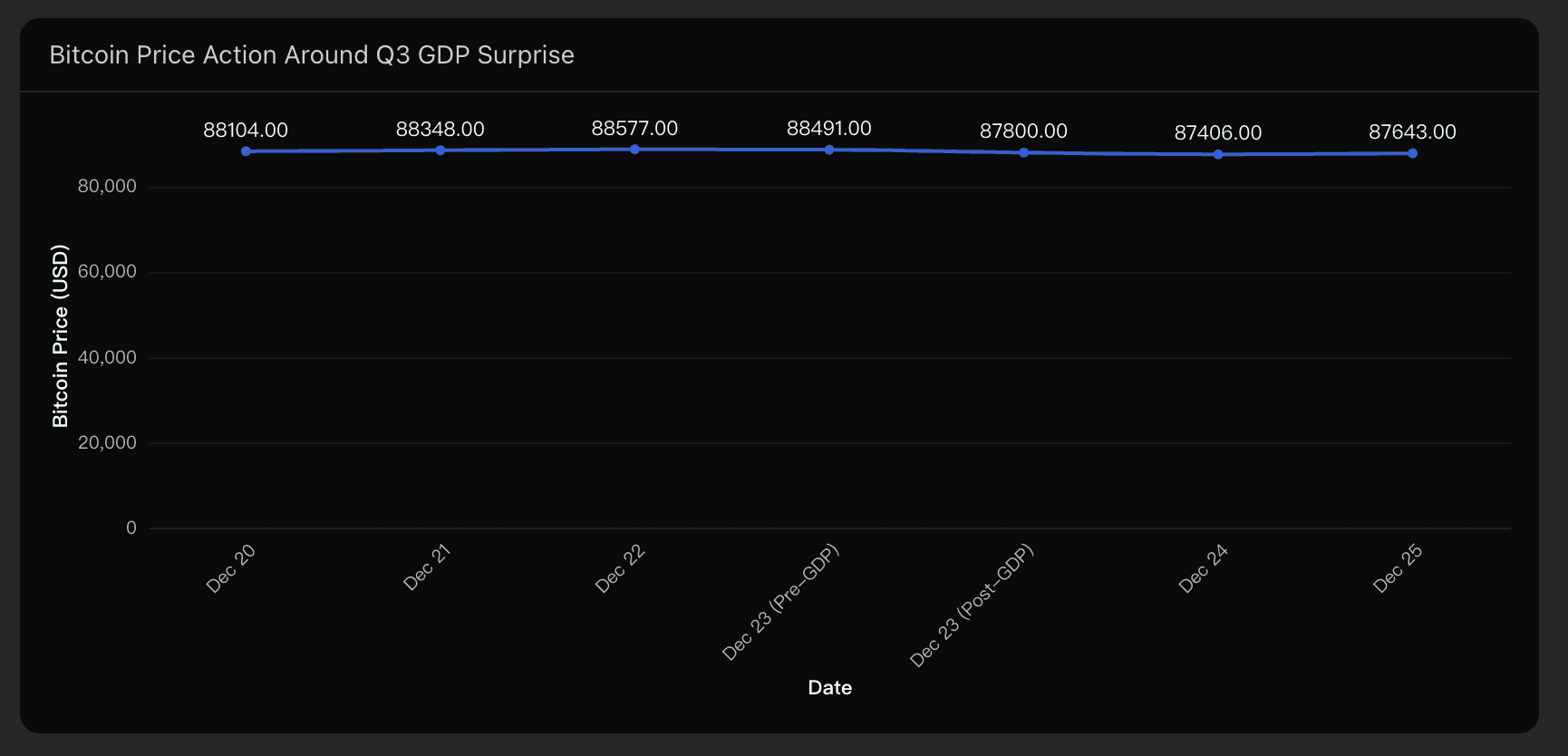

The December 23, 2025, Q3 GDP print of 4.3%—shattering the 3.3% consensus—is not just an economic data point; it is a monetary regime shock. According to Powerdrill Bloom, this surprise forces a complete re-evaluation of the liquidity environment, challenging the "imminent pivot" narrative that many bulls were betting on.

The Mechanism: Why "Good Data" is Hitting Bitcoin Hard

To understand the price action, we must look at the transmission mechanism. The GDP beat didn't hurt Bitcoin because the economy is strong; it hurt because it tied the Federal Reserve's hands.

Immediately post-announcement, the market’s expectation for a January 2026 rate cut collapsed from 19.9% to 14.4%. This creates a mechanical ceiling for price:

Repricing Reality: Markets now price in only two cuts for all of 2026 (down from 3-4).

The Yield Problem: Strong growth keeps real yields elevated, increasing the opportunity cost of holding non-yielding assets like Bitcoin.

