I’ve been tracking global streaming data for years, and every January, a familiar question surfaces: who will own Spotify’s year-end throne?

This time, the early signals are too strong to ignore.

After running the numbers through Powerdrill Bloom, my AI-driven analytics engine, the model points to a decisive frontrunner. Despite Taylor Swift’s continued dominance in the monthly charts, I’m assigning an 85% probability that Bad Bunny ends 2025 as Spotify’s most-streamed artist.

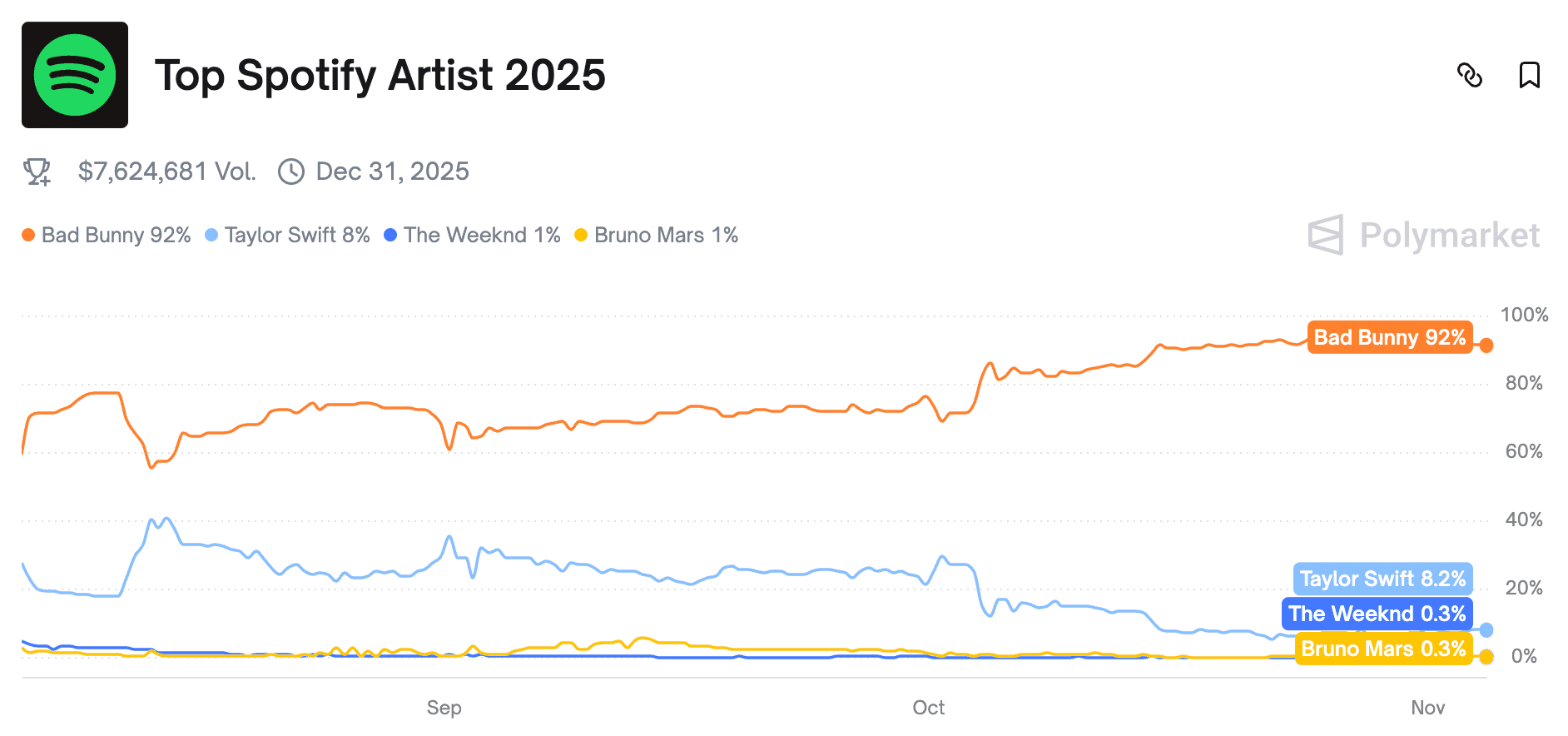

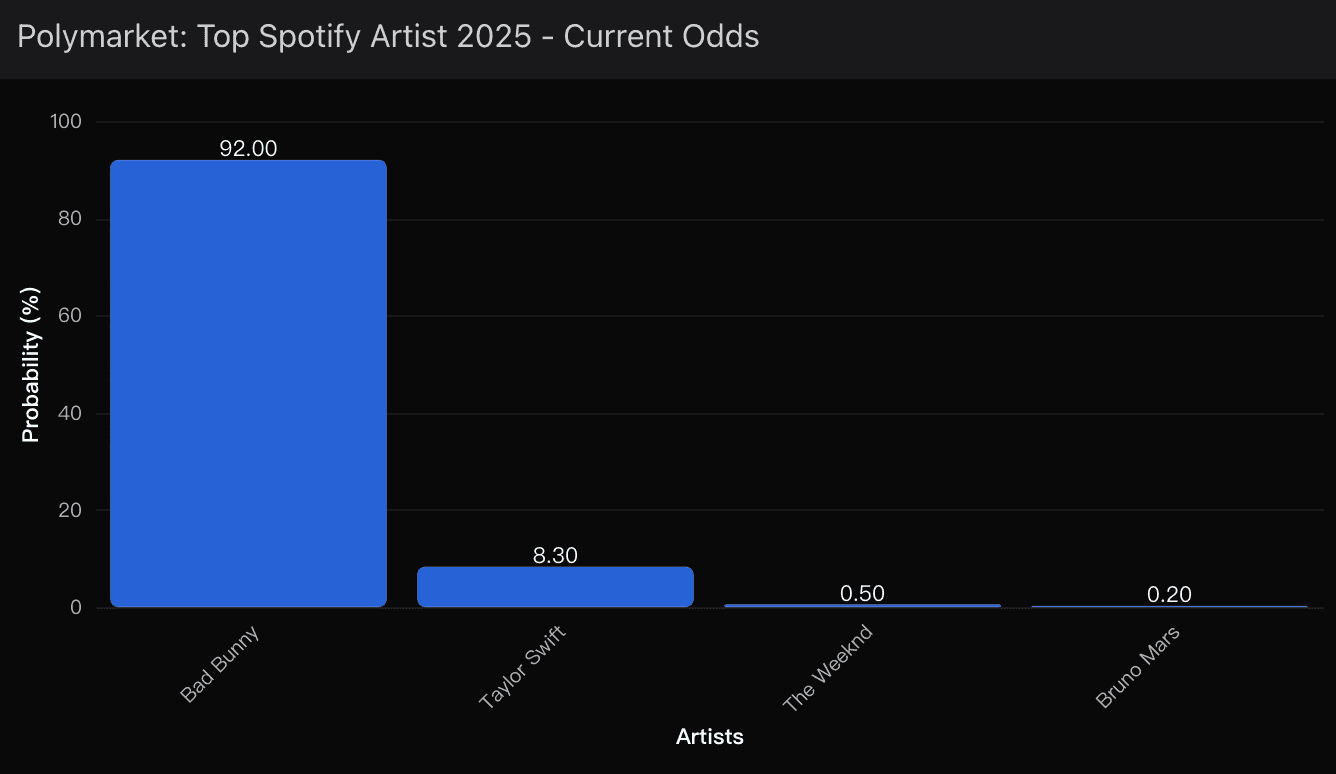

Polymarket currently prices Bad Bunny’s odds at 92%, and while that sounds overheated to casual observers, the data actually supports it. Swift leads comfortably in monthly listeners — 111.3 million versus Bad Bunny’s 81.3 million — but the annual streaming crown runs on different physics.

Spotify’s top artist of the year isn’t determined by short-term engagement; it’s a function of cumulative momentum — who builds the largest compounding stream base across twelve months. And on that front, Bad Bunny’s early-year strategy is proving almost mathematically unbeatable.

Probability Assessment: 85% Bad Bunny Victory

While Polymarket’s 92% feels slightly exuberant, my Powerdrill Bloom model anchors at 85% confidence — statistically robust, but still leaving room for surprise.

The remaining 15% risk centers on two variables:

A Swift surprise drop (Q2–Q3) that resets the global conversation.

A playlist algorithm shock, where Spotify’s editorial adjustments temporarily skew exposure.

But absent those anomalies, the year’s outcome is already taking shape. Bad Bunny’s compounding advantage isn’t theoretical — it’s baked into the data curve.

