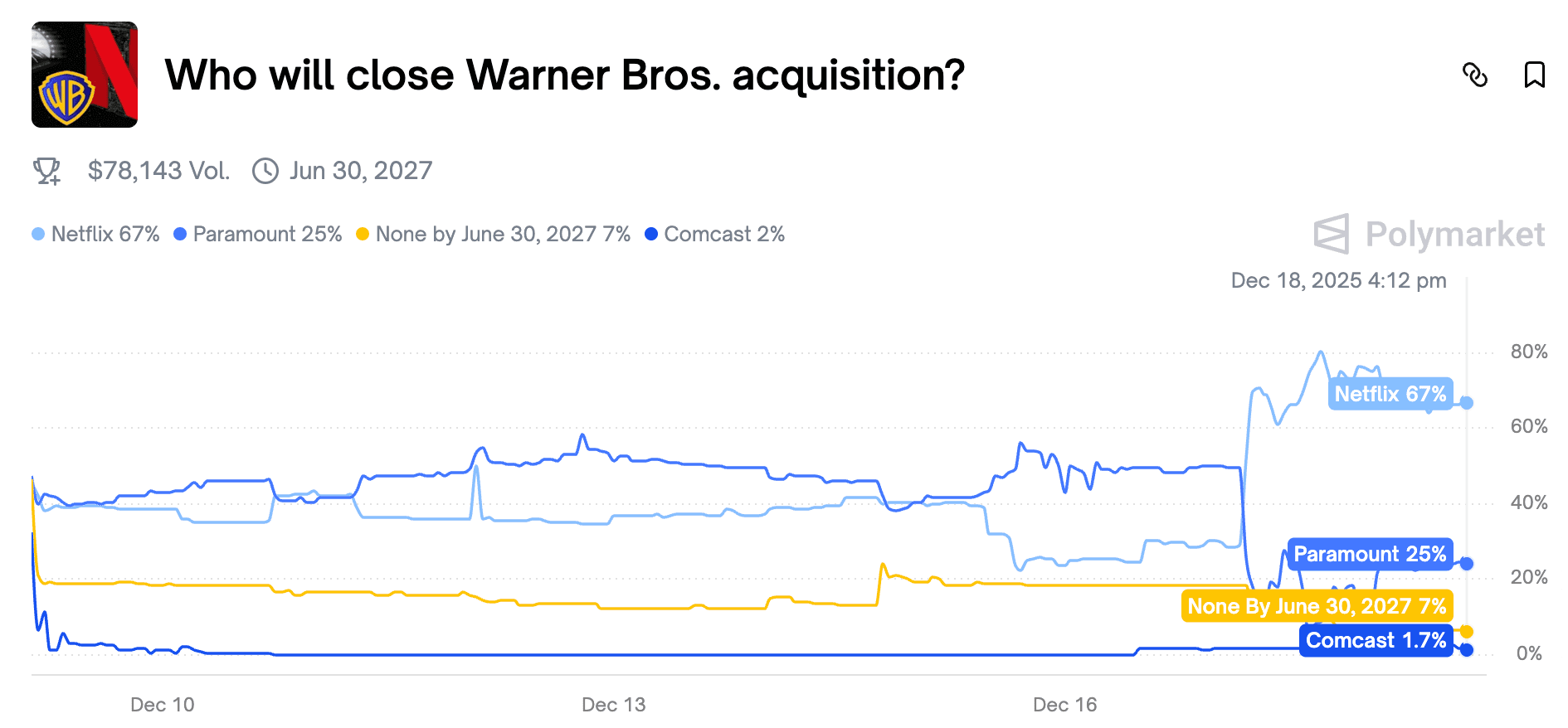

A Netflix acquisition of Warner Bros. would materially change how the global streaming market is structured.

For investors and industry observers, the key question is not just if the deal will close, but when. Deal timing directly impacts valuation, regulatory risk, and strategic positioning across the sector.

To estimate a realistic closing window, I use Powerdrill Bloom to map regulatory timing against market-implied probabilities and deal constraints.

The result is a probability-based estimate of when Netflix is most likely to complete the Warner Bros. acquisition.

