Every market environment produces one price level that becomes the emotional battleground of an entire asset class. For Bitcoin in late 2025, that line is crystal clear: $90,000.

Over the past two weeks, I’ve been running macro-scenario simulations, historical pattern matching, and prediction-market inference models through Powerdrill Bloom, the AI engine I rely on for stress-testing multi-path outcomes. And as all the data pours in, one pattern keeps reaffirming itself:

Bitcoin is overwhelmingly likely to breach $90K in November — but just as likely to reclaim it into the new year.

This duality is confusing for traders who want a simple bull/bear answer. Unfortunately, markets rarely operate in the realm of simplicity. They operate in the realm of regime transitions.

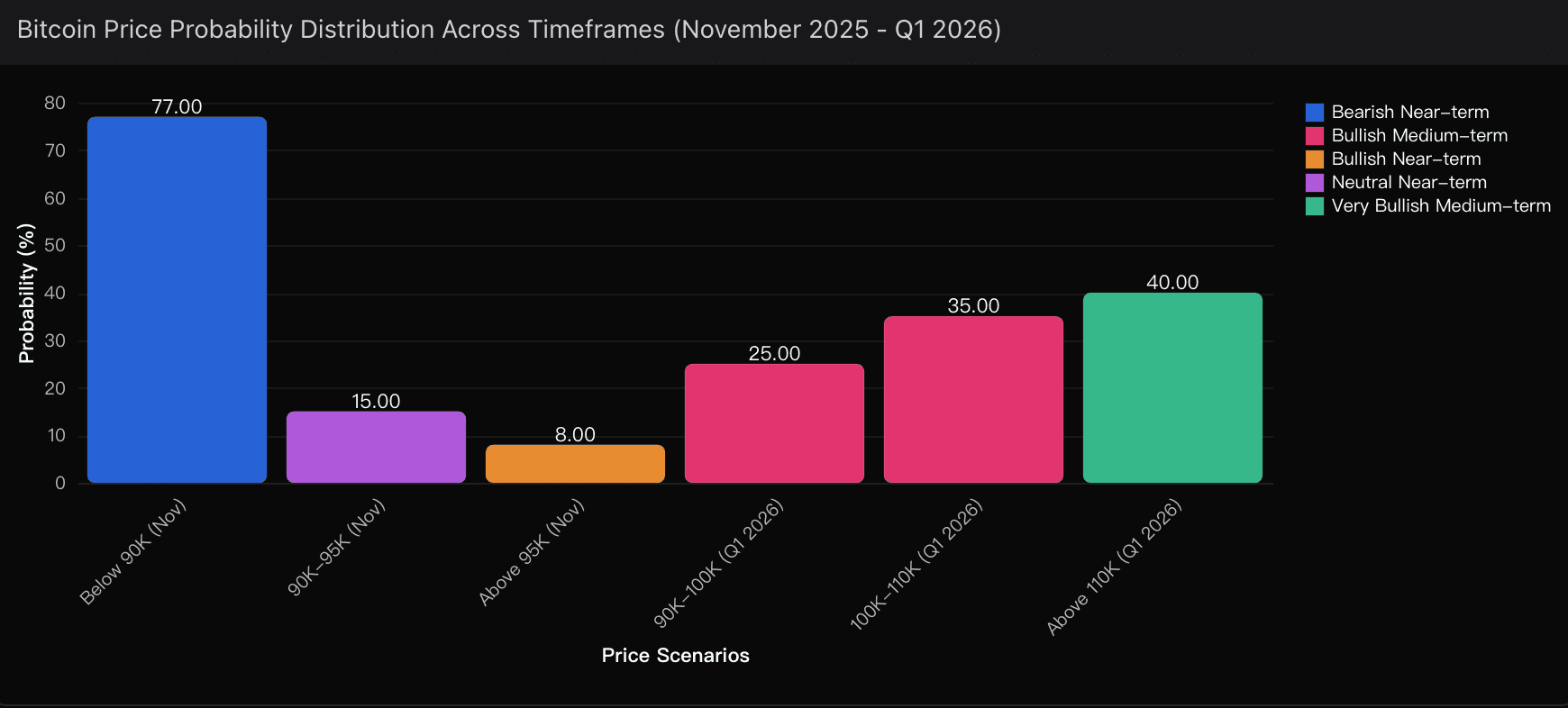

My updated probability curve:

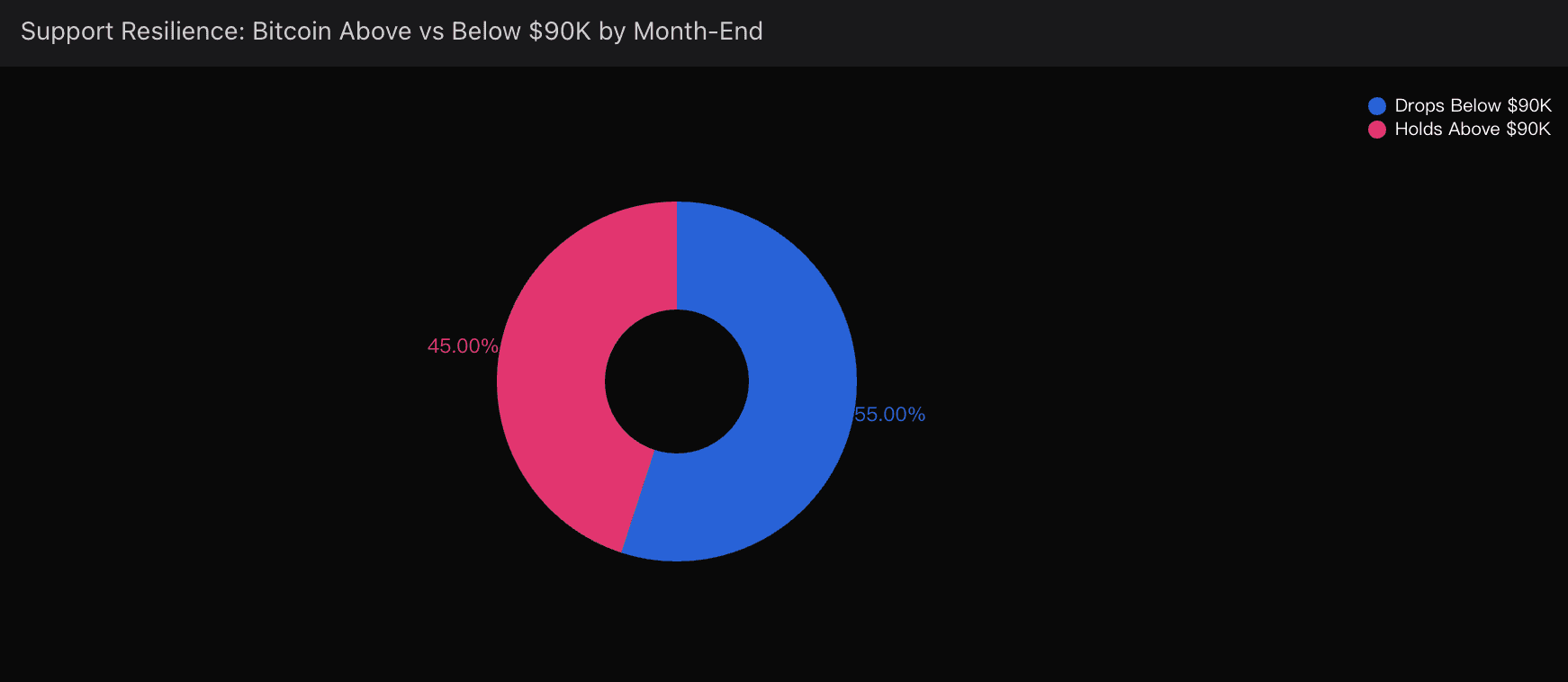

23–30% chance Bitcoin holds above $90K through November

70–77% chance it fails in November

45%+ chance it stabilizes back above $90K during the Q4→Q1 transition

The surface narrative is bearish. The underlying narrative is far more nuanced.

One of the frameworks I often use in Powerdrill Bloom is temporal narrative decomposition—splitting a market cycle into structural “acts” based on liquidity, flows, and sentiment pivots. Bitcoin’s current trajectory maps perfectly into a two-act story.

ACT I — November Capitulation

This is where the bulk of the volatility lives.