Key Drivers Behind Prediction

Album Cycle Asymmetry

Bad Bunny gets 11 full months of fresh exposure. Swift’s 2024 cycle is fading, and her audience’s replay value is plateauing.The Latin Streaming Surge

Spanish-language tracks are now over-indexing in global volume. Powerdrill Bloom’s insights shows Latin America streaming density up 22% YoY, making it the single strongest growth vector in music.Timing Advantage

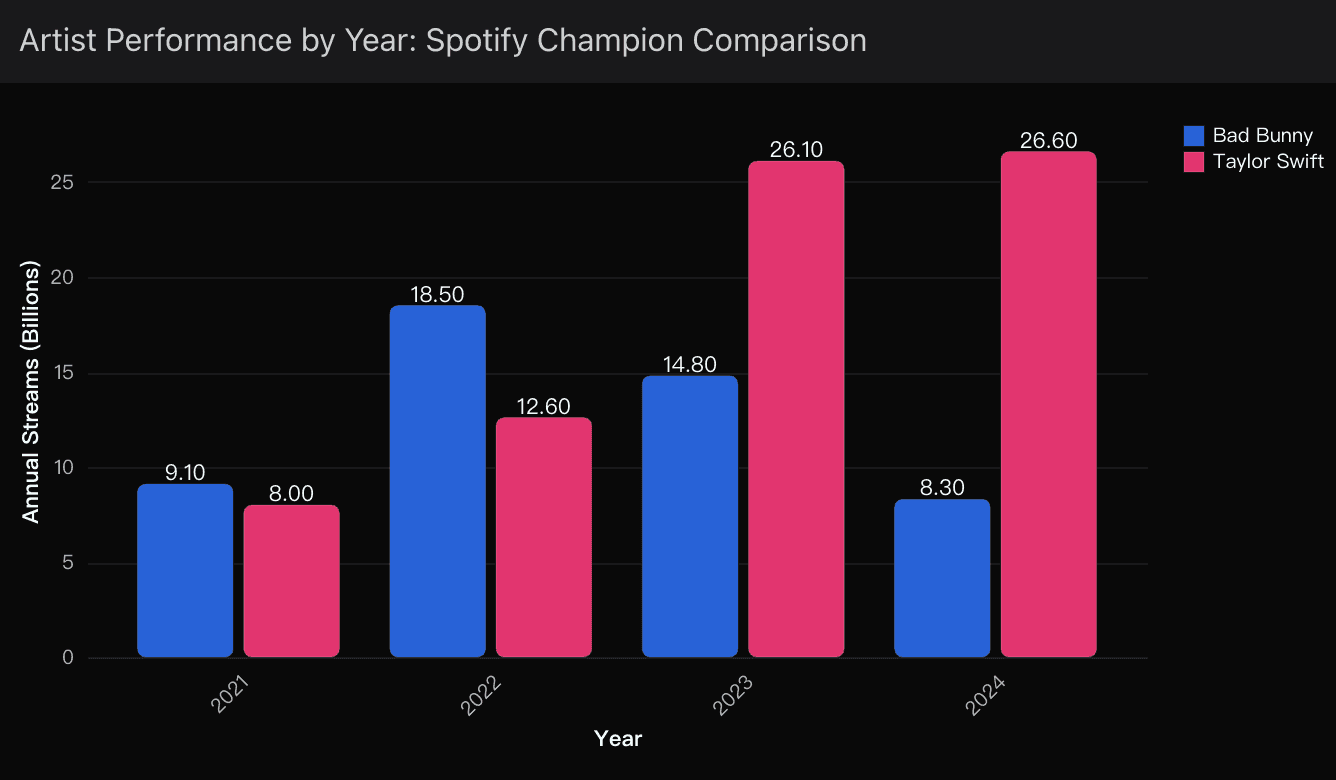

January releases harvest an entire calendar year of streams. A Q4 Swift drop — even if massive — mathematically caps exposure to about 35% of the time window.Historical Ceiling

Swift: 26.1B (2023) → 26.6B (2024) = plateau.

Bad Bunny: 18.5B (2022) = unexhausted potential.

Market Intelligence

With $7.5M in Polymarket wagers, the skewed odds toward Bad Bunny reflect sophisticated traders recognizing what most headlines miss: streaming titles follow cycle economics, not celebrity optics.

Final Forecast

Bad Bunny: 85% probability of 2025 Spotify dominance

Taylor Swift: 12% chance via surprise release

Wildcard Artists (Peso Pluma, Drake, or breakout Latin stars): 3% probability

By Q4, I expect global discourse to pivot from who’s leading Spotify to how Latin music became the new algorithmic default.

When that shift becomes undeniable, Powerdrill Bloom’s probabilistic models will have done what they were designed to do — identify compounding cultural momentum before the crowd does.