Core Prediction: Netflix Deal Timing

Powerdrill Bloom’s core prediction places the most likely closing window for Netflix’s acquisition of Warner Bros. between Q4 2026 and Q2 2027. Based on regulatory reviews, market probabilities, and deal-specific factors, the earliest realistic closing date is late Q4 2026 (December 2026).

However, the more likely outcome is a Q1 2027 closing (January-March), with a 45-50% probability.

Here’s how Powerdrill Bloom arrived at this conclusion:

Key Analysis: Breaking Down the Timeline

Discovery Global Separation (Q3 2026)

The deal cannot close until Discovery Global is spun off as a separate public company. This step is a hard prerequisite for the Netflix acquisition. Current timelines point to the separation being completed between mid-2026 and Q3 2026, after which the regulatory review process can begin.Regulatory Review Process (Late 2026)

After the separation, the deal will undergo a rigorous regulatory review process.This includes:

U.S. DOJ/FTC filing and Phase I review (expected to take 3-4 months)

European Commission assessment running in parallel

Additional industry comment periods and hearings

If the regulatory review stays within a standard timeframe, the deal could close as early as late Q4 2026. If approvals slip into January, the balance of probabilities shifts toward a Q1 2027 closing.

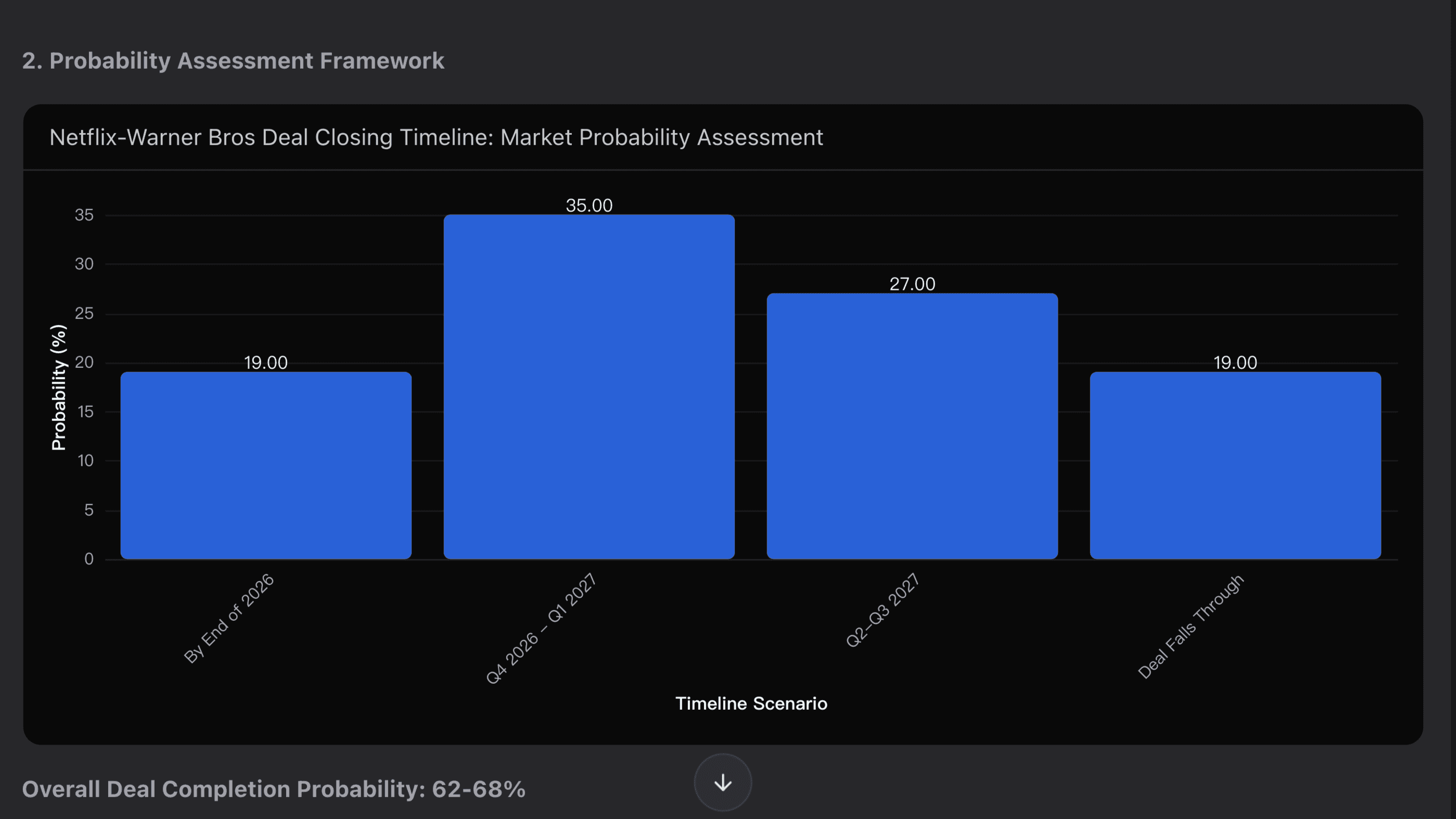

Probability Assessment: Closing Timing

Powerdrill Bloom has provided a probability-weighted assessment of the various outcomes:

By End of 2026: 19% probability — An accelerated closing scenario assuming Discovery Global separation completes early in Q3 2026 and regulatory reviews conclude without delay.

Q4 2026 – Q1 2027: 35% probability — The highest-probability closing window identified by Powerdrill Bloom, based on the expected separation timeline and standard DOJ/FTC and EU review durations.