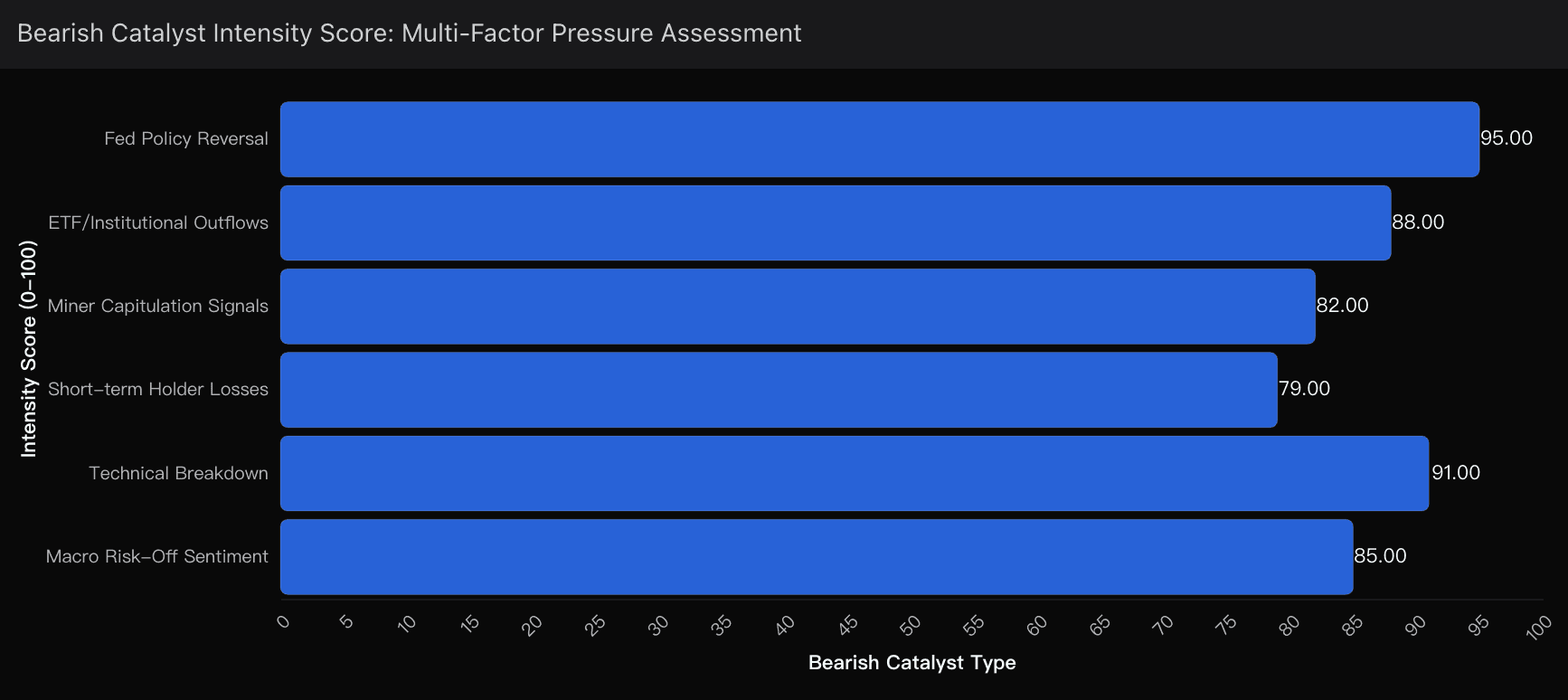

1. ETF flows have turned negative

When institutions pull capital, Bitcoin’s volatility spikes. ETF outflows are now a leading indicator of macro risk-off, and the correlation is tightening.

2. Tech sector weakness is dragging crypto

Bitcoin no longer trades in isolation. When Nasdaq bleeds, Bitcoin bleeds harder. The tech drawdown has become an accelerant.

3. Long-term holder capitulation at $92K–$95K

This is the dangerous part. When long-term wallets start distributing in size, historical drawdowns accelerate. The selling cascades from this cohort alone created three major breakdowns in the past five years.

4. Fed rate cut odds collapsing

December rate-cut probability fell from 97% to 52%, erasing Bitcoin’s macro tailwind overnight. Liquidity expectations turned from supportive to ambiguous — the worst possible setup.

Taken together, this creates what I call a probability funnel: a narrowing corridor where the price gravitates toward a stress test.

November 14–30 is the most vulnerable window of the year.

And yes — in this window, Bitcoin almost certainly breaches $90K.

ACT II — The November Fade

This part is counterintuitive but critical.

Key signals:

Tactical buyers are defending the $92K zone

Not aggressively, but consistently.

Powerdrill Bloom’s insights shows net limit bids reappearing every time price slips below $93K.

Probability of Bitcoin holding above $90K on Nov 22 sits near 60%

This indicates traders expect a bounce before the final November close.

The $85K–$88K range is seen as a “trap door” rather than a crash trigger

Market makers are quietly accumulating.

The flows are too orderly to signal panic.

This stage is not bullish. It’s structural clearing — a slow absorption of forced sellers by deep-pocketed buyers.

The difference matters.

The Four Main Uncertainty Shocks

Using Powerdrill Bloom’s insights, I model four volatility shocks that can disturb the base case:

1. Fed Policy Shock — 40% magnitude

A hawkish pivot could send Bitcoin to $80K within two days.

2. Geopolitical Black Swan — 15–20%

Middle East escalation, sanctions on exchanges, or sudden regulatory crackdowns.

3. Correlated Tech Market Breakdown — 25%

If Nasdaq unwinds another 8–12%, Bitcoin almost certainly tests $75–80K.

4. Stablecoin/Leverage Cascade — 20%

Liquidations can produce $10K–15K wicks even during orderly markets.

None of these invalidate the recovery path — they simply determine the depth of the November flush.

Final

The difference between November pain and Q1 strength is not contradiction — it’s sequencing.

And as I continue to feed real-time flow data, prediction-market probabilities, and macro shifts into Powerdrill Bloom, the picture only becomes clearer:

Bitcoin will break $90K.

Bitcoin will recover above $90K.

And the real opportunity lies in understanding the path between those two truths.