Inverted Correlation: While equities rallied on the growth news, Bitcoin suffered from the resulting liquidity tightening.

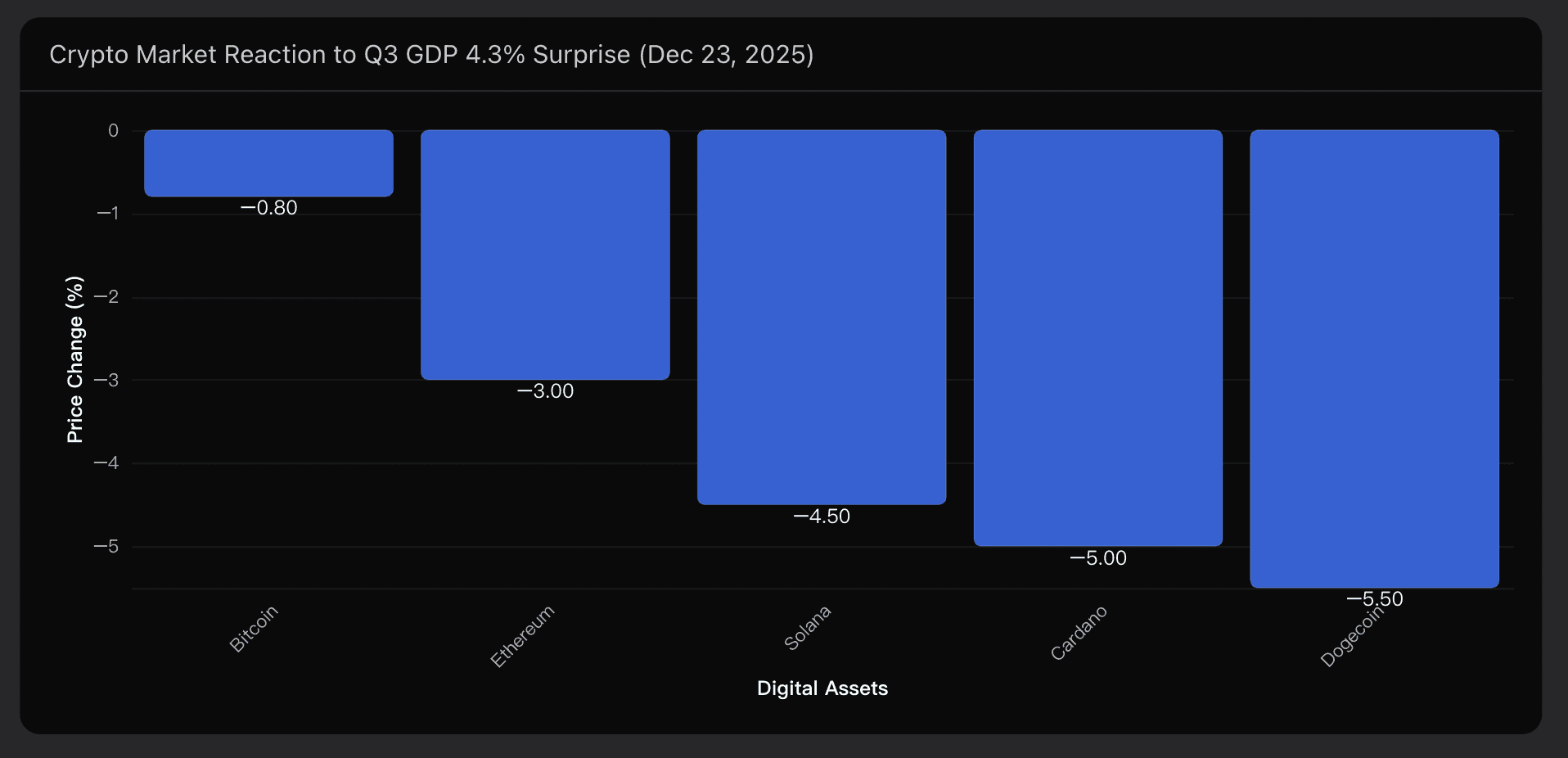

The Signal: Bitcoin is Decoupling from Crypto Risk

While the macro environment tightened, the market response revealed a critical divergence. Bitcoin functioned as a hardened macro asset, while the rest of the crypto market traded like a leveraged proxy.

When the news hit, Bitcoin declined just -0.8% (holding $87,800). Compare this resilience to the broader liquidation cascade:

Ethereum: -3.0%

Solana: -4.5%

Dogecoin: -5.5%

This 2:1 to 6:1 underperformance ratio in altcoins suggests that the "liquidity crunch" fear is real, but Bitcoin is uniquely insulated by institutional support that other assets lack.

The Context: Why the Drop Wasn't Deeper

If the macro news was so bearish for liquidity, why didn't Bitcoin crash through $87,000? The answer lies in market positioning before the print.