Q2–Q3 2027: 27% probability — A delayed-but-successful outcome where regulatory reviews extend longer than expected or approval conditions slow final closing.

Deal Fails or Extends Beyond Mid-2027: 19% probability — A downside scenario reflecting regulatory rejection, extended Phase II review, or prolonged delays pushing the deal beyond mid-2027.

Supporting Evidence Driving the Prediction

The reliability of these predictions comes from Powerdrill Bloom’s comprehensive analysis of various data points:

WBD Separation Timeline

Multiple sources confirm that the separation of Discovery Global is on track for Q3 2026, providing a clear timeline for when Netflix can proceed with the deal.Deal Structure Designed for Speed

Netflix and Warner Bros. Discovery have already approved the deal (as of December 5, 2025), and both parties are highly motivated to close quickly. Netflix’s acquisition is expected to generate $2-3 billion in annual cost synergies within three years, which adds strong financial incentives to close the deal without delays.Regulatory Pathway

While there may be concerns over regulatory approval, Netflix has strong defenses, including its argument that it needs HBO’s scale to compete with YouTube in the streaming space. The deal’s $59 billion debt commitments and the trend toward market consolidation further support the likelihood of regulatory approval without significant delays.Industry Precedents

Recent major media deals, such as Microsoft’s acquisition of Activision and Disney’s acquisition of Fox, offer relevant insights into expected timelines. These acquisitions generally closed between 12 to 18 months after announcement, a timeline that Powerdrill Bloom’s data suggests is realistic for Netflix and Warner Bros.

