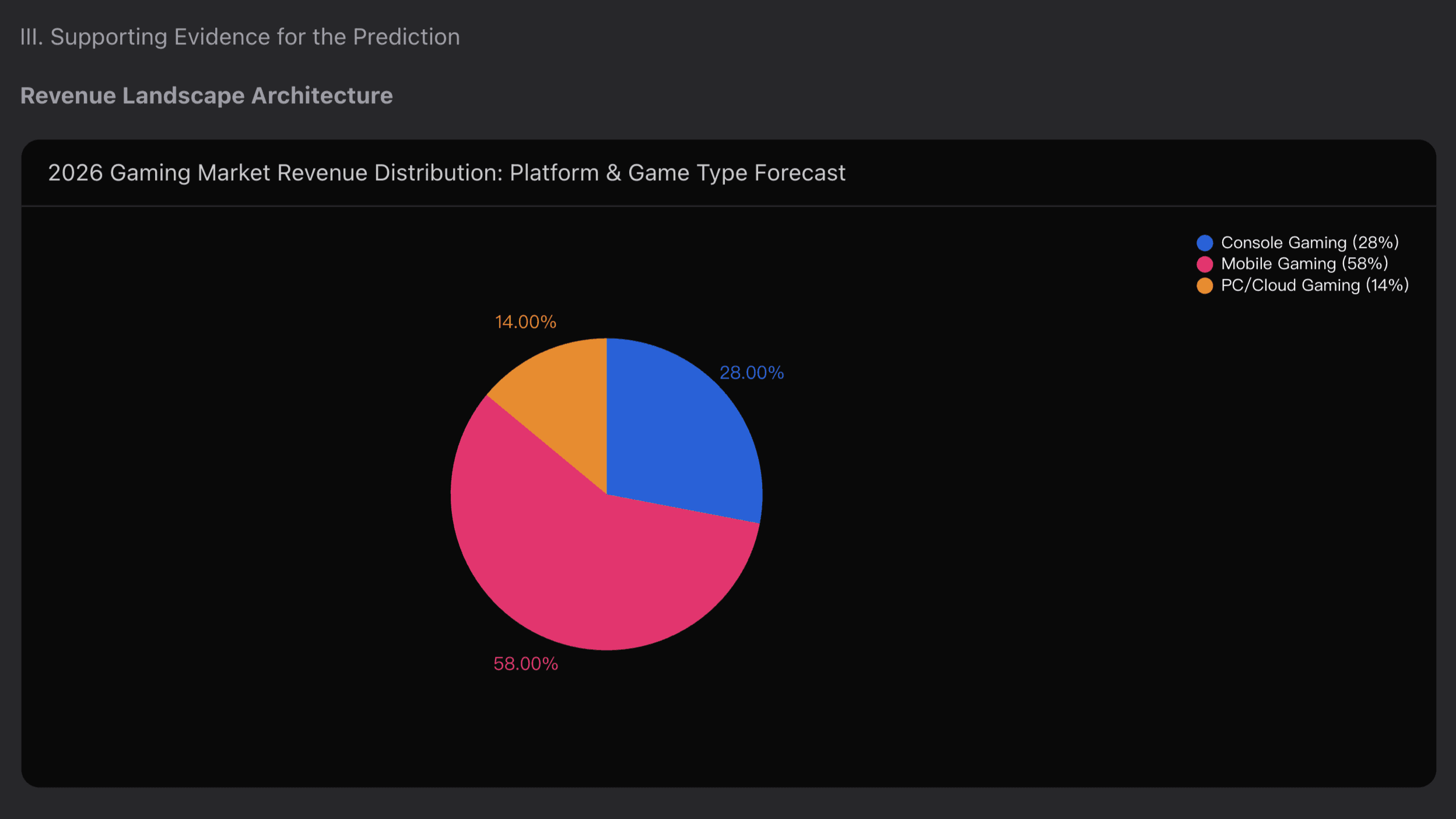

Revenue Landscape Architecture

Mobile Gaming: Set to generate 58% of the total gaming market revenue, mobile games will dominate with a projected $110-$118 billion.

Console Gaming: Will account for 28% of the market, generating around $53-$55 billion.

PC/Cloud Gaming: Estimated at 14%, translating to $25-$30 billion in 2026.

These projections make it clear that mobile-native games will not only command the majority of the market share but also drive the largest revenue segment by default.

Cross-Platform Engagement Premium

Powerdrill Bloom’s analysis also revealed that cross-platform games, like Fortnite, enjoy a significant revenue advantage over single-platform games. Here’s a quick breakdown of cross-platform versus single-platform metrics:

Player Retention: Cross-platform games see 25% higher retention.

Time Spent: Players spend 40% more time in cross-platform games.

Revenue per User: Cross-platform players generate 375% higher monthly revenue compared to single-platform players.

Fortnite’s ability to seamlessly integrate across multiple platforms is a key factor in its leadership position. It shows how important it is to support cross-platform play to maximize player engagement and revenue.

Franchise Validation

Data also confirmed that best-selling franchises like Mario (193M sales), Pokemon (155M sales), and Grand Theft Auto (50M sales) will continue to dominate, thanks to their entrenched fanbases and strong brand moats. This type of validation is crucial for understanding which franchises have staying power and are most likely to weather the ups and downs of the market.

Player Engagement vs. Revenue Generation

An important insight from Powerdrill Bloom’s trend analysis is that player engagement doesn’t always equate to revenue. For example, while mobile franchises may boast massive player bases (over 92 million active players), their per-user revenue tends to be lower, around $490 per year on average. On the other hand, premium console games like GTA VI will attract high-spending users, generating $2.1-$2.8 billion in initial revenue.

Key Risks and Uncertainties

As with any market prediction, there are uncertainties that could impact the 2026 gaming landscape:

GTA VI Performance Variability: The performance of GTA VI could vary, with potential upside to $7 billion in revenue if it becomes a cultural phenomenon, but also risks of downward swings due to controversies or economic pressures.

Mobile Gaming Saturation: The mobile market could face challenges if top-tier players start to churn, as whales (top 1% spenders) are already showing signs of fatigue. Additionally, regulation changes could impact revenue from mobile games.

Cloud Gaming Adoption: Cloud gaming’s rapid growth could bypass both console and mobile categories, depending on the speed of adoption and the emergence of new technologies.

Conclusion: Forecasting the Future of Gaming

After thoroughly analyzing the available data, I am confident in the following:

Mobile games will dominate by revenue, capturing 58% of the market with franchises like Candy Crush and PUBG Mobile leading the way.

GTA VI will be a major event in the console segment, with $3-5 billion in potential post-launch revenue.

Fortnite will remain the undisputed leader in cross-platform engagement, benefiting from its ability to capture and retain players across devices.

The combination of Powerdrill Bloom’s data insights and my own predictive analysis has provided a clear roadmap of where the gaming market is heading in 2026. By understanding the market structure, leveraging cross-platform data, and validating franchise performance, I’ve been able to develop a comprehensive view of which games will thrive in the next few years.

For anyone looking to make informed decisions about the gaming market, whether as a developer, marketer, or investor, this data-driven approach offers a valuable framework for predicting which games will lead the charge into 2026 and beyond.