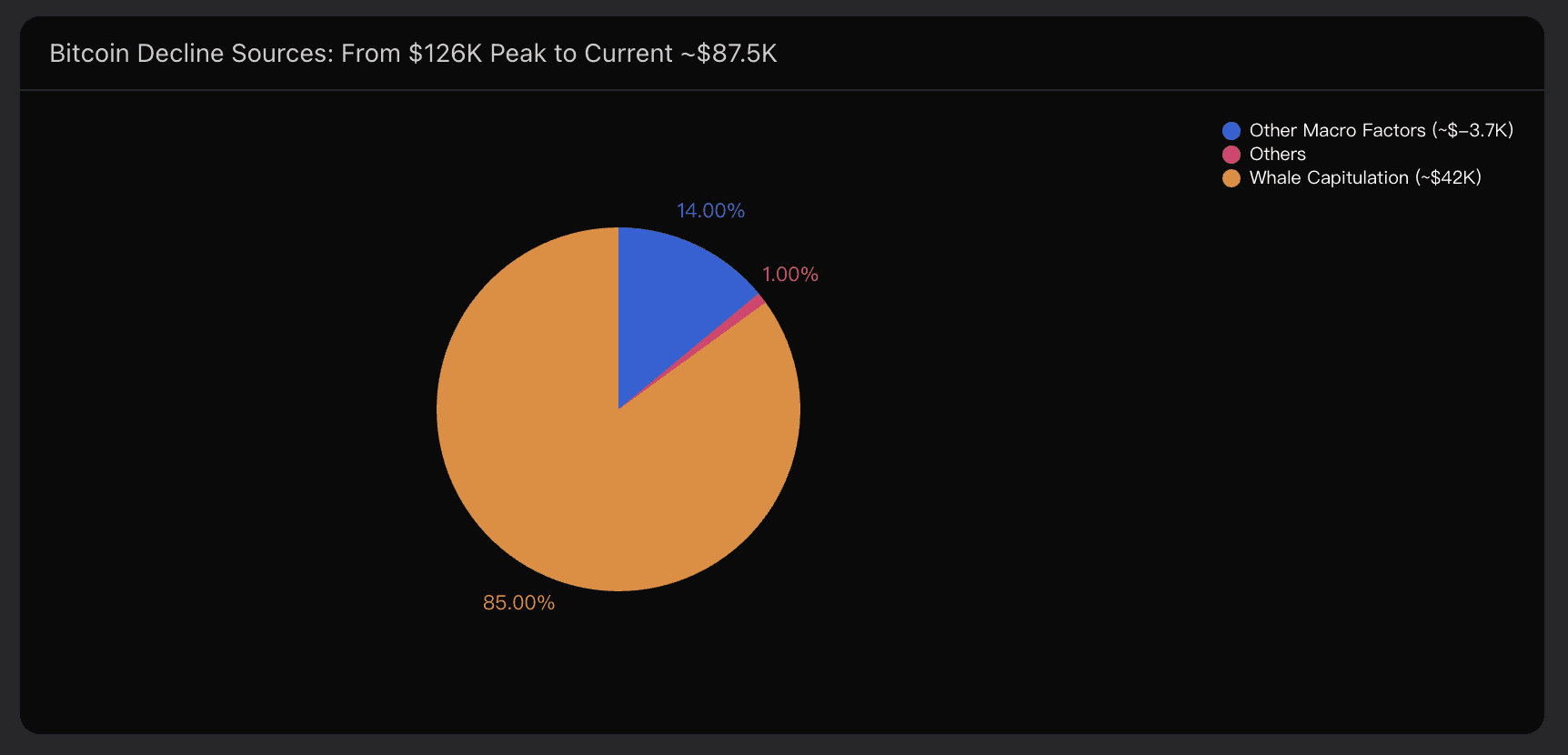

The data reveals that the "sell-the-news" event effectively happened weeks ago. The massive drawdown from the $126k peak to current levels was driven by whale capitulation selling into the $84k–$90k range.

The Math: The GDP surprise accounted for less than $700 of downside.

The Implication: Smart money had already front-run the "no rate cut" thesis. The weak hands are already out, leaving a stickier, albeit cautious, holder base.