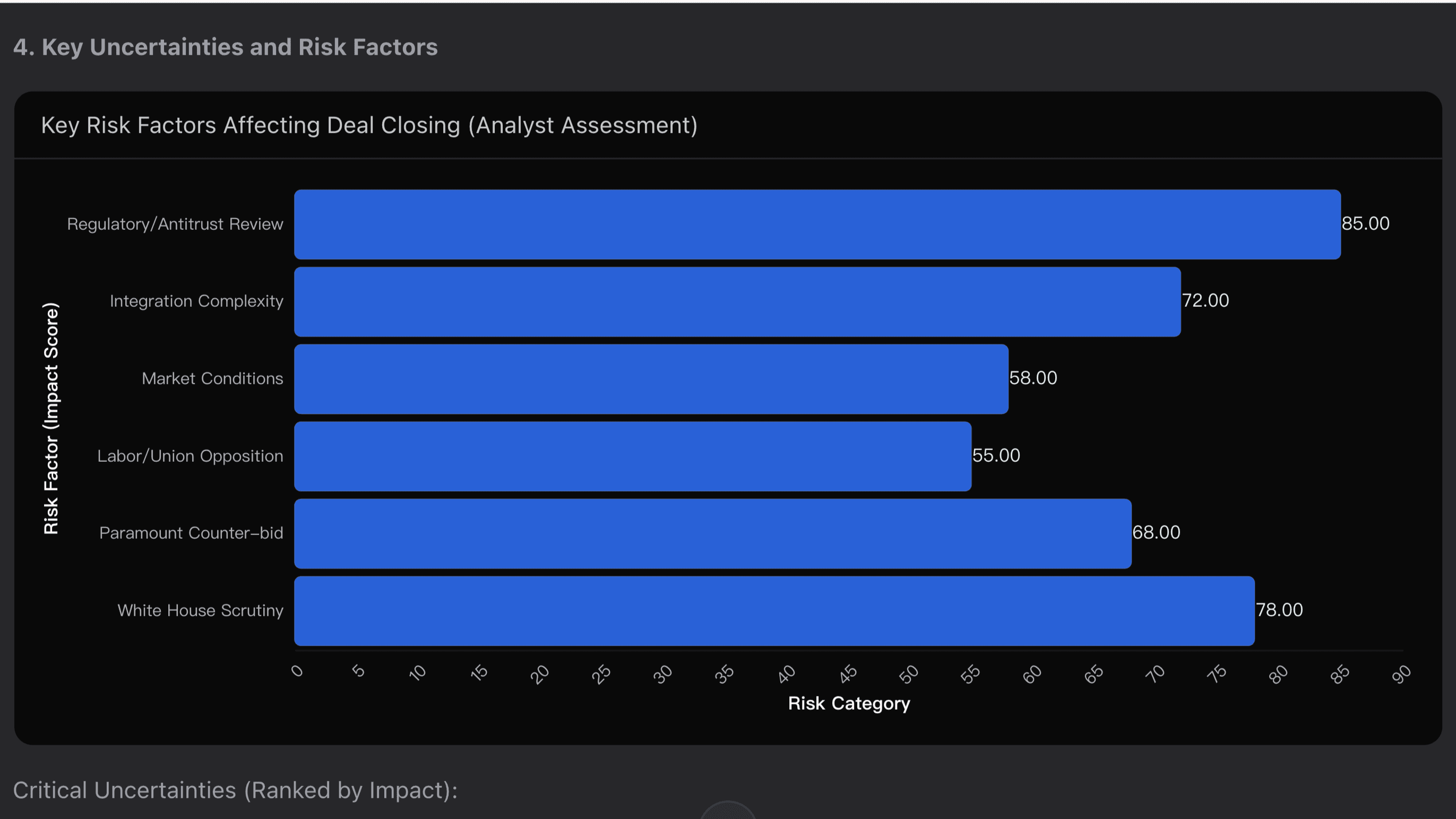

Key Risks and Uncertainties

Despite the relatively high likelihood of closing the deal by Q1 2027, several risk factors could affect the timeline:

Regulatory/Antitrust Review (85% risk impact)

The primary risk factor is whether the DOJ/FTC will impose conditions or block the deal altogether. However, with Netflix’s defense that YouTube is the real competitor in the streaming space, the probability of regulatory rejection remains low (10-15%).Political Influence (78% risk impact)

The Trump administration’s stance on the deal could cause delays, although public statements have suggested a negotiated resolution rather than outright rejection. A politically motivated delay could add 3-6 months to the timeline.Paramount Counter-Bid (68% risk impact)

While Paramount’s bid was rejected by the WBD board, there is still a very low chance (less than 10%) that Paramount could mount a successful shareholder challenge, potentially causing delays.Integration Complexity (72% risk impact)

Post-deal, Netflix will need to integrate HBO into its operations, including adapting to the theatrical business model. This is a post-closing risk rather than a pre-closing blocker, and it is unlikely to impact the closing date.

Conclusion: Expected Closing Timeline

After considering all the factors, Powerdrill Bloom’s analysis points to a Q1 2027 closing for Netflix’s acquisition of Warner Bros., with a 45-50% probability. The key to this prediction lies in the successful completion of Discovery Global’s separation by Q3 2026, followed by regulatory reviews that are likely to clear by the end of 2026.

This analysis was conducted using Powerdrill Bloom to structure regulatory timelines, market probabilities, and deal-specific constraints into a single probability-weighted framework.

If you’re interested in getting your own actionable insights into major market events like Netflix’s acquisition of Warner Bros., Powerdrill Bloom provides the predictive analysis you need. Dive deeper into the data, and get a clearer view of the market’s future.

Note: The timeline and probabilities are model-driven projections, not guaranteed outcomes.