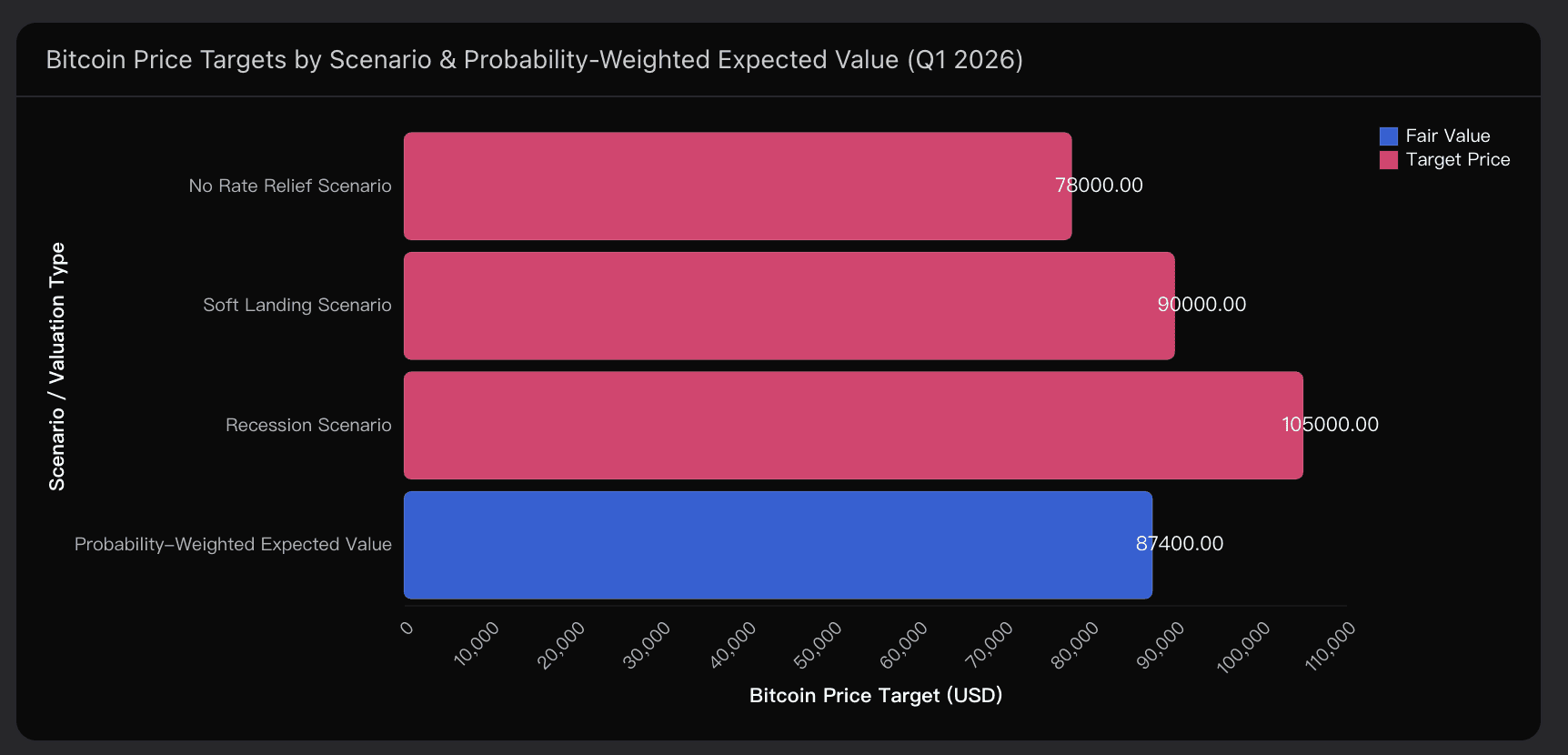

Forward Outlook: Three Paths for Q1 2026

With the "immediate pivot" off the table, we are looking at three probabilistic scenarios driven by how the Fed reacts to this growth:

1. The "No Rate Relief" Grind (45% Probability)

Trigger: Inflation remains sticky (>2.5%) alongside this strong GDP.

Bitcoin Impact: Bitcoin reprices into the $75,000–$82,000 range as the market digests a “higher-for-longer” rate regime.

2. The "Soft Landing" Equilibrium (35% Probability)

Trigger: Growth moderates to 2.5–3% without spiking inflation.

Bitcoin Impact: Price stabilizes in a $85,000–$95,000 accumulation zone, awaiting the H2 2026 easing cycle.

3. The Recession Wildcard (20% Probability)

Trigger: The 4.3% GDP is a "last gasp" before unemployment spikes (>4.8%).

Bitcoin Impact: A flight-to-safety rally targeting $95,000–$115,000 as the Fed is forced into emergency cuts.

Conclusion: A Game of Patience

The 4.3% GDP surprise has clarified the board: we are not getting easy money in January. However, the muted reaction (-0.8%) confirms that Bitcoin is currently fairly valued at $87,400 relative to this new restrictive reality.

As highlighted in the Powerdrill Bloom analysis, the asymmetric trade now lies in waiting for the next macro break—likely the January 15 CPI print—rather than chasing the noise of a single GDP number.

This analysis reflects data-driven projections based on current market conditions and is not guaranteed or intended as financial advice.